Cigniti Technologies: PAT growth of 25% & Revenue growth of 12% in H1-24 at a PE of 16

3 quarters of sequential growth followed by CIGNITITEC management indicating for a H2-24 stronger than H1-24 with margin expansion. Outlook for growth in FY24 supported by a strong order book.

1. Software testing and digital transformation services

cigniti.com | NSE : CIGNITITEC

Service Offerings

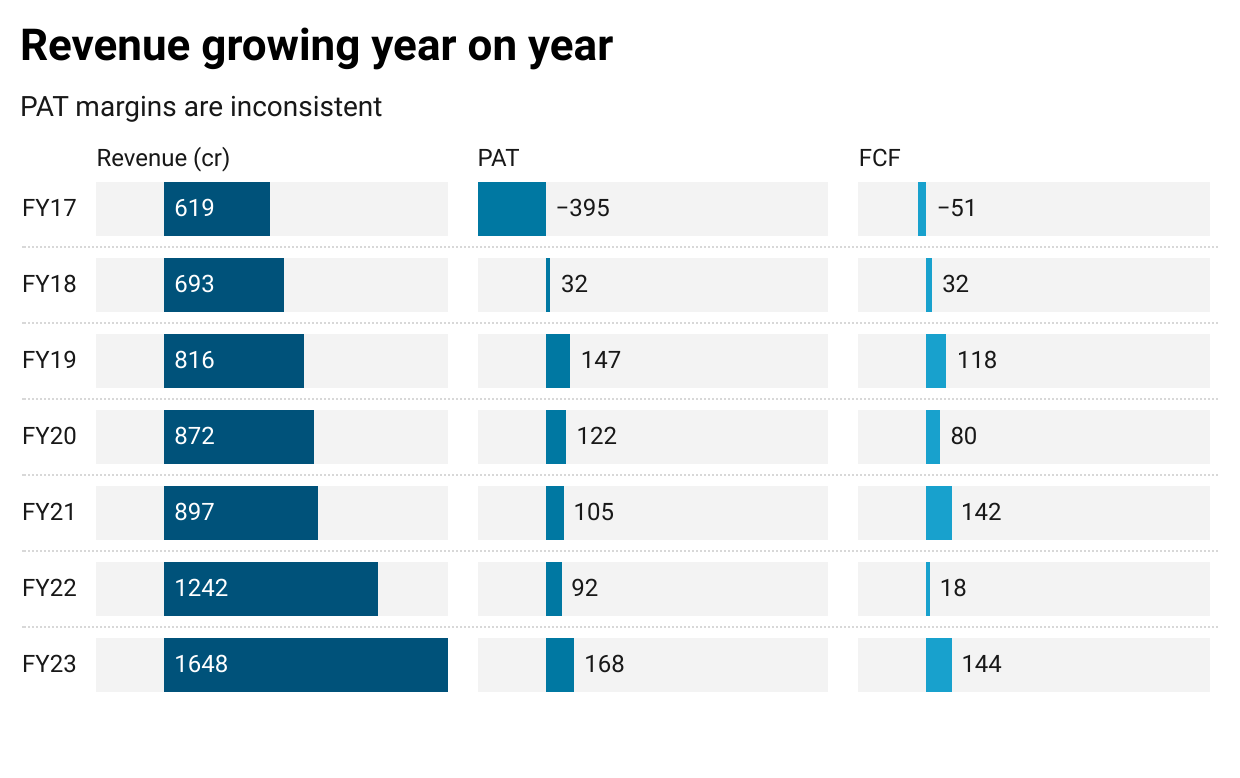

2. FY17-23: Revenue CAGR of 18%

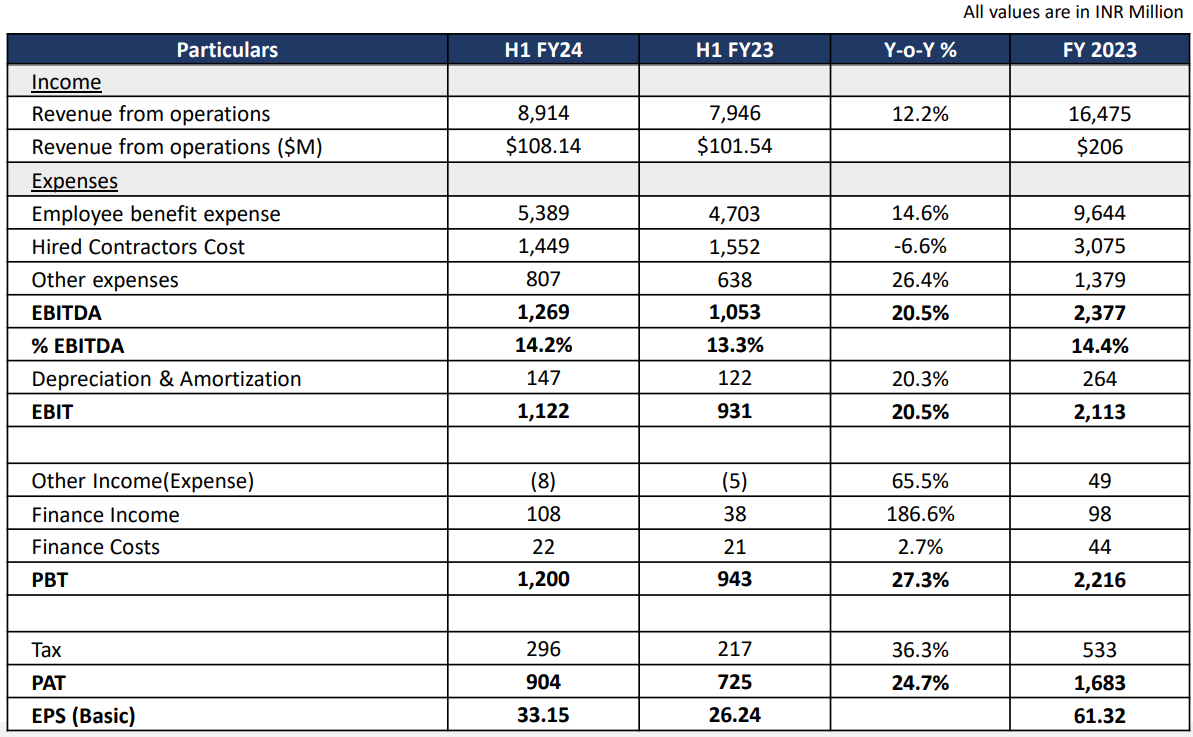

Revenue has become 2.7X between FY17-23 while PAT is stagnant in a range. PAT has exhibited growth only in FY23

CIGNITITEC starts looking interesting on the basis of its performance since FY22

3. A strong FY23: PAT up 84% and Revenue up 33% YoY

4. Momentum carries on in Q1-24: PAT up 44% & Revenue up 16% YoY

5. Q2-24: PAT up 10% & Revenue up 8% YoY

PAT up 3% & Revenue up 3% QoQ

6. H1-24: PAT up 25% & Revenue up 12% YoY with expansion of EBITDA margin

7. Return ratios are strong and consistent

PAT Margin has been inconsistent across the years, however return ratios are solid along with strong cash generation.

8. Outlook: Momentum of FY22 & FY23 to carry into FY24

i. H2-24 expected to be stronger than H1-24

basically we said that the headwinds are there and Q1, Q2 remains subdued over. We are optimistic on Q3 and Q4.

ii. Momentum of FY22 & FY23 to carry on into FY24

So if you look at it on an apple to apple basis, if you look at it over the last two years in terms of what have been the growth and comparing to that current year I think that's not a wishful thinking for the current year.

iii. Indications for EBITDA margin expansion in H2-24

we are optimistic that the next two quarters the EBITDA should move up the value chain.

iv. Order book is strong providing visibility for FY24

order book as it stands basically for a trailing 12 months, effective October stands at about close to 176 million and we have a lot of renewals coming through in the month of December and we are optimistic that we should be able to pull it through at least to 95% by 97% of the renewals. As we have not heard till now in terms of any pushback.

9. PAT growth of 25% & Revenue growth of 12% in H1-24 at a PE of 16

10. So Wait and Watch

If I hold the stock then one may continue holding on to CIGNITITECH

Coverage of CIGNITITECH was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24

CIGNITITECH management is indicating for a H2-24 stronger than H1-24

Order book is strong with indications of margin expansion

The impact of the resignation of the MD is not clear

CV Subramanyam resigns as Managing Director of the company w.e.f. November 3, 2023

CIGNITITECH has a track record of generating free cash flow hence slackening on the receivables needs to be watch closely for improvement in Q3-24

So that there has been some slackening on the receivables which we have trying to push around. Which has probably impacted a little bit on the cash flow.

11. Or, join the ride

If I am looking to enter the stock then

CIGNITITEC has delivered PAT growth of 25% & Revenue growth of 12% in H1-24 at a PE of 16 which makes the valuations look reasonable.

CIGNITITEC has delivered 3 consecutive quarters of top-line growth and guiding for a H2-24 stronger than H1-24 which provides a positive outlook for FY24

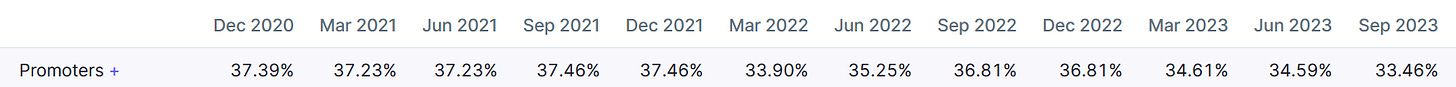

The promotors continuously reducing their stake is a big red flag. The promotor holding has reduced consistently.

Previous coverage of CIGNITITEC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades