Capacite Infraprojects: PAT growth of 120% & Revenue growth of 26% in 9M-25 at a PE of 14

FY25 Revenue growth of 25%. Minimum FY26 growth of 25% with potential of 30-32%. Sustainable margins. Guiding FY24-28 revenue CAGR of 25%. Revenue growth supported by order book 4X+ FY25 revenue.

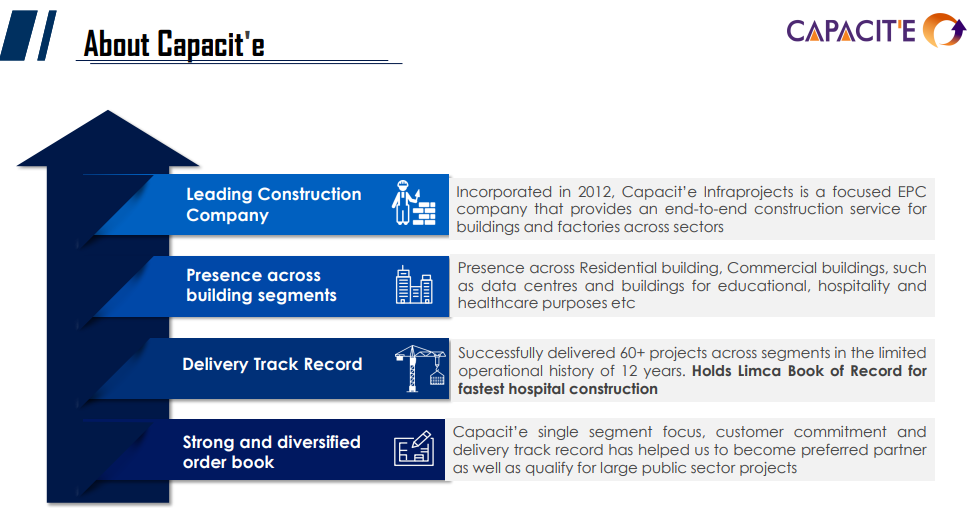

1. Construction Company

capacite.in | NSE : CAPACITE

Capacit'e provides end-to-end construction services for High Rise and Super High-Rise Buildings, Townships, Mass Housing, etc. in the residential space, Office Complexes, IT & ITES Parks in the commercial space and Hospitality, Healthcare Facilities, Industrial Buildings, MLCPs in the institutional space.

2. FY22-24: PAT CAGR of 65% & Revenue CAGR of 20%

3. FY24: PAT up 26% & Revenue up 7% YoY

4. Strong Q3-25: PAT up 77% & Revenue up 23% YoY

5. Strong 9M-25: PAT up 120% & Revenue up 26% YoY

6. Business metrics: Weak but improving return ratios

7. Outlook: 25% revenue CAGR for FY24-28 with PAT growing faster

i. FY25: 25% revenue growth

Q4-25: We we have done about 190 crores in January and we have certain targets for February and March and this is a peak working season. So we are confident we have we need to touch 700 crores we will do that

FY25: we will be giving 25% growth and a much better growth on the bottom line. It will be an historic PAT for the whole year again in the current financial year.

ii. FY26: Min 25% revenue growth with potential for 30-32% growth

Anticipates a 25-30% year-on-year growth.

Minimum of 25% growth is expected for the next financial year.

For FY26, new orders coming in have a shorter execution period, and therefore the 25% growth could become 30-32%.

However, the guidance year on year on a higher base will be a minimum of 25%.

iii. FY24-28: Revenue CAGR of 25%

We have already said that we will grow by 25% CAGR from '23-'24 onwards for the next 4 years. So 1 year has gone. We have grown by that number. And other 3 years, we will grow on an incremental base at minimum 25%, if not there.

iii. FY25: Sustainable EBITDA margins

Guiding for an 18% EBITDA margin, and this has been maintained over a 9-month period.

iv. Strong order book: Order book 4.2X FY25 expected revenue

Based on 25% growth in FY25. The order book of Rs 10,061 cr is 4X+ time FY25 expected revenue of Rs 2415 cr. Capacite has a target of 3,000 crore order intake in FY25 which creates a strong outlook for FY26 & FY27

Target of 3,000 crore order intake in FY25

Confident in surpassing its guided order book addition for FY25.

Aiming for ₹4,000 crores of fresh order inflow in the next financial year

8. PAT growth of 120% & Revenue of 26% in 9M-25 at a PE of 14

9. Hold?

If I hold the stock then one may continue holding on to CAPACITE

9M-25 performance is pointing towards achievement of the management guidance of 25% revenue growth in FY25.

Outlook for FY26 is strong with minimum growth of 25%

The strong order book provides a reason to continue with CAPACITE. The execution of the current order book would out till FY27

Revenue uptick to gain further Momentum owing to quality of order book & improved Liquidity condition

Well funded projects including projects with Investments by global players in our clients; enhancing project visibility

10. Buy?

If I am looking to enter CAPACITE then

CAPACITE has delivered a PAT growth of 120% on a revenue growth of 26% in 9M-25, the PE of 14 looks quite attractive.

CAPACITE is guiding for 25% revenue growth in FY25 with PAT expected to grow faster than the revenue at a PE of 14 which makes the valuations attractive from a FY25 perspective.

CAPACITE is guiding for minimum 25% revenue growth in FY26 at a PE of 14 which makes the valuations attractive from a FY26 perspective.

CAPACITE is guiding for FY24-28 revenue CAGR of 25% with margins expanding at a PE of 16 which makes the valuations quite attractive in the long term.

Previous Coverage of CAPACITE

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Thanks for sharing. In Infra space I was looking at something very attractive from valuation perspective. I blv when compared with ganesh housing which js also good stock, Capacite is better placed in terms of returns for long term at CMP lvls

Beautifully analysed , well explained ❤️❤️❤️👏👏