Angel One - Attractively priced

Path to growth is not crystal clear, yet attractively priced

Company Overview

Angel One is the largest listed broking house in India with more than 13.8 million clients and 4.3 million active clients on NSE as of March 2023. The company had a 12% market share in India’s demat accounts and its overall equity turnover market share was 21.8% in FY23.

Business Segments:

Broking: equity, commodity & currency segments & depository operations.

Client funding: funding up to 80% of value to the clients in cash delivery segment of equities

Distribution: Mutual funds, IPOs & bonds.

Angel One is largely driven by F&O brokerage income and its market share has plateaued between FY22 and FY23. Following the F&O segment is the Cash segment where market share has come down quite clearly. The market share is a parameter which needs to be watched closely. It is an indicator of flattening of the growth curve coming forward?

Share Details

NSE: ANGELONE( angelone.in)

Quality: Returns on capital employed in cash

Return ratios have improved consistently over the last four financial years. Cash conversion is also solid.

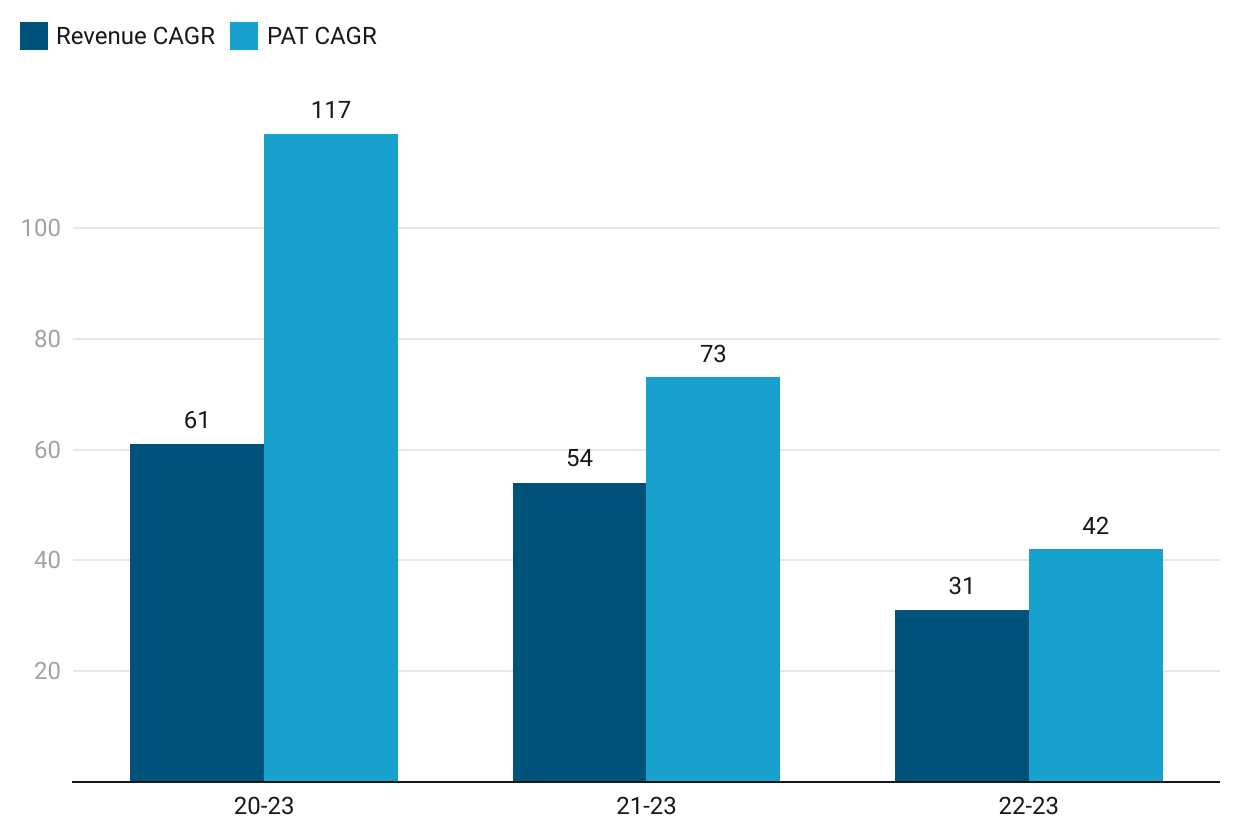

Growth

ANGELONE has been able to grow both the top line and the bottom line while generating free cash flow giving confidence in the company’s ability to execute efficiently in the future.

Growth Momentum

There is a slowdown in growth over the last three years.

Outlook

The comments around the margin during the earning calls inspires confidence where the company management is guiding for a strong and consistent operating margin.

Our goal is to operate the business in the 45% to 50% ballpark

The fact that the company is looking to buy market share makes one curious on the quality of top-line and bottom-line growth in the coming years and quarter. This has to be looked in conjunction with the plateauing of the F&O market share between F23 and FY24 along with the fall in market share in Cash segment.

We would be spending to gain more market share. Already we have done it every quarter. So, focus would be increasing our market share.

The fact that our operating margin has remained above our desired range of 45% to 50% gives us very strong headroom to achieve our aggressive growth targets.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. If I intend to hold it then one needs to look out for the growth trajectory of the company.

If I don't currently own the stock, I might consider entering it only if I am convinced about the growth outlook for the company. If one is not convinced on the growth outlook then also one can view ANGELONE as an attractively priced stock at a PE of 17, considering the past growth and future willingness of the management to buy market share while maintaining the 45-50% operating margin. Additionally ANGELONE generated a free cash flow of Rs 689.1 crore on a market cap of Rs 15,082 crore which means that its available at a free cash flow yield of 4.57% which makes it quite attractive in terms of valuation.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades