BLS International Services: PAT up 70% and Revenue up 28% in Q1-25 at PE of 44

BLS guiding for 50-60% PAT growth in FY25. EBITDA margin expansion to 25-27% .

1. Leading global player in visa processing & tech-enabled citizen services

blsinternational.com | NSE: BLS

Business Services

Corporate Structure

2. FY21-24: PAT growth 86% & Revenue growth 52% CAGR

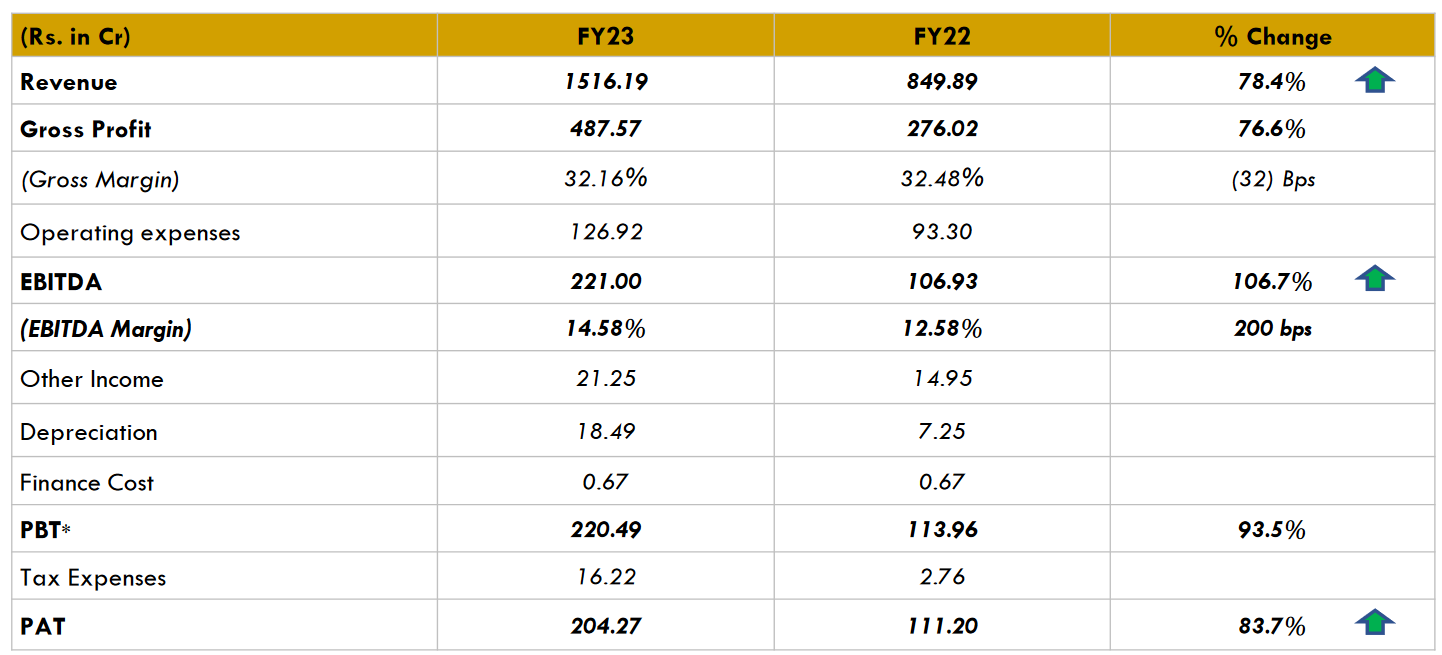

3. FY23: PAT up 84% and Revenue up 78%

Highest ever cash generation; Q4-23 biggest quarter ever

4. FY24: PAT up 59% and Revenue up 11%

5. Q1-25: PAT up 70% and Revenue up 28% YoY

PAT up 41% and Revenue up 10% QoQ

6. Business Metrics: Strong & improving return ratios

Ours is a negative working capital cycle. So we don't need money for the working capital.

8. Outlook: 50-60% PAT growth in FY25

i. FY25: PAT growth of 50-60%

Will Maintain The Last 3 Year Profit After Tax CAGR Of 50-60% In FY25

For FY24, we closed at INR 325 crores of PAT, so which was a 60% growth compared to last year. So whatever we have achieved last year, our objective will be to maintain that.

First of all, as a company, I personally look at more EBITDA and PAT numbers. I feel we have done a 60% growth at EBITDA level. And a year before that, we also did more than 100% growth in EBITDA. So that is what we are focused on. And I feel definitely this year also, we will surpass the numbers that we achieved last year.

ii. FY25: EBITDA Margin expansion of 25%+

EBITDA margin in FY25 to be maintained at 25-27%+ compared to 20.6% in FY24 and 27% in Q1-25.

Our intention is to be around 25% - 27%. That is our target to reach immediately. And then let's see from there how we can improve it further.

iii. FY25: Organic revenue growth of 15%

BLS International's recent acquisition, iDATA, based in Turkey, generated revenue of around ₹300 crore and an EBITDA of ₹144 crore in the last calendar year. It is expected to maintain similar financial performance this year as well

Whatever is our existing business, this will add to that, and the existing revenues are also growing at around 15% every year.

9. PAT growth of 70% & Revenue growth of 28% in Q1-25 at a PE of 44

10. So Wait and Watch

If I hold the stock then one must question holding on to BLS.

Coverage of BLS was initiated after strong Q1-24 results. Overall 9M-24 looks reasonable with very strong bottom-line growth and a muted growth on the top-line. BLS looks on track to deliver a stronger FY24 compared to FY23.

Outlook is strong with the BLS management sticking to a 50%+ PAT CAGR

If you have seen in the last 3-4 years we have given more than 50% CAGR growth, and next year also coming years our objective is obviously to grow the company. We cannot give you any firm numbers or percentages where target to grow, but definitely we have aggressive growth internally set within the company.

BLS in Q1-25 is ahead of its 15% organic revenue growth guidance.

11. Or, join the ride

If I am looking to enter BLS then

For a PAT growth of 70% and revenue growth of 28% in Q1-25, the PE of 44 looks reasonable.

For a FY25 guidance of 50-60% PAT growth, the PE of 44 looks acceptable.

At a 44 PE the margin of safety is low and even one weak quarter can impact the stock price significantly.

Previous coverage of BLS

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Very gud stock pls share peg ratio also and future planning