Deep Industries: PAT growth of 33% & Revenue growth of 35% in H1-25 at a PE of 26

Guidance of 35% revenue CAGR for FY24-26. Margins to remain stable during FY24-26. Order book in place to support revenue projections. Strong outlook for order inflows provides visibility into FY27

deepindustries.com | NSE: DEEPINDS

1. Providing various Oil & Gas support services

DEEPINDS focuses on onshore oil and gas services, while its subsidiaries expand its offerings to include offshore support services and gas processing in the Middle East.

Dolphin Offshore: Specialises in providing offshore support services to the oil and gas industry. It owns a barge, Prabha, currently under refurbishment and expected to be operational in Q4 FY25, and a Diving Support Vessel (DSV). DEEPINDS is expecting daily revenue of $50,000 to $55,000 from the Prabha barge and around $2-3 million in revenue from the DSV contract for H2 FY25.

Middle East Operations: Providing gas processing services, including compression, dehydration, and processing in Egypt and Oman. It contributes around Rs. 40 to 50 crores annually and is expected to grow by 10-15%.

RAAS: Focuses on the booster compression business but is not expected to grow significantly due to extensions being granted to City Gas distribution companies.

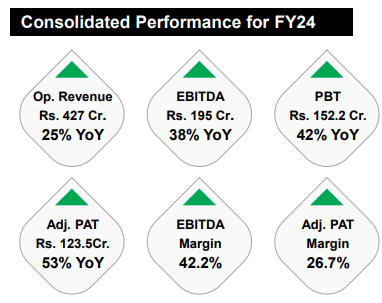

2. FY20-24: PAT CAGR of 42% & Revenue CAGR of 13%

3. FY24: PAT up 53% & Revenue up 25% YoY

4. Q2-25: PAT up 41% & Revenue up 2% YoY

5. H1-25: PAT up 33% & Revenue up 25% YoY

6. Business metrics: Strong & improving return ratios

7. Outlook: FY24-26 Revenue CAGR of 35%

Much of the growth is driven by two major opportunities, the production sharing enhancement contract with ONGC, which will start contributing to revenue in FY26, and the full year operation of the Prabha barge, which is expected to be operational in Q4 FY25.

For the standalone business, DEEPINDS is aiming at around Rs. 460 crores in revenue for FY25. With its existing fleet, including three new rigs that will start contributing to revenue in Q4 FY25 or Q1 FY26, DEEPINDS has the capacity to book revenue of around Rs. 460 to 500 crores a year.

DEEPINDS order book has grown to Rs. 2,622 crores, almost 119% higher than Q2 FY24. This is separate from the order book of its subsidiary Dolphin Offshore.

i. FY25: 35% Revenue growth

this year we are expecting almost 35% growth to close FY25.

ii. FY26: 35% Revenue growth

And similar amount of growth we are expecting for FY26. So, our estimate says that we can close FY26 topline somewhere around Rs. 800 crores.

iii. Margins expected to remain stable

DEEPINDS management expects to maintain strong EBITDA margins, in line with its historical performance.

Overall EBITDA Margin: DEEPINDS has consistently maintained EBITDA margins in the range of 45%, providing a healthy cash flow for future growth. The company aims to continue this trend moving forward.

Production Enhancement Contract (PEC) Margin: DEEPINDS anticipates EBITDA margins above 40% for the PEC with ONGC. This high-value, 15-year contract is expected to significantly contribute to both top-line and bottom-line growth.

Fixed-Price Contracts: DEEPINDS primarily operates on fixed-price contracts for its services, providing insulation from price fluctuations and supporting margin stability.

Focus on Natural Gas: DEEPINDS primary focus on natural gas services, rather than oil, further mitigates its exposure to price volatility, contributing to a more predictable margin outlook.

iv. Order book in place to support 35% revenue CAGR for FY24-26

Order book of Rs 2,622 cr is 4.5X expected revenue for FY25. Expectation of strong order inflow in FY25

Core business order book is somewhere around Rs. 1,250 crores

good amount of orders should come in next 3-6 months and considering the bidding pipeline of almost Rs. 800 crore for our regular traditional business, it should continue to grow even further

8. PAT growth of 33% & Revenue growth of 25% in H1-25 at a PE of 26

9. Hold?

If I hold the stock then one may continue holding on to DEEPINDS

DEEPINDS has delivered a strong H1-25. The expectations for H2-25 and overall FY25 are strong

The Financial Year ‘25 is shaping up to be a landmark year for us as we are on track to achieve our highest ever revenue, EBITDA and net profit.

With government initiatives expected to boost infrastructure, exploration and production sector investments, particularly in the energy sector, we anticipate maintaining our upward trajectory throughout the rest of the year.

Our H2 would definitely be higher in terms of revenue than H1

The outlook for DEEPINDS is strong and supported with a strong order book.

The outlook for order inflow is strong with a good amount of orders expected in next 3-6 months and considering the bidding pipeline of almost Rs. 800 crore for the regular traditional business

10. Buy?

If I am looking to enter DEEPINDS then

DEEPINDS has delivered PAT growth of 33% & Revenue growth of 25% in H1-25 at a PE of 26 which makes valuations quite reasonable in the short term.

Revenue CAGR guidance of 35%+ with stable margins for FY24-26 at a PE of 26 makes valuations quite reasonable from the medium to longer term.

One needs to keep in mind the risks associated with a sub Rs 1,000 cr company.

Previous coverage of DEEPINDS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer