Avantel: 49-72% PAT growth in FY24 at a PE of 66

H1-24 carries forward the momentum of FY23. Avantel grew 2X in H1-24 compared to H1-23. However, management commentary is not very encouraging & orders in hand have reduced as of end of Q2-24

1. Design, development & manufacture of products for C4ISR Solutions

avantel.in | BSE: 532406

C4ISR = Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance

Avantel Ltd. is engaged in the designing, developing and maintaining wireless and satellite communication products, defense electronics, radar systems and the development of network management software applications for its customers predominantly from the aerospace and defense sectors.

Avantel products include repeaters, filters, power dividers, power amplifiers, directional couplers, and cavity splitters or tappers.

Avantel also offers satellite communication products comprising ship borne terminals, handheld terminals, S-band receivers, UHF transmitters, burst demodulators, network management systems, and solid state power amplifiers, as well as provides vehicle tracking systems.

2. FY17-23: Revenue CAGR of 28% & PAT CAGR of 9%

FY20-23: 44% Revenue CAGR and 36% PAT CAGR

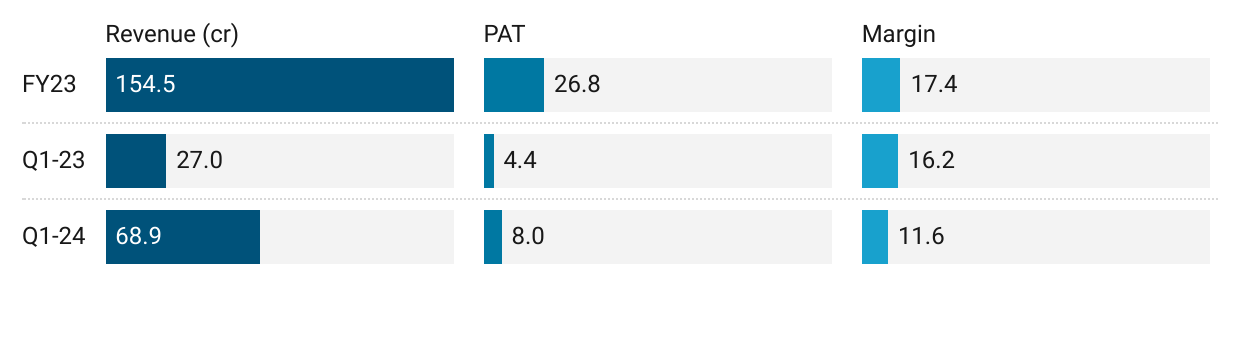

3. Strong Q1-24: PAT up 83% & Revenue up 155% YoY

executing close to around 68 crores so far in this quarter

4. Strong Q2-24: PAT up 162% & Revenue up 50% YoY

5. Overall H1-24 looking strong: PAT up 129% & Revenue up 95%

Avantel can double in top-line and bottom-line in FY24 based on H1-24 performance.

Margin expansion delivered in H1-24. H1-24 PAT touching FY23 PAT

6. FY24 return ratios expected to be better than FY23

7. Outlook: Conservative management or slowing down

i. 30% revenue growth in FY24 after delivering 95% growth in H1-24

In the FY23 AGM management has talked about achieving Rs 200 cr turnover in FY24. It looks like a very conservative guidance or else the management knows something

In H1-24 Avantel delivered 95% revenue and 129% PAT growth yoy and has orders in hand to repeat H1 in H2-24.

If H1-24 performance is repeated in H2-24, we could end up with 2X of FY23. Historically, H2 is bigger than H1 and if the momentum continues one could expect Rs 250 cr in top-line. In this context a revenue guidance of Rs 200 cr looks very conservative.

So, we should be comfortable and achieving 200 crores turnover during the financial year 2023 and 24.

ii. Conservative guidance or growth slowing down?

Revenue guidance of 25% CAGR till FY26

FY24 = Rs 200 cr

FY25 = Rs 250 cr

FY26 = Rs 300 cr

Is the management guiding for the business momentum to crash or is it being conservative? We will go by what the management. After all the management knows more than we do.

So, I would say we are hopeful and positive that after completing 200 crores this year, we should be able to do next two years around 550 crores. So, 250 and 300 crores. That is the target we kept for ourselves. Okay, so, I cannot say anything more than that.

iii. Margin expansion: 49-72% PAT growth in FY24

Even if we go by the management guidance of Rs 200 cr revenue in FY24 with a margin of at least 20-23%, we are looking at PAT of Rs 40-46 cr which is a 49-72% growth over FY23

And most of you should have gone through the ratio analysis and all where by and large we are around 20% net profit after tax and this year it's slightly higher 23%. With that around, with that kind of ratios we should be able to maintain.

iv. Revenue visibility weakening: Order book 1X FY23 revenue

Rs 188 cr of orders in hand as of 23-Jun-23,

I would like to share with you that we have about 188 crores of orders in hand.

The Q2-24 revenue of Rs 54.3 cr would have been delivered out of the Rs 188 cr orders in hand as of 23-Jun-23. Additionally Avanatel has informed the exchange of receiving 4 new orders totaling Rs 34.96 cr between 23-Jun to 6-Oct

So, orders in hand = 188 - 54.3 + 34.96 = Rs 168.66 cr as of 6-Oct.

Is the reduction in orders in hand a reason for management being conservative?

8. 49-72% PAT growth in FY-24 for a PE of 66

9. So Wait and Watch

If I hold the stock then one may continue holding on to Avantel given the momentum from FY23 has continued on into H1-24 end. However there are question marks regarding H2-24 going up to FY26

On one hand H1-24 has been excellent. On the other hand management guidance regarding FY24 revenue makes the outlook for H2-24 uncertain.

Given that Q2-24 was strong we may give Avantel the benefit of doubt and wait till Q3-24.

10. Or, join the ride

If I am looking to enter the stock then

Avantel has delivered 95% growth in top-line and 129% growth in PAT for H1-24 with 49-72% growth in PAT for FY-24 at PE of around 66 makes the valuations reasonable.

However, the revenue guidance by the management till FY26 is indicating a slowdown in growth. This is further corroborated by the order book getting smaller from Q1-24 end to Q2-24 end

Decision on entry in stock depends on whether one gives more weightage to H1-24 performance or if one gives more weightage to revenue guidance till FY26

Given the uncertainty, positions into Avantel should be built over a period of time.

The real issue is that the management commentary may be dated as it is from the AGM held on 23-Jun. We don’t know what has changed in Q2-24 as there is no management commentary after that.

What if the management was being conservative ?

What if the management is really pointing towards a slow down?

It uncertain.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades