BLS International Services: 50%+ revenue growth, IPO of subsidiary & inorganic growth possibility at PE ratio of 49

Will grow organically as well as explore inorganic opportunities. Witnessing momentum across all businesses and are optimistic about sustaining growth and margins

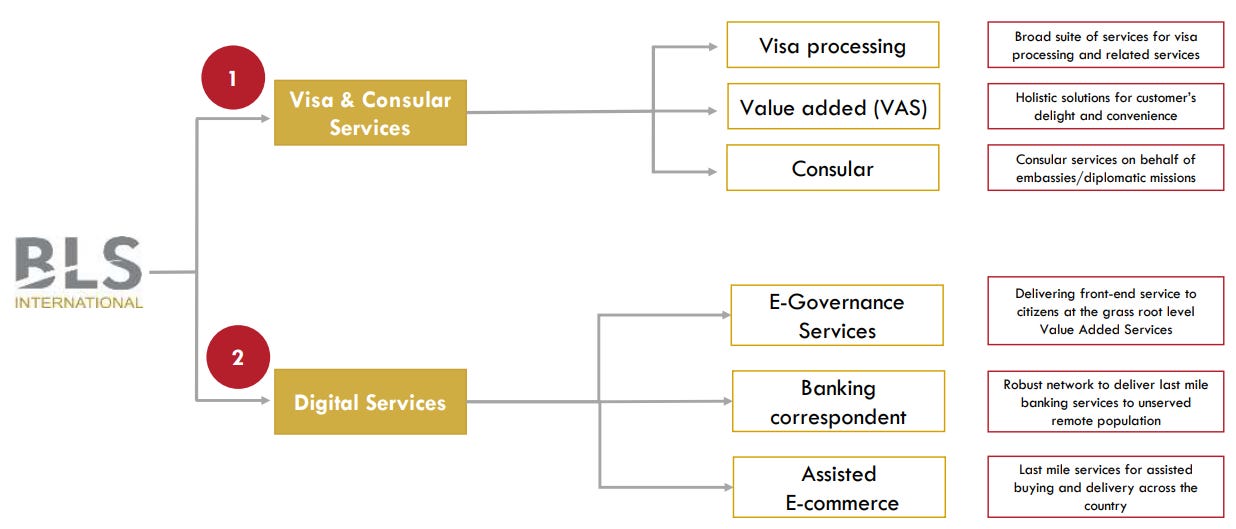

1. Leading global player in visa processing & an early mover in tech-enabled citizen services

blsinternational.com | NSE: BLS

Business Services

Corporate Structure

2. FY23: Highest ever cash generation; Q4-23 biggest quarter ever

FY23 Revenue grew 78.4% YoY to ₹ 1,516.19 crores

EBITDA and PAT for the year increased 106.7% & 83.7% YoY

Company registers highest ever Consolidated Operational Revenue of Rs 448.6 Cr & quarterly EBITDA at Rs. 66.5 Cr in Q4 FY23

3. Q1-24: Continuing the trajectory of FY23

PAT grew 131% YoY on the back of 84% PAT growth in FY24

Q1 FY24 operational revenue up 40.6% YoY driven by robust recovery in Visa & Consular business

Digital Services revenue up ~140% YoY

4. High quality of growth generating free cash flow

Ours is a negative working capital cycle. So we don't need money for the working capital.

Return on Equity stands at 25.4%.

Company generated cash from operations of Rs. 225 crores during the year, which the highest ever cash generation.

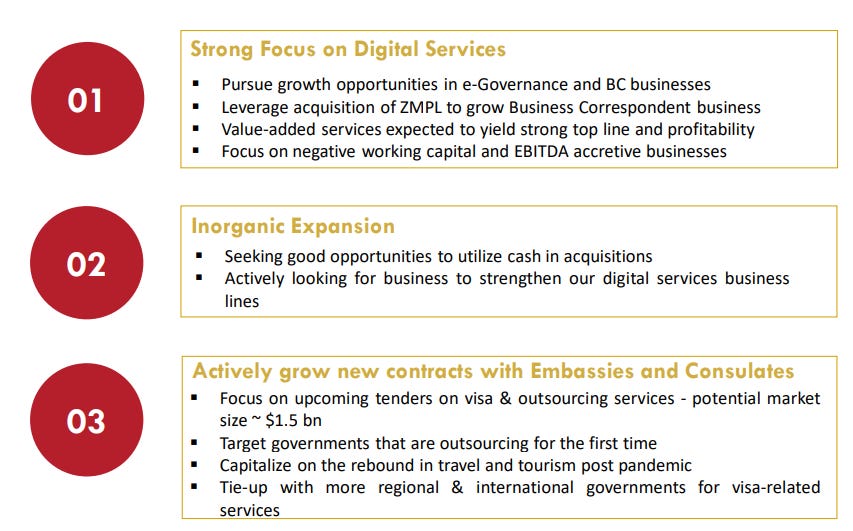

5. Outlook:~50% organic growth with possibility of inorganic growth

i. Visa Services: 30-40% revenue growth

See, last year, we have done about 70% to 80% growth. Going forward, it will taper down to around 20% to 25% of the existing business. But with the opening of new geographies like China and others, may grow by another 10% to 15%. So that is the range which we expect.

ii. Digital Services: 100%+ revenue growth

Yes, we are very bullish and we should continue with this momentum, which we have seen, the percentage rise more than 100% growth is what we are foreseeing in the near future.

iii. Overall : ~50% revenue organic growth

One can consider the segmental revenues in the same proportion as Q1-24 revenue i.e. visa services 81% of Q1-24 revenue and remaining as digital services. On this applying the growth rate outlook for each of the segments one can arrive at an overall growth rate of around 50%

iv. Potential for inorganic growth

We are seriously looking at acquisitions in both the Segments, not only in Visa, but we are also looking into digital business also.

Yes, we are talking to couple of targets and let's see when they get finalized.

v. Margins to be maintained during the growth

Visa Services: What we have achieved in the current quarter, we are looking at maintaining that at least if we cannot increase it further, this will become the base now for the further growth.

vi. Value unlocking should happen via the IPO of its subsidiary BLS E-Services

Company announced IPO for subsidiary BLS E-Services to raise funds to support growth strategies for Digital Services business

You know we see growth coming in that business also, but we do not want to utilize the money earned in visa business for the growth of that business. That was the reason that we wanted to list the company.

5. 50%+ revenue growth and opportunity for inorganic growth for a free cash flow generating business at a PE of 49

6. So Wait and Watch

If I hold the stock, then one can hold on to BLS given its ability to run on a negative working capital cycle and generate free cash flow while providing an outlook for 50% inorganic growth in FY24. Barring recent entrants into the stock, all must be sitting on a profit as the stock is trading near its all-time highs. One can sit on the stock for a longer term unless the nature of the business changes in terms of cash generation or the ability of the management to deliver growth becomes an issue.

7. Or, join the ride

If I am looking to enter BLS then

For 50%+ growth outlook with the possibility of inorganic growth , the PE of 49 looks reasonable.

The ability of the business to operate on a negative working capital cycle and generate free cash flow makes it an attractive candidate for a stock which can be held for the long term.

The management does not want to utilize the money earned in visa business for the growth of the digital business and is proceeding with the IPO of the digital business. As with any other IPO one can expect value unlocking to take place through the IPO.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades