CreditAccess Grameen: PAT growth of 97% & Total Net Income growth of 52% in 9M-24 at a PE of less than 20

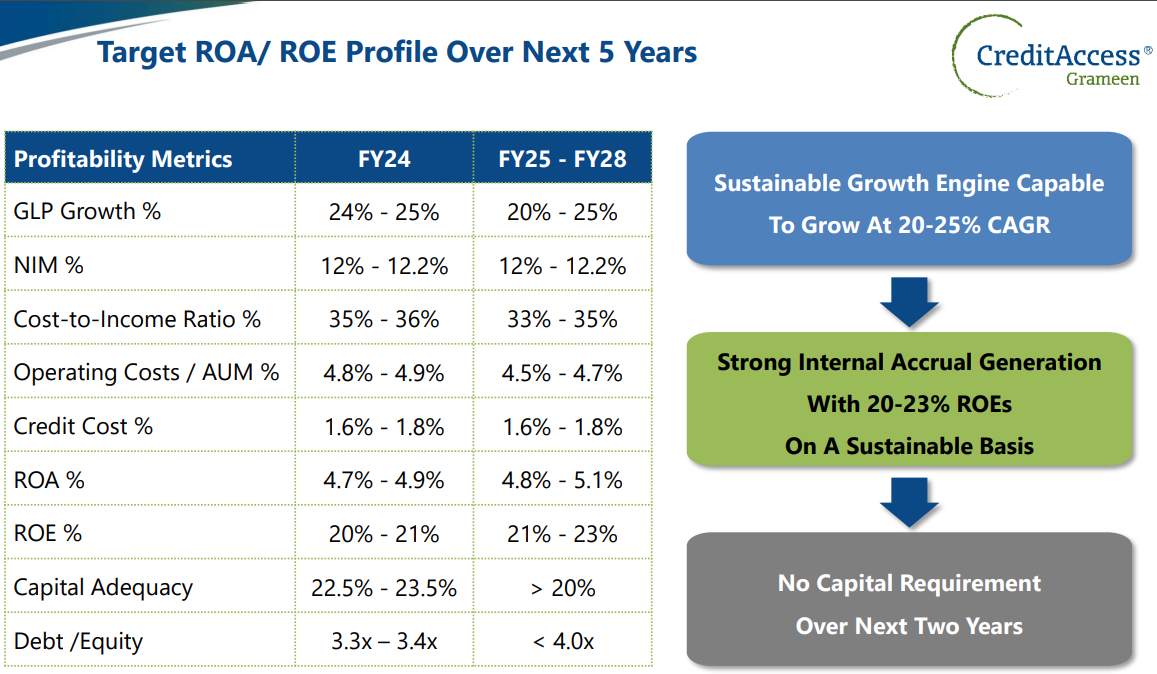

CREDITACC looks on track to beat its FY24 guidance based on 9M-24 performance. CREDITACC has a strong roadmap for FY28 which provides opportunity over the long term.

1. Non-Banking Financial Company-Micro Finance Institution

creditaccessgrameen.in | NSE: CREDITACC

One of the Leading NBFC-MFIs in India headquartered in Bengaluru

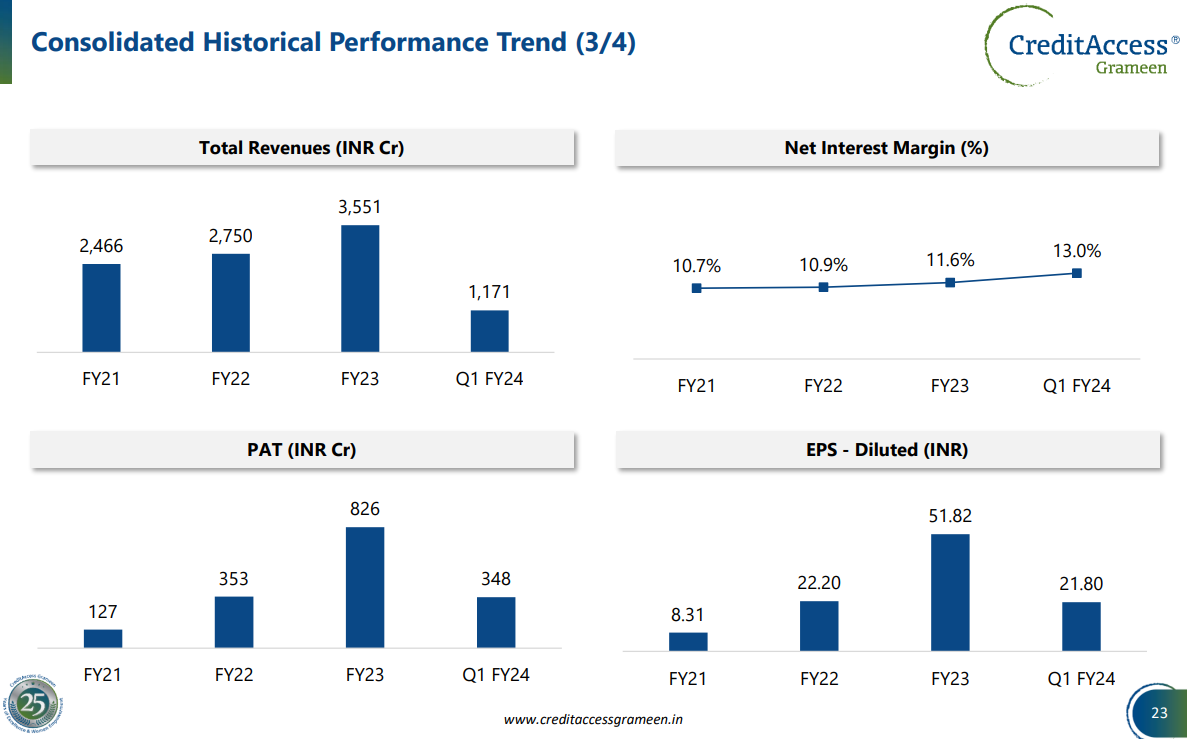

2. FY17-23: PAT CAGR of 49%

From the bottom in FY21: CAGR for FY21-23

PAT = 151%

Total Income = 20%

3. Strong H1-24: PAT up 122% & Total Net Income up 58%

4. Q3-24: PAT up 64% & Total Net Income up 43% YoY

PAT up 2% & Total Net Income up 4% QoQ

5. 9M-24: PAT up 97% & Total Net Income up 52% YoY

6. Strong and improving return ratios

7. Outlook: Beat on FY24 Guidance

i. FY24: Performance ahead of revised guidance

ii. Long term growth outlook is attractive & looks achievable based on FY21 to H1-24 performance

8. PAT growth of 97% & Total Net Income growth of 52% in 9M-24 at a PE of less than 20

9. So Wait and Watch

If one holds the stock then one may continue holding on to CREDITACC

Coverage of CREDITACC was initiated after Q1-24 results. The investment thesis has not changed in the last two quarters delivering a strong 9M-24. There is confidence that CREDITACC is on track to beat the FY24 guidance set out by the management.

CREDITACC has delivered a strong performance in all the three quarters of FY24. Q4-24 is expected to be equally strong

Normally in the third quarter and fourth quarter, the higher disbursement will happen therefore I do not see any reason to worry about the potential growth guidance.

FY24 performance is in the price. One needs to start looking forward to the guidance till FY28. CREDITACC looks on track to deliver as per the long term guidance.

10. Or, join the ride

If one is looking to enter CREDITACC then

CREDITACC has delivered a strong 9M-24 with PAT growth of 97% & Total Net Income growth of 52% at a PE of 20 which makes the valuations reasonable.

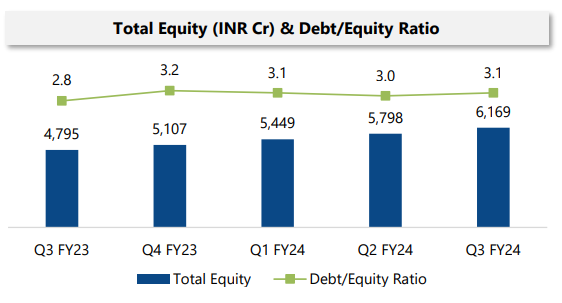

CREDITACC has a net-worth of Rs 6169 cr and is available for a market cap of Rs 26,552.89 cr which implies that its available at price to book of 4.3. It makes the valuation look steep and can be justified only if the growth momentum continues

Over the long-term, the guidance for FY25-28 looks achievable given the growth trajectory seen in 9M-24 and hence justify the steep price to book.

In the short term, the performance for FY24 is in the price. CREDITACC may have run ahead of its price and opportunities may be limited

Previous coverage of CREDITACC

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action