CreditAccess Grameen: Aiming 20-25% CAGR over next 4-5 years

4-5 years plan is to double loan portfolio by leveraging leadership position in the microfinance industry.

1. Largest Pure-Play Microfinance Institution In India

creditaccessgrameen.in |NSE: CREDITACC

CreditAccess Grameen Limited is a leading Indian microfinance institution headquartered in Bengaluru, focused on providing micro-loans to women customers predominantly in rural areas across India. CreditAccess is operating in 353 districts in 14 states

We closed FY '23 by recording 26.7% Y-o-Y growth in AUM to INR 21,031 Crores, serving 42.6 Lakh customers. It was a historic year for us as we crossed INR 20,000 Crores AUM, becoming the first pure-play microfinance institution to achieve this feat. We were the only NBFC to feature in the top five of the Fortune India Next 500 list given our revenue profile

While our aim is to soon surpass INR 25,000 Crore loan portfolio during the 25th year of our operations, the next 4-5 years plan is to see us doubling our loan portfolio to over INR 50,000 Crore by leveraging our solid foundation and leadership position in the microfinance industry.

2. A track record of top-line and bottom-line growth

For FY '23, NII stood at INR 2,234 Crores registering a 35.1% growth

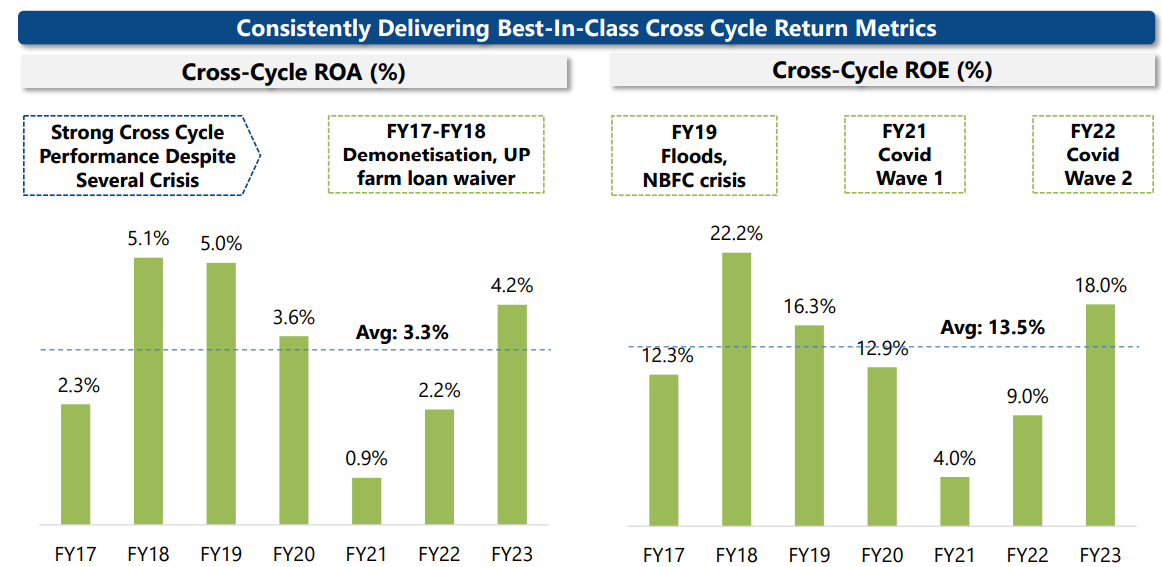

For FY '23, we delivered a PAT of INR 826 Crores leading to a ROA of 4.2% and ROE of 18% meeting our annual performance guidance.

Top-line i.e. Net Interest Income (NII) has grown at a CAGR of 21 for FY17-23

PAT has grown at a CAGR of 49 for FY17-23

Average PAT margin of 21% for the period FY17-23

3. FY23 performance in line with guidance

Inspires confidence in managements ability to meet FY24 guidance

It's comforting to acknowledge that we have once again achieved our annual performance guidance.

4. Growth quality reflected in return ratios

5. Q1-24: Strong performance beats FY24 guidance

The strong performance during Q1 FY24 vs. our guidance was primarily due to robust customer and portfolio growth. While we do anticipate borrowing and operating costs to moderately increase over the coming quarters, we believe that the benefits of strong portfolio growth in the first quarter will continue to accrue in the form of higher interest income over the coming quarters.

6. Outlook: 20-25% CAGR growth till FY28 with possibility of increasing the FY24 guidance

Strong Q1-24 opening up the possibility of guidance revision

Assuming a stable operating environment, we look forward to achieving loan portfolio growth of 24% to 25% in FY '24.

Given our stronghold on borrowing costs, we foresee maintaining NIMs in the range of 12% to 12.2%, with a cost-to-income ratio between 35% to 36%.

We are anticipating a credit cost of 1.6% to 1.8%.

Overall, we aim to achieve a ROA of 4.7% to 4.9% and an ROE of 20% to 21% in FY '24.

We shall continue to monitor our performance and re-evaluate our annual guidance after two quarters.

But still, we would review after Q2 or Q3 to re-evaluate our guidance.

7. Outlook: 20-25% CAGR growth till FY28 at a PE (ttm) of 21

7. So Wait and Watch

If I hold the stock then one must hold on as the CreditAccess is providing visibility for the next five years with its guidance going up to FY28. One needs to wait and watch for quarterly results to see if the company is on track to execute on their guidance till FY28

8. Join the ride

If I am looking to enter the stock then

PE (trailing twelve months) at 21 looks very reasonable given its track record of growing the top-line and bottom line at CAGR of 21% and 49% respectively for FY17-23 with a PAT margin of 21%

Valuations are reasonable for the visibility CreditAccess provides for the next five years through its guidance going up to FY28.

Given the past record the guidance till FY28 looks achievable though nothing spectacular

Possibility of the guidance for FY24 to be upgraded provides a potential catalyst for the stock.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades