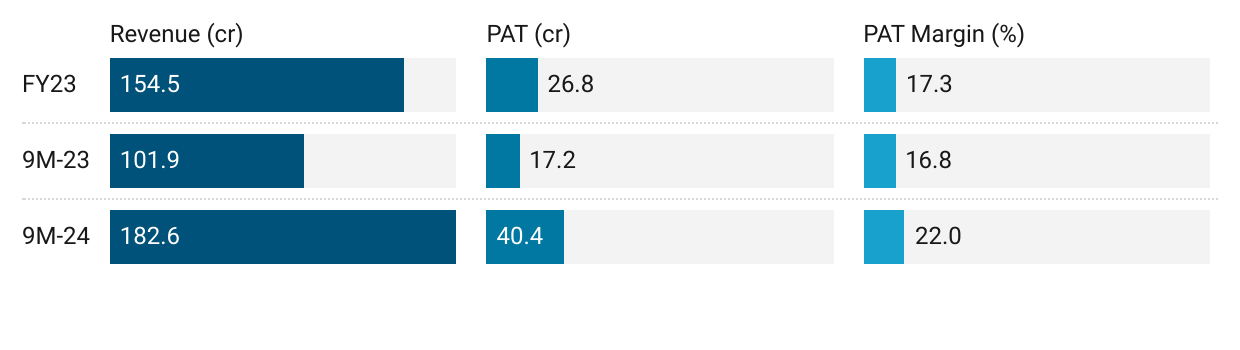

Avantel: PAT growth of 139% & Revenue growth of 79% in 9M-24 at a PE of 54

9M-24 carries forward the momentum of FY23. Strong top-line and bottom-line growth with margin. Absence of management commentary makes it difficult to understand the potential in the stock

1. Design, development & manufacture of products for C4ISR Solutions

avantel.in | imedsglobal.com | BOM: 532406

C4ISR = Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance

The company is currently focused on two business segments

Communications and signal processing products: Manufacturing of Wireless Front End, Satellite communication, Embedded Systems, Signal

Health Care Service

iMeds Global Private Limited, India is the Health Care service subsidiary of Avantel and it is for Design, Development & Manufacture of Medical Electronics Devices

2. FY17-23: Revenue CAGR of 28% & PAT CAGR of 9%

FY20-23: 44% Revenue CAGR and 36% PAT CAGR

3. Strong H1-24: PAT up 129% & Revenue up 95% YoY

4. Strong Q3-24: PAT up 144% & Revenue up 53% YoY

PAT up 2% & Revenue up 9% QoQ

5. Strong 9M-24: PAT up 135% & Revenue up 79% YoY

6. FY24 return ratios expected to be better than FY23

7. PAT growth of 135% & Revenue growth of 79% in 9M-24 for a PE of 54

8. So Wait and Watch

If I hold the stock then one may continue holding on to Avantel .

Coverage of Avantel was initiated after Q2-24 results. The investment thesis has not changed after a strong 9M-24. It has increased the confidence in the management to deliver a strong FY24 with the highest PAT, more than double of FY23 PAT.

Avantel has delivered a strong performance in all the three quarters of FY24.

In the absence of any commentary by the Avantel management, one needs to keep a close watch quarter by quarter.

The Health Care segment of Avantel though less than 1% of total revenue is loss making. While losses seem to be reducing, one needs to keep a watch on it.

9. Or, join the ride

If I am looking to enter the stock then

Avantel has delivered PAT growth of 135% & Revenue growth of 79% in 9M-24 at a PE of around 54 makes the valuations fair.

There is no margin of safety at a PE of 54, one bad quarter and the valuations could become very expensive.

The real challenge in entering Avantel is the absence of management commentary. It is very difficult to take a long view on the stock in the absence any outlook for the business.

Previous Coverage of Avantel

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer