BLS International Q1 FY26 Results: PAT up 50%, On-track FY26 Growth Guidance

Growth of 20-25% for next 2 years on revenue and bottom line with stable margins and cash-backed balance sheet provide visibility. Valuations rest on strong execution

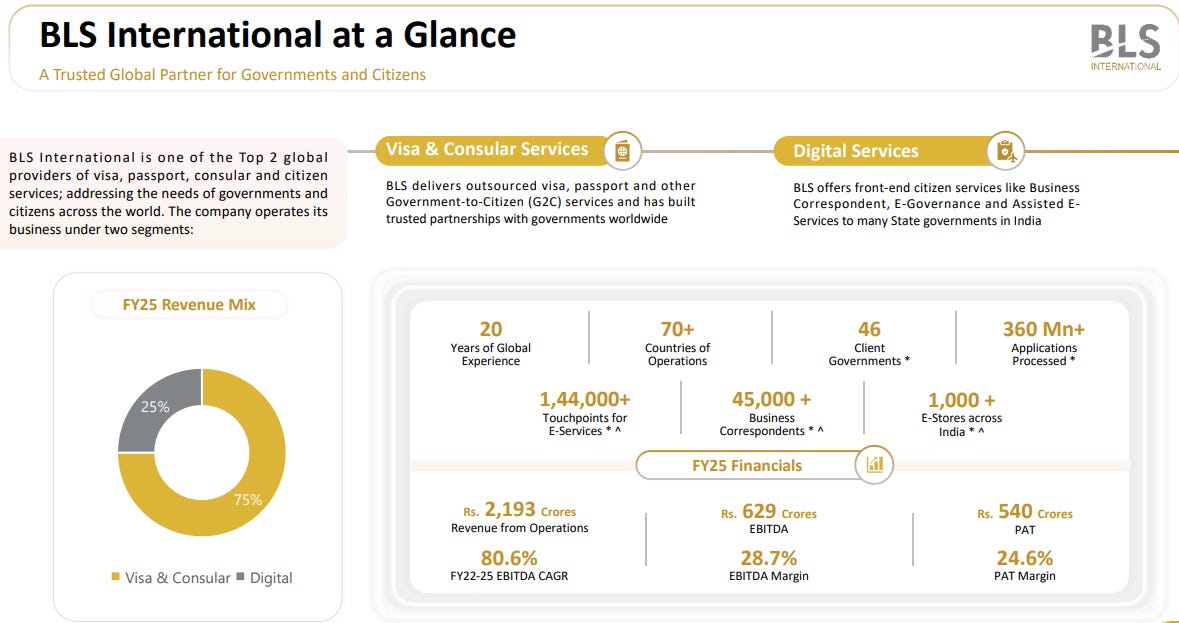

1. Visa & consular services | Digital services

blsinternational.com | NSE: BLS

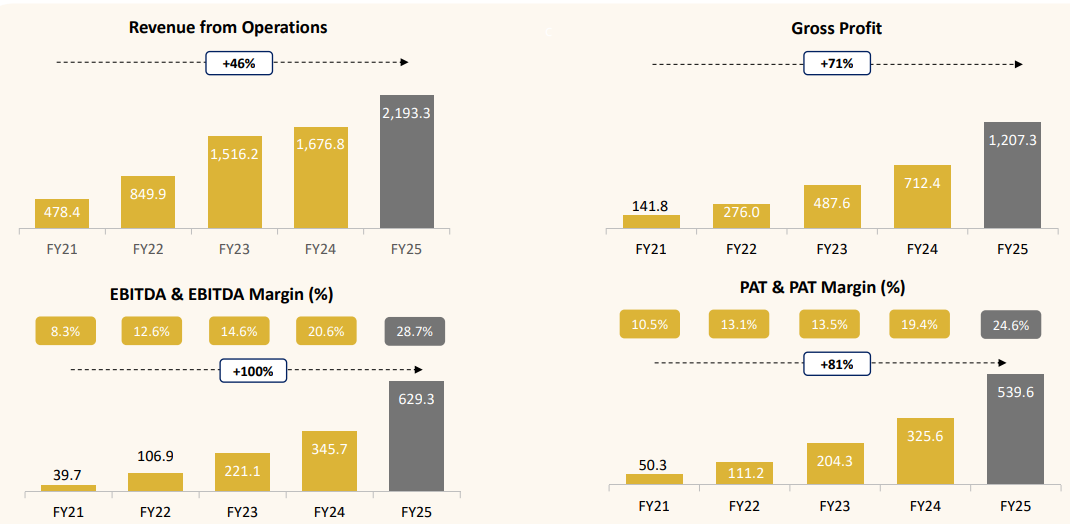

2. FY21-25: PAT growth 81% & Revenue growth 46% CAGR

Strong operating leverage: Each year, fixed costs became more productive—driving margin expansion across EBITDA and PAT.

Structural shift post-FY23: Margin jump from FY23 to FY25 (EBITDA: 14.6% → 28.7%) reflects transformation to a higher-margin, scaled business.

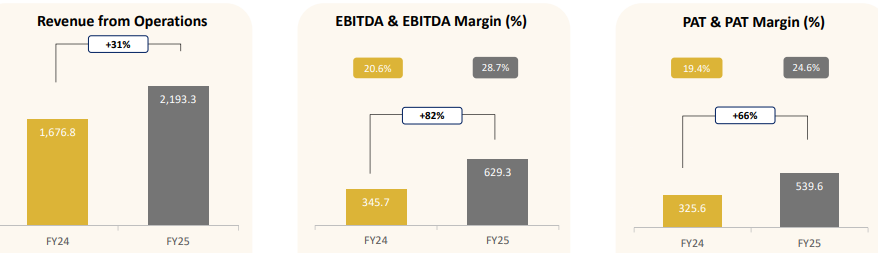

3. FY-25: PAT up 66% and Revenue up 31% YoY

Revenue growth, driven by higher visa volumes, improved pricing, and new acquisitions.

EBITDA margin expansion led by operating leverage and high-margin contracts.

Integrated iDATA, Citizenship Invest, and Aadifidelis, adding scale and margin diversity across segments.

Secured 90%+ contract renewals, expanded global footprint, and reinforced the base for long-term compounding.

Visa & Consular Services accounts for over 75% of total revenue and nearly 90% of EBITDA.

Margin expanded indicating significant operational leverage and business model maturity.

Digital Services is scaling revenue rapidly but remains margin-dilutive due to Aadifidelis’s lower profitability.

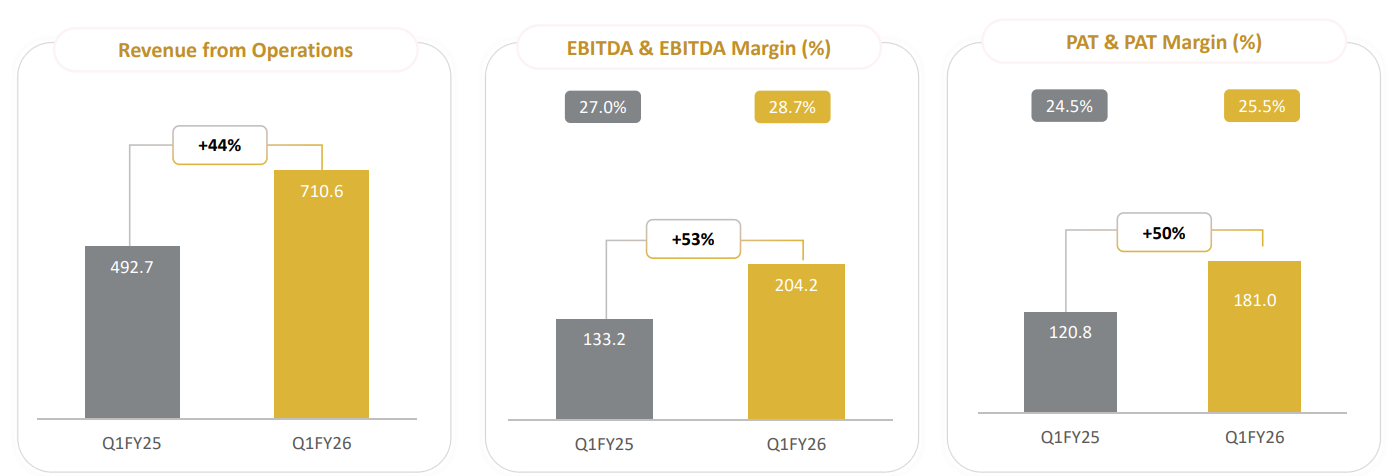

4. Q1-26: PAT up 50% and Revenue up 44% YoY

Growth driven by organic expansion and full-quarter consolidation of FY25 acquisitions (iDATA, Citizenship Invest, Aadifidelis).

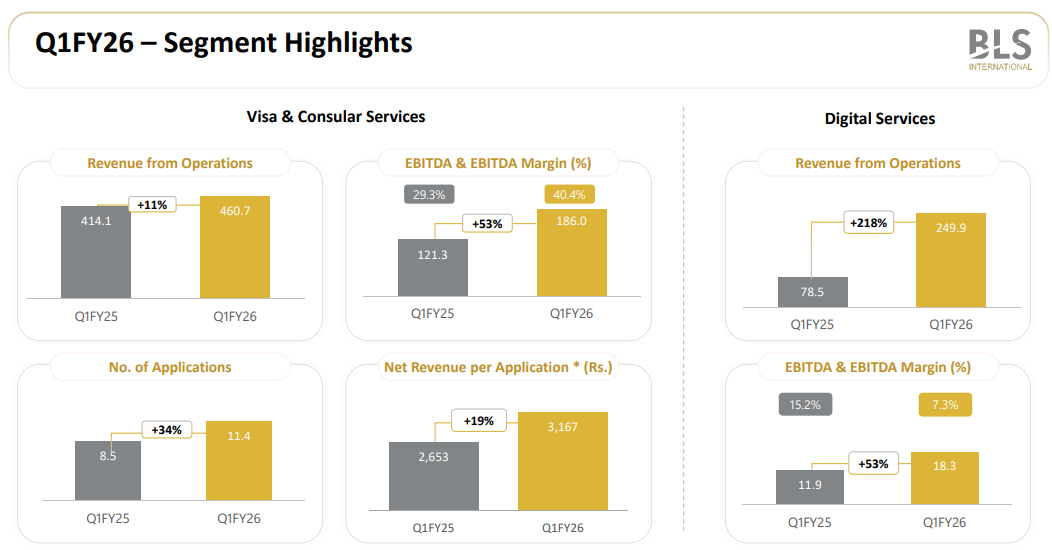

Segment Highlights

Visa & Consular Services

EBITDA margin: 40.4% vs 29.3% in Q1 FY25 – uplift from shift to self-managed model and high-margin iDATA consolidation.

Digital Services

Revenue: ₹249.9 Cr (+218% YoY), aided by Aadifidelis integration.

EBITDA: ₹18.3 Cr; margin at 7.3% vs 15.2% in Q1 FY25 due to lower-margin Aadifidelis loan distribution business.

Expanded BC & e-governance reach: 10,000+ new retailers onboarded, partnerships with major banks & fintechs.

Key Operational Drivers

Self-managed transition: Most partner-run centres now converted, boosting margins as partner commissions are retained.

Acquisition synergies:

iDATA – expanded European government contracts, higher-margin profile.

Citizenship Invest – entry into residency & citizenship programmes.

Aadifidelis – scaled digital BC network and loan processing.

Market share: Estimated ~17% global visa outsourcing market by value (ex-USA).

Balance Sheet & Cash

Net cash position improved to ₹1,126 Cr (vs ₹928 Cr in Mar’25) despite prior year’s ₹1,000+ Cr acquisition spend.

Asset-light model (leased centres) and negative working capital continue to support high cash conversion.

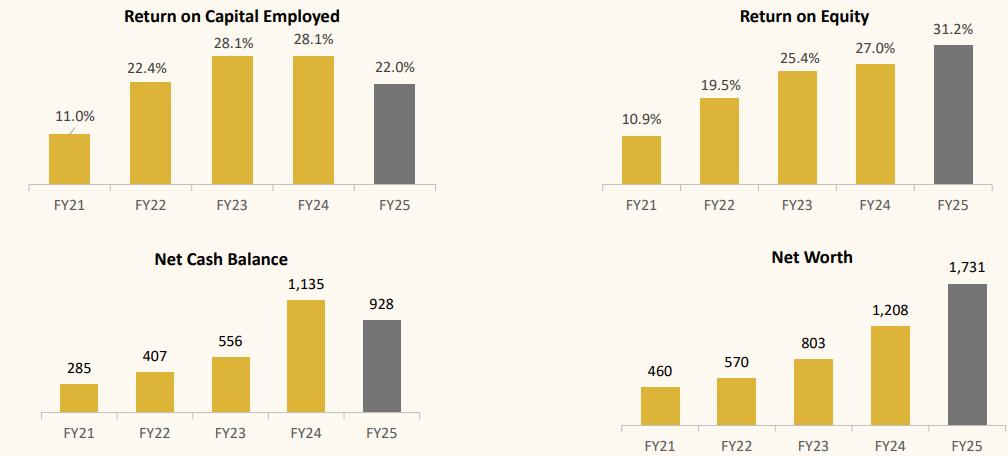

5. Business Metrics: Strong return ratios

BLS International continues to deliver top-tier capital efficiency, robust internal accruals, and a cash-rich balance sheet—all supported by its asset-light and negative working capital model.

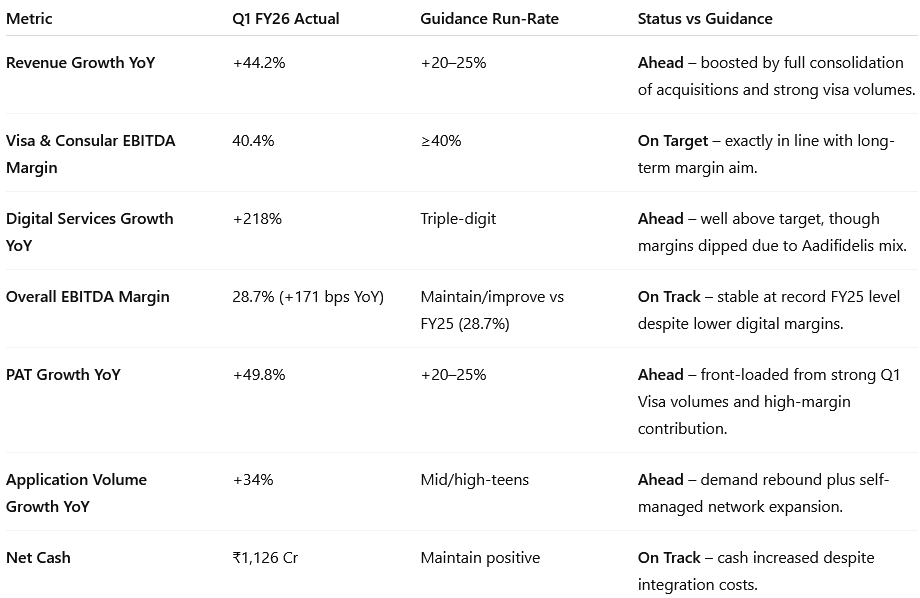

6. Outlook: 20-25% Growth

6.1 FY26 Guidance — BLS International Services Ltd

FY26 Guidance

Growth

Revenue: Maintain ~20–25% YoY growth in both revenue and profitability, even on a higher base.

Visa & Consular Applications: Mid- to high-teens % volume growth from a 37.5 lakh FY25 base, supported by new contracts and market expansion.

Digital Services: Triple-digit growth in FY26, driven by Aadifidelis integration and BC/e-governance expansion.

Margins

Visa & Consular EBITDA Margin: Sustain ≥40% after the shift from partner-run to self-managed centres.

Overall EBITDA Margin: Maintain at FY25’s 28.7% level or improve slightly despite digital business mix drag.

Digital Services EBITDA Margin: Improve from ~7–11% post-Aadifidelis by cross-selling higher-margin services.

Profitability: PAT Margin: Around 25%, consistent with FY25 levels.

Capital Allocation

Maintain positive net cash (>₹1,000 Cr) and asset-light structure.

No large immediate acquisitions, but active M&A scouting in visa outsourcing and tech-enabled citizen services.

Medium-Term Guidance (3–5 Years)

Growth Trajectory

Sustainable annual growth: Maintain 20%+ CAGR in revenue and profitability over 3–5 years.

Market Share: Increase global visa outsourcing share beyond current ~17% by value and ~10% by volume (ex-USA market).

Business Drivers

Visa & Consular:

Win large global tenders — pipeline worth $1–2 billion coming up for renewal in next 2 years.

Expand into new geographies and government contracts to diversify revenue.

Digital Services:

Scale BC and e-governance footprint across more Indian states.

Explore adjacent B2C verticals (insurance, travel, remittances, e-commerce fulfilment) to enhance per-outlet profitability.

Potential expansion into overseas markets once India coverage is optimised.

Margins & Profitability

Visa & Consular EBITDA Margin: Sustain 35–40% long term, with upside from operational leverage.

Consolidated EBITDA Margin: Target to stay above 28–30% despite digital scale-up.

Maintain ROE above 30% and ROCE above 20% through asset-light operations and negative working capital cycle.

Capital Allocation & Strategy

Deploy surplus cash for selective high-EBITDA acquisitions (like iDATA, Citizenship Invest) to boost margins and market share.

Continue high dividend payout (~30% of PAT) alongside reinvestment in growth.

6.2 Q1 FY26 vs FY26 Guidance – Performance Evaluation

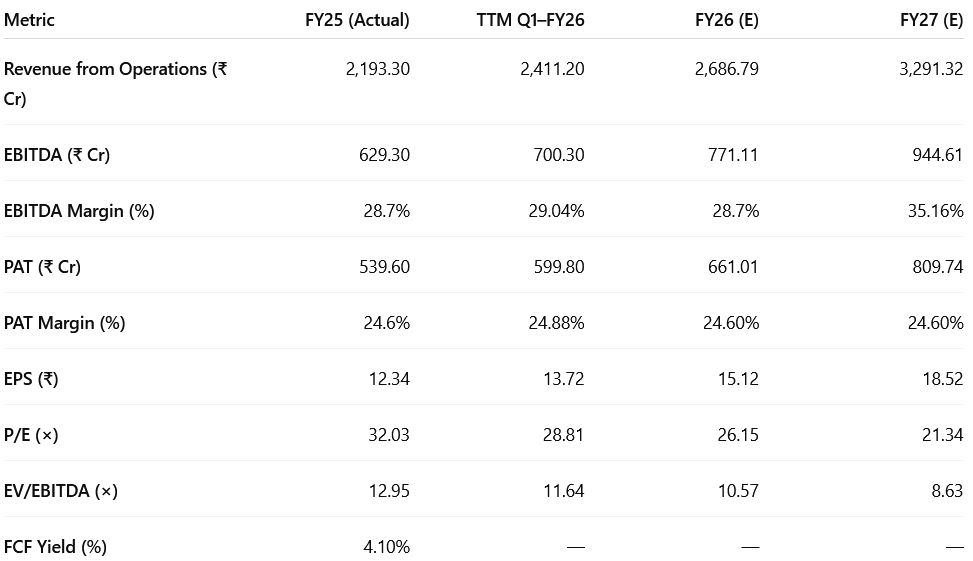

7. Valuation Analysis

7.1 Valuation Snapshot — BLS International

Market Cap: ₹16,274.06 Cr, EV: ₹8,149.36 Cr (as on FY25)

Interpretation

Valuation Compression: Forward P/E expected to decline from 32.0× in FY25 to ~21.3× by FY27 on earnings growth outpacing price.

Valuation premium is justified by high ROE (>30%), net cash balance sheet, and strong earnings visibility.

P/E still commands a growth premium over global outsourcing peers, reflecting dominance in high-margin visa vertical.

Attractive EV/EBITDA: Slips from 12.95× in FY25 to sub-9× by FY27, indicating improving value relative to operating cash flows — attractive re-rating potential if execution sustains.

Margin Stability: Visa business sustains high EBITDA margins (~28–29%) while digital services grow; FY27 spike in margins assumes mix improvement and Aadifidelis synergy realisation.

Strong FCF Yield: FY25 yield of ~4.1% is solid for a high-growth, asset-light services business with net cash position.

Net Cash Position: ₹1,126 Cr, providing flexibility for acquisitions and dividend payouts (payout policy ~30% of PAT).

Asset-Light Model: >99% offices on rental; negative working capital cycle supports cash conversion.

FCF Profile: FY25 FCF yield ~4.1%, with potential to improve as capex remains minimal.

Key Takeaways

Premium Justified: High margins, strong balance sheet, global scale, and predictable contract-based revenues support valuation multiples.

Upside Drivers:

Sustained application volume growth (mid-teens % organic + inorganic boosts)

Margin stability from self-managed centres

Digital services scaling with cross-sell potential

M&A optionality with ₹1,000+ Cr net cash

Risks to Valuation:

Visa volume cyclicality from geopolitical/travel shocks

Digital segment margin drag if Aadifidelis integration slows

Contract renewal risk in large geographies

7.2 Opportunity at Current Valuation

Strong growth visibility

FY26–27E PAT CAGR of ~20–25%, driven by visa outsourcing volume growth (+34% YoY in Q1 FY26), full-year consolidation of iDATA & Citizenship Invest, and rapid digital service scale-up (Aadifidelis).

Structural tailwind — only ~50% of the global visa market is outsourced; tender pipeline includes high-value contracts in US, Schengen, and emerging markets.

High-margin, asset-light model

Visa & consular segment EBITDA margin ≥40%, with consolidated margins at ~28–29% despite digital dilution.

Self-managed centre shift improves per-application revenue (₹3,167 in Q1 FY26, +19% YoY) and margin capture from partners.

Valuation multiple compression

EV/EBITDA expected to fall from 12.95× (FY25) to 8.63× (FY27E); forward P/E drops from 32× to ~21× while sustaining high ROE (>30%).

Net cash of ₹1,126 Cr supports both inorganic expansion and 30% dividend payout policy.

Diversification & pipeline strength

Expanding into adjacent government service verticals (citizenship, residency, financial inclusion, e-governance) with strategic acquisitions.

Multi-year visibility — 90% of contracts renewed in last 12 months; new contracts in multiple geographies with 4–10 year tenure.

Opportunity Rating: MODERATE-HIGH

High visibility, strong margins, and cash-backed balance sheet provide growth runway. Sustained execution in both visa and digital services can support re-rating as EV/EBITDA compresses into single digits.

7.3 Risk at Current Valuation

Visa volume cyclicality

Sensitive to geopolitical events, travel restrictions, and macro shocks. Any prolonged disruption to tourism or business travel could impact application volumes.

Contract renewal and competition risk

Large government tenders face re-bid risk; increased competition from incumbents like VFS Global could pressure pricing or delay awards.

Qualification thresholds limit new entrants, but market share losses in key geographies could affect growth.

Digital margin drag

Aadifidelis integration currently at ~4% EBITDA margin; slower operational improvements could dilute consolidated margin profile longer than expected.

Execution dependency in tenders

Delays in tender awards or onboarding (especially in large markets like China) can shift revenue recognition timelines.

Valuation sensitivity

Current multiples factor in consistent execution. Any miss on growth or margin trajectory could lead to sharp de-rating, especially given relatively low institutional ownership.

Risk Rating: MODERATE

Premium valuation rests on high growth delivery and margin stability. While net cash and diversification cushion downside, contract risk and macro shocks remain key watchpoints.

If you want, I can also prepare a side-by-side FY25–FY27E growth vs. valuation compression chart for BLS International so it’s visually aligned with your sector notes. That would make the opportunity/risk balance easier to communicate. Would you like me to do that?

Previous coverage of BLS

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Hi, good work as usual! BLS international is a fundamentally strong company but despite the performance the stock price is stuck for a year now. The EPS, ROCE is growing too. Is stock price not appreciating due to global market chaos like war & trump tariffs?