Deep Industries FY25 Results: In Losses, Possibility of ₹ 1,000 Cr Revenue by FY27

Guides 30% revenue growth in FY26, 25% in FY27. Stable margins with potential for expansion, strong order book, & reasonable multiples create opportunity in Deep

1. Providing various Oil & Gas support services

deepindustries.com | NSE: DEEPINDS

Key Business Segments

Gas Compression & Dehydration

Builds, owns, and operates gas compression and dehydration units across India

Provides turnkey gas processing plants on charter-hire, from design to operation

Core legacy business with stable cash flows and long-standing PSU relationships

Onshore Drilling & IPM

Fleet includes 9 workover rigs and 5 drilling rigs (30–100T capacity)

Offers Integrated Project Management (IPM) for full well lifecycle — drilling to completion

Recent projects include Selan contracts across Gujarat and Northeast India

Production Enhancement Contracts (PEC)

10–15 year contracts to enhance output from mature fields (starting with ONGC)

Revenue = fixed fee + share of incremental production

First ₹1,402 Cr PEC launched in March 2025; more tenders under evaluation

Offshore & Marine Services — Via Dolphin Offshore

Acquired Dolphin Offshore (NCLT) to enter offshore energy services

Assets include DP2 barge, AHTS vessels, and marine infra

FY26+ focus: barge deployment (₹281 Cr contract), export marine charters (Mexico, Africa)

Chemical & Fluid Supply (Backward Integration) — Via Kandla Energy & Chemicals Acquisition

Acquired to secure in-house supply of chemicals, drilling fluids, and materials

Supports PEC/IPM operations by improving margin control and reducing third-party dependency

Will begin margin contribution in FY26 and beyond

2. FY21-25: EBITDA CAGR of 32% & Revenue CAGR of 30%

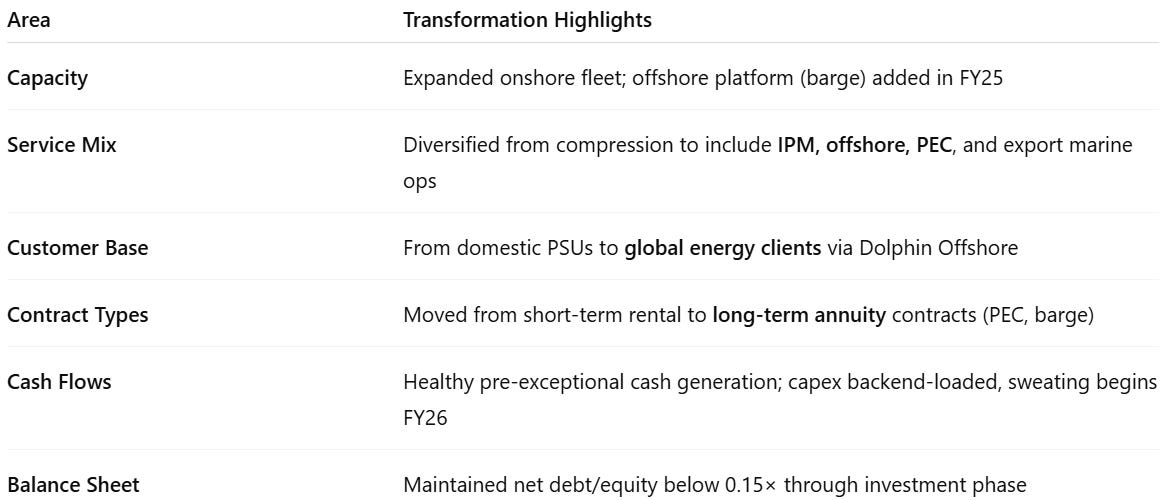

2.1 Business Evolution: FY21–FY25

3. Q4-25: In Losses with Revenue up 40% YoY

Deep Industries reported an exceptional item loss of ₹251 crore in Q4 FY25. It is primarily consisting of writing-off inventory and receivables which are not recoverable. This clean-up followed the acquisitions of:

Kandla Energy & Chemicals (acquired from liquidation)

Dolphin Offshore Shipping Ltd. (acquired via CIRP)

The ₹251 crore exceptional item was a strategic, non-cash clean-up related to acquired entities’ legacy issues. It was necessary to reset the books, and does not reflect any deterioration in Deep’s core operations or profitability.

4. FY25: In Losses & Revenue up 35% YoY

Revenue: driven by strong execution in gas, IPM, and rig contracts

Order book doubled to ₹2,960 Cr; ₹1,400 Cr from PEC and ₹1,560 Cr short-cycle across services

DP2 barge refurbished and contracted (₹281 Cr, 3-year lease); offshore revenue to begin FY26

Dolphin Offshore acquisition unlocked marine capability; signed export contracts for Mexico, Gulf

Kandla Energy acquisition completed for backward integration in PEC/IPM chemicals

PEC contract with ONGC operationalized; full ramp-up from FY26

Export business initiated via Dolphin/Beluga; set to scale in FY26–27

5. Business metrics: Improving return ratios

The improving return ratios, calculated excluding the ₹251 crore exceptional loss in Q4-25, confirm that Deep’s core operations and profitability remain intact with no underlying deterioration.

6. Outlook: FY26 Revenue CAGR 25%+ with margin expansion

Strong visibility supported by diversified order book, margin resilience, and offshore/PEC scale-up

6.1 FY25 Expectations vs Performance — Deep Industries

✅ Hits in FY25

Guidance Achieved Despite Offshore Delay: Delivered full-year revenue of ₹571 Cr, in line with the guided ₹570–575 Cr range — even without barge contribution. Core business resilience was clearly demonstrated.

Strong Margin Delivery: EBITDA margin expanded to 43.4%, driven by disciplined cost control, stable onshore service pricing, and improved mix from high-margin verticals like IPM.

Order Book Expansion: Total order book doubled YoY to ₹2,960 Cr, led by ₹1,400+ Cr PEC win and increased offshore contract wins; short-cycle book of ₹1,500+ Cr executable over FY26–28.

PEC Execution Begins: Operationalized ₹1,402 Cr Production Enhancement Contract (PEC) with ONGC by March-end. Full-scale monetization begins FY26.

Offshore Capabilities Ready: Completed refurbishment of Prabha DP2 barge; secured 3-year contract worth ₹281 Cr to commence from Q1 FY26, marking a major offshore monetization milestone.

Capital Structure Intact: Maintained net debt-to-equity of ~0.14x despite pre-committing to ₹500+ Cr in capex. Positioned for aggressive FY26 growth using internal accruals and planned QIP.

❌ Misses in FY25

Barge Revenue Slipped to FY26: Offshore barge Prabha was expected to contribute in FY25, but deployment delays (critical equipment from US) pushed revenue to FY26. However, full contract is locked in.

Non-Cash Exceptional Write-Off: Reported ₹251 Cr one-time exceptional loss due to write-off of legacy receivables/inventory from Dolphin and Kandla acquisitions; no impact on core cash flow or profitability.

Working Capital Drag at Dolphin: Subsidiary receivables (~₹164 Cr) remain outstanding; collections expected in FY26. Some impact on reported return ratios.

Modest Export Flow: Dolphin’s offshore contribution remains below potential; FY26 expected to see full-year revenue from international barge lease and new marine asset deployment.

ROCE Dip (Reported): ROCE declined on reported basis due to exceptional item; adjusted ROCE remains strong on operational performance.

6.2 Future Outlook – FY26 and Beyond

Strong Growth Visibility

Revenue Growth: Management expects 30% YoY growth in FY26 and ~25% in FY27, driven by:

Execution of ₹1,500+ Cr short-cycle order book

Ramp-up of the ₹1,402 Cr ONGC PEC contract

Full-year monetization of the ₹281 Cr barge lease via Dolphin Offshore

Initial contribution from offshore marine assets (tugs, vessels)

Margin Stability with Upside Optionality

EBITDA Margin Guidance: 41–44%, driven by:

High-margin offshore chartering (barge, marine)

Exceptional PEC economics (low capex, high share of incremental production)

Cost savings from backward integration via Kandla Energy

PAT Margins expected to improve to ~27–30%, supported by low overseas tax rates and operating leverage.

Strengthening Business Model

Deep is transitioning from a charter-driven, onshore-focused model to a multi-segment, integrated oilfield services platform, offering:

Long-cycle visibility via PECs

High-margin export revenue from offshore operations

IPM and gas service contracts for base revenue

Order Book & Bidding Pipeline

Current Order Book: ₹2,960 Cr, with:

₹1,400 Cr from 10–15 year PEC contract

₹1,560 Cr executable over 2.5–3 years

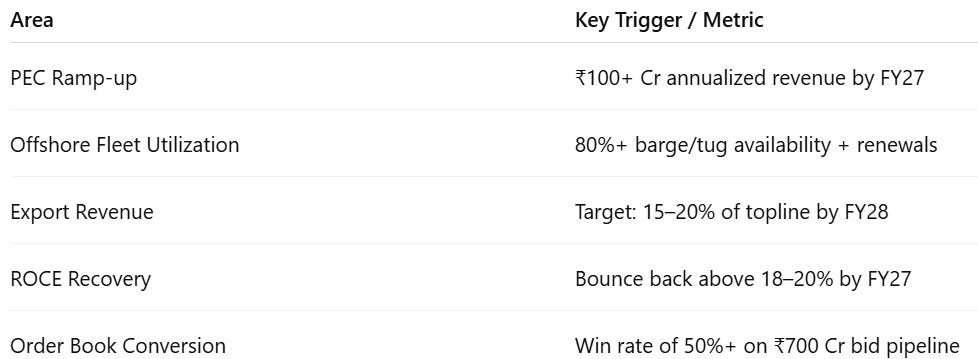

Bidding Pipeline: ₹550 Cr, with a strong historical success rate

Ongoing evaluation of new PEC tenders, offshore contracts, and exports

Capital Allocation Plans

₹500 Cr capex planned for FY26 across rigs, offshore assets, and PEC infrastructure

Funded via: ₹350 Cr QIP (planned)

Strategic & Geographic Expansion

Dolphin Offshore to scale operations in Mexico, Africa, and the Gulf

Exploration of platform support vessels, diving support, and offshore wind integration

Backward integration through Kandla to support margin expansion in chemical and fluid-intensive contracts

7. Valuation Analysis — Deep Industries Ltd

7.1 Valuation Snapshot

Assumptions

EBITDA Margin: 42.2% (FY24) → 43.4% (FY25) → 42.5–43.5% (FY26–27), driven by offshore and PEC scale-up

PAT Margin: 26.5%–28.5%, supported by operating leverage and international income tax benefits

EPS reflects dilution from ₹350 Cr QIP assumed at ₹438.65/share

FY25 EPS is on adjusted PAT and not on reported PAT

Valuation Progression

Valuations move from expensive (FY24) → elevated but improving (FY25) → reasonable (FY26) → undervalued (FY27)

Earnings, not re-rating, will likely drive returns going forward.

Execution of ₹950 Cr revenue and ₹271 Cr PAT in FY27 justifies further upside.

If management delivers on offshore, PEC, and bid pipeline conversion, current valuations may understate the true potential.

7.2 What’s in the Price?

The current valuation of ~17× FY26E P/E and ~13× forward EV/EBITDA suggests the market is pricing in:

FY26 PAT of ₹200–210 Cr with steady 27–28% margins

Successful monetization of:

DP2 barge Prabha (₹281 Cr, 3-year lease)

First phase of ONGC PEC (~₹65–70 Cr in FY26)

Revenue execution from short-cycle order book (~₹500–625 Cr spread across IPM, compression, rigs)

🔍 Implied Valuation Assumes:

Offshore operations stabilize with minimal delay

PEC infrastructure gets fully deployed without material cost overruns

Onshore base business continues at steady run-rate

₹350 Cr QIP does not excessively dilute ROE in the short run

Full earnings monetization by FY27 is priced in — any delay in offshore ramp-up, receivable recovery, or bid conversion could compress the multiple.

7.3 What’s Not in the Price?

Additional PEC Contracts: Only one ₹1,402 Cr contract is priced in; Deep is actively bidding for more long-cycle fields

Offshore Fleet Expansion: No value attributed to potential entry into platform support vessels, diving ops, fabrication

Arbitration Award Upside: Dolphin has pending claims under litigation, which could unlock high-margin cash flow

Backward Integration Margin Boost: Kandla Energy benefits (chemicals, fluids) could lift PEC profitability but are not factored in yet

Export Revenue from Beluga/Dolphin: LatAm + Gulf marine ops still at ~3% of sales — management targets 15–20% by FY28

Valuation Re-rating: Current 13–17× P/E could expand if ROCE improves to >20% sustainably post capex digestion

7.4 Risks and What to Monitor

The market is assuming smooth execution — here’s what could derail it:

Execution Risk

Barriers to barge deployment, PEC ramp-up, or delay in EPC handovers

Receivables stuck in Dolphin (~₹164 Cr in FY25)

Order Book Conversion: ₹700 Cr+ bid pipeline assumes a high win rate — any drop could impact FY27 top line

Working Capital Drag: Capex + poor collection cycles may strain ROCE below 15–16% in FY26

Sector Volatility: Regulatory, tax, or fuel price changes in offshore or oilfield services can materially affect volumes and margins

🔍 What to Monitor

The current valuation assumes clean execution, but also offers strong embedded optionality in offshore, exports, and asset productivity.

Monitoring execution cadence and return ratios will be key to multiple expansion and re-rating into FY27.

8. Implications for Investors

8.1 Bull, Base & Bear Scenarios — Deep Industries Ltd

Base Case assumes steady execution of current contracts, with high visibility.

Bull Case unlocks margin expansion, asset turns, and export optionality, triggering upside surprises.

Bear Case is driven by execution slippage, receivable delays, or underperformance in offshore, not core business weakness.

8.2 Is There Any Margin of Safety?

✅ Where There Is Margin of Safety

Business Quality & Model

Multi-segment model: Onshore, Offshore, PEC, IPM — reduces revenue concentration risk

Long-cycle PEC and offshore contracts provide annuity-like revenue visibility

Proven EBITDA engine: FY25 margin at 43.4% despite capex and restructuring

Offshore chartering (~60% margin) and PEC (~50%+) provide durable profitability

Capital Structure

Net debt-to-equity ~0.14× (FY25), strong cash flows pre-QIP

₹350 Cr QIP improves liquidity; no major equity dilution before FY26

Capex largely backend-loaded (barge, PEC infra) — sweating to drive ROCE

Execution Levers Not Priced In

Export scale-up from Dolphin/Beluga in Latin America and Gulf

Backward integration via Kandla Energy could boost PEC margins

Arbitration cash inflow from legacy Dolphin contracts could surprise positively

Additional PEC contracts (if won) could materially lift FY27–29 earnings visibility

Valuation vs Future Earnings

FY27 PAT of ₹271 Cr implies 12.9× P/E, and EV/EBITDA of 11.5× — attractive for high-quality infra/service model

Sustained PAT CAGR of 25%+ over FY25–27 locks in multi-year compounding runway

Offshore and PEC still scaling — room for operating leverage without re-rating

❌ Where There Isn’t Much Margin of Safety

Valuation Is Fair but Not Cheap

CMP P/E of ~17× FY26E assumes smooth delivery — no room for execution slippage

EV/EBITDA of 15× (FY26E) is not cheap for a business still digesting capex

Valuation improvement depends entirely on ROCE bounce and offshore delivery

Execution & Working Capital Risks

Dolphin receivables (~₹164 Cr) still under collection — could affect cash generation

PEC ramp-up timing and barge utilization are binary outcomes for margin delivery

Failure to win or execute new bids could lead to FY27 topline stagnation

Working capital absorption risk remains elevated due to long-cycle projects

FY25–27 valuation leaves low room for disappointment, but rewards any upside surprise in offshore execution, PEC expansion, or export ramp-up.

If Deep delivers ₹1,000 Cr in FY27 revenue and ₹270+ Cr PAT, current prices imply modest downside with significant optional upside — execution is the only missing link.

Previous coverage of DEEPINDS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer