Angel One: PAT up 33% & revenue up 30% in H1-24 for a PE of less than 17

ANGELONE has delivered a strong Q2-24 after a tepid Q1-24 leading to a strong overall performance in H1-24 where the growth is on par with FY23

1. Largest listed broking house in India

angelone.in | NSE: ANGELONE

Business Segments:

Broking: equity, commodity & currency segments & depository operations.

Client funding: funding up to 80% of value to the clients in cash delivery segment of equities

Distribution: Mutual funds, IPOs & bonds.

2. FY19-23: PAT CAGR of 117% & Revenue CAGR of 61%

YoY growth in PAT and Revenue delivered every year

PAT Margin expansion from 12% in FY19 to 30% in FY23

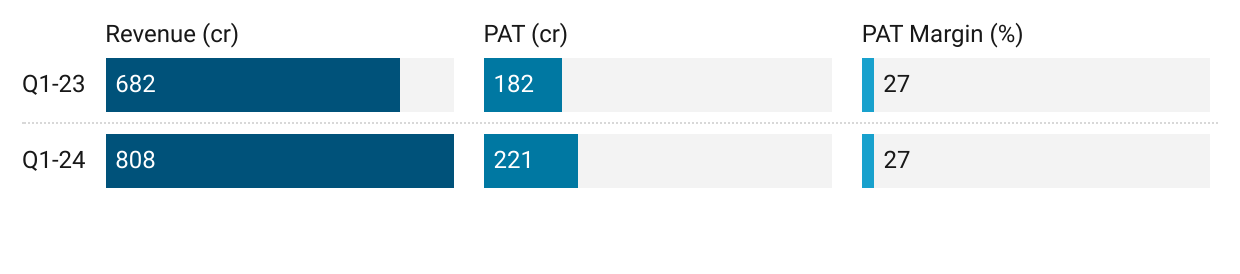

3. Q1-24: PAT up 22% & Revenue up 18% YoY

4. Strong Q2-24: PAT up 41% & Revenue up 43% YoY

Strong QoQ growth: PAT up 38% & Revenue up 30%

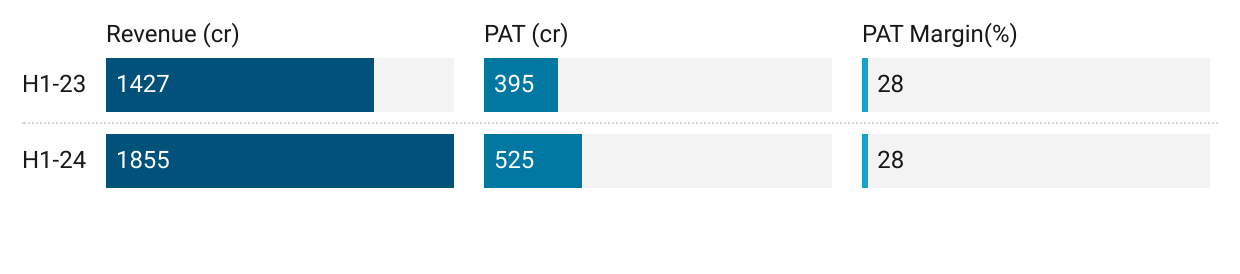

5. Overall H1-24 looking strong: PAT up 33% & Revenue up 30%

6. Strong and consistent return ratios

Book Value per share increasing every quarter

8. 33% revenue growth & 30% PAT growth in H1-24 for a PE of 17

TTM PAT of ₹ 10.2 bn translating into EPS of ₹ 121.8 / share

9. So Wait and Watch

If I hold the stock then one may continue holding on to ANGELONE

The growth delivered in Q2-24 after a tepid Q1-24. Because of the strong Q2-24, H1-24 looks strong.

Based on H1-24 performance ANGELONE looks on-track to deliver a similar performance as in FY23. Top-line growth in FY23 was 31% vs 30% in H1-24

10. Or, join the ride

If I am looking to enter the stock then

ANGELONE has delivered 30% growth in top-line and 33% growth in PAT for H1-24 at a PE of 17 which makes the valuations quite attractive.

Previous coverage of ANGELONE

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades