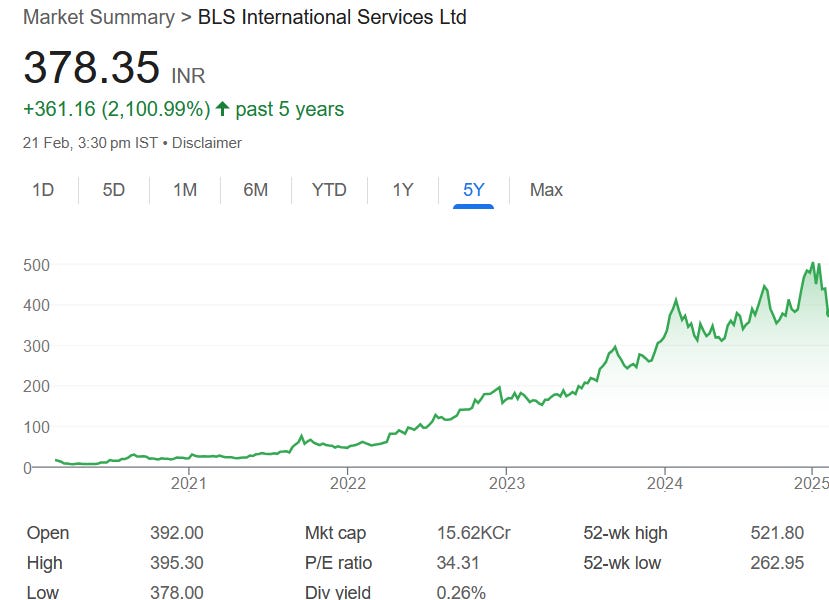

BLS International Services: PAT up 64% & Revenue up 22% in 9M-25 at PE of 34

Guiding 50-60% PAT growth & revenue growth of 20-30% in FY25. Strong & stable EBITDA margin. FY26 growth guidance of 25%. New tenders & expansion supported by inorganic growth to drive momentum

1. Visa & consular services | Digital services

blsinternational.com | NSE: BLS

2. FY21-24: PAT growth 86% & Revenue growth 52% CAGR

3. FY24: PAT up 59% and Revenue up 11%

4. Q2-25: PAT up 47% and Revenue up 17% YoY

PAT up 21% and Revenue up 0.5% QoQ

5. 9M-25: PAT up 64% and Revenue up 22% YoY

6. Business Metrics: Strong & improving return ratios

Ours is a negative working capital cycle. So we don't need money for the working capital.

7. Outlook: 50-60% PAT growth & 20-30% revenue growth in FY25

Revenue & Growth Outlook

Visa & Consular Services:

Strong growth expected as global travel & outsourcing to expand.

Aims to maintain over 30% EBITDA margin in the Visa business.

Visa application volumes are expected to rise in Q4 FY’25 and Q1 FY’26 due to seasonal trends.

Digital Business Growth:

Optimistic about sustained high growth.

Aadifidelis acquisition is expected to contribute significantly to Digital Business revenue.

Revenue growth will be driven by new services & expansion into loan processing and digital banking.

Profitability & Margins: Sustaining High Margins:

EBITDA margins have expanded from 20% to 30%+. Committed to maintaining these margins as a new base.

Profitability will be supported by operational efficiencies & a shift towards a self-managed model.

Acquisition & Expansion Strategy

Acquisitions & Investments:

Open to further acquisitions in both Visa & Digital segments.

Cash reserves of ₹690 crores will be strategically deployed for:

New tenders & expansion

Inorganic growth opportunities

Technology & infrastructure investments

New Business Tenders & Contract Renewals:

90% of contracts have been renewed, securing long-term revenue stability.

Actively bidding for multi-billion-dollar tenders worldwide.

5-10% of contracts up for renewal in the next 2 years.

Entering new geographies where outsourcing is increasing.

Guidance for FY'26

Sustained Growth Expectations:

The company aims to maintain & exceed the strong performance of FY'25.

Growth will be driven by:

Organic expansion in Visa & Digital businesses.

Higher visa application volumes & increased service offerings.

New contract wins & tenders.

Profitability Target:

Management expects to maintain a 30%+ EBITDA margin.

Visa business margins expected to stay at ~37%.

Digital business margins will fluctuate due to new acquisitions & revenue mix changes.

Long-Term Vision:

Market opportunity remains strong as only 50% of the visa & consular market is outsourced.

Management is confident about continued double-digit growth.

i. FY25: Revenue growth of 20-30%

Management expressed confidence in maintaining the growth trajectory observed in the first two quarters of FY25, characterized by a 20-30% revenue increase. This growth is attributed to strong performance in the visa and consular services business, contributions from recent acquisitions, and ongoing operational improvements.

ii. FY25: PAT growth of 50-60%

Will Maintain The Last 3 Year Profit After Tax CAGR Of 50-60% In FY25

For FY24, we closed at INR 325 crores of PAT, so which was a 60% growth compared to last year. So whatever we have achieved last year, our objective will be to maintain that.

First of all, as a company, I personally look at more EBITDA and PAT numbers. I feel we have done a 60% growth at EBITDA level. And a year before that, we also did more than 100% growth in EBITDA. So that is what we are focused on. And I feel definitely this year also, we will surpass the numbers that we achieved last year.

iii. FY25: EBITDA Margin to be maintained

So definitely, first of all, our objective is to maintain. Whatever number that we have achieved, we want to make that a new base. Whatever margins we have achieved, we want to make that the new base.

iv. FY26: Revenue growth of 25%

The company aims to maintain a 25% revenue growth rate in FY26, fueled by a combination of organic growth in existing businesses, contributions from acquisitions, and securing new contracts.

8. PAT growth of 64% & Revenue growth of 22% in 9M-25 at a PE of 34

9. Hold?

If I hold the stock then one must question holding on to BLS.

9M-25 has been strong and is in line with the growth momentum promised by the BLS management.

Outlook is strong with the BLS management sticking to a 50%+ PAT CAGR with a 25% revenue growth

If you have seen in the last 3-4 years we have given more than 50% CAGR growth, and next year also coming years our objective is obviously to grow the company. We cannot give you any firm numbers or percentages where target to grow, but definitely we have aggressive growth internally set within the company.

✅ Bull Case

✔ Strong growth (Visa business + Digital expansion)

✔ High EBITDA margins (30%+) & cash reserves (₹690 crores)

✔ New acquisitions fueling revenue & profit expansion

✔ Global travel demand recovering

✔ Multi-billion-dollar tenders up for grabs

✔ Healthy contract renewal rate (90%)

✔ Visa & Consular Services is a high-barrier-to-entry industry

❌ Bear Case (Potential Risks)

❗ High PE (34) = priced for growth, any slowdown could trigger a correction

❗ Dependence on government contracts (renewal risks)

❗ Global economic conditions impact travel demand

❗ Acquisitions need to be well-integrated for sustained profitability

10. Buy?

If I am looking to enter BLS then

For a PAT growth of 64% and revenue growth of 22% in 9M-25, the PE of 34 looks reasonable.

For a FY25 guidance of 50-60% PAT growth with 25% revenue growth, the PE of 34 looks reasonable.

For a FY24-26 revenue CAGR of about 25%, the PE of 34 looks reasonable.

At a 34 PE the margin of safety is limited and a weak quarter can impact the stock price significantly.

Previous coverage of BLS

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer