BLS International Services: PAT up 88% and Revenue up 26% in H1-24 at PE of 40

BLS is a efficiently run cash generation company with emphasis on organic as well as inorganic growth while striving to maintain rate of return threshold. However, it was hit by a weak growth in Q2-24

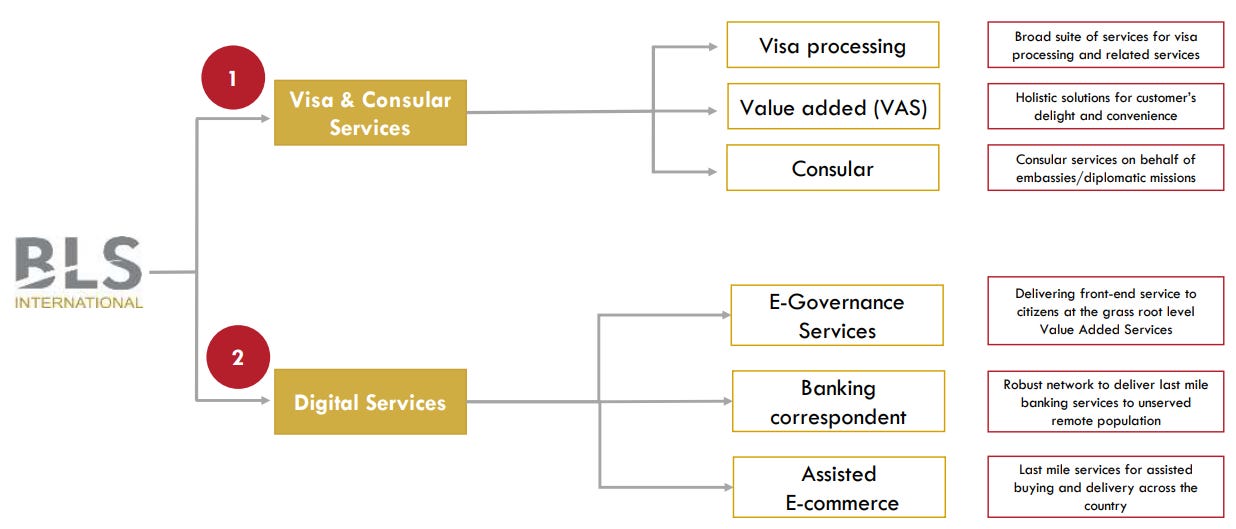

1. Leading global player in visa processing & an early mover in tech-enabled citizen services

blsinternational.com | NSE: BLS

Business Services

Corporate Structure

2. FY21-23: PAT growth 102% & Revenue growth 78% CAGR

3. FY23: Highest ever cash generation; Q4-23 biggest quarter ever

FY23 Revenue grew 78.4% YoY to ₹ 1,516.19 crores

EBITDA and PAT for the year increased 106.7% & 83.7% YoY

Company registers highest ever Consolidated Operational Revenue of Rs 448.6 Cr & quarterly EBITDA at Rs. 66.5 Cr in Q4 FY23

4. Q1-24: Continuing the trajectory of FY23

PAT grew 131% YoY on the back of 84% PAT growth in FY24

Q1 FY24 operational revenue up 40.6% YoY driven by robust recovery in Visa & Consular business

Digital Services revenue up ~140% YoY

5. Weak Q2-24: PAT up 61% and Revenue up 14% YoY

The company’s operating EBITDA margins continue to be in excess of 20%, primarily driven by an improved business mix, specifically in the Visa & Consular services segment.

Weak top-line growth for both segments

6. Good H1-24: PAT up 87% and Revenue up 26% YoY

Operational Revenue stood at ₹ 791.22 crores in H1 FY24, a growth of 25.66% from ₹ 629.66 crores in H1 FY23

EBITDA stood at ₹ 166.79 crores in H1 FY24, up 88.90% from ₹ 88.30 crores in H1 FY23.

PBT stood at ₹ 167.62 crores in H1 FY24 compared to ₹ 88.63 crores in H1 FY23, a growth of 89.11%

Profit after Tax (PAT) for the half year was ₹ 152.99 crores, 87.28% YoY higher compared to ₹ 81.69 crores in H1 FY23.

7. High quality of growth generating free cash flow

Ours is a negative working capital cycle. So we don't need money for the working capital.

Given the asset-light nature of the business, the company has been able to generate significant returns for its shareholders: ROCE at 35.5% & ROE at 34.6% (based on H1FY24 annualized financials).

8. Outlook: 60%+ PAT growth in FY24

i. Growth on account of margin expansion: PAT growth of 60%+ in FY24

Q2-24 top-line growth of 14% to be maintained along with the H1-24 margin of 19.3%.

FY24 PAT = 1516 X 114.3% X 19.3% = Rs 334 cr = 64% growth over FY23

Whatever we have achieved our wish is to definitely maintain it and we are working hard towards that

9. PAT growth of 88% & Revenue growth of 26% in H1-24 for a free cash flow generating business at a PE of 40

10. So Wait and Watch

If I hold the stock then one must question holding on to BLS.

Coverage of BLS was initiated after strong Q1-24 results. However, Q2-24 top-line growth was weak saved by the margin expansion. Overall H1-24 looks reasonable salvaged by strong growth in Q1 and margins sustained over Q1 and Q2.

BLS has a track record of good quality growth and execution. The Q2 weakness could be overlooked as an exception, yet one must watch for top-line growth very closely. Holding on to BLS cannot be justified only by margin expansion

In this context Q3 becomes a very important quarter as it is supposed to be a strong quarter for Visa & Consular services. Unless we see a recovery in Q3, the question marks on BLS performance in the short term will become bigger.

11. Or, join the ride

If I am looking to enter BLS then

For a PAT growth of 87% and revenue growth of 26% in H1-24, the PE of 40 looks reasonable only for FY24.

The PE of 40 looks reasonable for a 60%+ growth in PAT only for FY24.

However, the 14% top-line growth trajectory seen in Q2-24 cannot be sustained on a PE of 40 into FY25.

BLS is a efficiently run company but top-line growth needs to come back to sustain a PE of 40

Previous coverage of BLS

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades