Capacite Infraprojects: PAT growth of 180% & Revenue growth of 32% in Q1-25 at a PE of 22

Revenue guidance of 25% for FY25. Bottom line to grow faster than the top-line. Guiding for revenue CAGR of 25% for FY24-28. Revenue growth supported by order book 3.7X FY25 revenue.

1. Construction Company

capacite.in | NSE : CAPACITE

Incorporated in 2012, Capacit’e Infraprojects is a focused EPC company that provides an end-to-end construction service for buildings and factories across sectors

Capacit'e provides end-to-end construction services for High Rise and Super High-Rise Buildings, Townships, Mass Housing, etc. in the residential space, Office Complexes, IT & ITES Parks in the commercial space and Hospitality, Healthcare Facilities, Industrial Buildings, MLCPs in the institutional space.

2. FY22-24: PAT CAGR of 65% & Revenue CAGR of 20%

3. Strong FY23: PAT up 61% & Revenue up 34%

4. FY24: PAT up 26% & Revenue up 7% YoY

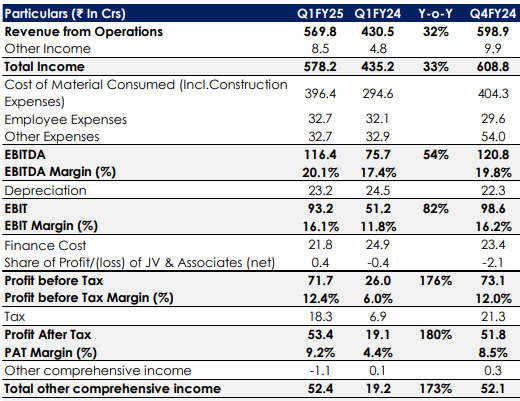

5. Strong Q1-25: PAT up 180% & Revenue up 32% YoY

6. Business metrics: Weak but improving return ratios

7. Outlook: 25% revenue CAGR for FY24-28 with PAT growing faster

i. FY25: 25% revenue growth

Revenue growing to Rs 7,500 cr by FY27 implies a revenue CAGR of 15%

So '25, we have already given a guidance of 25%. First quarter has happened and has panned out quite well. We see that, this will continue for the remaining of the financial year.

ii. FY24-28: Revenue CAGR of 25%

We have already said that we will grow by 25% CAGR from '23-'24 onwards for the next 4 years. So 1 year has gone. We have grown by that number. And other 3 years, we will grow on an incremental base at minimum 25%, if not there.

iii. FY25: Improvement in EBITDA margins

EBITDA Margins: once our order execution speed improves beyond INR550 crores, you will see an expansion in the margins. That's what you are actually witnessing now because there is a reduction as a percentage to turnover in the fixed cost of the company. So there is no reason why these margins plus or minus 1% should be achievable for the full year, if not better

iv. Strong order book: Order book 3.66X FY25 expected revenue

Based on 25% growth in FY25. The order book of Rs 8,828 cr is 3.66X time FY25 expected revenue of Rs 2415 cr.

Order book on standalone basis stood at ₹ 8,828 crores as of June 30, 2024. Public sector accounts for 72% while private sector accounts for 28% of the total order book.

8. PAT growth of 180% & Revenue of 32% in Q1-25 at a PE of 22

9. So Wait and Watch

If I hold the stock then one may continue holding on to CAPACITE

CAPACITE delivered a strong FY24 followed by an excellent Q1-25 where bottom-line performance has been quite strong. Increased confidence in the management to deliver top-line growth of 25% with margin expansion given that FY24 targets were achieved.

highest ever Quarterly Profit After Tax of ₹ 53.4 crores in Q1 FY 25

Registered highest ever first quarter total income

The strong order book provides a reason to continue with CAPACITE. The execution of the current order book would out till FY27

Revenue uptick to gain further Momentum owing to quality of order book & improved Liquidity condition

Well funded projects including projects with Investments by global players in our clients; enhancing project visibility

10. Or, join the ride

If I am looking to enter CAPACITE then

CAPACITE has delivered a PAT growth of 180% on a revenue growth of 32% in Q1-25, the PE of 22 looks quite reasonable.

CAPACITE is guiding for 25% revenue growth in FY25 with PAT expected to grow faster than the revenue at a PE of 22 which makes the valuations attractive in the medium term.

CAPACITE is guiding for FY24-28 revenue CAGR of 25% with margins expanding at a PE of 22 which makes the valuations quite attractive in the long term.

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Like