Bank of Maharashtra Q4 FY25 Results: PAT Up 36%, FY26 Guidance Solid, Valuations Still Reasonable

MAHABANK guides for steady credit growth, stable ROA, and strong capital ratios in FY26. Valuations are reasonable, execution among best in PSU banks.

Confused about analyzing bank stocks? Most investors use P/E and get it wrong. Here’s how to actually do it right.

1. FY21-25: Solid Performance by Bank of Maharashtra

Bank of Maharashtra has transformed from an average PSU lender into one of the strong performers in the sector.

ROA: Up from 0.3% to 1.75%

GNPA: Down from 7.2% to 1.74%

PAT: Grown 10x

Loan Growth: Consistent double-digit rise

Capital & Asset Quality: Strengthened without compromise

1.1 Business Growth: Double-Digit Expansion Across Segments

Sustained double-digit growth with a well-balanced RAM + Corporate loan mix. Retail advances grew 25.4% YoY in FY25.

1.2 Profitability: Margin-Led, Capital-Efficient Growth

Profit 10x’d in 5 years — a rare feat among PSU banks, driven by better spreads, clean asset book, and strong liability franchise.

1.3 Asset Quality: One of the Cleanest Bank Books

BoM has the cleanest book among PSU banks — with NNPA at just 0.18% and provisioning coverage near 100%.

2. Q4-25 Results: High-Quality Growth Continues

PAT Up 23%, NII Up 21%: Margin Defense Remains Strong

Strong margin defense and improving operating leverage were key performance highlights.

Asset quality improved across the board, with GNPA and NNPA at record lows.

CASA base grew sharply, helping contain cost of funds and support NIMs.

Retail advances grew 25.4%

Deposit accretion remained healthy, even with a strong CASA mix

Net Interest Margin held firm above 4%, despite EBLR-linked re-pricing pressure

3. FY25 Performance: Profits, Margins, Book Quality All Rise

3.1 FY25 Financials: PAT +36%, NIM @ 4%, ROA @ 1.75%

3.2 Balance Sheet Strength: Ample Capital, Tight Cost Ratios

Best-in-class provisioning and negligible net NPAs underline BoM’s conservative underwriting approach.

Strong CASA base (53.3%) helps sustain margins and lowers funding cost.

3.3 Loan Book Composition: Retail, MSME, Agri Power 62% of Book

Retail loans up 25.4% YoY

Home loans grew 28.7%

Car loans surged 46.6%

MSME credit and agri loans grew >14%

RAM (Retail + Agri + MSME) now forms 62% of the loan book, reinforcing BoM’s mass-market focus.

4. Business metrics: Strong Return ratios

ROE consistently above 20% — rare for PSU banks

NIMs have improved 100+ bps and ROA has expanded 5x since FY21 — evidence of structural profitability uplift.

NIM expanded consistently due to better loan mix and strong CASA — reaching 4.00% in FY25, one of the best in the PSU space.

ROA rose from 0.30% to 1.75% — a 5-year compounding story of capital-efficient growth.

ROE is now in the 20–23% range, typically associated with top-tier private banks.

Cost-to-income ratio dropped significantly, reflecting better operating leverage.

5. Management Commentary & FY26 Strategic Roadmap

Bank of Maharashtra’s FY25 commentary reflects confidence and discipline — with a clear focus on growth, capital strength, and navigating macro shifts.

5.1 FY26 Guidance: Growth with Margin and Risk Control

Management expects some NIM compression due to repricing of 37% of its book linked to repo rates, but aims to preserve profitability through cost control and strong CASA.

5.2 FY26 Strategic Priorities

Branch-Led Expansion:

BoM plans to add 200–220 new branches in FY26 and over 1,000 by FY30, especially in underpenetrated zones.

Growth will remain organic and branch-led, with minimal NBFC pool buyouts.

Digital & Technology Playbook:

Rollout of GenAI tools for compliance and sentiment analysis is underway.

Digital adoption is scaling fast — mobile banking up 139% YoY, UPI up 43%.

Risk & Governance Focus:

Continued emphasis on tight underwriting standards, particularly in RAM lending.

Zero exposure to unsecured personal loans below pricing threshold — avoiding margin-dilutive segments.

“We will not chase growth at the cost of credit quality. Even if we achieve a business goal 1–2 quarters later, we will do it with a clean book.”

— Nidhu Saxena, MD & CEO

Management emphasized its “quality-first” philosophy, particularly in the context of rapid loan growth, technology transformation, and evolving global conditions.

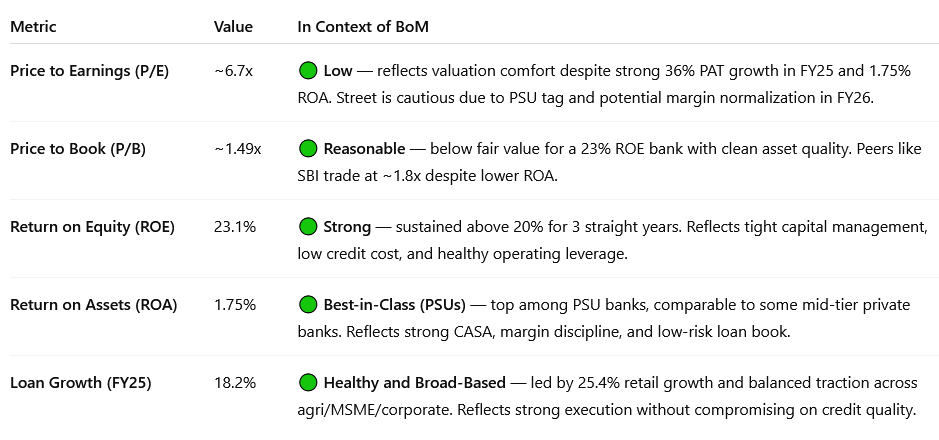

6. Valuation Analysis: Still Reasonable for the Growth

6.1 Current Valuation Snapshot: P/E 6.7x | P/B 1.49x | ROE 23%

6.2 What’s Priced In: Clean Book, Capital Strength, Stable NIM

1. Clean Balance Sheet and Top-Tier Asset Quality

NNPA of just 0.18%, PCR at 98.3%, and negligible write-offs — the Street recognizes BoM as one of the cleanest PSU lenders.

2. Sustained ROA/ROE Expansion

ROA of 1.75% and ROE of 23.1% have been stable for 2+ years.

Valuations reflect this consistency — but not necessarily any further upside from re-rating.

3. Capital Strength

CET-1 at 15.8% and CRAR at 20.5% — ample buffer for growth without dilution.

Street confidence is visible in low-beta valuation support.

4. Retail-Led, Branch-Based Growth

Retail book up 25.4% YoY, with minimal NBFC pool reliance.

Deposits growing steadily with CASA above 53% — validating funding resilience.

5. Margin Discipline in a Challenging Cycle

NIMs held at 4.00% in FY25 despite repricing pressure on EBLR-linked loans.

Analysts are factoring in some compression for FY26, but still model NIMs >3.75%

6.3 What’s Not Fully Priced In: Branch Scale-Up, GIFT City

1. Expansion-Fueled Scale Uplift

BoM plans to add 1,000+ branches by FY30, including 200+ in FY26 alone.

This can significantly grow the deposit base, improve rural reach, and drive low-cost liabilities — not fully modeled into consensus.

2. GIFT City IBU Launch in FY26

Entry into international banking (trade finance, NRI flows) via GIFT City is a strategic leap.

Early-mover advantage among PSBs could create new revenue streams in FX, offshore lending, and cross-border corporate flows.

3. Valuation Catch-Up with Peers

BoM trades at 1.49x P/B and 6.7x P/E, while peers like SBI trade closer to 1.8x P/B despite lower ROA.

A clean FY26 with stable NIMs and sub-2% GNPA could trigger a re-rating to ~1.75–2.0x P/B.

4. Rating Upgrade

Consistent earnings + high ROE + asset quality could lead to a rating upgrade, expanding BoM’s eligibility for more passive flows.

6.4 The Big Question: Why Isn’t It Priced Like a Private Bank?

Because it’s still a PSU. And the market doesn’t believe PSUs can:

Sustain margin discipline

Execute scale-up efficiently

Monetize tech and talent like private banks

BoM is challenging all three assumptions — but investors are still watching, not acting.

That’s the trade. If BoM proves it’s different, the stock won’t stay at 1.49x book for long.

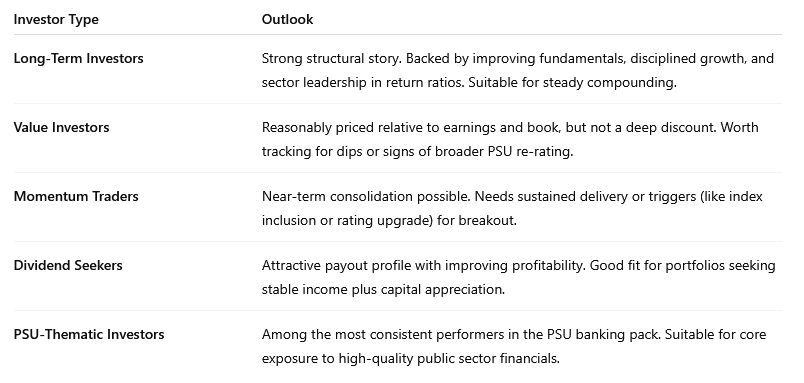

7. Implications for Investors: What to Watch

7.1 Bull, Bear, Base Case: Scenario Framework for FY26

At ₹50.59, the stock is fairly valued in the base case, with meaningful upside only if FY26 execution remains flawless.

7.2 Reasons to Stay Invested: Guidance-Linked Upside Still Intact

1. Guided Stability in Return Ratios

FY26 guidance reiterates ROA near 1.75% and NIM ~3.75%, even with re-pricing headwinds.

This reflects strong earnings visibility — rare for PSU banks during rate transitions.

2. Branch Expansion = Long-Term Deposit and CASA Moat

Management plans to add 1,000+ branches by FY30, starting with 200+ in FY26.

This strategy targets sticky, granular liabilities — supporting future NIM resilience even if rates soften.

3. Capital Strength Enables Clean Growth

CET-1 at 15.8% and CRAR at 20.5% allows BoM to fund loan growth without dilution.

FY26 credit growth guidance of ~17% is entirely organic, not reliant on NBFC pools — ensuring loan book quality remains high.

4. Tech Adoption Signals Future Cost Leverage

FY26 will see the rollout of GenAI pilots for compliance and underwriting.

BoM’s FY25 digital metrics (mobile banking up 139%, UPI up 43%) show it's ready to leverage tech-led operating efficiency.

5. Dividend + Compounding = Total Return Appeal

With a nearly 3% dividend yield, BoM offers both income and upside.

Unlike many high-ROE stories that reinvest heavily, BoM balances growth with cash return.

6. Undemanding Valuation Leaves Room for Re-rating

P/E of ~6.7x and P/B of ~1.49x remain reasonable, even as BoM outperforms peers on ROA, ROE, and asset quality.

FY26 guidance — if delivered — could trigger a re-rating toward private bank multiples.

7.3 Risks to Track: NIM Compression, Execution, Sector Sentiment

NIM compression risk: ~37% of loans are EBLR-linked — could reduce NIM in falling rate cycles.

PSU sector drag: Despite good fundamentals, PSU banks may trade at a valuation ceiling.

Execution of branch-led growth: Aggressive expansion must not dilute credit quality.

Tariff/trade risks (macro): Could impact broader sentiment and funding costs.

Tech stack scalability: Digital adoption must match private peers to sustain cost efficiencies.

7.4 Who Should Buy Bank of Maharashtra?

If you're looking for a low-risk, high-quality PSU financial with valuation comfort and long-term tailwinds — Bank of Maharashtra offers one of the best setups in the sector today.

Previous coverage of MAHABANK

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer