BLS International Services: PAT up 88% and Revenue up 15% in 9M-24 at PE of 52

BLS guiding 50-60% PAT growth & 20%+ EBITDA margin in FY25. Challenge for BLS in FY25 is top-line growth. 50-60% PAT growth cannot be sustained into FY26 with 15% top-line as seen in 9M-24

1. Leading global player in visa processing & an early mover in tech-enabled citizen services

blsinternational.com | NSE: BLS

Business Services

Corporate Structure

In January 2024, BLS International signed definitive agreement to acquire 100% stake in iDATA for an enterprise valuation of EURO 50 Mn (~ Rs. 450 Crores)

iData is a Turkey-based Visa & Consular services provider

The transaction will be EPS accretive from day one and is anticipated to be completed within the current fiscal year

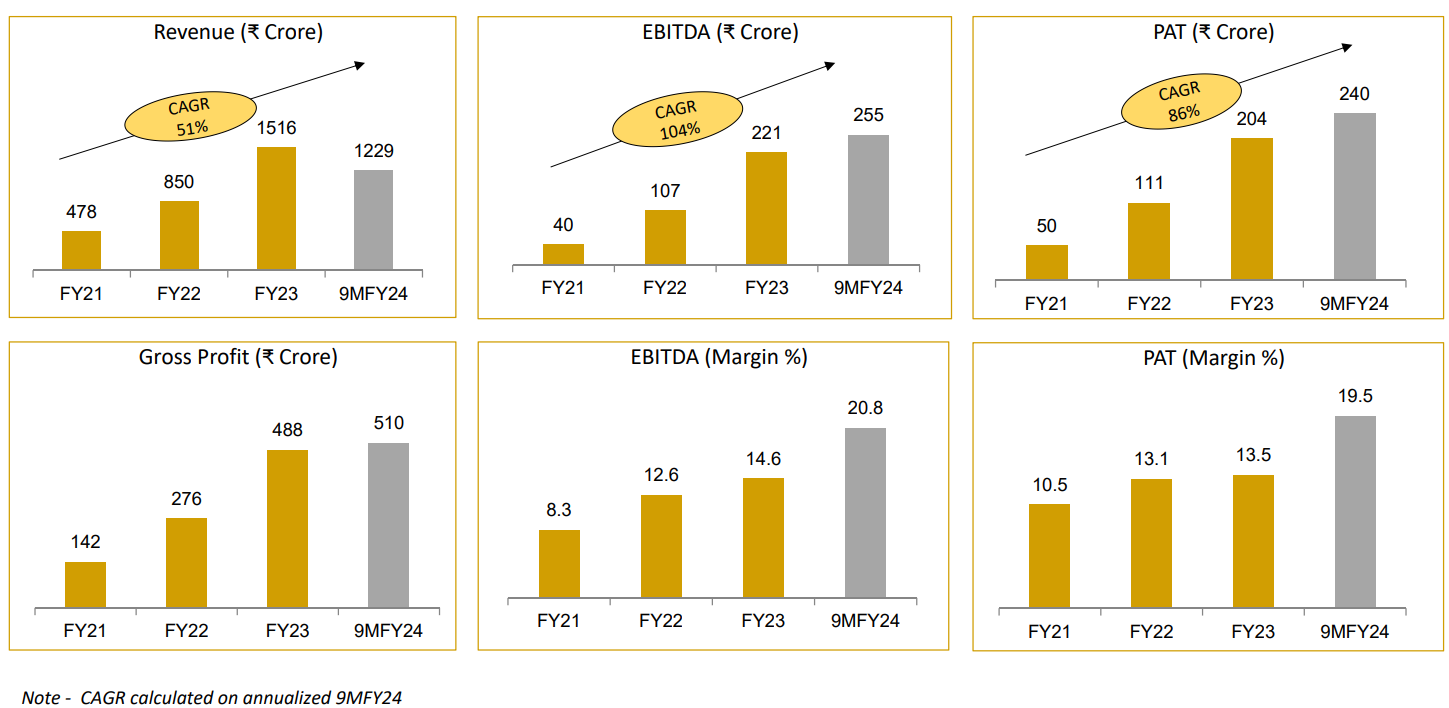

2. FY21-23: PAT growth 102% & Revenue growth 78% CAGR

3. FY23: Highest ever cash generation; Q4-23 biggest quarter ever

FY23 Revenue grew 78.4% YoY to ₹ 1,516.19 crores

EBITDA and PAT for the year increased 106.7% & 83.7% YoY

Company registers highest ever Consolidated Operational Revenue of Rs 448.6 Cr & quarterly EBITDA at Rs. 66.5 Cr in Q4 FY23

4. Strong H1-24: PAT up 87% and Revenue up 26% YoY

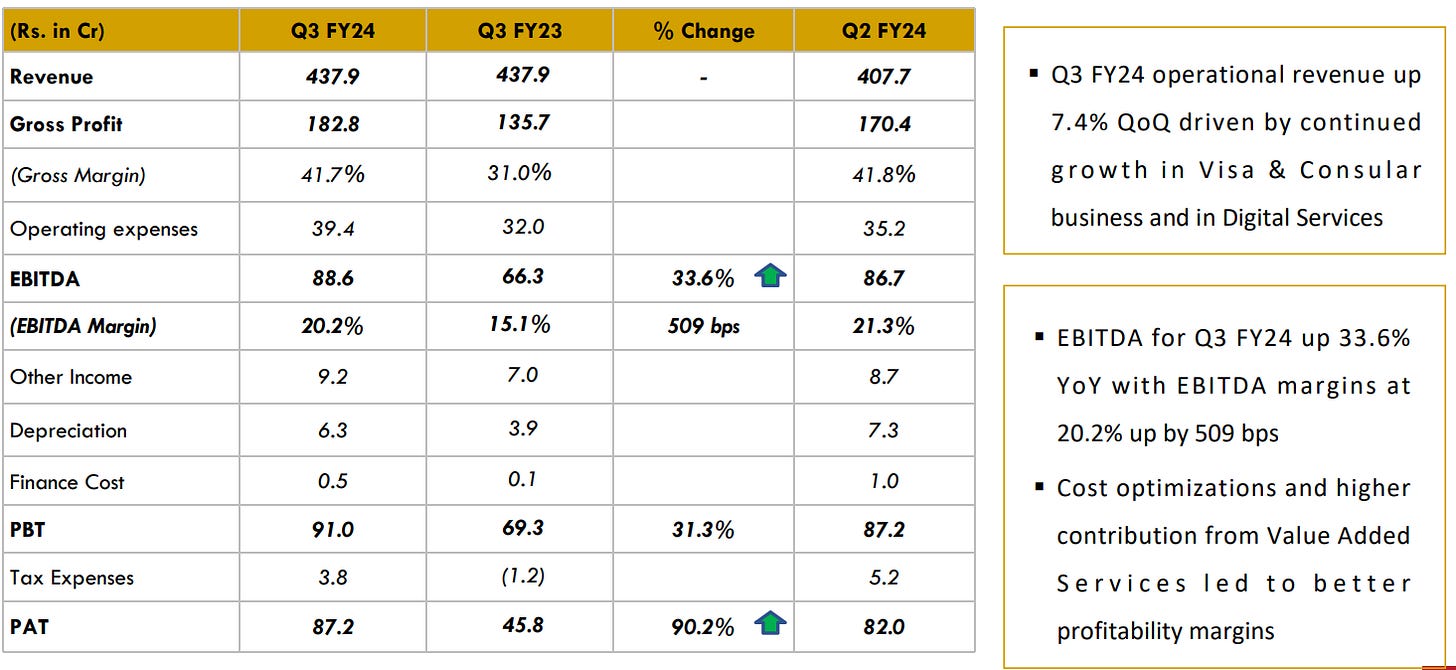

5. Q3-24: PAT up 90% and Revenue is flat YoY

PAT up 6% and Revenue up 7% QoQ

6. 9M-24: PAT up 88% and Revenue up 15%

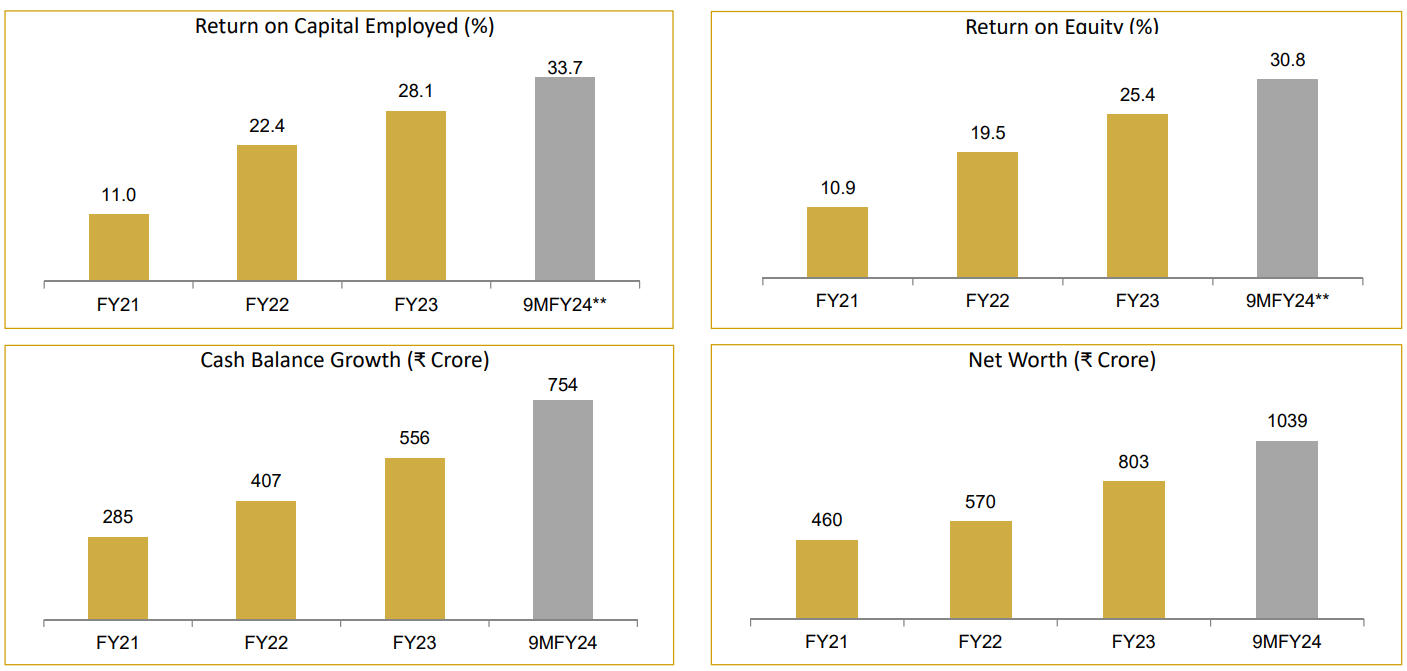

7. Business Metrics: Strong & improving return ratios

Ours is a negative working capital cycle. So we don't need money for the working capital.

8. Outlook: 50-60% PAT growth in FY25

i. FY25: PAT growth of 50-60%

Will Maintain The Last 3 Year Profit After Tax CAGR Of 50-60% In FY25

ii. FY25: EBITDA Margin of 20%+

EBITDA margin in FY25 to be maintained at 20%+ compared to 20.8% in 9M-24.

I would say one year, quarter on quarter we have been able to maintain over 20% EBITDA margin and we are quite confident of continuing and maintaining that.

9. PAT growth of 88% & Revenue growth of 15% in 9M-24 at a PE of 52

10. So Wait and Watch

If I hold the stock then one must question holding on to BLS.

Coverage of BLS was initiated after strong Q1-24 results. Overall 9M-24 looks reasonable with very strong bottom-line growth and a muted growth on the top-line. BLS looks on track to deliver a stronger FY24 compared to FY23.

Outlook is strong with the BLS management sticking to a 50% revenue CAGR

If you have seen in the last 3-4 years we have given more than 50% CAGR growth, and next year also coming years our objective is obviously to grow the company. We cannot give you any firm numbers or percentages where target to grow, but definitely we have aggressive growth internally set within the company.

11. Or, join the ride

If I am looking to enter BLS then

For a PAT growth of 88% and revenue growth of 15% in 9M-24, the PE of 52 looks reasonable.

For a FY25 guidance of 50-60% PAT growth, the PE of 52 looks acceptable.

The 15% top-line growth seen in 9M-24 cannot be sustained on a PE of 52 into FY25 and beyond. One needs to see top-line growth coming back in FY25

At a 50+ PE margin of safety is low and even one weak quarter can impact the stock price significantly.

Previous coverage of BLS

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer