Angel One: PAT growth of 36% & Revenue growth of 57% in H1-25 at a PE of 18

Best-ever performance across financial and operational metrics in Q2-25. H1-25 pointing towards a strong FY25 for ANGELONE. Underlying business remains strong with market share gains & strong margins.

1. Largest listed broking house in India

angelone.in | NSE: ANGELONE

21.1% share in India’s incremental demat accounts in Q2 ‘25

15.4% (+19 bps QoQ) Share in India’s Demat Accounts

2nd (Maintained) Rank In Incremental NSE Active Clients

Business Segments

2. FY20-24: PAT CAGR of 90% & Revenue CAGR of 56%

3. FY-24: PAT up 26% & Revenue up 42% YoY

4. Q2-25: PAT up 39% & Revenue up 44% YoY

PAT up 45% and Revenue up 8% QoQ

5. H1-25: PAT up 36% & Revenue up 57% YoY

6. Strong and consistent return ratios

7. Outlook: Top-line growth to remain strong

i. FY25: Top-line growth to remain strong

Q2FY25 has marked a historic quarter for us, as we have achieved our best-ever performance across financial and operational metrics.

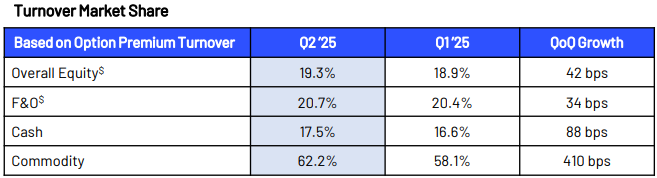

With a 19.3% share in overall retail equity turnover, we continue to report an improvement in market share across all segments.

Growth, client satisfaction and technological advancements is helping us maintain our position as a leading player in India’s evolving financial ecosystem

8. PAT growth of 36% & revenue growth of 57% in Q1-25 for a PE of 18

9. Hold?

If I hold the stock then one may continue holding on to ANGELONE

Concerns on the lagging bottom line growth seen in FY24 which continued in Q1-25 has been largely overcome in Q2-25. H1-25 is pointing to a strong FY25.

From an underlying business perspective ANGELONE is gaining market share which is a big positive for the business. .

While bottom-line growth is lagging on account of IPL sponsorship, the margins normalized for IPL expenses remain strong, confirming that the business is performing well.

10. Buy?

If I am looking to enter ANGELONE then

ANGELONE has delivered 36% growth in PAT and 57% growth in revenue in H1-25 at a PE of 18 which makes the valuations quite reasonable from a short term perspective

The lagging bottom line growth on account of IPL sponsorship masks the fact that business margins are intact as seen from the Normalised EBDAT Margin expanding from 48% in Q1-25 to 49.9% in Q2-25. The sustained margins from the business along with the outlook of strong growth creates opportunity in the stock from its current levels.

From a longer term perspective the valuations of PE of 18 are not too high on which to generate returns from the stock.

Previous coverage of ANGELONE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer