CreditAccess Grameen: 122% PAT growth & 54% income growth in H1-24 at a PE of 20

1. Non-Banking Financial Company-Micro Finance Institution

creditaccessgrameen.in |NSE: CREDITACC

One of the Leading NBFC-MFIs in India headquartered in Bengaluru

2. FY17-23: PAT CAGR of 88%

From the bottom in FY21: CAGR for FY21-23

PAT = 151%

Total Income = 20%

3. Strong Q1-24: PAT up 150% & Revenue up 54% YoY

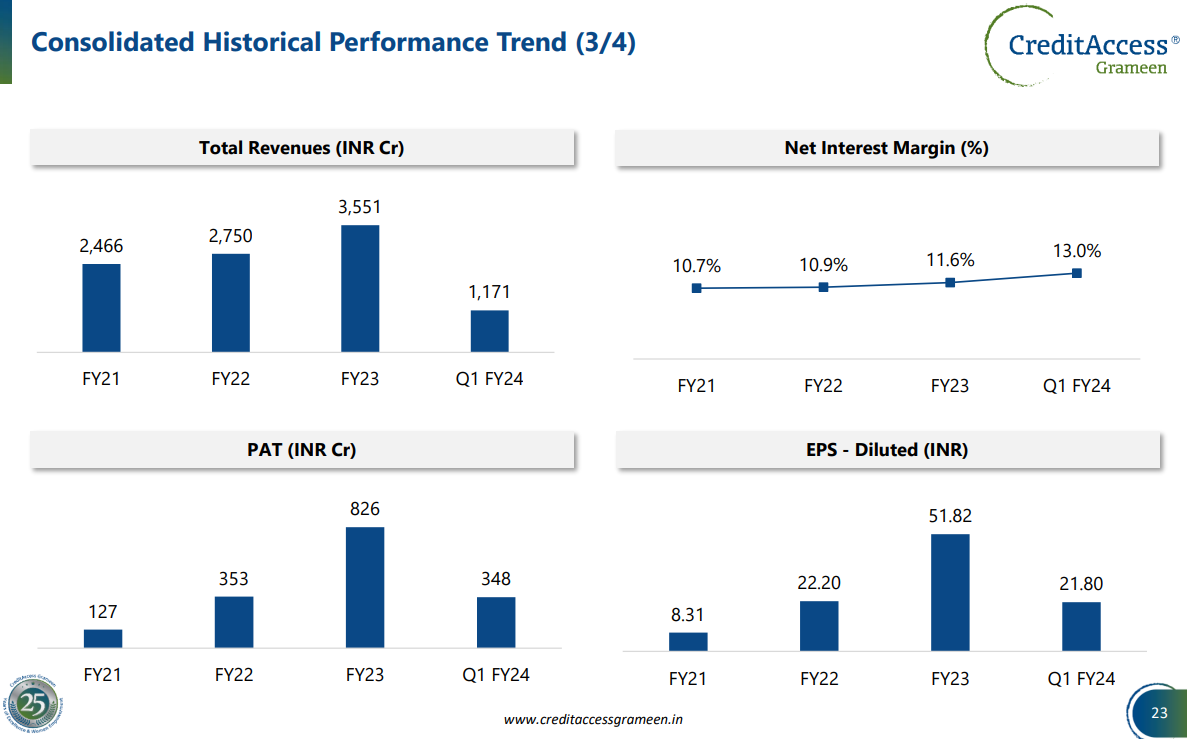

Total income increased by 53.9% YoY from INR 760.5 to INR 1,170.7 crore

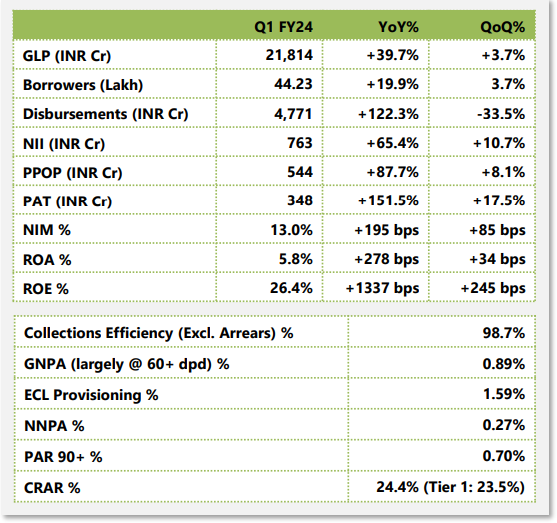

PAT grew 151.5% YoY and 17.5% QoQ to Rs. 348 Crore during Q1 FY24.

This has resulted in RoA of 5.8% and RoE of 26.4%.

We are confident of achieving our annual performance guidance for FY24 given the growth momentum gained in the first quarter.

4. Strong Q2-24: PAT up 98% & Income up 53% YoY

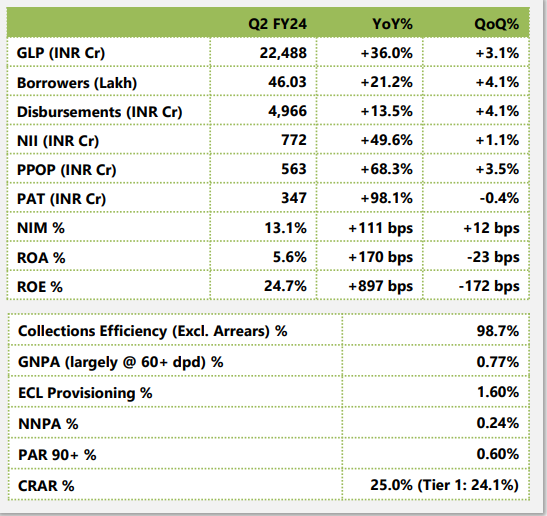

Our asset quality underpinned by robust internal controls remains the best in class with a gross NPA of 0.77% and net NPA of 0.24%.

On the back of an improved income profile and a strong control on the cost of operations, our PAT grew by 98.1% YoY to INR 347 crore during Q2 FY24. This resulted in RoA of 5.6% and RoE of 24.7%.

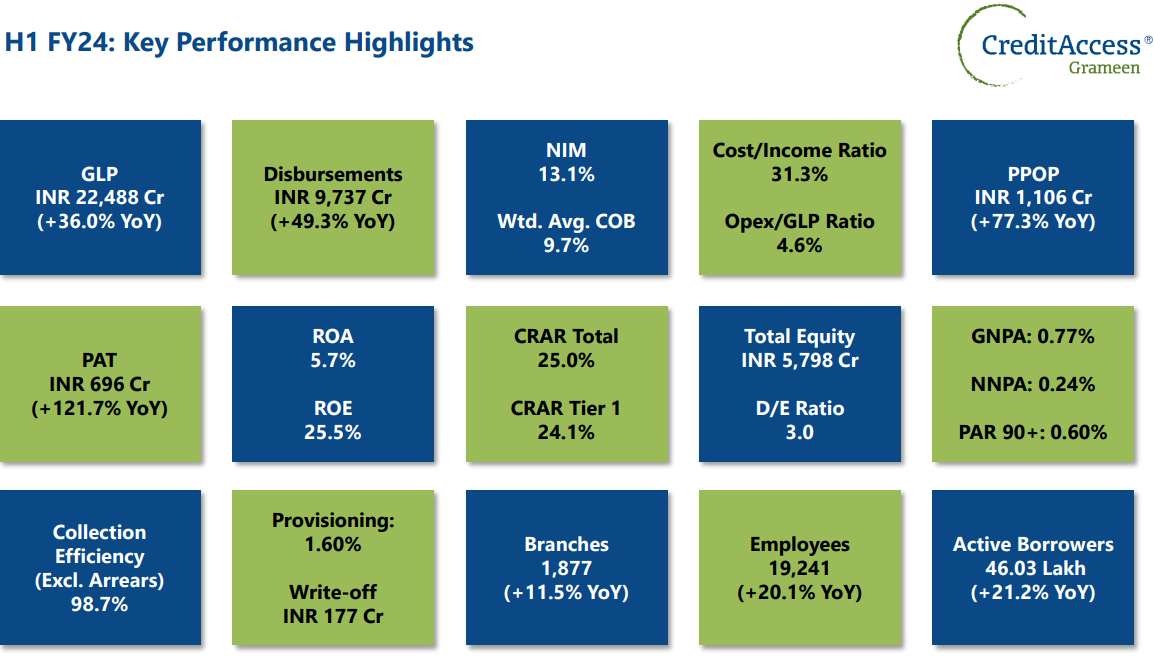

5. Overall H1-24 looking strong: PAT up 122% & Income up 54%

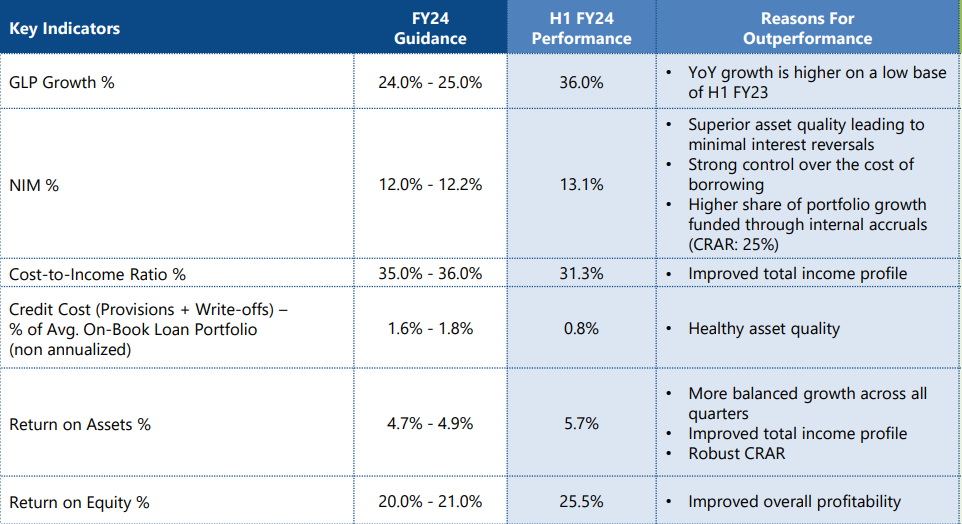

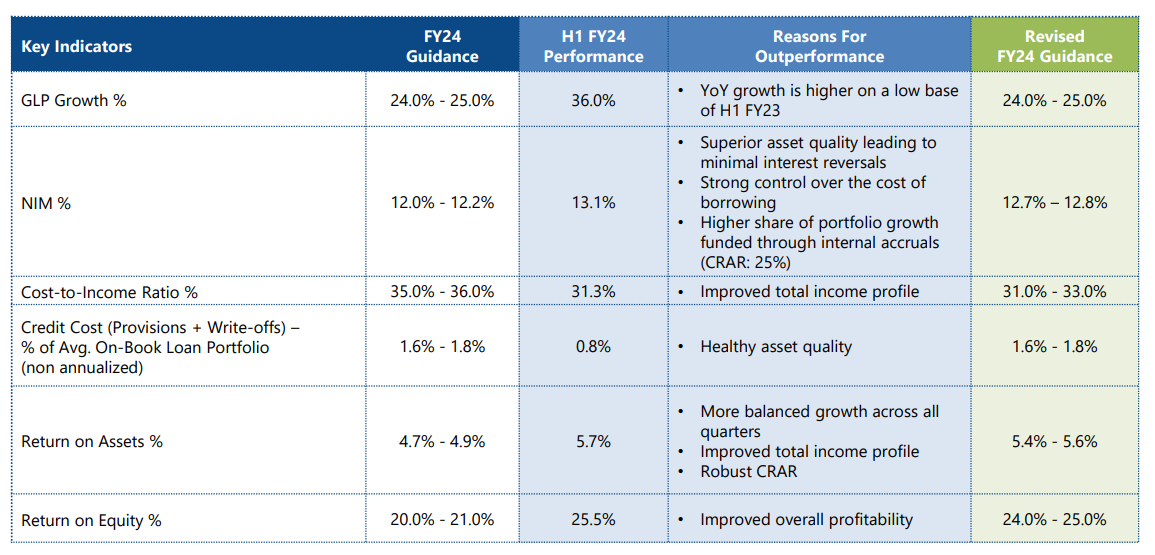

Considering strong business performance during H1 FY24, we have revised our FY24 guidance to achieve a portfolio growth of 24.0%-25.0%, NIMs of 12.7% - 12.8%, credit cost of 1.6% - 1.8%, ROA of 5.4% - 5.6% and ROE of 24.0% - 25.0%.

H1-24 outperforms the FY24 guidance

6. Return ratios managed efficiently across cycles

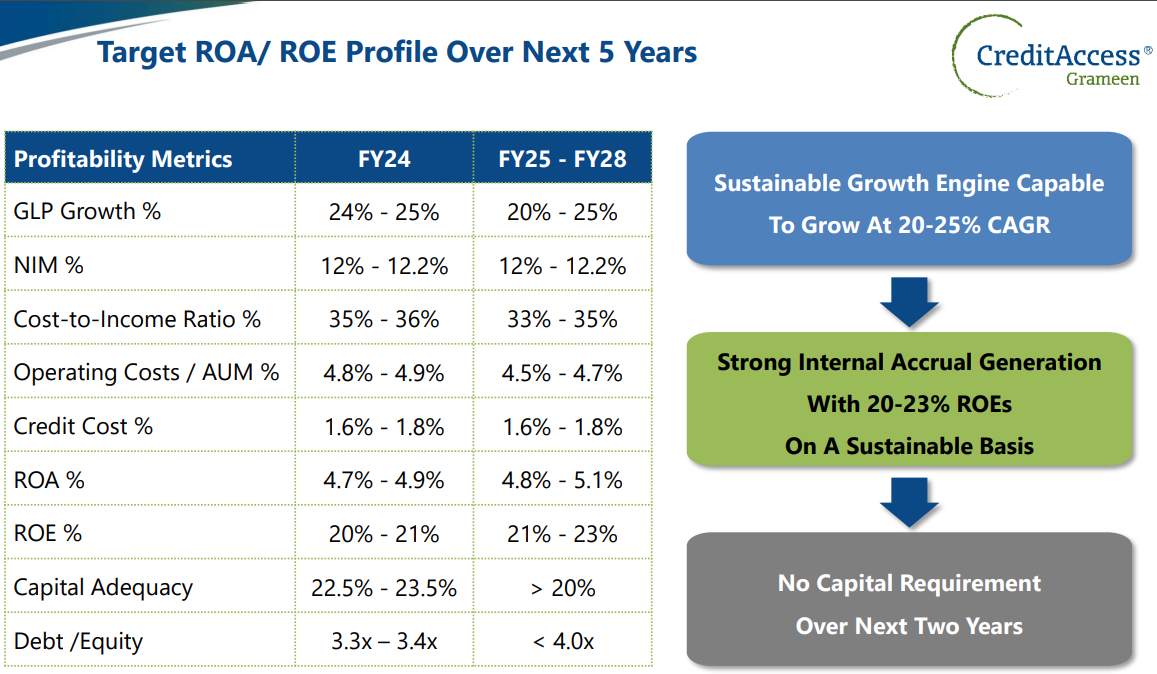

7. Outlook: Aiming 20-25% CAGR To Cross INR 50,000 Crore GLP Over Next 4-5 Years

i. FY24 guidance revised based on a solid H1-24

Revision in NIM, Cost-to-Income Ratio indicates that the bottom-line growth will continue to be stronger than top-line growth for CREDITACC

ii. Long term growth outlook is attractive & looks achievable based on FY21 to H1-24 performance

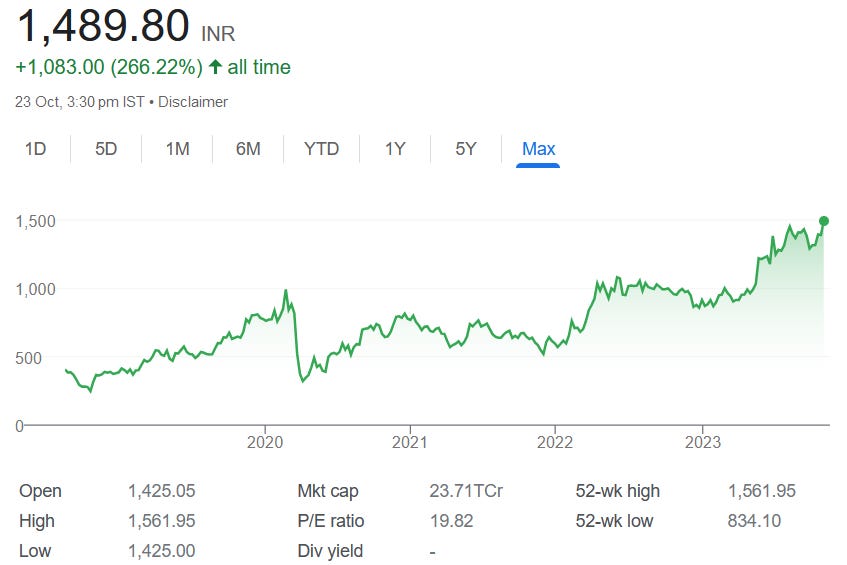

8. 100% PAT growth in H1-24 at a PE of less than 20

9. So Wait and Watch

If I hold the stock then one may continue holding on to CREDITACC given the momentum from FY21 has continued on into H1-24 end. Additionally, the momentum is expected to be stronger in H2-24 given that the guidance has been revised.

H1-24 was business as usual for CREDITACC & one could wait & watch the growth unfold. However, one needs to look out for credit quality which is quite good as of H1-24

Given we are moving into the second half of FY24, one needs to start looking forward to the FY25-28 guidance which is a reason to continue with CREDITACC over the long term.

10. Or, join the ride

If I am looking to enter the stock then

CREDITACC has delivered a very strong H1-24 continuing the trajectory from FY21. The trajectory is expected to continue into H2-24 given the revision in guidance. CREDITACC is available at a PE of less than 20 which makes the valuations reasonable for the 100%+ growth delivered in H1-24 while maintaining credit quality .

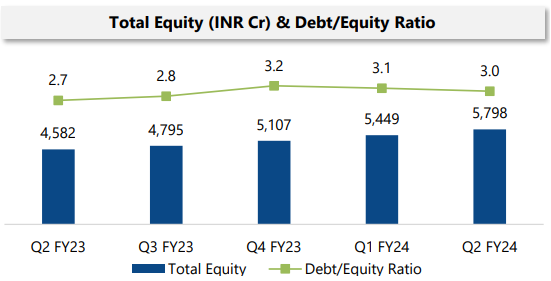

CREDITACC has a networth of Rs 5798 cr and is available for a market cap of Rs 23,980 cr which implies that its available at price to book of 4.14. It makes the valuation look steep and can be justified only if the growth momentum seen since FY21 is sustained

The guidance for FY25-28 looks achievable given the growth trajectory since FY21 and can justify the steep price to book.

Previous coverage of CREDITACC

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades