Capacite Infraprojects: PAT growth of 153% & Revenue growth of 28% in H1-25 at a PE of 16

Revenue guidance of 25% for FY25. Guidance for margin expansion. H1-25 margins are sustainable. Guiding for revenue CAGR of 25% for FY24-28. Revenue growth supported by order book 4.2X FY25 revenue.

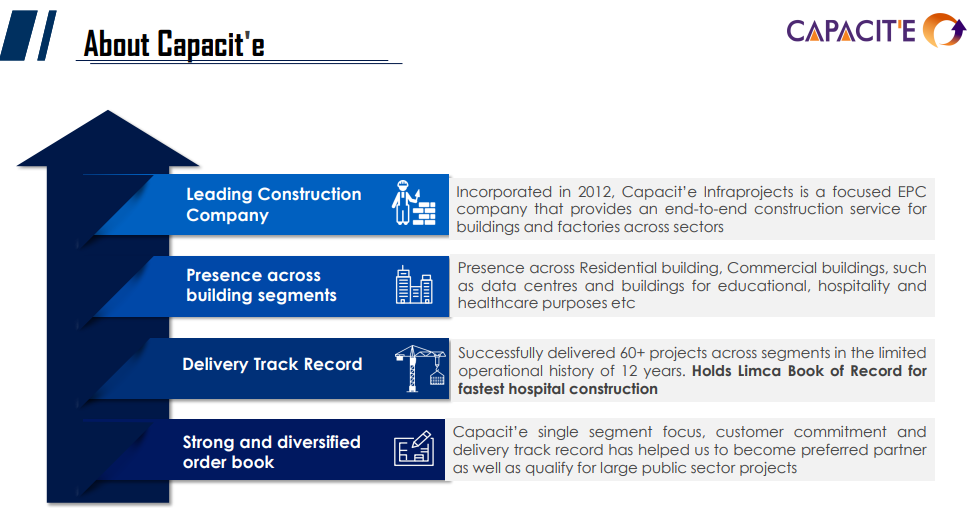

1. Construction Company

capacite.in | NSE : CAPACITE

Capacit'e provides end-to-end construction services for High Rise and Super High-Rise Buildings, Townships, Mass Housing, etc. in the residential space, Office Complexes, IT & ITES Parks in the commercial space and Hospitality, Healthcare Facilities, Industrial Buildings, MLCPs in the institutional space.

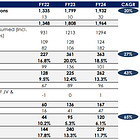

2. FY22-24: PAT CAGR of 65% & Revenue CAGR of 20%

3. FY24: PAT up 26% & Revenue up 7% YoY

4. Strong Q2-25: PAT up 126% & Revenue up 23% YoY

5. Strong H1-25: PAT up 153% & Revenue up 28% YoY

6. Business metrics: Weak but improving return ratios

7. Outlook: 25% revenue CAGR for FY24-28 with PAT growing faster

i. FY25: 25% revenue growth

So '25, we have already given a guidance of 25%.

ii. FY24-28: Revenue CAGR of 25%

We have already said that we will grow by 25% CAGR from '23-'24 onwards for the next 4 years. So 1 year has gone. We have grown by that number. And other 3 years, we will grow on an incremental base at minimum 25%, if not there.

iii. FY25: Improvement in EBITDA margins

EBITDa margins would continue at their current levels for at least the next four quarters. This suggests that they are expecting to maintain or even potentially improve on the margin performance they have achieved in recent periods

EBITDA Margins: once our order execution speed improves beyond INR550 crores, you will see an expansion in the margins. That's what you are actually witnessing now because there is a reduction as a percentage to turnover in the fixed cost of the company. So there is no reason why these margins plus or minus 1% should be achievable for the full year, if not better

iv. Strong order book: Order book 4.2X FY25 expected revenue

Based on 25% growth in FY25. The order book of Rs 10,061 cr is 4.2X time FY25 expected revenue of Rs 2415 cr. Capacite has a target of 3,000 crore order intake in FY25 which creates a strong outlook for FY26 & FY27

Order Book: ₹ 9,203 Cr as on September 30, 2024

As of September 30th, 2024, Capacite holds a standalone order book of 9,203 crores. Including the recently awarded BDD project worth 858 crores, the total order book stands at approximately 10,061 crores.

Have a target of 3,000 crore order intake in FY25

Order inflow during FY 25 (YTD) - ₹ 1,459 crores

8. PAT growth of 153% & Revenue of 28% in H1-25 at a PE of 16

9. Hold?

If I hold the stock then one may continue holding on to CAPACITE

H1-25 performance is pointing towards achievement of the management guidance of 25% revenue growth in FY25.

The strong order book provides a reason to continue with CAPACITE. The execution of the current order book would out till FY27

Revenue uptick to gain further Momentum owing to quality of order book & improved Liquidity condition

Well funded projects including projects with Investments by global players in our clients; enhancing project visibility

10. Buy?

If I am looking to enter CAPACITE then

CAPACITE has delivered a PAT growth of 153% on a revenue growth of 28% in H1-25, the PE of 16 looks quite reasonable.

CAPACITE is guiding for 25% revenue growth in FY25 with PAT expected to grow faster than the revenue at a PE of 16 which makes the valuations attractive in the medium term.

CAPACITE is guiding for FY24-28 revenue CAGR of 25% with margins expanding at a PE of 16 which makes the valuations quite attractive in the long term.

Previous Coverage of CAPACITE

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer