Deep Industries Q2 FY26 Results: PAT up 78%, Can Beat FY26 guidance

Guidance of 35%+ revenue CAGR for FY25-27 with stable margins. Order-book provides revenue visibility till FY27. Valuations creates opportunity for re-rating

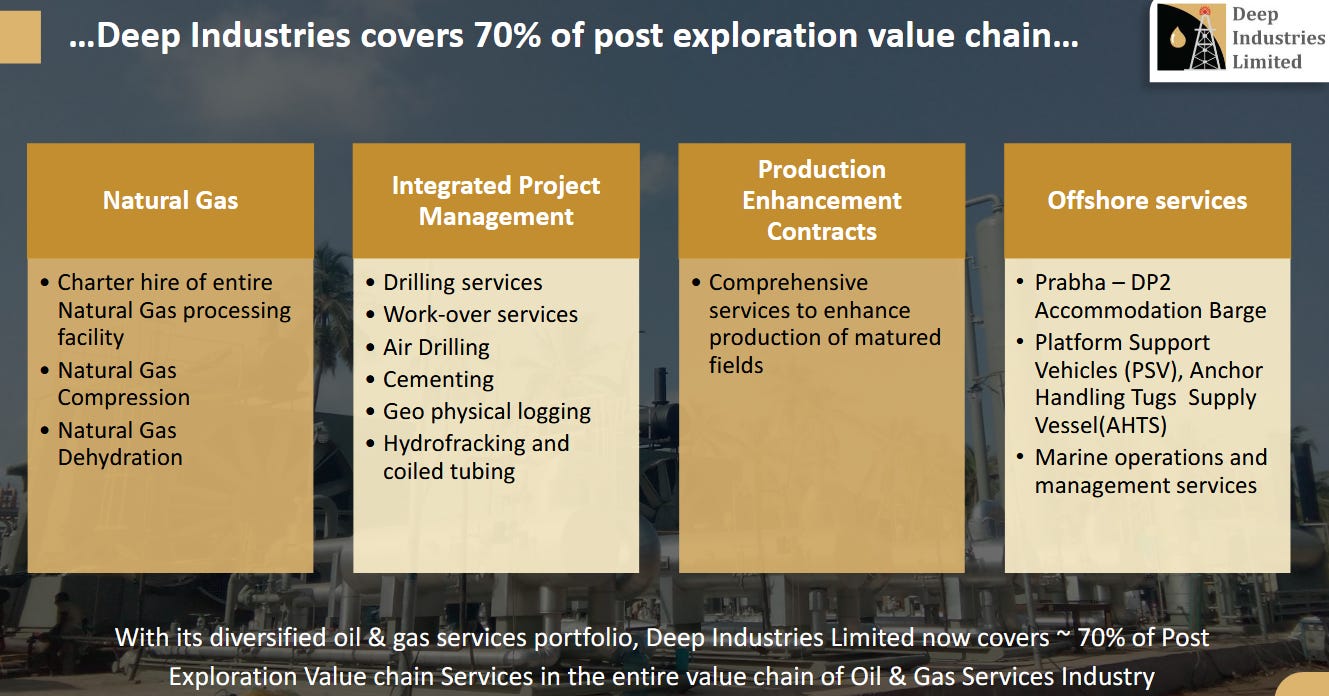

1. Oil & Gas Support Services

deepindustries.com | NSE: DEEPINDS

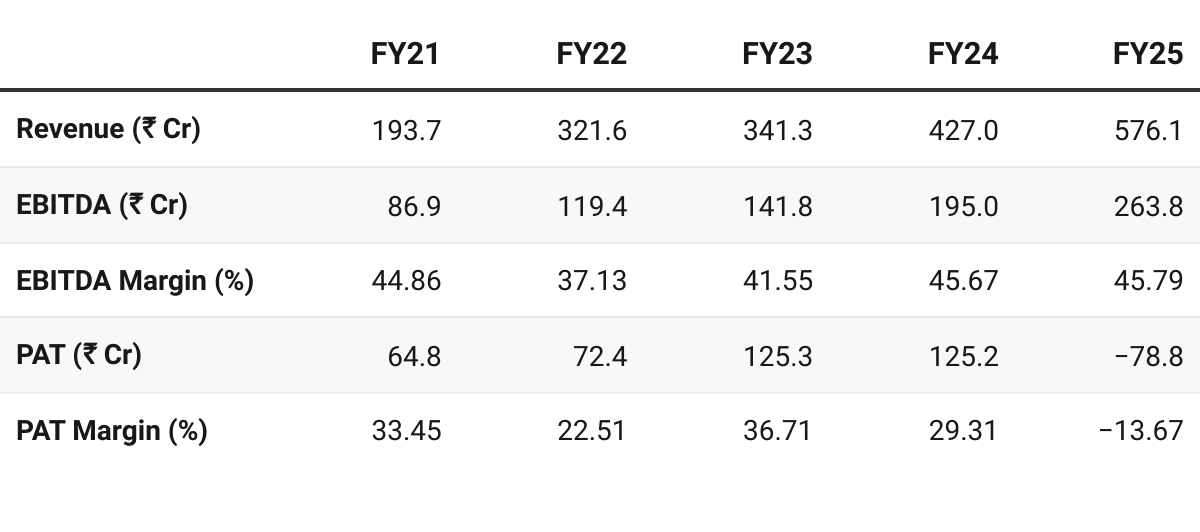

2. FY21-25: EBITDA CAGR of 32% & Revenue CAGR of 30%

3. FY25: In Losses & Revenue up 35% YoY

Acquisitions in FY25

Dolphin Offshore: Marine capability — signed export contracts for Mexico, Gulf

Kandla Energy: backward integration in PEC/IPM chemicals

Exceptional item loss of ₹251 crore in Q4 FY25

Consisting of writing-off inventory and receivables which are not recoverable. Clean-up followed the acquisitions of:

Kandla Energy & Chemicals (acquired from liquidation)

Dolphin Offshore Shipping Ltd. (acquired via CIRP)

A strategic, non-cash clean-up related to acquired entities’ legacy issues.

No deterioration in Deep’s core operations or profitability as seen from the revenue growth and EBITDA margins

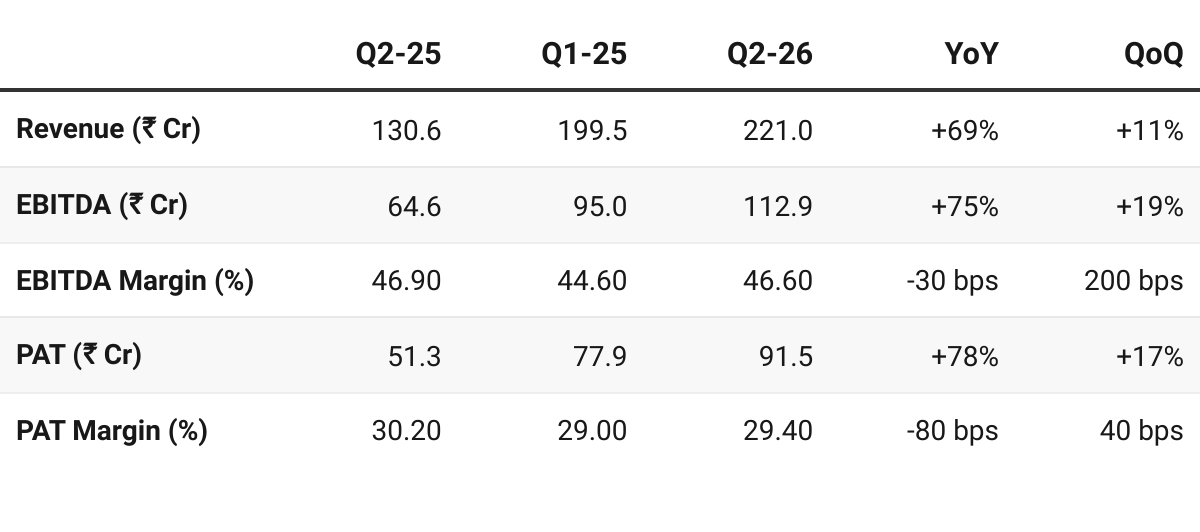

4. Q2-26: Profit up 78% & Revenue up 69% YoY

Profit up 17% & Revenue up 11% QoQ

Increase in revenue due to addition of new assets into operation.

Rigs: Six more rigs in the last eight months.

Gas Processing: A new project has been added to the operating fleet in the entire gas processing services segment.

Future Deployment: 2 additional rigs are expected to be deployed in H2 FY26

Strong Q2 performance to be seen within a broader context of favorable market conditions

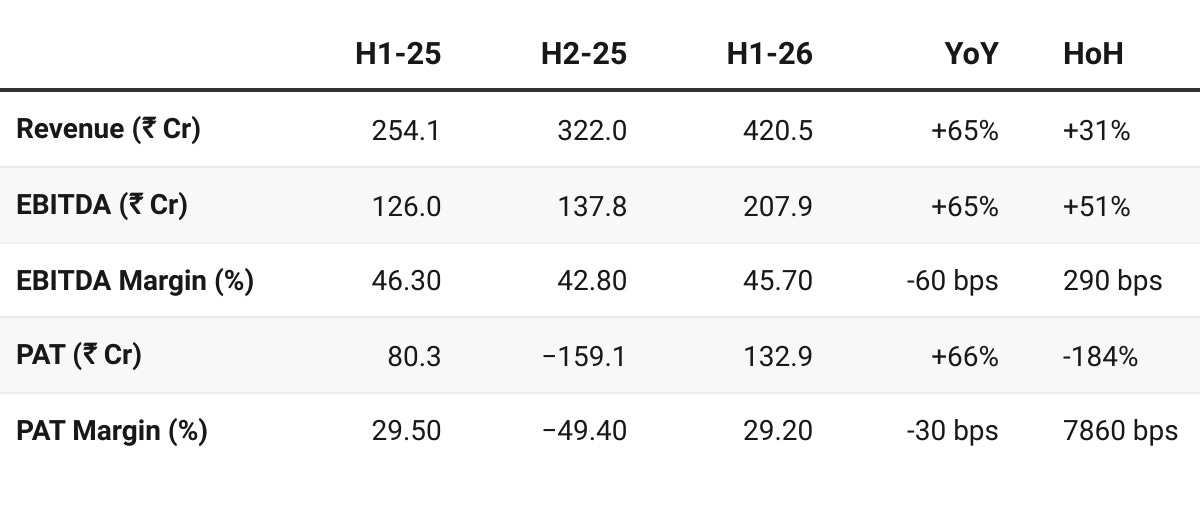

5. H1-26: Profit up 78% & Revenue up 65% YoY

Profit up 17% & Revenue up 11% QoQ

The successful first half has “laid a solid foundation for the remainder of the year”. Management anticipates the H2 revenue would be higher than H1.

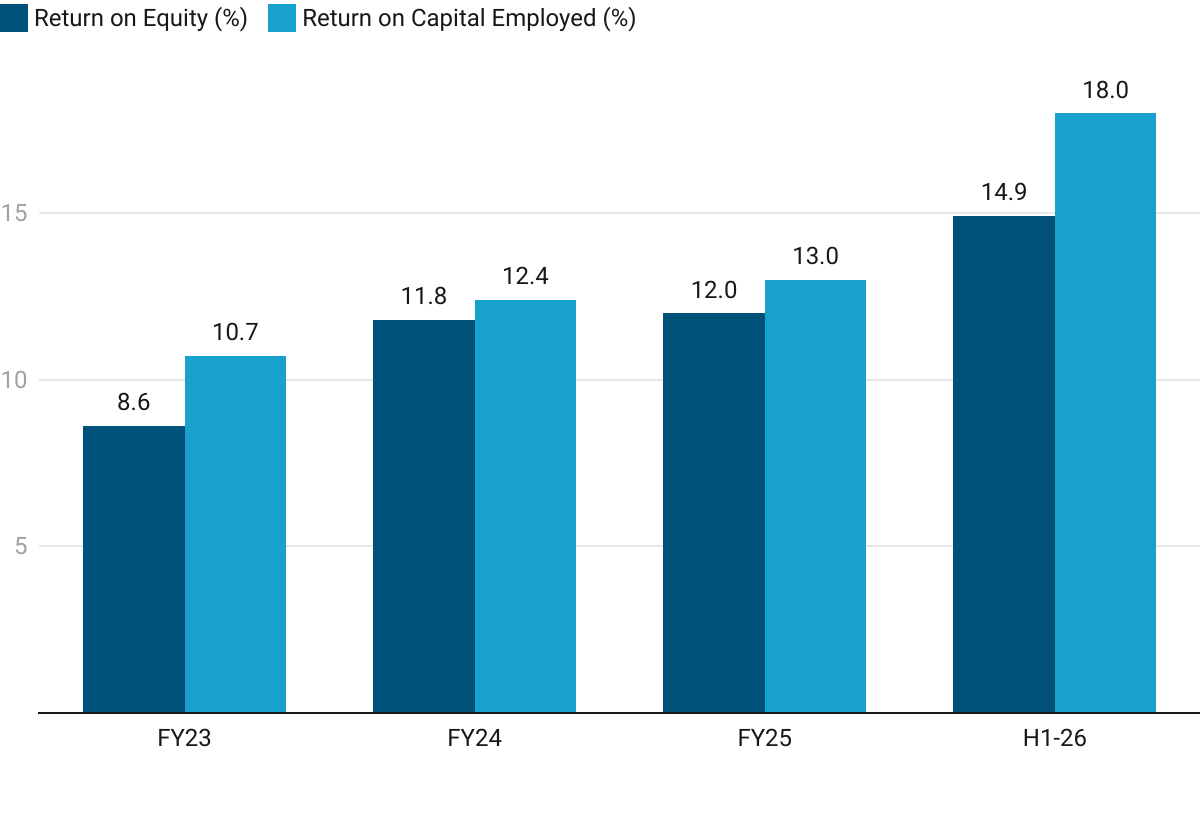

5. Business Metrics: Improving Return Ratios

FY25 - excluding the ₹251 crore exceptional loss

6. Outlook: Revenue CAGR of 35%+ FY25-27

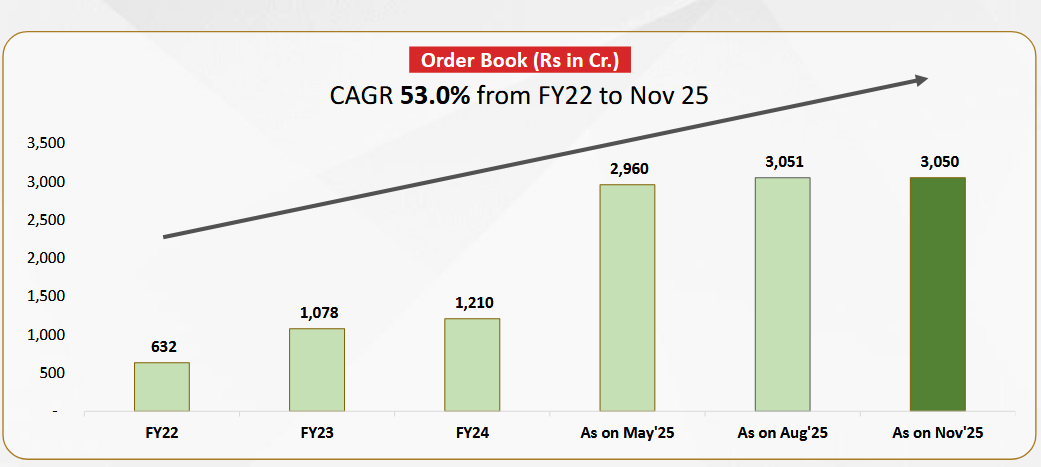

Strong growth visibility supported by order book

6.1 Management Guidance – FY26

FY26

Revenue Growth: This year we are expecting to close with growth of more than 35% and I think we are right there on that trajectory. So even if we are not factoring growth in H2 it would be more than 38-39% kind of growth over and above over previous years.

Margins: So margin we believe uh it should improve a bit uh going forward and we are expecting our EBITDA margins to grow upwards beyond 45% in coming quarters.

FY27 Revenue Growth: Production enhancement contract and new addition of rigs which have not contributed on full year basis in current financial year. They would start contributing revenue on full year basis from next financial year and of course Dolphin will also have full year revenue from next financial year. So all put together we are expecting growth of another 35 to 38% kind of growth on year-on-year basis in next financial year as well.

Revenue Visibility: Based on existing order book we believe for next 2 years this kind of growth is clearly visible. Depending on further addition to this order book uh we can continue the momentum beyond two years as well

6.2 H1 FY26 Performance vs Full-Year FY26 Guidance

Revenue: If we assume H2 revenue to be same as H1 revenue — FY26 revenue = ₹840 Cr i.e a 46% growth over FY25

This implies FY25 growth guidance is conservative as the DEEPINDS management confirms that H2 revenue will be higher than H1

Strong possibility of beating current guidance

So H2 would continue the momentum and we are expecting H2 would have a growth over H1.

EBITDA Margin(%): Within guided range

Order Book: Provided visibility and supports FY27 growth

Kandla Receivables Status: Unresolved, no recovery yet

Not taken any provision on those receivables

Could be a repeat of one-off like Q4-25 which led to -ve PAT in FY25

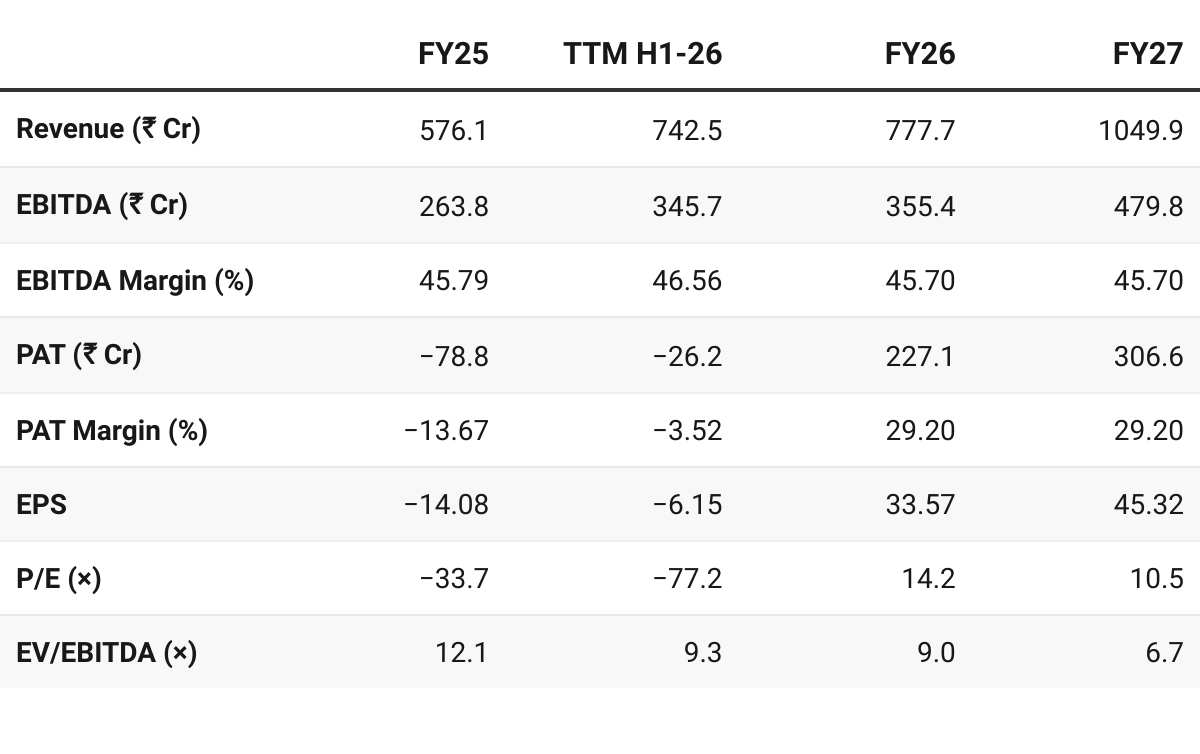

7. Valuation Analysis — Deep Industries Ltd

7.1 Valuation Snapshot

CMP: ₹475 Cr | Market Cap: ₹3,040 Cr

Assumptions — 35% revenue growth with stable margins (as per guidance)

Attractive Forward Valuations

FY26 and FY27 valuations are not demanding — provide flexibility to sustain a quarter or two where performance is not as per guidance

Reasonably valued on FY26E and attractively valued on FY27E, provided execution sustains with the guided range with stable margins. Multiples leave room for re-rating if FY27 is delivered.

7.2 Opportunity at Current Valuation

Conservative Guidance: Management guidance is conservative and possibility of 45%+ growth in revenue possible

Revenue Visibility: FY26 and FY27 revenue projections supported by an order book of ₹3,050 Cr order book

Possibility of re-rating: PAT turns positive in FY26

7.3 Risk at Current Valuation

Execution Risks: Delivering 35%+ growth for 2 consecutive years requires execution excellence

Client Concentration:

ONGC contributes almost 60% of the total revenue.

Dependency reduced over time — Earlier ONGC contributed 75-80%

DEEPINDS has added private clients and overseas operations

However, in India, ONGC would definitely be there as a primary client.

A court case (arbitration) with ONGC is ongoing

Kandla + Dolphin Receivables: No recovery since the last quarter.

Have not yet taken any provision on these receivables

While management expects no write-offs.

A repeat of Q4-25 possible where one-off items made PAT negative for FY25

Previous coverage of DEEPINDS

If you want to share any suggestions about the Money Muscle, or if there are any specific stocks you’d like us to cover, just send an email to hi@moneymuscle.in

Don’t miss reading our Disclaimer