Deep Industries Q1 FY26 Results: PAT up 59%, On track FY26 guidance

Growth of 30%+ in FY26 with expanding margins. Strong visibility across PEC, offshore, and rig services, combined with attractive valuations provides opportunity

1. Providing various Oil & Gas support services

deepindustries.com | NSE: DEEPINDS

Key Business Segments

Gas Compression & Dehydration

Builds, owns, and operates gas compression and dehydration units across India

Provides turnkey gas processing plants on charter-hire, from design to operation

Core legacy business with stable cash flows and long-standing PSU relationships

Onshore Drilling & IPM

Fleet includes 9 workover rigs and 5 drilling rigs (30–100T capacity)

Offers Integrated Project Management (IPM) for full well lifecycle — drilling to completion

Recent projects include Selan contracts across Gujarat and Northeast India

Production Enhancement Contracts (PEC)

10–15 year contracts to enhance output from mature fields (starting with ONGC)

Revenue = fixed fee + share of incremental production

First ₹1,402 Cr PEC launched in March 2025; more tenders under evaluation

Offshore & Marine Services — Via Dolphin Offshore

Acquired Dolphin Offshore (NCLT) to enter offshore energy services

Assets include DP2 barge, AHTS vessels, and marine infra

FY26+ focus: barge deployment (₹281 Cr contract), export marine charters (Mexico, Africa)

Chemical & Fluid Supply (Backward Integration) — Via Kandla Energy & Chemicals Acquisition

Acquired to secure in-house supply of chemicals, drilling fluids, and materials

Supports PEC/IPM operations by improving margin control and reducing third-party dependency

Will begin margin contribution in FY26 and beyond

2. FY21-25: EBITDA CAGR of 32% & Revenue CAGR of 30%

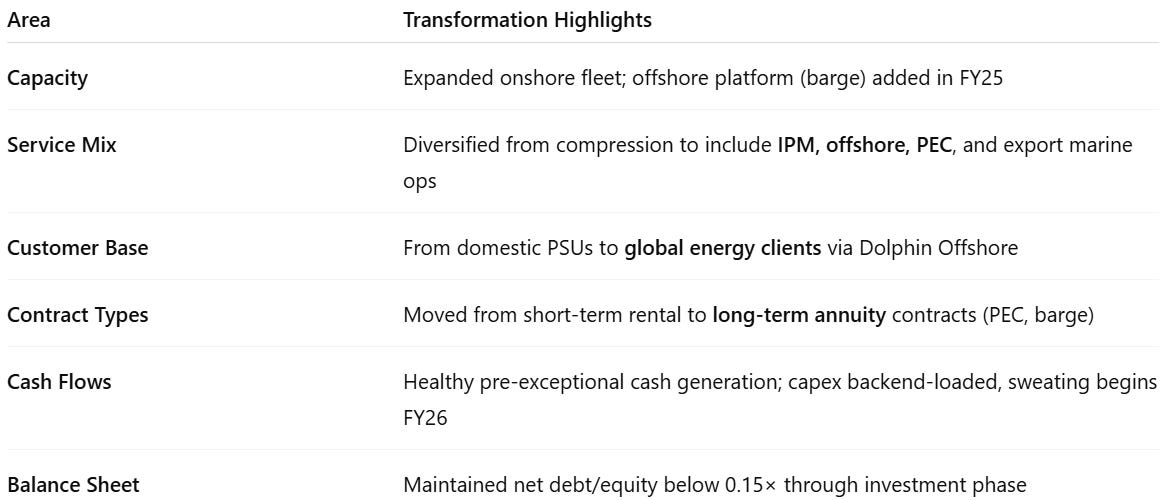

2.1 Business Evolution: FY21–FY25

3. FY25: In Losses & Revenue up 35% YoY

Revenue: driven by strong execution in gas, IPM, and rig contracts

Order book doubled to ₹2,960 Cr; ₹1,400 Cr from PEC and ₹1,560 Cr short-cycle across services

DP2 barge refurbished and contracted (₹281 Cr, 3-year lease); offshore revenue to begin FY26

Dolphin Offshore acquisition unlocked marine capability; signed export contracts for Mexico, Gulf

Kandla Energy acquisition completed for backward integration in PEC/IPM chemicals

PEC contract with ONGC operationalized; full ramp-up from FY26

Export business initiated via Dolphin/Beluga; set to scale in FY26–27

Exceptional item loss of ₹251 crore in Q4 FY25

Consisting of writing-off inventory and receivables which are not recoverable. Clean-up followed the acquisitions of:

Kandla Energy & Chemicals (acquired from liquidation)

Dolphin Offshore Shipping Ltd. (acquired via CIRP)

A strategic, non-cash clean-up related to acquired entities’ legacy issues.

Necessary to reset the books, and does not reflect any deterioration in Deep’s core operations or profitability.

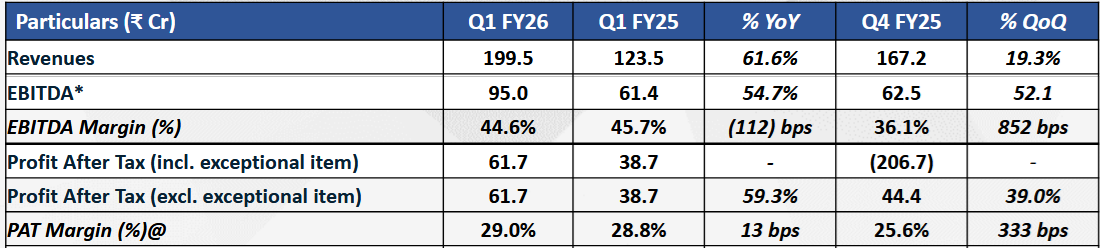

4. Q1-26: Profit up 59% & Revenue up 62% YoY

Growth was volume-led across all segments, with no contribution yet from Kandla and only partial contribution from Dolphin and PEC.

Broad-Based Execution Driving Growth

Revenue rose 61.6% YoY, led by timely execution of diversified contracts across gas compression, workover rigs, and modular gas processing.

No contribution from Kandla in Q1. Dolphin and PEC segments contributed partially.

Margin Outlook Stable

EBITDA margin at 44.6% remains within the guided range of 40–45%.

Management expects further margin improvement from:

Full-scale Dolphin revenue (60–65% margin on offshore services)

Backward integration via Kandla from FY27 (1.5–2% margin benefit)

Segment Ramp-Up in FY26

Dolphin Offshore expected to contribute ₹100 Cr+ in FY26. Q1 revenue from Dolphin: ~₹16 Cr (2-month impact).

Prabha barge operational from May 2025; will have full-quarter impact from Q2.

PEC contract: ₹140 Cr annual run-rate. Contribution begins meaningfully from H2 FY26.

Workover rigs: ₹96.7 Cr and ₹45 Cr contracts from Oil India. Deployment from Q4 FY26 post mobilization.

Order Book & Pipeline

Order book at ₹3,051 Cr, up 152% YoY.

Bid pipeline of ₹700 Cr, with high confidence in conversions.

Diversified across PEC, offshore, gas processing, and rig services.

Receivables Situation

Legacy receivables from Dolphin & Kandla: ₹350 Cr+.

Management does not expect write-offs in FY26; recovery expected over 2 years.

Already secured legal awards for part of Dolphin receivables (~₹31 Cr).

Capex Plans

Dolphin fleet expansion planned at ₹350–400 Cr over FY26–27.

To be triggered only after firm contracts.

Vessels include tugs (

$20k/day) and platform support vessels ($50k/day).

Funding Position

Comfortable liquidity; QIP deferred due to strong internal accruals.

Open to capital raise depending on market timing and Dolphin capex needs.

5. Business metrics: Improving return ratios

The improving return ratios, calculated excluding the ₹251 crore exceptional loss in Q4-25, confirm that Deep’s core operations and profitability remain intact with no underlying deterioration.

6. Outlook: Revenue growth of 30%+ with margin expansion

Strong visibility supported by diversified order book, margin resilience, and offshore/PEC scale-up

6.1 Management Guidance – FY26

Revenue Growth (YoY): 30%+ growth expected based on current order book

EBITDA Margin: Maintained at 43–45%, with upside from offshore & backward integration

PAT Growth: Higher than revenue growth due to margin tailwinds

Order Book ₹3,051 Cr as of Q1 FY26 (+152% YoY); expected to support growth for 2–3 years

Bid Pipeline: ₹700 Cr currently; management confident of steady conversions

Capex – PEC: ₹160 Cr for ONGC PEC contract (₹70–80 Cr in FY26, rest in FY27)

Capex – Dolphin (Offshore): ₹350–400 Cr over FY26–27 for vessel acquisitions (to be timed with contracts)

Receivable Recovery: ₹350 Cr total legacy receivables (Kandla + Dolphin); expected recovery over 2 years, no FY26 write-offs

Cash Flow & Liquidity: Healthy operating cash; sufficient internal accruals to fund capex

QIP / Equity Raise: Deferred; will time based on market conditions. All approvals in place

6.2 Q1 FY26 vs Full-Year FY26 Guidance

Revenue: Strong start; Q1 run-rate supports target

EBITDA: On track; Q1 is 29%+ of full-year target

EBITDA Margin (%): 44.6% 43–45% — Within guided range

PAT (₹ Cr): ~31% of FY26 PAT achieved in Q1

Order Book (₹ Cr) ₹3,051 Cr Maintain 2–3 year visibility and supports medium-term growth

Dolphin Offshore Revenue:

~₹16 Cr (May–June only)

₹100+ Cr expected for FY26

On track; full-quarter contribution from Q2

PEC Contract Revenue:

Minimal (~₹1 Cr/month baseline)

₹70–75 Cr in FY26 (H2 weighted)

Will ramp up in H2

Capex – PEC: Yet to begin. ₹160 Cr total (₹70–80 Cr in FY26)

To commence later in FY26

Capex – Dolphin: Evaluating opportunities; not yet committed ₹350–400 Cr (based on contract triggers)

Conservative approach as guided

Bid Pipeline Active; ₹700 Cr Steady inflow expected — Reinforces future growth

Utilization of Rigs: 100% Adding 2 more rigs in FY26 — Operational execution on track

Key Takeaways

Q1 performance is materially ahead of linear run-rate:

₹199.5 Cr revenue already implies 26.6% of the full-year ₹750 Cr target — providing significant buffer.

PAT and EBITDA already >29–30% of FY26 estimates.

Segment-wise execution is aligned with expectations:

Dolphin Offshore began contributing in May; Prabha’s full impact will reflect from Q2 onward.

PEC contract is currently contributing minimal baseline amounts, as expected. H2 ramp-up is key.

Guidance appears conservative:

Management reiterated 30% revenue growth, despite strong Q1.

Embedded upside from Dolphin scale-up, PEC annuity, and potential bid wins not yet factored into the topline guidance.

Margin and working capital discipline maintained:

EBITDA margin remains in the guided 43–45% band.

Receivable recovery is being pursued actively, and no new write-offs are planned in FY26.

Q1 FY26 Delivery Strongly Supports FY26 Targets

Execution across segments is aligned with guidance.

Momentum from new verticals (offshore, PEC) to accelerate from Q2 onwards.

Guidance looks achievable with upside potential, especially if bid conversions and asset utilization sustain.

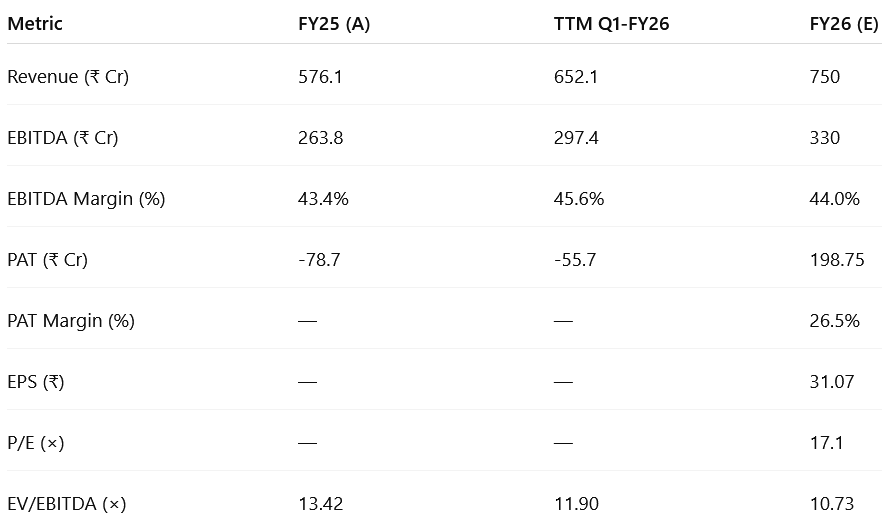

7. Valuation Analysis — Deep Industries Ltd

7.1 Valuation Snapshot

Here is the updated valuation analysis of Deep Industries Ltd, incorporating the most recent financial performance, management commentary, and guidance from Q1 FY26:

Market Cap: ₹3,398.4 Cr | EV: ₹3,876 Cr

P/E Ratio – 17.1x FY26E

Suggests modest premium to broader small/mid-cap industrial services sector.

However, justified by:

Strong 30%+ growth trajectory

Expanding offshore margins (Dolphin 60–65%)

High visibility from multi-year PEC and charter contracts

High PAT margin of ~26.5%

EV/EBITDA – 10.7x FY26E

Valuation multiple is compressing despite earnings growth, signaling:

Improving operating leverage

Scope for further rerating if execution sustains

Room for upside if Dolphin and PEC scale-up outperforms base assumptions

Strategic Upside Triggers (Not Fully Priced In)

FY27 EBITDA could exceed ₹410 Cr, implying FY27E EV/EBITDA < 9x

PAT growth outpacing revenue due to margin leverage

Dolphin offshore vessel expansion + PEC + Kandla = multiyear margin expansion + volume growth

Conclusion:

Current valuation (P/E 17.1x and EV/EBITDA 10.7x FY26E) appears reasonable-to-attractive given:

High PAT margin profile (26.5%)

3-year visibility from ₹3,000+ Cr order book

Strong balance sheet and disciplined capital allocation

7.2 Opportunity at Current Valuation

Robust Growth Visibility: FY26 revenue expected to grow 30%+ YoY, supported by a ₹3,051 Cr order book (+152% YoY) and ₹700 Cr bid pipeline. Key growth levers include ramp-up of offshore services (Dolphin), baseline PEC contracts, and expansion in gas processing under lease-operate-maintain models.

Margin Leadership Across Segments: Q1 FY26 EBITDA margin at 44.6%, with Dolphin offshore delivering 60–65% margins. FY26 PAT margin guided at ~26.5%, placing Deep among the most profitable names in oil & gas services.

Execution-led Earnings Expansion: TTM EBITDA already at ₹297 Cr vs FY26 guidance of ₹330 Cr, suggesting high visibility. PAT for Q1 is ₹61.7 Cr — already 31% of FY26 target — indicating potential for beat if execution continues.

Asset-light Capex Model: Dolphin and PEC assets being scaled only with firm orders, allowing strong control over return on capital. FY26 capex (~₹70–80 Cr PEC; ₹350–400 Cr Dolphin) will be internally funded with minimal dilution pressure.

Valuation Compression + Earnings Growth:

EV/EBITDA: Compressing to 10.7x FY26E from 13.4x (FY25)

P/E: At 17.1x FY26E, reasonable for 30%+ revenue and 150%+ PAT growth

Room for rerating as revenue growth compounds and net profit turns positive

Kandla Integration Upside: From FY27, expected to lower cost base by 1.5–2%, improving margin profile without new revenue risk.

Opportunity Rating: HIGH

Strong earnings visibility, expanding margins, capital discipline, and strategic diversification offer significant upside. If Dolphin, PEC, and Kandla ramp up as guided, the stock has rerating potential with minimal execution risk embedded.

7.3 Risk at Current Valuation

Receivable Overhang: Legacy receivables of ₹350 Cr (Dolphin + Kandla) yet to be recovered; while management expects no write-offs in FY26, recovery remains critical over the next 24 months.

Execution Risk in Offshore Expansion: Dolphin’s vessel capex (~₹400 Cr) is opportunity-linked, but funding and timely mobilization will be key. Slippage in charter demand or delay in asset deployment can impact FY27 visibility.

Lumpy Revenue Recognition: Contracts (especially PEC, offshore) have back-ended ramps. Q1 was seasonally strong; quarterly volatility possible, which may affect sentiment in the interim.

Kandla & Ras Equipment Still Stabilizing:

Kandla to contribute from FY27; revenue model not fully defined

Ras Equipment remains underutilized due to weak city gas compressor demand

High Base Effect: Q1 FY26 YoY growth was 61.6%. This sets a high benchmark, and future quarters may appear flattish despite underlying strength.

Risk Rating: MODERATE

Risks are execution- and receivable-related, not structural. Deep’s strategy of order-backed capex, margin discipline, and contract visibility helps mitigate most downside scenarios. Monitoring receivable recovery and Dolphin scale-up will be key.

Previous coverage of DEEPINDS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer