Anant Raj: PAT growth of 78% & revenue growth of 51% for H1-25 at a PE of 74

Revenue CAGR of 34% for FY24-29 on the back of strong revenue visibility. Rs 15,000 cr revenue over a period of 5 years from real estate. Rs 3300 cr of rental income from data centers by FY29

1. Real Estate Development, Construction & Infrastructure Development

anantrajlimited.com | NSE: ANANTRAJ

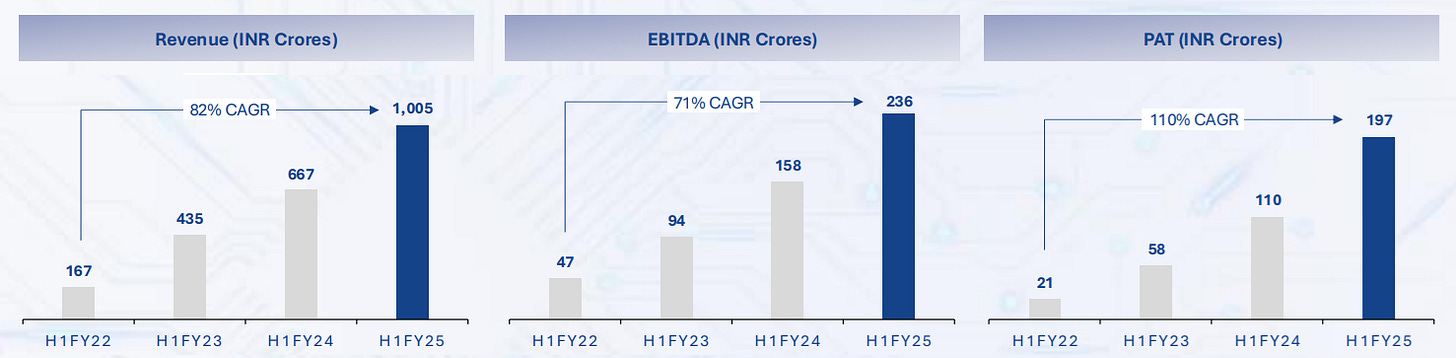

2. FY21-24: PAT CAGR of 189% & Revenue CAGR of 78%

3. Strong FY24: PAT up 71% & Revenue up 51%

4. Strong Q2-25: PAT up 75% & Revenue up 54%

5. Strong H1-25: PAT up 78% & Revenue up 51% YoY

6. Business metrics: Improving but weak return ratios

7. Strong outlook: Revenue growth of 35%+

i. FY24-29: Strong Revenue visibility in real estate business

Potential to grow from Rs 1,500 cr revenue in FY24 to Rs 3000 cr per year by FY29.

~INR 15,000crs of revenue potential in next 4 to 5 years from residential sales in Sector 63A, Gurugram

ii. FY24-29: Strong Revenue visibility in Data Center Business

One can expect rental of Rs 3300 cr by FY29.

Scale up to 307 MW IT Load Data Center within the next 4 to 5 years

Converting existing 5.66 msf commercial property into a 157 MW Data Centre, with another 150 MW expansion planned in Rai and Panchkula;

Expected rentals of INR 3,300 crores once the 307 MW is fully operational.

iii. FY24-29: Revenue CAGR of 34%

Expected revenue in FY29 of Rs 3000 (real estate)+ Rs 3300 (data center rentals) would implies revenue rowing Rs 6300 cr in FY29 from Rs 1483 cr in FY24 at a CAGR of 34%. The Rs 6,300 cr of revenue does include any other revenue from other parts of its residential and commercial businesses.

8. PAT growth of 78% & revenue growth of 51% in H1-25 at a PE of 74

9. Hold?

If I hold the stock then one may continue holding on to ANANTRAJ

ANANTRAJ has a track record of delivering strong performance with a FY20-24 PAT CAGR of 189% & Revenue CAGR of 78%. The historic performance was continued in FY24 and followed up in H1-25 with an extremely strong performance.

FY24 PAT: I am very pleased to share that this is the company's best profit so far, which we have achieved over the last 15 years.

The outlook of ANANTRAJ growing 4X+ form a Rs 1483 cr business to a Rs 6300 cr business by FY29 is a strong reason to continue with it. H1-25 execution shows that its moving in the right direction to achieve FY29 targets.

10. Buy?

If I am looking to enter ANANTRAJ then

ANANTRAJ has delivered PAT growth of 78% with revenue growth of 51% in H1-25 at a PE of 74 which makes the valuations acceptable in the short term.

The outlook of ANANTRAJ to deliver revenue CAGR of 34%+ for FY24-29 at a PE of 74 makes the valuations quite acceptable over the longer term

ANANTRAJ is a story which will develop over the next 5 years and one needs to keep a close watch on the execution as the margin of safety is limited at a PE of 74.

Since ANANTRAJ is a longer term story one should build positions over a period of time as the execution evolves, given the limited margin of safety

Previous Coverage of ANANTRAJ

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer