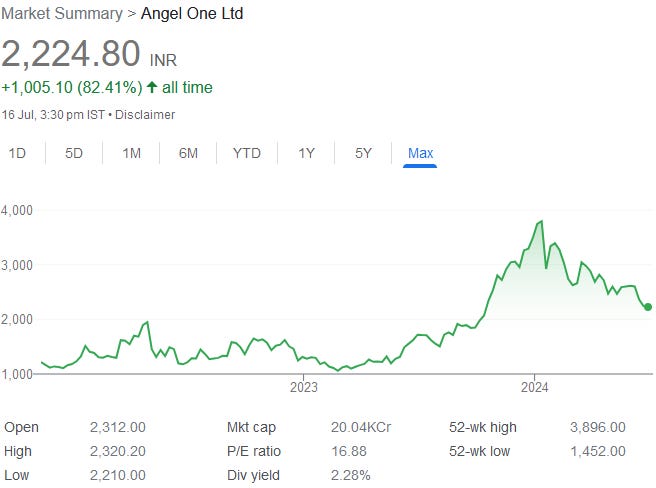

Angel One: PAT growth of 33% & Revenue growth of 74% in Q1-25 at a PE of 16

ANGELONE impacted by the upfront booking of IPL sponsorship expenses in Q1-25 & Q4-24. Underlying business remains strong with a strong outlook for growth.

1. Largest listed broking house in India

angelone.in | NSE: ANGELONE

22.8% share in India’s incremental demat accounts in Q1 ‘25

15.2% (+54 bps QoQ) Share in India’s Demat Accounts

2nd (Maintained) Rank In Incremental NSE Active Clients

Business Segments

2. FY20-24: PAT CAGR of 90% & Revenue CAGR of 56%

3. FY-24: PAT up 26% & Revenue up 42% YoY

4. Q1-25: PAT up 33% & Revenue up 74% YoY

PAT down 14% and Revenue up 4% QoQ

5. Strong and consistent return ratios

6. Outlook: Top-line growth to remain strong

i. FY25: Top-line growth to remain strong

continue to see very strong growth coming ahead for the company but that also means that the working capital requirements for Angel one have now shot up

ANGELONE is undertaking a change in its business model, which will incrementally drive the focus towards gaining market share in the cash segment, along with strong growth in distribution revenues, over the next 2-3 years. Growth in the distribution segment will be driven by loans, insurance and a few other products

7. PAT growth of 33% & revenue growth of 74% in Q1-25 for a PE of 16

8. So Wait and Watch

If I hold the stock then one may evaluate holding on to ANGELONE

Coverage of ANGELONE was initiated after Q4-23 results. The investment thesis for top-line has not changed even after Q1-24 and the business is delivering growth. Concerns on the lagging bottom line growth seen in FY24 which continues in Q1-25 are guided to recover in a few quarters. One can be patient for another quarter.

From an underlying business perspective ANGELONE is gaining market share which is a big positive for the business. Reduction in Commodity market share needs to be watched as 84% of broking business is for commodities.

While bottom-line growth is lagging on account of IPL sponsorship, the margins normalized for IPL expenses remain strong, confirming that the business is performing well.

9. Or, join the ride

If I am looking to enter ANGELONE then

ANGELONE has delivered 74% growth in top-line and 33% growth in PAT in Q1-25 at a PE of 16 which makes the valuations quite fair from a short term perspective

The lagging bottom line growth on account of IPL sponsorship masks the fact that business margins are intact as seen from the Normalised EBDAT Margin expanding from 47% in Q4-24 to 48% in Q1-25. The sustained margins from the business along with the outlook of strong growth creates opportunity in the stock from its current levels.

From a longer term perspective the valuations of PE of 16 are not too high on which to generate returns from the stock.

Previous coverage of ANGELONE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer