Bank of Maharashtra Q2 FY26 Results: PAT up 23%, FY26 Guidance on Track

Solid execution in H1 FY26 with ROA and NIM above guidance. Deposit & advance growth trails run-rate, but strong execution leaves room for re-rating if targets are met.

Confused about analyzing bank stocks? Most investors get confused about NIM’s and CASA. Here’s how to actually do it right.

1. Public Sector Bank

bankofmaharashtra.in | NSE: MAHABANK

Products & Services

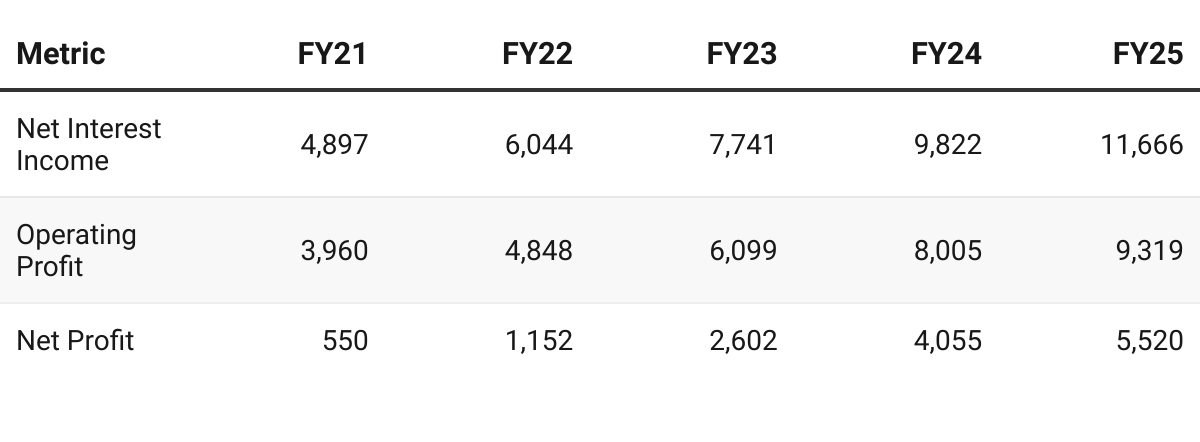

2. FY21-25: PAT CAGR of 96% & Net Interest Income CAGR of 24%

3. FY25: PAT up 36% & Net Interest Income up 19% YoY

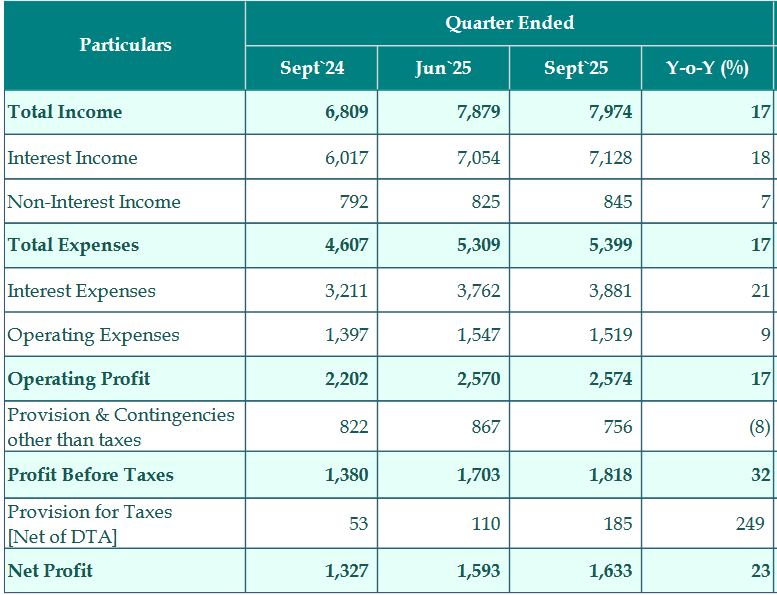

4. Q2-26: PAT up 23% & Net Interest Income up 16% YoY

PAT up 3% & Net Interest Income down 1% QoQ

5. H1-26: PAT up 23% & Net Interest Income up 17% YoY

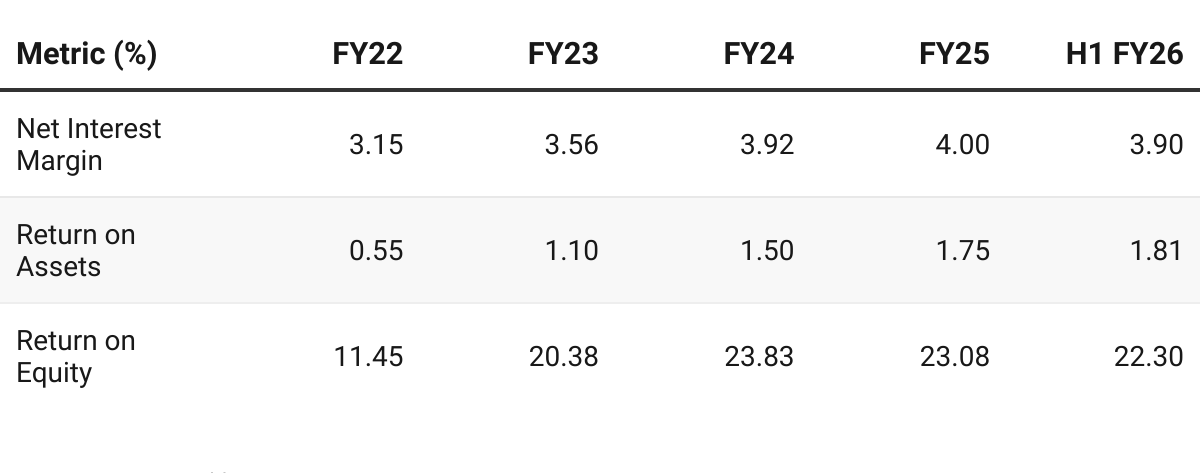

6. Business metrics: Strong Return ratios

ROE consistently above 20% — rare for PSU banks

7. Outlook: Mid-teen growth

7.1 Management Guidance

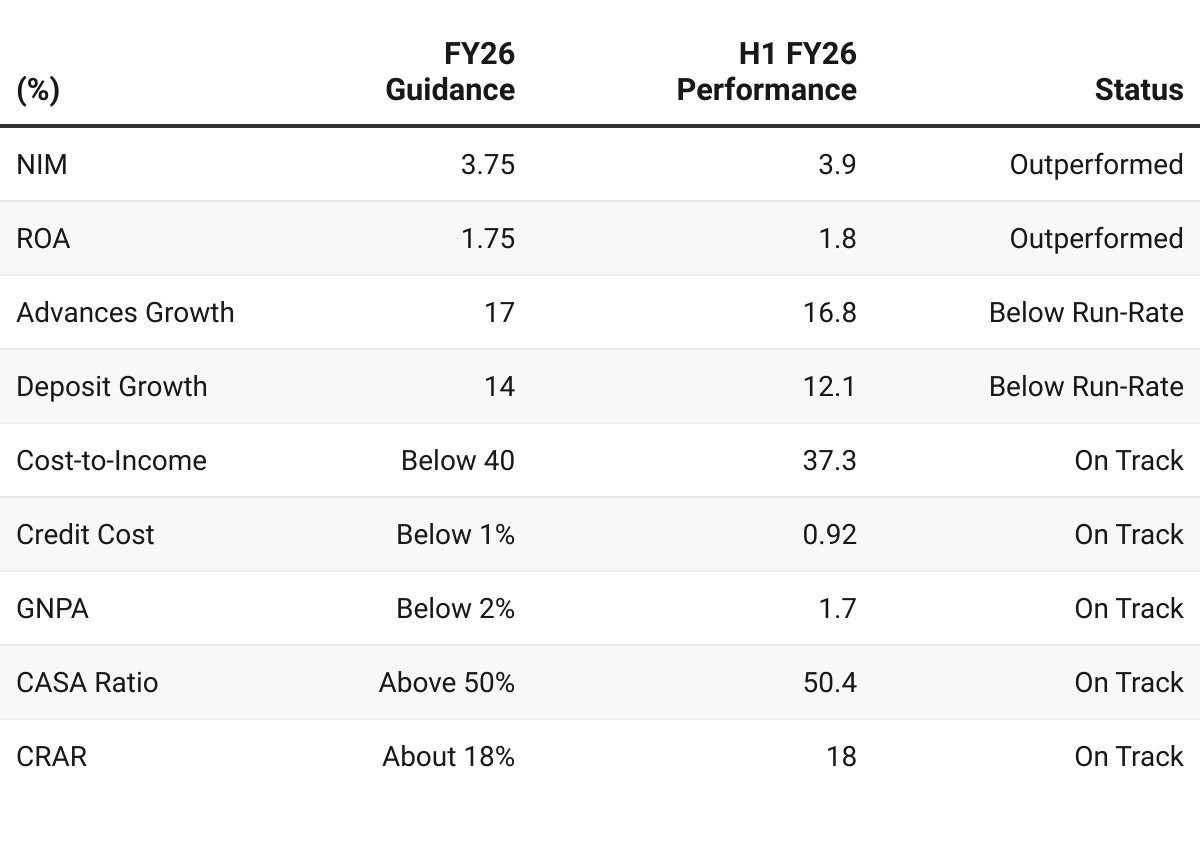

We are again going to keep a conservative guidance for NIM for the next year at 3.75%

For advances, we are keeping a guidance at around 17%. For deposits, we are keeping around 14%.

CASA will be maintained above 50%.

My guidance for ROA is 1.75%, which we would like to maintain for the next year.

GNPA has again seen a reduction, and has come down to 1.74%, but guidance is to maintain it below 2% and the credit cost to maintain below 1%.

The guidance, again for cost to income is to maintain it below 40%.

We have kept the guidance to maintain CRAR at around 18%.There is no immediate case for me to go and raise capital, number one

Overall share of RAM is 62:38 and our guidance has been to maintain it at 60:40 plus/minus 2%.

Branch Expansion:

1,000 new branches planned over 5 years (FY26–FY30).

FY26 will see 321 branches under “Project 321”.

GIFT City Ambitions:

Aspires to scale GIFT IBU book to $1 billion within 12 months.

Expected to become a profitable business line supporting international aspirations.

Capital Raise:

Board-approved capital raise of ₹7,500 Cr (₹5,000 Cr equity + ₹2,500 Cr debt) in FY26.

No urgent requirement, but plan aligns with maintaining capital adequacy and SEBI MPS compliance.

7.2 H1 FY26 Performance vs FY26 Guidance

Maintaining guidance quarter-on-quarter

I am satisfied as a bank, as a management that whatever guidance at the beginning of the year for the last 12 to 15 months we have been talking about, we are maintaining and beating our own guidance quarter-on-quarter.

8. Valuation Analysis

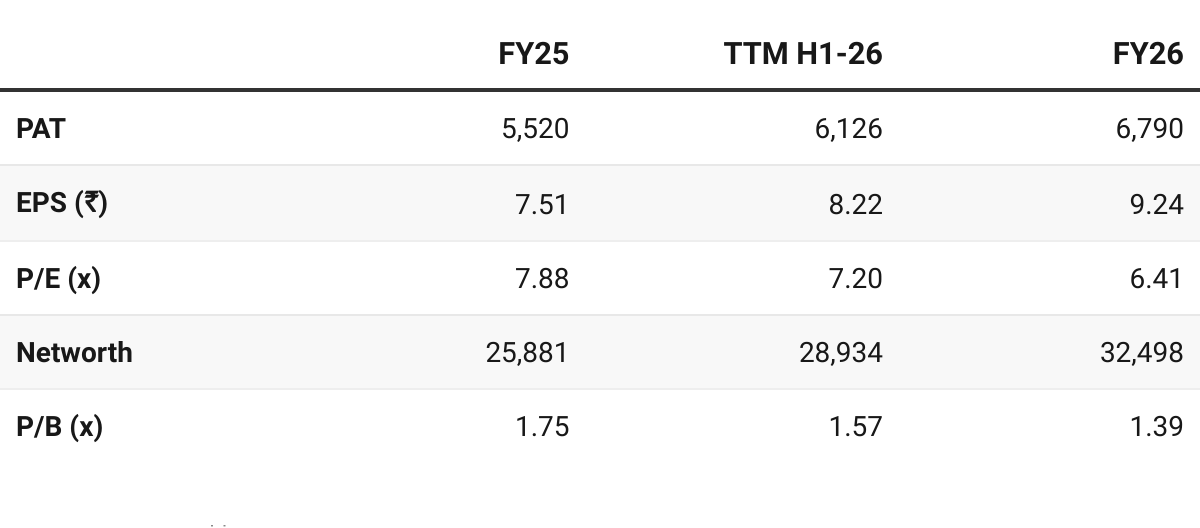

8.1 Valuation Snapshot — Bank of Maharashtra

CMP ₹59.2; Mcap ₹45,325.21 Cr

PAT growth of 23% sustaining the growth of H1-26

FY26E Net Worth = H1-26 NW + H2 26E PAT

FY26E P/E = 6.41×, based on projected PAT of ₹6,790 Cr and EPS ₹9.24.

Earnings Yield (1/PE) = ~15.6% — significantly above cost of equity, indicating undervaluation.

If FY26 guidance is delivered, there is scope for multiple re-rating based on FY26E numbers:

P/B of ~1.75× (vs 1.39× now)

This would imply valuation upside without requiring redefinition of fundamentals.

Despite strong execution, solid asset quality, and high return ratios, the market is pricing Bank of Maharashtra like a regular PSU bank.

8.2 Opportunity at Current Valuation

NIM’s guidance is conservative — Profitability could surprise

Profitability could surprise on the upside as 3.75% NIM guidance is conservative and it has delivered NIM of 3.9 for H1-26.

we are keeping a conservative number of 3.75% in terms of the NIM guidance.

Optionality from Re-rating

If current metrics hold, P/E could re-rate to 8–9× and P/B to ~1.75× — purely by matching peer metrics.

Re-rating does not require exceptional performance —- continuity of FY25 into FY26

Optionality from Sectoral Re-rating

PSU banks as a basket trade at a discount to intrinsic profitability.

MAHABANK could emerge as the first PSU bank to trade like a private bank, if it maintains its current performance

Limited Downside

Valuations are undemanding — provide protection against a weak quarter

8.3 Risk at Current Valuation

Execution Dependence in H2

Loan & Advance growth slightly below run-rate in H1.

FY26 PAT assumption of ₹6,790 Cr requires no slippage on NIM or operating cost — though trajectory so far is solid.

Rate Cycle & Margin Sensitivity

NIM has held at 3.9%+ so far, but rate cuts and deposit repricing could reduce margins.

MAHABANK is confident of delivering on its 3.75% NIM guidance

This quarter also, we have, despite the rate cut impact coming in completeness in this quarter, we have been able to maintain our NIM above the guidance that we had shared in the beginning. And the Q3 and Q4, we have seen that with most of our deposit maturity profile, seeing the deposits getting repriced, we should see that further NIM contraction should not be.

PSU Discount May Persist

Despite strong metrics, PSU label may cap valuation multiples.

Any resurgence of PSU ownership discount narratives (e.g., capital raise, governance risk) could affect sentiment.

Valuation reflects confidence in BoM’s execution — not euphoria.

The market is pricing in consistency, not breakout upside.

If BoM simply delivers what it has guided, there is still room for multiple expansion without requiring aggressive forecasts.

Previous coverage of MAHABANK

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer