Cigniti Technologies: 25% dollar revenue CAGR till FY27 at PE of about 12

Pace picking up since FY20. Pace is expected to be faster as high teens organic growth along with inorganic growth expected to deliver revenue 25% CAGR till FY27 & make CIGNITITECH a $500 mn company

1. Software testing and digital transformation services

cigniti.com | NSE : CIGNITITEC

Service Offerings

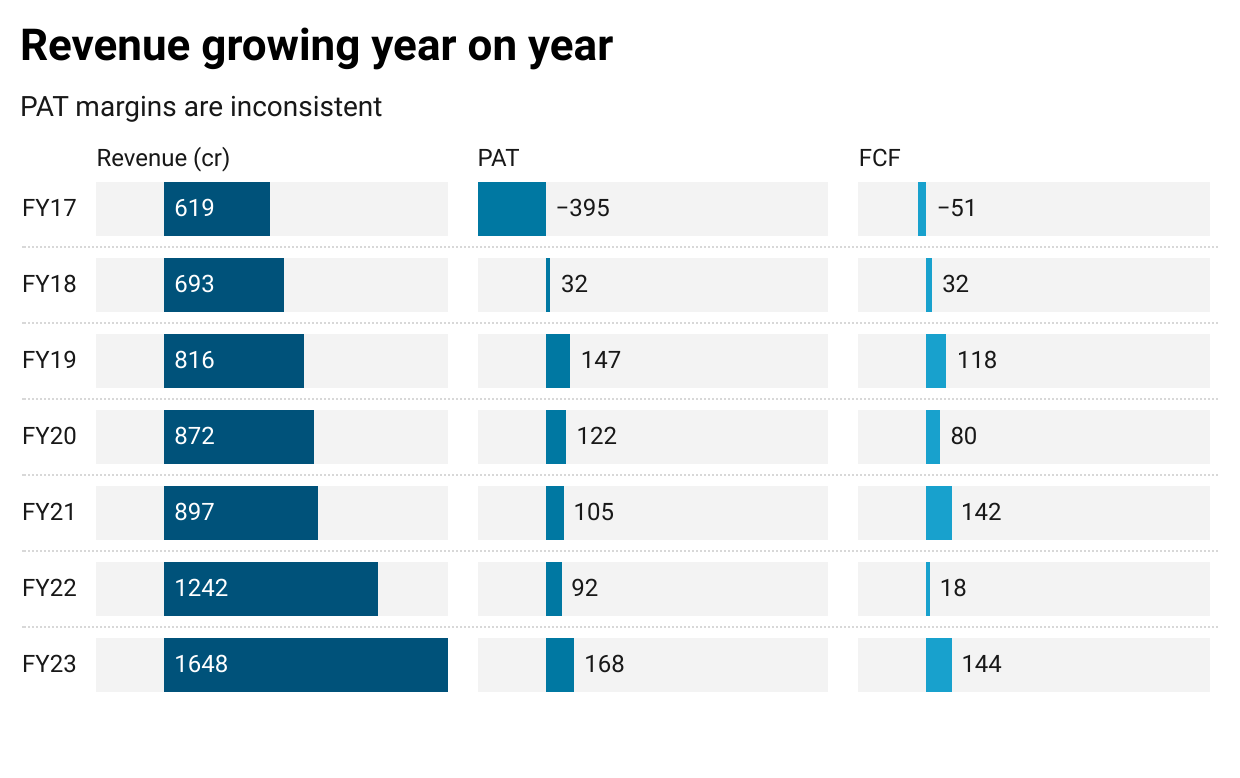

2. FY17-23: Revenue CAGR of 18%

Revenue has become 2.7X between FY17-23 while PAT is stagnant in a range. PAT has exhibited growth only in FY23

CIGNITITEC starts looking interesting on the basis of its performance since FY22

3. A strong FY23: PAT up 84% and Revenue up 33% YoY

For the fiscal year FY22-23, Company has reported total revenue of Rs. 1,647.58 crore, a 32.7% increase over the previous fiscal year.

EBITDA and Net profit for the year was Rs. 237.70 crore and Rs. 168.32 crore, representing 83.9% and 83.5% increase over the previous year.

Growth has been achieved with change in strategy of the company to work around beyond testing and offering digital transformation services.

4. Momentum carries on in Q1-24: PAT up 44% & Revenue up 16% YoY

The Company’s Consolidated Revenue from operations for the quarter Q1’FY24 stood at Rs 439.53 crore as against Rs.377.97 crore corresponding quarter Q1’FY23 up by 16.3%.

EBITDA margin for the June quarter was at 14.1% and EBITDA stood at Rs. 62.07 crores, up by 39.3% compared to Q1’FY23.

5. Return ratios are strong and consistent

PAT Margin has been inconsistent across the years, however return ratios are solid along with strong cash generation.

6. Outlook: 25% $ revenue CAGR till FY27

i. 25% revenue CAGR till FY27

Growing from $ 162 million in FY22 to $500 million by FY27 implies an asking revenue run rate CAGR of 25% in dollar terms. FY23 top-line grew to $206 million i.e. 25% in dollar terms without the support of inorganic growth. The asking rate for revenue CAGR from FY24 to FY27 remains at 25%.

Organic growth of high teens is taken as 16% in our analysis.

Aspiration to grow to $ 1 billion is noted but not considered in the current analysis.

As of Q1-24 CIGNITITECH is confident of reaching the $ 500 million target

We still remain intact 200% confident because it's a combination of both organic and inorganic contribution mission statement and which has been framed in 2022 with a purpose to achieve in 2028

7. 25% dollar revenue CAGR till FY27 at a PE of 12

8. So Wait and Watch

If I hold the stock then one may continue holding on to CIGNITITECH only if you are confident about its ability to deliver on the $ 500 million revenue target by FY27.

The long term track record has been ordinary in terms of delivering top-line growth (16% CAGR for FY17-23). Bottom-line performance has been below average and PAT has not grown the way its revenue has. Cash-flow generation has been a positive.

The performance since FY22 is the catalyst for generating interest in the company. If one continues to hold on then

Track for 16% growth in dollar (not INR) revenue growth

PAT margins hold FY23 levels

The asking rate to achieve $ 500 million remains at a manageable level.

Given that CIGNITITECH FY23 revenue was $ 206 million one can expect the acquisition to be of a company with less than $ 50 million revenue. One would be vey surprised if the acquisition is closer to a $ 100 million revenue

9. Or, join the ride

If I am looking to enter the stock then

CIGNITITEC has a a an average track record over the long term but INR revenue CAGR of 24% since FY22 is what is generating interest. With a target of 25% $ revenue growth till FY27 a PE of around 12 makes the valuations reasonable.

A lot depends on ones conviction in CIGNITITECH achieving the $ 500 million target by FY27

CIGNITITEC is a consistent free cash flow generator. It generated FCF of Rs 144 cr in FY23 and is available at market cap of Rs 2,327. This makes the free cash flow yield as 6.2% which makes the valuations look very attractive.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades