BLS International FY25 Results: PAT up 66%, Momentum to Sustain in FY26

Visa-processing growth, strong margins, ₹928 Cr net cash and robust FCF position BLS International for organic & M&A expansion. Can it deliver on its valuations?

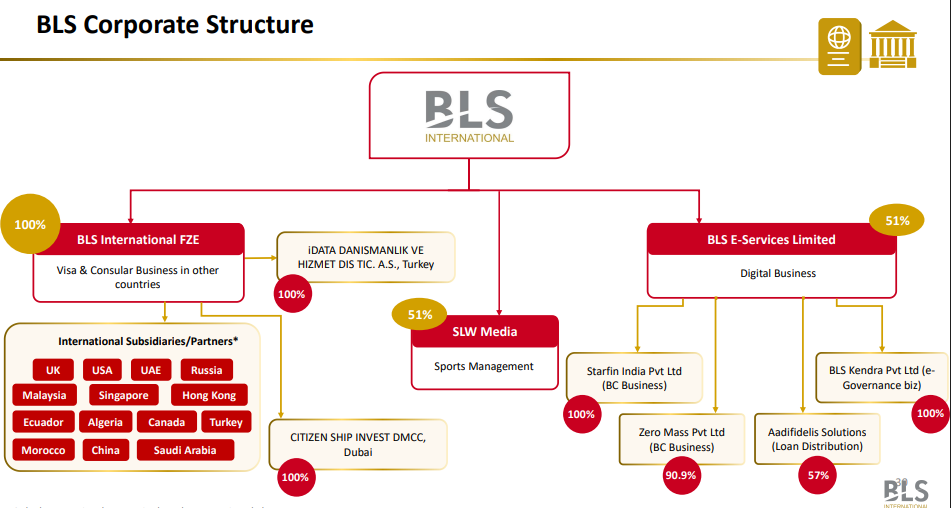

1. Visa & consular services | Digital services

blsinternational.com | NSE: BLS

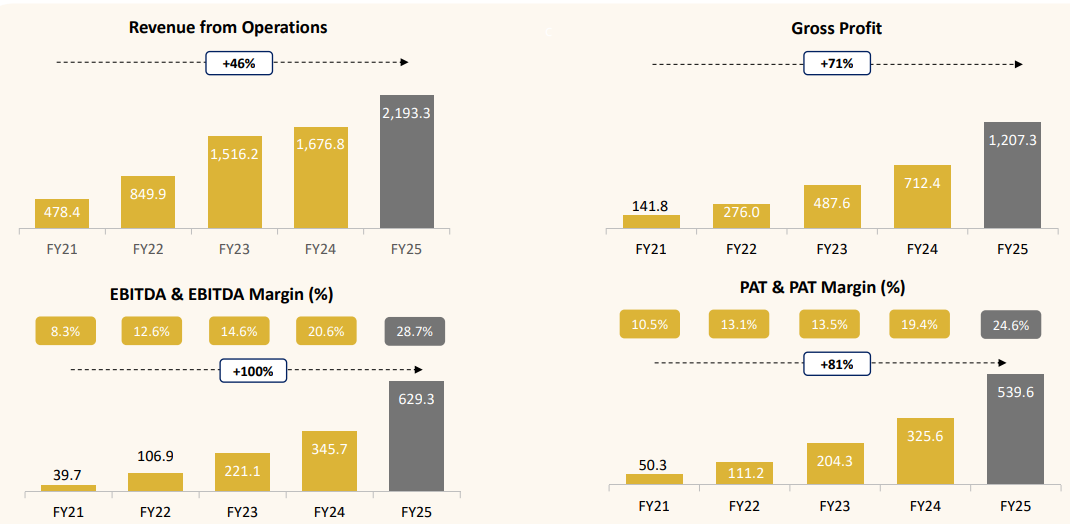

2. FY21-25: PAT growth 81% & Revenue growth 46% CAGR

Strong operating leverage: Each year, fixed costs became more productive—driving margin expansion across EBITDA and PAT.

Structural shift post-FY23: Margin jump from FY23 to FY25 (EBITDA: 14.6% → 28.7%) reflects transformation to a higher-margin, scaled business.

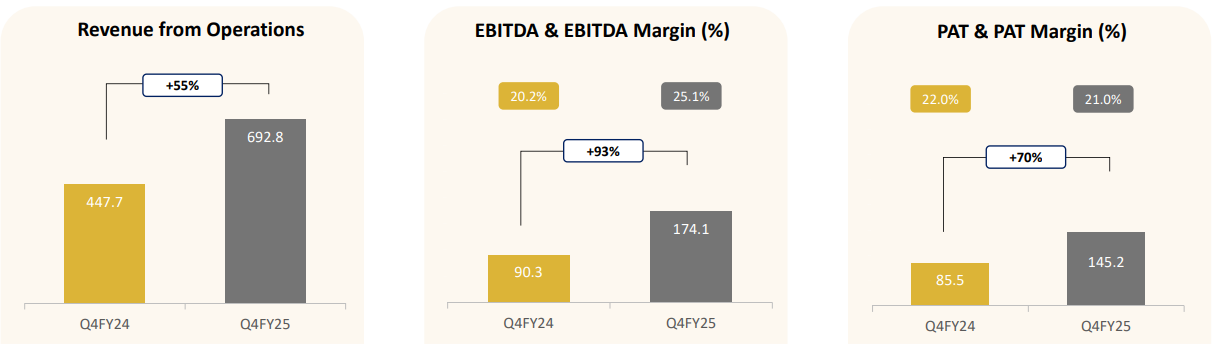

3. Q4-25: PAT up 70% and Revenue up 55% YoY

Visa segment strength and better revenue per application contributed materially to the Q4 surge.

Digital business integration, particularly Aadifidelis, did not dilute margins in Q4—suggesting early synergy realization.

The Q4 performance exceeded full-year trend lines, lifting confidence in FY26 baseline estimates.

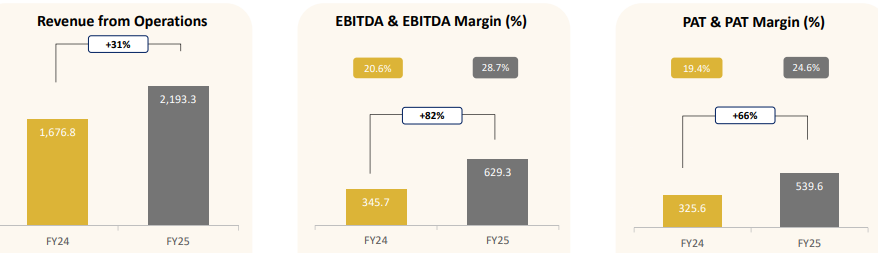

4. FY-25: PAT up 66% and Revenue up 31% YoY

Revenue growth, driven by higher visa volumes, improved pricing, and new acquisitions.

EBITDA margin expansion led by operating leverage and high-margin contracts.

Integrated iDATA, Citizenship Invest, and Aadifidelis, adding scale and margin diversity across segments.

Secured 90%+ contract renewals, expanded global footprint, and reinforced the base for long-term compounding.

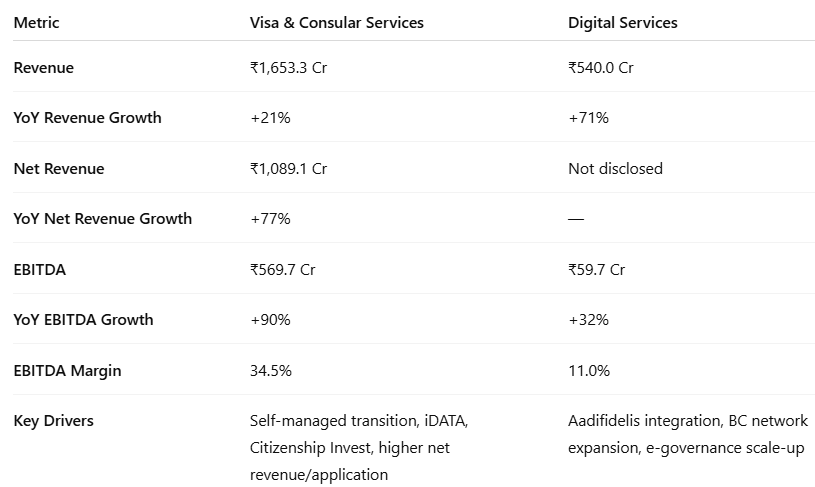

4.1 Segmental Performance — FY25

Visa & Consular Services accounts for over 75% of total revenue and nearly 90% of EBITDA.

Margin expanded indicating significant operational leverage and business model maturity.

Digital Services is scaling revenue rapidly but remains margin-dilutive due to Aadifidelis’s lower profitability.

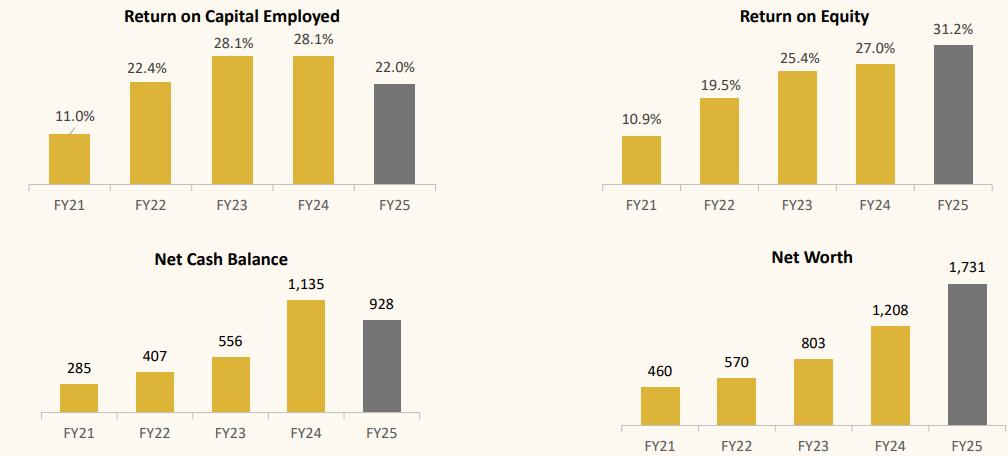

5. Business Metrics: Strong return ratios

BLS International continues to deliver top-tier capital efficiency, robust internal accruals, and a cash-rich balance sheet—all supported by its asset-light and negative working capital model.

6. Outlook: Growth Momentum to Sustain

As we move forward, we remain deeply committed to deliver sustainable and profitable growth. Our strategy remains two-fold, aggressively pursue organic growth by winning new contracts and deepen client engagement while also exploring value generation, inorganic opportunities in tech-enabled outsourcing and digital services globally.

6.1 BLS – FY25: Expectations vs. Performance

Hits:

Visa application volumes grew 31% YoY

Net revenue per application rose to ₹2,797, indicating strong pricing power and value-added service uptake.

EBITDA margin expansion driven by the successful transition from partner-run to self-managed centers and strong operational leverage

PAT grew 66% YoY.

Free cash flow surged to ₹667.6 Cr in FY25 more than doubling over ₹ 286.1 Cr in FY24

Acquisitions like iDATA and Citizenship Invest were swiftly integrated and contributed meaningfully to Visa segment profitability.

Misses / Cautions:

Digital business margins remained soft due to Aadifidelis (EBITDA margin ~4–5%) weighing on blended profitability.

6.2 BLS Outlook for FY26

Revenue Growth: Targeting double-digit growth, led by Visa & Consular and full-year contribution from acquisitions.

PAT Growth: Implied 20–25% YoY growth, continuing past CAGR trajectory.

Visa Application Volumes: Expecting volumes to rise from 37.5 lakh in FY25 to 45–50 lakh in FY26.

EBITDA Margins:

Consolidated margins to be maintained above 30%.

Visa segment margins expected to remain strong at 34–37%.

Digital Business:

Full-year integration of Aadifidelis in FY26.

Focus on improving margins and operational efficiency.

Free Cash Flow: Continued strong generation; FCF expected to exceed PAT, as in FY25.

Capital Allocation:

Exploring inorganic growth opportunities.

Open to deploying cash for tech investments, M&A, or selective expansion.

Tender Pipeline:

Actively bidding for $1B+ in global visa contracts.

Success in large tenders could significantly boost FY26 volumes and revenue.

Contract Renewals: Over 90% of contracts already renewed; next 2 years have minimal renewal risk.

Balance Sheet: Remains debt-light with ₹928 Cr net cash, offering strategic flexibility.

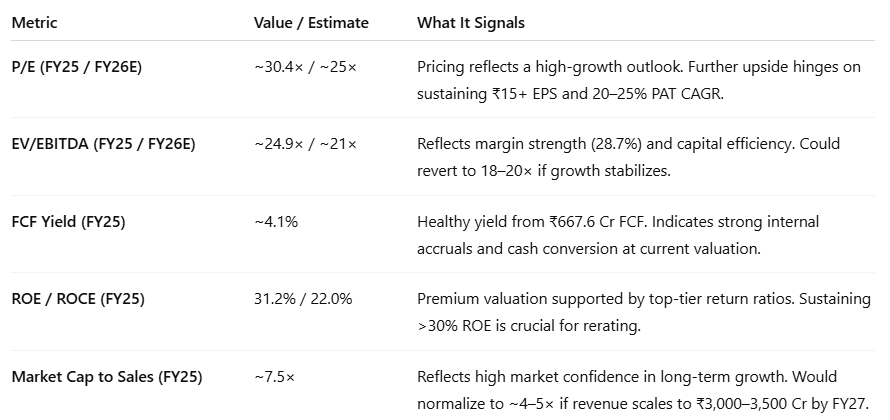

7. Valuation Analysis

7.1 Valuation Snapshot

7.2 What’s in the Price? (Valuation Expectations Embedded in BLS)

Strong PAT & EPS Growth: Valuation implies a 20–25% PAT CAGR over the next 2–3 years.

Margin Sustainability: Market expects 28–30% EBITDA margin to hold, even with digital dilution and integration costs. Visa margins of 34.5% are assumed to be defended.

High FCF Conversion: A FCF-to-PAT ratio of 1.24x and a 4.1% FCF yield imply continued strong cash generation with minimal capex needs.

Acquisition Execution: Pricing assumes iDATA and Citizenship Invest will sustain high margins and contribute meaningfully in FY26. BLS E-Services is expected to scale without dragging consolidated profitability.

Tender Pipeline Realization: Market builds in successful bid conversion from the $1B+ pipeline, with volumes projected to grow to 50–60 lakh applications in the next 2–3 years.

7.3 What’s Not in the Price? (Potential Upside Triggers)

Full-Year Acquisition Impact: FY25 captured only part-year revenue from iDATA and Citizenship Invest. A full FY26 contribution could lift margins and EPS beyond expectations, especially in high-margin EU contracts.

Geographic Expansion of Digital Services: The market hasn’t factored in international scaling of BLS E-Services into emerging markets, which could unlock a larger addressable market.

Operating Leverage: Fixed-cost model means any volume growth beyond 45 lakh can generate disproportionate EPS and FCF gains—likely underappreciated in current multiples.

Tender Upside: Current pricing assumes moderate wins. A few large international contracts could materially boost earnings and visibility.

Capital Allocation Levers: With ₹928 Cr in net cash, optionalities like buybacks, dividends, or high-ROIC tech investments are not fully priced in, though they could enhance returns and support rerating.

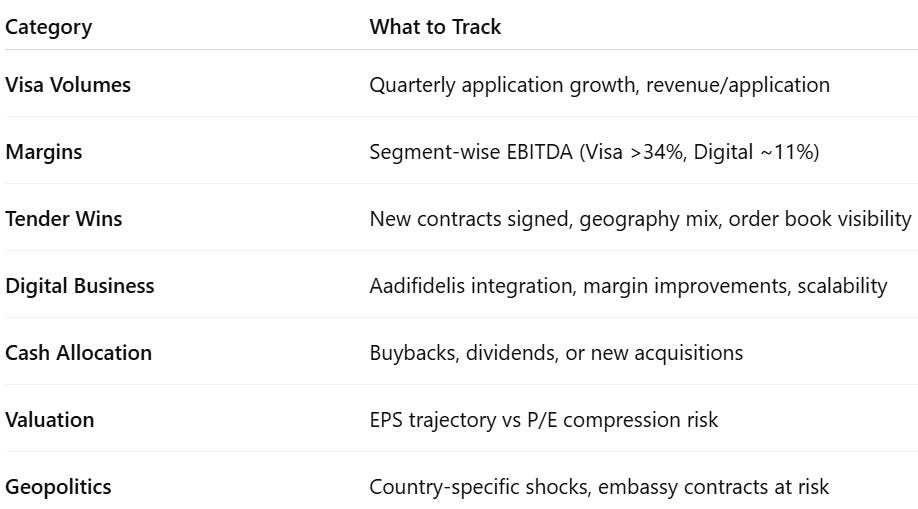

8. Implications for Investors: What to Watch

8.1 Bull, Base & Bear Case Scenarios

Bull Case

Outperformance across all levers leads to earnings and valuation upside.

Visa Volume Growth: 20–25% CAGR, driven by strong travel recovery and major tender wins

Revenue per Application: ₹3,100+ through premium VAS and pricing power

EBITDA Margin: 30–33%, aided by integration of iDATA & Citizenship Invest

Digital Business: Scales profitably without margin dilution

Capital Allocation: Strong FCF enables buybacks or accretive M&A

Valuation: P/E sustains at 30–32×, reflecting premium positioning

Base Case

Steady execution meets expectations; no major surprises.

Visa Volume Growth: 12–15% CAGR from organic growth and stable renewals

Revenue per Application: ₹2,800–2,900, with limited VAS expansion

EBITDA Margin: 28–30%, with some digital drag offset by operating leverage

Capital Allocation: Healthy FCF used for reinvestment and moderate dividends

Valuation: P/E normalizes to ~25×, in line with quality compounders

Bear Case

Underperformance on growth or margin leads to derating.

Visa Volume Growth: <10% CAGR due to delayed tenders or travel weakness

Revenue per Application: <₹2,600 from pricing pressure or lower-fee geographies

EBITDA Margin: 24–26% due to digital scale-up and weaker Visa contribution

Capital Allocation: Inefficient use of cash; M&A fails to deliver returns

Valuation: P/E compresses to 18–20× on lower growth confidence

8.3 Key Risks & What to Monitor

A. Volume Sensitivity to Travel & Immigration

BLS's core revenue is tightly linked to global travel flows and visa policy shifts.

Monitor: IATA trends, Schengen/EU visa updates, visa application volumes, geopolitical disruptions.

B. Tender Execution Risk

FY26–27 growth hinges on successful execution of $1B+ in tenders. Delays or missteps could hurt volumes and margins.

Monitor: Tender wins (filings), rollout timelines, execution updates, order book growth.

C. Acquisition Integration Risk

iDATA, Citizenship Invest, and Aadifidelis must scale smoothly. Aadifidelis’s lower margins (4–5%) risk diluting blended profitability.

Monitor: Segmental EBITDA trends, synergy timelines, margin commentary in earnings calls.

D. Margin Dilution from Digital Segment

Digital business has lower margins. If it scales faster than Visa, overall margin profile may weaken.

Monitor: Revenue and EBITDA from Digital vs Visa, mix shifts, monetization strategy.

E. Client Concentration & Regulatory Risk

Heavy dependence on exclusive government contracts. Policy shifts or non-renewals could impact revenue sharply.

Monitor: Contract renewals, immigration policy changes (India, EU, GCC), outsourcing regulations.

F. Geopolitical Exposure

Presence in 70+ countries adds exposure to war, sanctions, and embassy closures.

Monitor: Country-specific political developments, advisories, and BLS management disclosures.

9 Margin of Safety for a BLS Investor?

A. Valuation Already Prices in Strong Execution with Limited Downside Protection

Current P/E of ~30× assumes:

Sustained 20–25% PAT CAGR

Stable 28–30% EBITDA margins

Visa volumes growing 15–20% annually

These expectations don’t leave much buffer if any of the growth engines falter.

Any earnings disappointment or geopolitical disruption could compress the P/E multiple leading to a price correction

C. Acquisitions Still Maturing

The digital segment (Aadifidelis) operates at lower margins and isn't yet contributing significantly to profit.

If synergy realization is delayed, earnings could lag valuation assumptions.

D. What’s Protecting the Downside?

Despite a thin valuation buffer, a few factors help cushion against deep downside:

Asset-light model and high ROE (31%)

Negative working capital and high FCF conversion

₹928 Cr net cash and internal accrual-funded acquisitions

Sticky, long-term government contracts

So while valuation is rich, business quality is high, which limits long-term capital loss — but not short-term drawdowns.

Overall Margin of Safety: Low to Moderate

BLS is a classic “quality at a premium” bet — best suited for long-term holders confident in management execution and tender win trajectory.

Previous coverage of BLS

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Hello Team, Comprehensive analysis indeed.

Quick doubt on the net cash number of 928Cr, from where it has been derived ?

Excellent Analysis team! I do feel that even after such excellent results every quarter the stock is struggling to maintain 400 levels. Any idea?