Dynacons Systems & Solutions: 35% PAT growth & 25% Revenue growth in H1-25 at a PE of 32

Riding momentum of FY20-24 with PAT CAGR of 75% & Revenue CAGR of 33%. FY25 outlook strong driven by order book & repeat orders. Sustained margin expansion from FY20 to H1-25.

1. IT infrastructure company

dynacons.com | NSE: DSSL

DSSL is an IT infrastructure company providing systems integration, networking solutions, facility management services, security solutions, and software services.

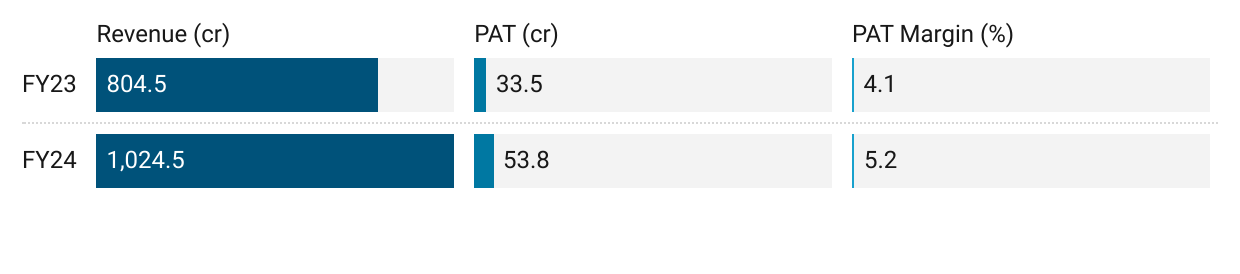

2. FY20-24: PAT CAGR of 75% & Revenue CAGR of 33%

3. Strong FY-24: PAT up 71% & Revenue up 27% YoY

4. Strong Q2-25: PAT up 45% & Revenue up 39% YoY

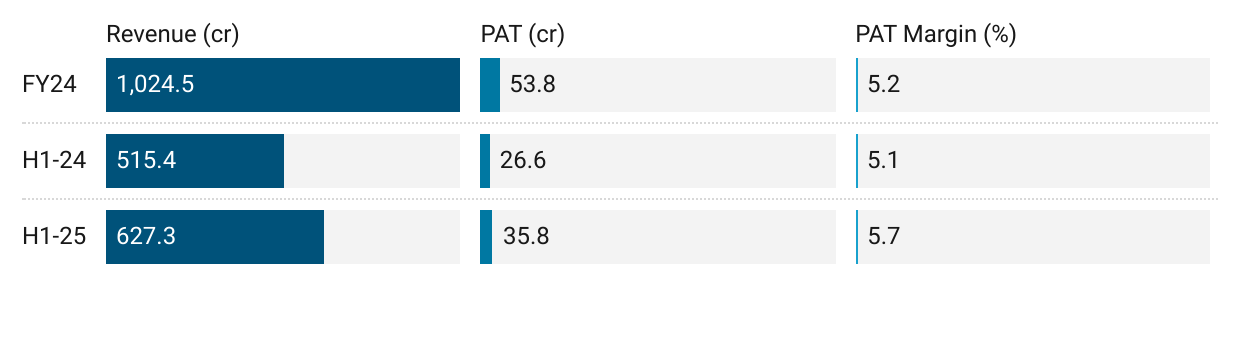

5. Strong H1-25: PAT up 35% & Revenue up 22% YoY

6. Strong & improving return ratios

7. Outlook: Strong expectations from FY25

Analysis of DSSL is limited due to a lack of management commentary and publicly available information about the company. Information from rating agencies indicate to a positive outlook for DSSL.

8. PAT growth of 35% & Revenue growth of 25% in H1-25 at a PE of 32

9. Hold?

If I hold the stock then one may continue holding on to DSSL

DSSL has delivered a reasonable strong H1-25, looks on track to deliver a strong FY25. The margin expansion seen from FY20 onward continues into H1-25

With limited information on DSSL one needs to keep a quarter to quarter view on performance and keep riding the business momentum till it lasts.

Given the limited information available about DSSL, it’s important to monitor performance closely on a quarter-by-quarter. One can keep riding the underlying business momentum till it lasts.

The key driver for DSSL is its consistent margin growth, which has risen from 1.7% in FY20 to 5.7% in H1-25. If this margin expansion slows or reverses, it could signal a potential slowdown in the company's momentum.

10. Buy?

If I am looking to enter DSSL then

DSSL has delivered PAT growth of 35% & Revenue growth of 25% in H1-25 at a PE of 32 which makes valuations fully priced in the short term.

Based on information from credit rating agencies, one can expect FY25 to be similar to the performance delivered in H1-25, which at a PE of 32 makes the valuations acceptable from a FY25 perspective.

From a FY26 perspective, the order book and repeat order of customers can sustain growth momentum. However, the margin of safety is limited at a PE of 32.

DSSL delivered Rs 11.703 cr of free cash flow against a market cap of Rs 1,994.63 cr. As of H1-25 end it is available on a free cash flow yield of 0.6% (not annualized)

One could take a bigger call on DSSL if there was management commentary to consider given that its working in an industry where challenges exist.

in a highly competitive and fragmented industry, along with intensive working capital operations,

timely realization of its receivables will remain a key

Previous Coverage of DSSL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer