Angel One: PAT up 26% & revenue up 33% in 9M-24 at a PE of 27

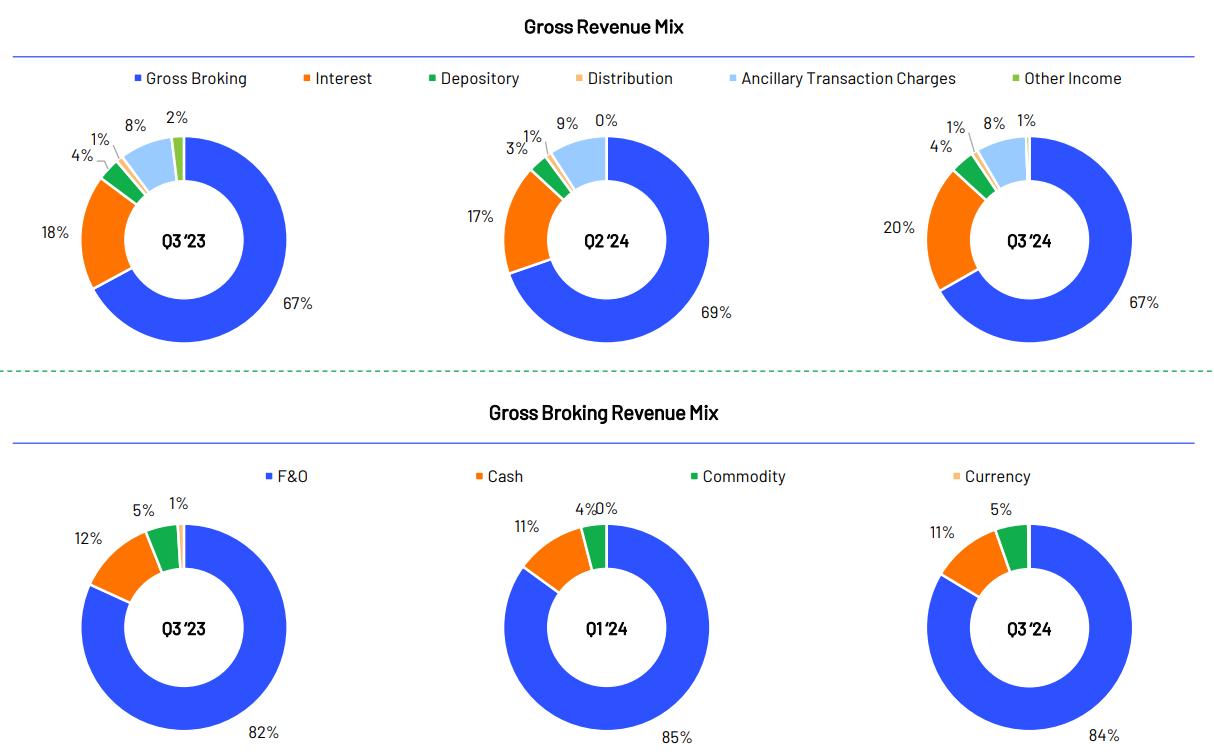

ANGELONE has delivered a strong H1-24 following it up with a weak Q3-24. The strong revenue growth could not deliver PAT growth which is a red-flag and needs to be watched

1. Largest listed broking house in India

angelone.in | NSE: ANGELONE

Business Segments

Broking: equity, commodity & currency segments & depository operations.

Client funding: funding up to 80% of value to the clients in cash delivery segment of equities

Distribution: Mutual funds, IPOs & bonds.

2. FY19-23: PAT CAGR of 117% & Revenue CAGR of 61%

YoY growth in PAT and Revenue delivered every year

PAT Margin expansion from 12% in FY19 to 30% in FY23

3. Strong H1-24: PAT up 33% & Revenue up 30%

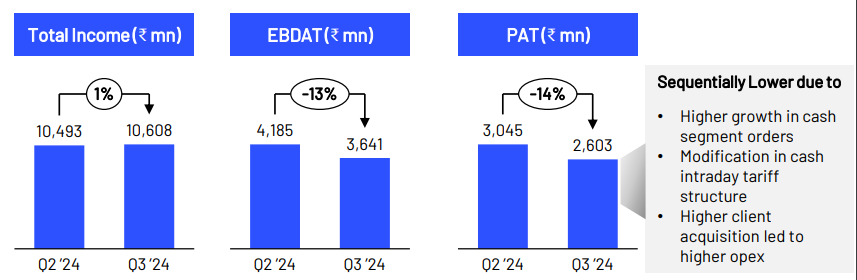

4. Weak Q3-24: PAT up 14% & Revenue up 40% YoY

PAT down 14% & Revenue up 1% QoQ

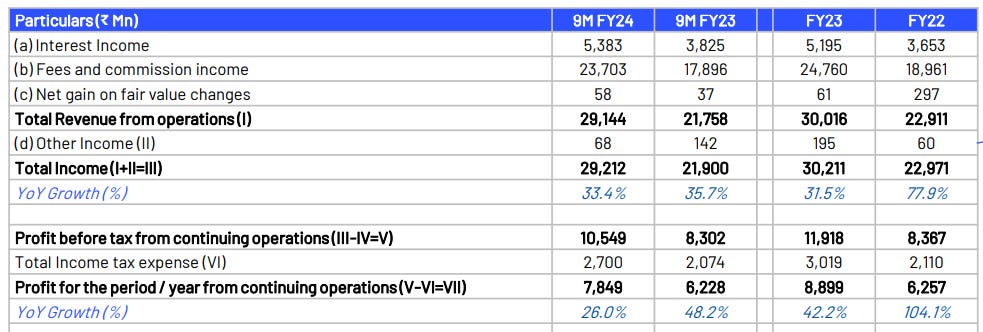

5. 9M-24: PAT up 26% & Revenue up 33% YoY

6. Strong and consistent return ratios

Book Value per share increasing every quarter

8. 26% PAT growth & 33% revenue growth in 9M-24 for a PE of 27

TTM PAT of ₹ 10.5 bn translating into EPS of ₹ 125.7 / share

9. So Wait and Watch

If I hold the stock then one may continue holding on to ANGELONE

Coverage of ANGELONE was initiated after Q4-23 results. The investment thesis has not changed even after a weak Q3-24. The management is on track to beating its guidance for delivering a strong FY-24

From an underlying business perspective ANGELONE is gaining market share which is a big positive for the business

The bottom-line performance in Q3-24 is a small red flag which one needs to watch out for. If the bottom-line growth does not keep pace with top-line then it would be difficult to justify holding on to ANGELONE

10. Or, join the ride

If I am looking to enter ANGELONE then

ANGELONE has delivered 33% growth in top-line and 26% growth in PAT for 9M-24 at a PE of 27 which makes the valuations fair from a short term perspective.

The expected performance of FY24 is already discounted in the price. Outlook for FY25 will now decide the trajectory in the stock. While the company is executing well the stock price may have run ahead of its performance in the short term on account of the slow down in bottom-line growth in Q3-24

Previous coverage of ANGELONE

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action.