Balu Forge Industries: PAT growth of 106% & revenue growth of 58% for H1-25 at a PE of 65

Guidance of 40-45% revenue growth in FY25 while maintaining EBIDTA margins of 23-24%. Expectations of guidance to be beaten. Strong order book & capex in-place to support growth guidance.

1. Manufacturing fully finished & semi-finished crankshafts and Forged Components

baluindustries.com | NSE: BALUFORGE

Balu Forge Industries Ltd (BFIL) is one of the prominent companies in India for producing precision machined components.

It is engaged in the manufacturing of finished and semi-finished crankshafts and various other forged components and has a strong clientele comprising of 25+ OEM’s.

2. FY21-24: PAT CAGR of 131% & Revenue CAGR of 58%

3. Strong FY24: PAT up 141% & Revenue up 71% YoY

4. Strong Q2-25: PAT up 107% & Revenue up 60% YoY

PAT up 41% & Revenue up 27% QoQ

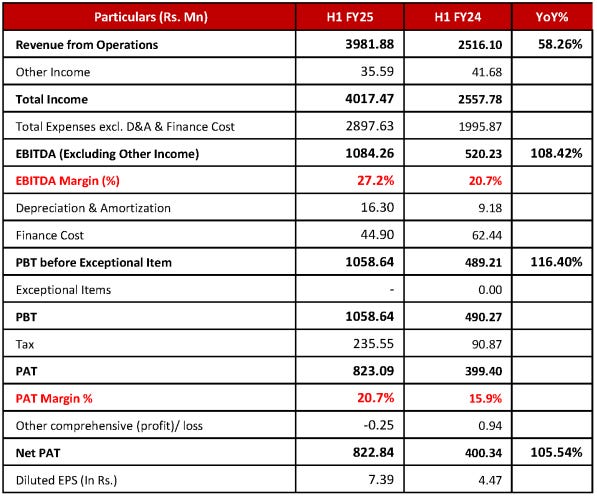

5. Strong H1-25: PAT up 106% & Revenue up 58% YoY

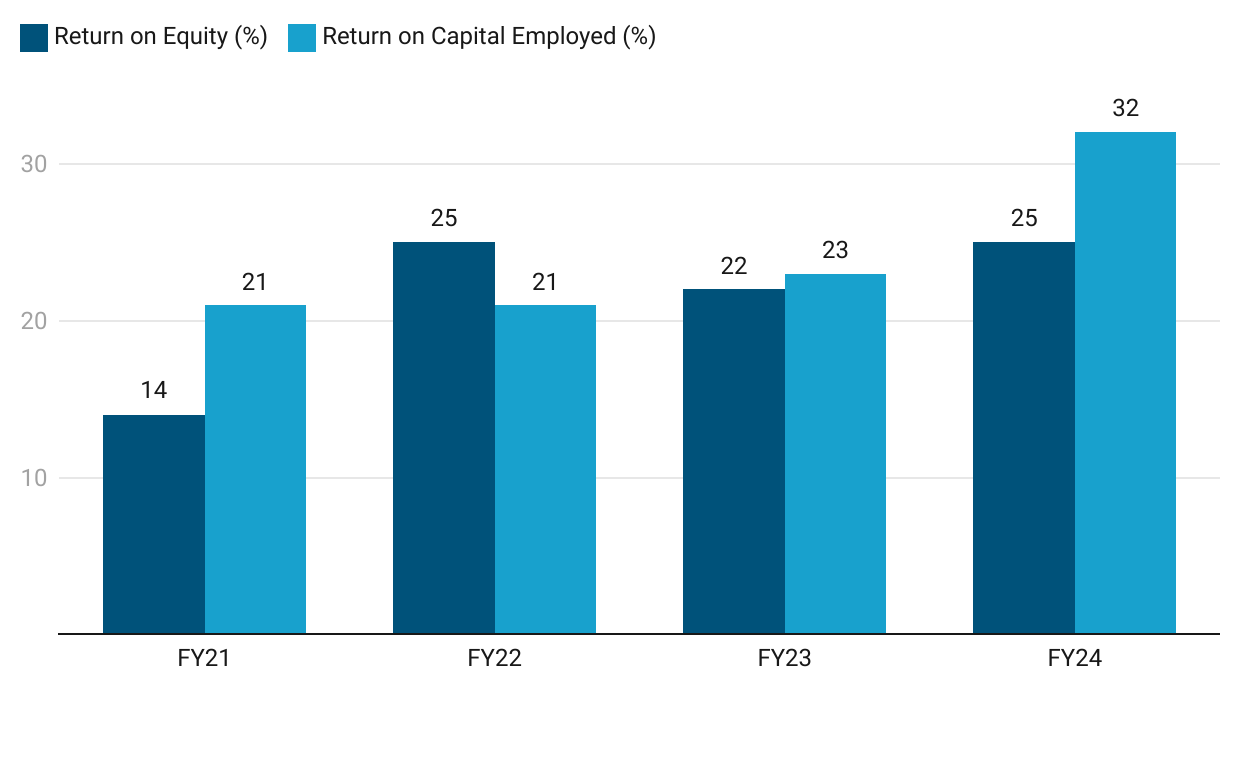

6. Business metrics: Strong & improving return ratios

7. Strong outlook: Revenue growth of 40-45%

i. FY25: Revenue growth of 40-45%

ii. FY25: EBITDA margin 23-24%

FY25 EBITDA margins to be sustained against the FY24 EBITDA margin of 23%

EBITDA margins are expected to be in the corridor of 23.0%-24.0% in the upcoming quarter on the back of increasing scale of operations and efficiencies thereon.

iii. FY25: Capacity expansion (1.8X) in place to support growth

The new unit progress at Belgaum continues in full swing. The company is on the verge of commercialising the first phase of the new manufacturing campus and it will drive the next leg of growth.

On capability augmentation front, the development of our newly acquired Mercedes Benz unit is progressing well on expected timelines and commercialization from said plant are expected to commence from Q2 FY25.

The manufacturing capacity is poised to rise from 18,000 TPA to 32,000 TPA with the commencement of Mercedes Benz's machining plant.

iv. Strong order book to support upcoming capacities

Strong order book for the existing infrastructure and the planned infrastructure is expected to commercialise in the coming quarters.

The 32,000 tons of machining capacity will be fully utilised in terms of the order book and the forging output from the initial commercialisation also has clear visibility to fulfil the capacity of the Mercedes Benz production line as well as the machining capacity expansion which is underway.

Clear visibility for 72,000 tons of forging capacity with agreements in place in highly specialised domains of Railways, Defence & Aerospace.

8. PAT growth of 106% & Revenue growth of 58% in H1-25 at a PE of 65

9. Hold?

If I hold the stock then one may continue holding on to BALUFORGE

BALUFORGE has delivered a strong H1-25 which is providing confidence that the conservative guidance of 40-45% revenue growth and EBITDS margins of 23-24% will be met.

BALUFORGE is in the middle of a strong run and has delivered sequential QoQ growth in PAT for the last eight quarters starting from Q3-23

BALUFORGE has the order book and upcoming capacities in place to support future growth

The capex coming online provides a roadmap for growth till FY26. The capacity expanding to 1.8X times FY24 capacity provides potential for the scale of the business to double.

10. Buy?

If I am looking to enter BALUFORGE then

BALUFORGE has delivered PAT growth of 106% and revenue growth of 58% in FY24 at a PE of 65 which makes the valuations fully priced in the short term.

FY25 conservative guidance of 40-45% revenue growth with 23-24% EBITDA margins at a PE of 65 which makes the valuations fully priced from a FY25 perspective

The opportunity in BALUFORGE is expected to emerge from FY26 performance as it rides the strong industry tailwind given the strong domestic demand, and supportive government policies

the combination of global market growth, strong domestic demand, and supportive government policies creates a highly conducive environment for the expansion of forging companies in India, especially Balu forging

The company plans to expand its workforce to over 1000 personnel in the coming financial year.

The special focus will also be on Research & Development teams for new product development, new material chemistries and expansion into the sunrise sectors under the infrastructure push

Previous coverage of BALUFORGE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer