Deep Industries: PAT growth of 112% & Revenue growth of 45% in H1-24 at PE of 10

Order book providing revenue visibility for 3 years. Highest ever bidding pipeline which could further enhance the order book going forward. Available at attractive valuations 1.2 times price to book

1. Providing various of Oil & Gas support services

deepindustries.com | NSE : DEEPINDS

Deep Industries Ltd. is specialized in providing various of Oil & Gas support services including Natural Gas Compression Services, Drilling and Workover Rigs Services, Natural Gas Dehydration Services and Integrated Project Management Services.

Recently, the company also forayed into EPC of gas processing facilities on charter hire basis for our client. Deep Industries is the first entity in the country to provide this one of it’s kind service

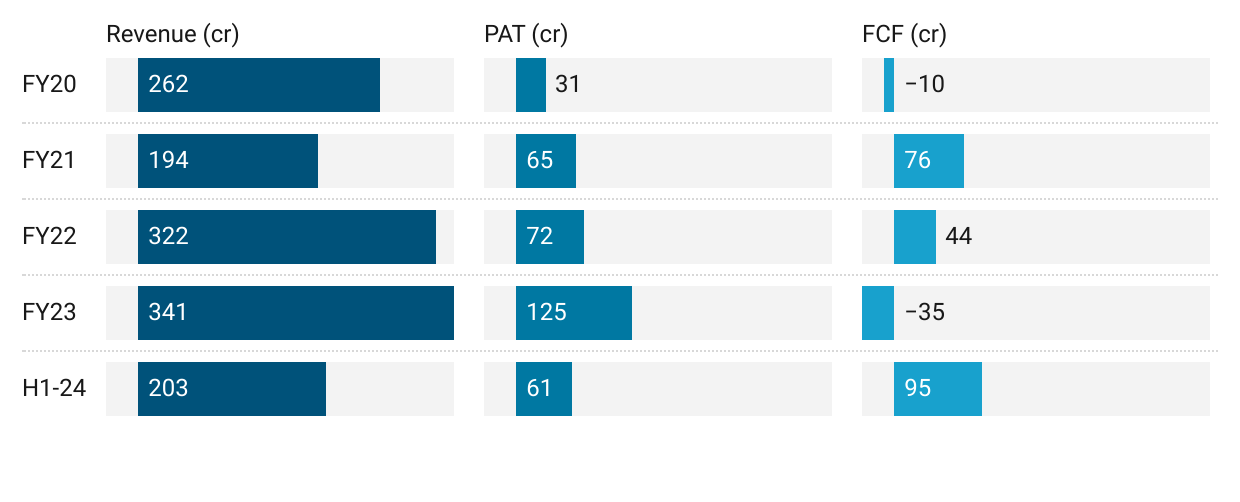

2. FY20-23: Barring FY22, low or no revenue growth

Sequential YoY growth in PAT for all years in FY20-23

Strong top-line and bottom line growth expected in FY24

3. Tepid FY23: PAT up 11% and Revenue up 6% YoY

4. Strong Q1-24: PAT up 54% and Revenue up 39% YoY

5. Strong Q2-24: PAT 342% & Revenue up 52% YoY

6. Strong H1-24: PAT up 112% & Revenue up 45% YoY

7. Business metrics: Ordinary, yet improving return ratios

ROCE: So, we are targeting to take it closer to 20% in the next 2-3 years.

8. Outlook: Revenue CAGR of 21%+

i. FY23-25: Revenue CAGR of 21%+

Revenue of Rs 500+ cr in FY25, implies that DEEPINS is growing at FY23-25 CAGR of 21%+.

FY '25, we are definitely looking forward beyond INR500 crores for sure.

With regards to guidance, we have always been conservative. So, we continued to be with 20% on a conservative basis. It definitely can increase is what you are saying, but as a guidance we would continue as 20%.

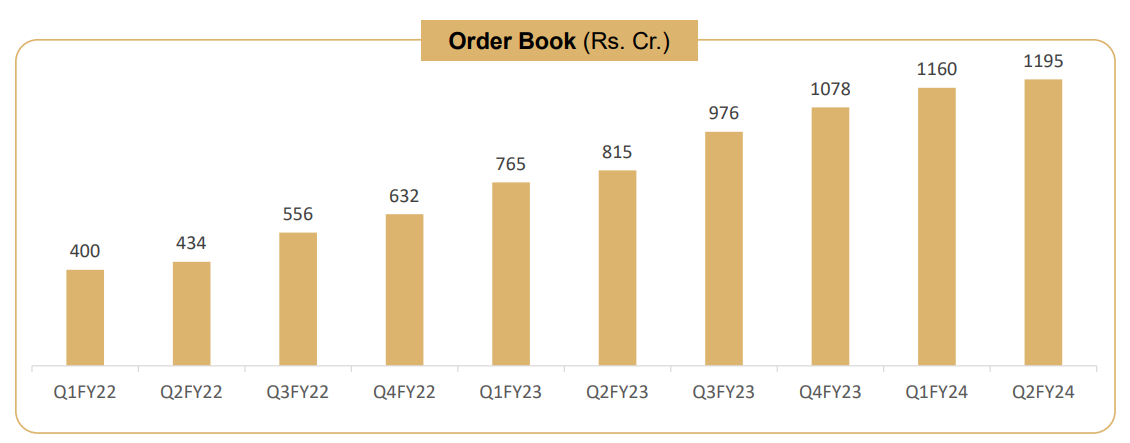

ii. Strong revenue visibility: Order book to be executed in 3 years

Highest ever bidding pipeline which could further enhance the order book going forward

Order book has shown strong growth for 10th consecutive quarter.

But on an average basis, you can say it is around three years order book.

iii. Bottom-line to grow faster than top-line: EBITDA margin expansion

So we have been able to secure margins over 40% in last more than 10 years now. And we would continue to maintain that. In addition, we are expecting some improvement as well.

9. PAT growth of 112% & Revenue growth of 45% in H1-24 at a PE of 10

10. So Wait and Watch

If I hold the stock then one may continue holding on to DEEPINDS

Based on H1-24 performance, DEEPINDS looks on track to deliver the strongest top-line and bottom line performance in FY24 and then deliver a bigger year in FY25.

DEEPINDS is guiding for a stronger growth from Q3-24 onwards as compared to H1-24

the order book, which is growing consistently, will result into revenue only after six months to eight months of its mobilization. So yes, we are expecting some good amount of growth in coming quarters from Q3 onwards. And we are definitely guiding towards a good amount of growth going forward.

11. Or, join the ride

If I am looking to enter DEEPINDS then

DEEPINDS has delivered PAT growth of 112% & Revenue growth of 45% in H1-24 at a PE of 10 which makes valuations quite reasonable.

Outlook for top-line CAGR of 21%+ for FY23-25 makes the valuations at a PE of 10 quite reasonable.

DEEPINDS delivered Rs 95 cr of free cash flow against a market cap of Rs 1628 cr. As of H1-24 end it is available on a free cash flow yield of 5.9% (not annualized) which makes the valuations quite attractive.

DEEPINDS has a net worth of Rs 1379.4 cr as of end of Q2-24 against a market cap of Rs 1628 cr. It implies that DEEPINDS is available at price to book of less than 1.2 which makes the valuations quite attractive.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action