Dynacons Systems & Solutions: PAT up 95% & Revenue up 27% in H1-24 at a PE of 18

DSSL is reasonably priced based on H1-24 performance. A challenge in investing in DSSL is that apart from the financial information shared with the exchanges there is no management commentary

1. An IT infrastructure services company

dynacons.com | NSE : DSSL

Dynacons undertakes all activities related to IT infrastructure including infrastructure design and consulting services, turnkey systems integration of large Network and Data Centre infrastructures including supply of associated equipment and software, onsite and remote facilities management of multi location infrastructure of domestic clients.

2. FY17-23: Track record of consistent growth

3. FY23: PAT up 104% and Revenue up 23% YoY

Revenue from operations for FY 2023 at Rs 80,677 lakhs was higher by 23% over the previous year. The profit after tax stood at Rs 3,345 Lakhs for the current year, an increase of 104% over the previous year

4. Q1-24: PAT up 209% and Revenue up 85% YoY

5. Q2-24: PAT up 38% and Revenue down 11% YoY

6. H1-24: PAT up 95% and Revenue up 27% YoY

7. Business metrics are strong and consistent

The business has delivered returns consistently. Cash conversion has been weak

8. Outlook: 25% revenue growth in FY24

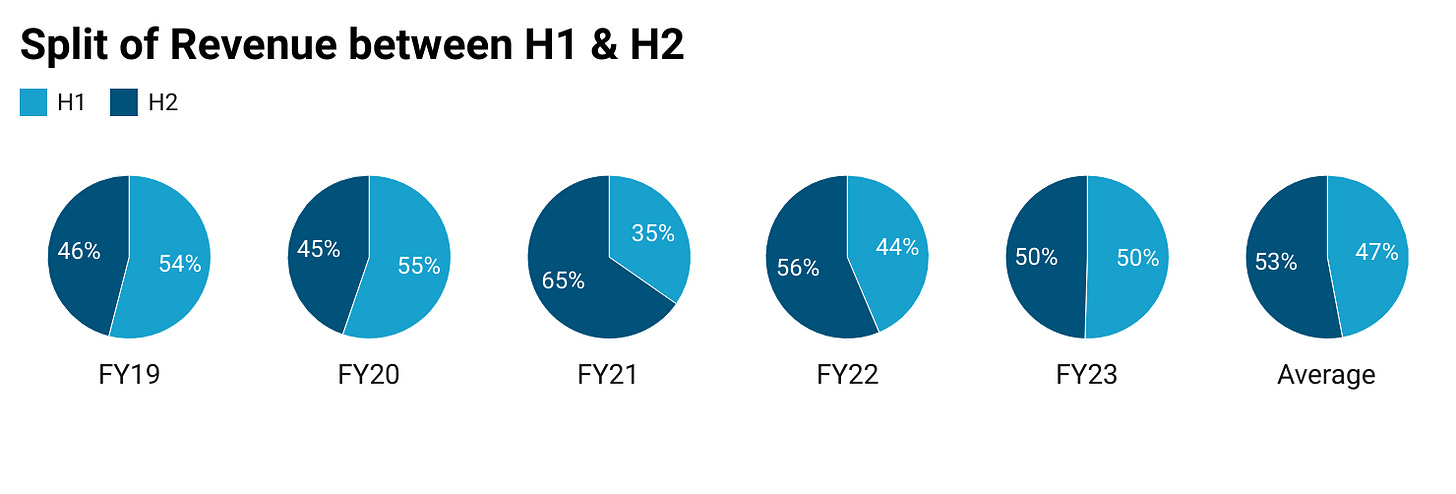

In the absence of any management commentary or public information on the DSSL, one is relying on past trends repeating themselves in FY24. Overall overage for the five years is 47% of annual revenue coming from H1.

On can estimate Rs 1,000+ cr revenue for FY24 which would be around 25% growth over FY23. It is a significant downward revision from our estimate based on analysis of Q1-24 results given a weak Q2-24

9. PAT growth of 95% & 27% revenue growth in H1-24 at a PE of 18

8. So Wait and Watch

If I hold the stock then one may continue holding on to DSSL. This efficiently managed business consistently generates growth consistently over the long term.

Coverage of DSSL was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24 even though Q2-24 was not strong. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a Rs 1,000cr revenue in FY24

Q2 was good in terms of PAT but was weak in terms of revenue. One needs keep watching it quarter over quarter as PAT growth cannot be sustained in the absence of revenue growth

All the views on DSSL are based on published financials only. In the absence of management commentary, one can one can only make estimates which keep changing quarter on quarter. FY24, based on H1-24 performance (PAT up 95% & revenue up 27%) looks like a repeat of FY23 where 104% PAT and 23% Revenue growth was delivered.

9. Or, join the ride

If I am looking to enter the stock then

DSSL has achieved an impressive a strong H1-24 on the back of an excellent FY23 where it doubled its PAT. It looks like PAT for FY24 may double over FY23 PAT. Keeping the past performance along with the outlook for FY24, the PE of 17 looks quite reasonable.

DSSL delivered Rs 15.6 cr of free cash flow against a market cap of Rs 818 cr. As of H1-24 end it is available on a free cash flow yield of 1.9% (not annualized) which makes the valuations reasonable.

Previous coverage of DSSL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades