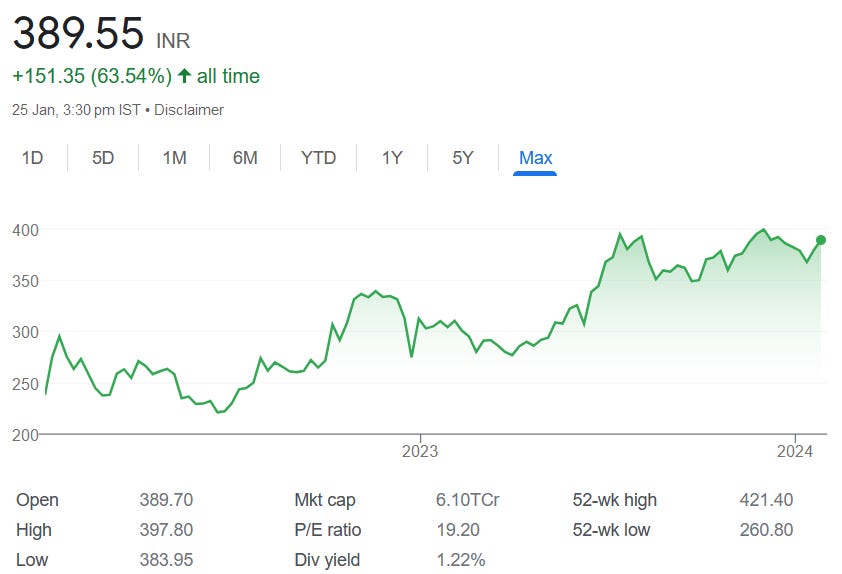

CMS Info Systems: PAT growth of 18% & Revenue growth of 16% in 9M-24 at PE of 19

On track to meet revenue guidance of Rs 2500-2700 cr by FY25 with 7 consecutive quarters 20%+ YoY earnings growth. CMSINFO expected to deliver highest revenue, PAT & PAT Margin in FY24

1. Largest Cash Management company in India

cms.com | NSE : CMSINFO

ATM Cash Management #1 Player

Retail Cash Management (RCM) #1 Player

Cash-in-Transit (CIT) #1 Player

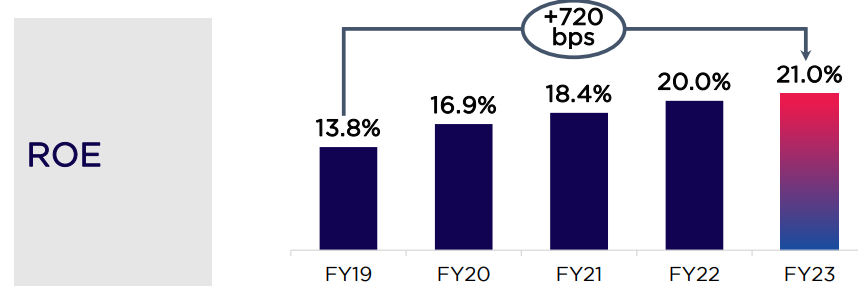

2. FY19-23: Track record of growth with expanding margins

3. Strong FY23: PAT up 33% and Revenue up 20% YoY

4. Strong H1-24: PAT up 19% & Revenue up 14% YoY

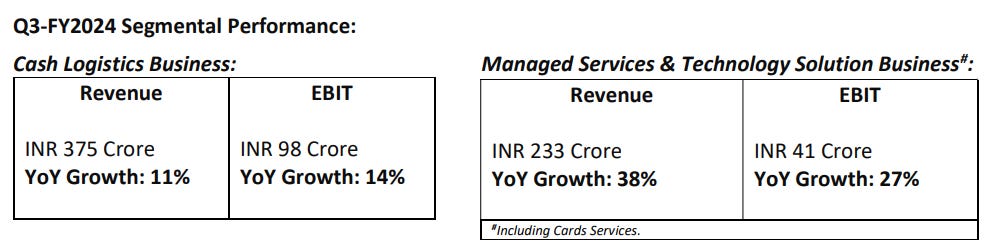

5. Strong Q3-24: PAT up 15% & Revenue up 19% YoY

PAT up 3% & Revenue up 7% QoQ

6. Strong 9M-24: PAT up 18% & Revenue up 16% YoY

7. Business metrics: Solid return ratios converting profits to cash

8. Outlook: 14-19% revenue CAGR for FY23-25

i. FY24: Revenue growth of 17-19%

Basis the execution and order book, we aim to grow between 17% - 19% in FY24 and have total revenues in the range of Rs. 2250-2300 Cr revenues for FY24

ii. FY23-25: Revenue CAGR of 14-19%

Moving from Rs 1915 cr revenue in FY23, to Rs 2500-2700 cr by FY25 implies a revenue CAGR of 14-19% for FY23-25.

Based on our current momentum at half of this year, we feel confident of achieving our FY ’25 revenue target of doubling our revenue on a FY ‘21 basis from INR1,300 crores to a range of INR2,500 crores to INR2,700 crores.

Margins, we have not guided towards at all. We have no margin guidance at all, and we will refrain from giving any margin guidance.

iii. Strong Revenue Visibility: Managed Services order book ~2X expected revenue for FY24

Our integrated platform is helping us execute large order book. We have also won new orders and our total order book has grown to INR 4,400 Cr.

9. PAT growth of 18% & Revenue growth of 16% in 9M-24 at a PE of 19

10. So Wait and Watch

If I hold the stock then one may continue holding on to CMSINFO

Coverage of CMSINFO was initiated after Q2-24 results. The investment thesis has not changed after a reasonable Q3-24. The management is on track to deliver the biggest PAT, beating the previous high made in FY23.

Based on 9M-24 performance, CMSINFO looks on track to deliver a strong yearly performance in FY24 with the highest top-line, bottom-line and PAT margin

On an annual run rate CMSINFO is on track to deliver as per the revenue guidance set out by the management.

CMSINFO is in the middle of a strong run. One can ride along with the strong quarterly performances.

Q3’FY24 is the seventh consecutive quarter with 20%+ YoY earnings growth.

While a 14-19% revenue CAGR for FY23-25 may not sound exciting, the consistent improvement in PAT margins has ensured that bottom-line is growing faster than the top-line

11. Or, join the ride

If I am looking to enter CMSINFO then

CMSINFO has delivered PAT growth of 18% & Revenue growth of 16% in 9M-24 at a PE of 19 which makes valuations acceptable.

The order book and the revenue guidance till FY25 provides long term opportunity in CMSINFO

Outlook for top-line growth at a CAGR of 14-19% for FY23-25 with expectation of bottom-line growing faster than the top-line makes the valuations acceptable.

The transition of CMSINFO from a Cash Logistics business to more of a Managed Services & Technology Solutions could transform it to a higher growth business. The Rs 4400 cr order book for Managed Services provides confidence in the transition taking place.

Previous coverage of CMSINFO

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action.