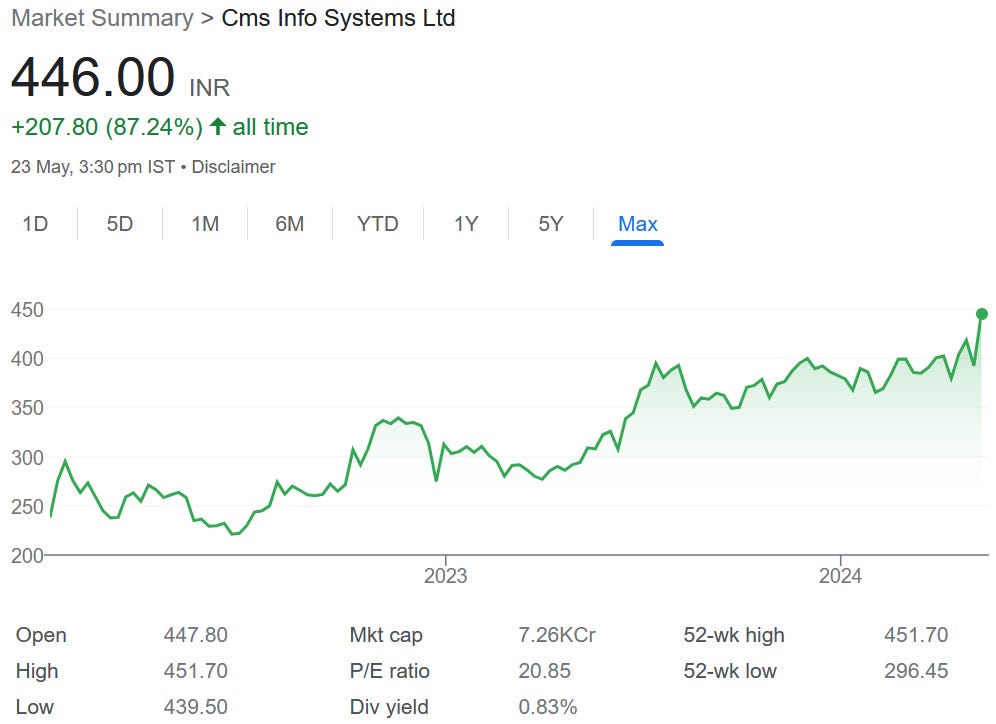

CMS Info Systems: PAT growth of 17% & Revenue growth of 18% in FY24 at PE of 21

20%+ YoY earnings growth for 8 consecutive quarters. 15-19% top-line growth guidance in FY25. At a free cash flow yield of 4.6%

1. Largest Cash Management company in India

cms.com | NSE : CMSINFO

39% revenue contribution from Managed Services and Tech Solutions

2. FY20-24: PAT CAGR of 27% & Revenue CAGR of 13%

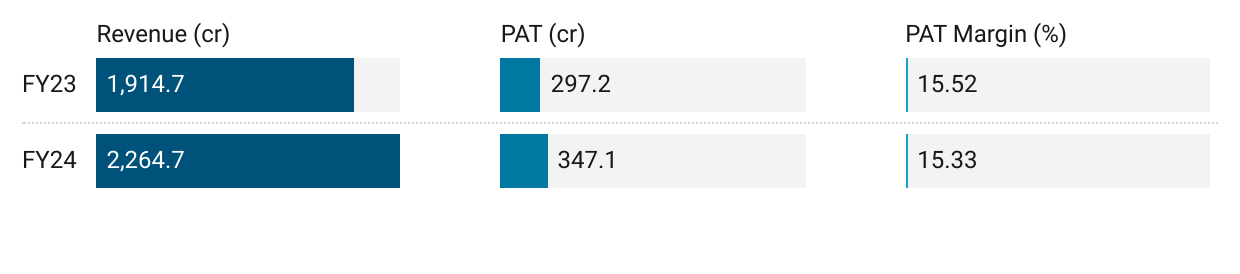

3. Strong FY23: PAT up 33% and Revenue up 20%

4. 9M-24: PAT up 18% & Revenue up 16%

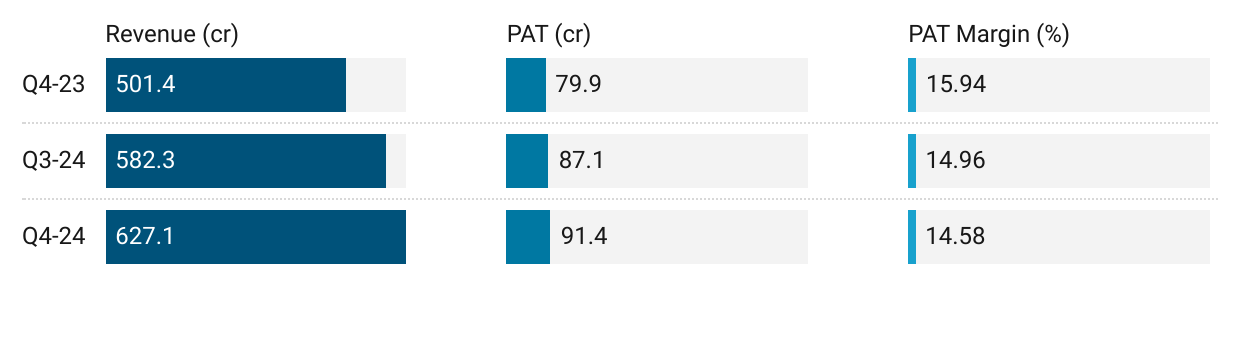

5. Q3-24: PAT up 14% & Revenue up 25% YoY

PAT up 5% & Revenue up 8% QoQ

6. FY24: PAT up 17% & Revenue up 18%

7. Business metrics: Strong return ratios

8. Outlook: 14-19% revenue CAGR for FY24-27

i. FY25: Revenue growth of 15-19%

FY25 revenue to be between Rs 2600-2700 cr implies a 15-19% revenue growth in line with historic growth of 20%

ii. FY24-27: Revenue CAGR of 14-19%

From Rs 2265 cr revenue in FY24 to Rs 3700-3800 cr by FY27 implies a revenue CAGR of 14-19% for FY24-27

iii. Strong Revenue Visibility: Managed Services

Rs 746 cr recurring services revenue, is 84% of Managed services FY24 revenue & 33% of CMSINFO revenue.

9. PAT growth of 17% & Revenue growth of 18% in FY24 at a PE of 21

10. So Wait and Watch

If I hold the stock then one may continue holding on to CMSINFO

Coverage of CMSINFO initiated after Q2-24 results. The investment thesis has not changed after a reasonable FY24.

FY24 performance provides confidence in the managements ability to to deliver Rs2600-2700 cr of revenue in FY25. CMSINFO looks on track to deliver Rs 3400-3800 cr by FY27

CMSINFO in the middle of a strong run. One can ride along with the strong quarterly performances. 11 out of last 12 quarters delivered YoY PAT growth of 20%+ with 8 consecutive quarters with 20%+ YoY PAT growth

11. Or, join the ride

If I am looking to enter CMSINFO then

CMSINFO has delivered PAT growth of 17% & Revenue growth of 18% in FY24 at a PE of 21 which makes valuations acceptable in the short term.

Revenue growth of 15-19% in FY25 at a PE of 21 makes valuations acceptable in the medium term.

Outlook for top-line growth at a CAGR of 14-19% for FY24-27 the valuations acceptable at a PE of 21 form a long term perspective.

CMSINFO generated a free cash flow Rs 334 cr in FY24 and is available of Rs 7,263 cr of market cap which implies that it is available at a free cash flow yield of 4.6% which makes the valuations reasonable.

FY24 was a very average year and the increased contribution of Managed Services & Technology Solutions in the overall business could lead to a higher growth overall.

Previous coverage of CMSINFO

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer