Deep Industries: PAT growth of 45% & Revenue growth of 33% in 9M-25 at a PE of 19

Guidance of 33-35% Revenue growth in FY25. FY26 revenue growth of 35%. Revenue CAGR of 30% for next 3 years. Margins to remain stable. Order book in place to support revenue projections.

deepindustries.com | NSE: DEEPINDS

1. Providing various Oil & Gas support services

Key Business Segments

Gas Compression & Dehydration Services:

Builds, owns, & operates equipment to compress and dehydrate natural gas, boosting production and transportation efficiency.

Also provides turnkey gas processing facilities on charter-hire, covering everything from design to operation.

Onshore Drilling & Workover Rigs:

Maintains a fleet of drilling and workover rigs (30T–100T capacity).

Offers end-to-end Integrated Project Management (IPM) for drilling, completion, and well-servicing.

Production Enhancement Contracts (PEC):

Long-term agreements (notably with ONGC) to increase output from mature oil/gas fields.

Earns a service fee on current production plus a share of incremental production revenue.

Offshore Services (Dolphin Offshore Acquisition):

Owns and operates marine assets (e.g., a DP2 barge, anchor-handling tugs, supply vessels) for charter to offshore operators.

Plans to expand into broader offshore solutions, including fabrication, installation, and underwater services.

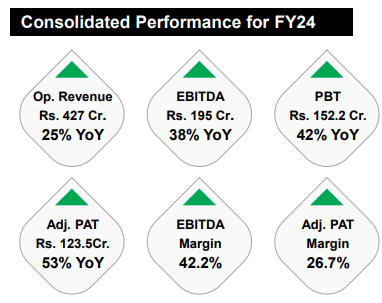

2. FY20-24: PAT CAGR of 42% & Revenue CAGR of 13%

3. FY24: PAT up 53% & Revenue up 25% YoY

4. Q3-25: PAT up 70% & Revenue up 48% YoY

PAT up 15% & Revenue up 19% YoY

5. 9M-25: PAT up 45% & Revenue up 33% YoY

6. Business metrics: Strong & improving return ratios

7. Outlook: FY25-28 Revenue CAGR of 30%

i. FY25: 33-35% Revenue growth

FY25 revenue of Rs 570-575 cr implies a 33-35% growth over the FY24 revenue of Rs 427 cr

this year we are expecting almost 35% growth to close FY25.

ii. FY26: 35% Revenue growth

And similar amount of growth we are expecting for FY26. So, our estimate says that we can close FY26 topline somewhere around Rs. 800 crores.

iii. FY25-28: Revenue CAGR of 30%

So we are all set for growth trajectory based on our existing order book and the new orders, which we are expecting to be awarded. We are expecting growth of more than 30% year-on year for next 3 years.

iv. Margins expected to remain stable

DEEPINDS management expects to maintain strong EBITDA margins, in line with its historical performance.

Maintained EBITDA margins around 45%–47% and intends to keep them in this range going forward, aided by cost discipline and operational efficiencies.

Management emphasized that the robust margin profile provides strong internal cash generation, which can help fund expansion.

v. Order book in place to support 30% revenue CAGR

Order book of Rs 2,701 cr is 3.4X the expected revenue for Rs 800 FY26.

Growth Drivers

Production Enhancement Contracts (PEC)

PEC from ONGC worth ~INR 1,402 crore over 15 years will contribute meaningfully once operational.

Deep will get a fixed service fee for current production levels plus a revenue share on incremental production from the fields.

Initial revenue to start flowing in late FY25, with a bigger uplift from FY26–27 onward.

Offshore Services via Dolphin Offshore

With the Dolphin Offshore subsidiary, management has pivoted to marine services (e.g., dynamic-positioning barges, tugs, and support vessels).

Deep’s refurbished DP2 barge, “Prabha,” is set for deployment soon (internationally, likely in the Gulf of Mexico region) and is expected to command strong daily charter rates (50%+ EBITDA margin).

Further expansion in offshore assets (tugs, diving support, and supply vessels) is on the anvil depending on demand and contract availability.

Charter Hire of Entire Gas Processing Facilities

Management sees robust potential for turnkey projects (design, installation, and operation) of gas processing and dehydration units.

Demand for outsourced compression and related services remains high, aided by tightening safety norms and the push for higher domestic gas output.

Onshore Workover & Drilling Rigs

Adding new onshore rigs (both workover and drilling), supported by increasing E&P activity from public and private oil companies.

Future capex will be backed by firm contracts, helping the company maintain capital efficiency in this segment.

M&A Plans.

Evaluating inorganic opportunities to accelerate growth in oilfield services

Sectoral Tailwinds

The updated Oilfields (Regulation and Development) Amendment Bill, 2024, expanding the definition of mineral oils and streamlining petroleum leases, should spur fresh exploration and production activity.

Management expects increased outsourcing of oilfield services in India, boosting demand for turnkey solutions in drilling, compression, production enhancement, and marine services.

8. PAT growth of 45% & Revenue growth of 33% in 9M-25 at a PE of 19

9. Hold?

If I hold the stock then one may continue holding on to DEEPINDS

DEEPINDS has delivered a strong 9M-25. The guidance for FY25, FY26 and overall next 3 years is 30%+. One can easily to ride out the growth for the next 3 years

The strong outlook for DEEPINDS is backed by a strong order book.

One should ride the 30% growth outlook as long as DEEPINDS

10. Buy?

If I am looking to enter DEEPINDS then

DEEPINDS has delivered PAT growth of 45% & Revenue growth of 33% in 9M-25 at a PE of 19 which makes valuations quite reasonable in the short term.

DEEPINDS is guiding for 33-35% revenue growth in FY26 at a PE of 19 which makes valuations quite reasonable from a FY26 perspective.

Revenue CAGR guidance of 30%+ with stable margins for the next 3 years at a PE of 19 makes valuations quite reasonable from the medium to longer term.

Previous coverage of DEEPINDS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

You haven’t mentioned the plan for QIP. What do you think will be the impact of equity dilution? it will be a big QIP 500 cr

Your view on this