Anand Rathi Wealth (Q4-25)-FY25 Results: PAT up 33%, Revenue up 30%

Guidance of 25% PAT growth & Revenue growth of 20% in FY25. ANANDRATHI is a sustainable 20-25% growth business. Long-term opportunity, fully priced in the short term

1. India’s leading wealth firms, catering to high & ultra-high net-worth individuals

anandrathiwealth.in | NSE: ANANDRATHI

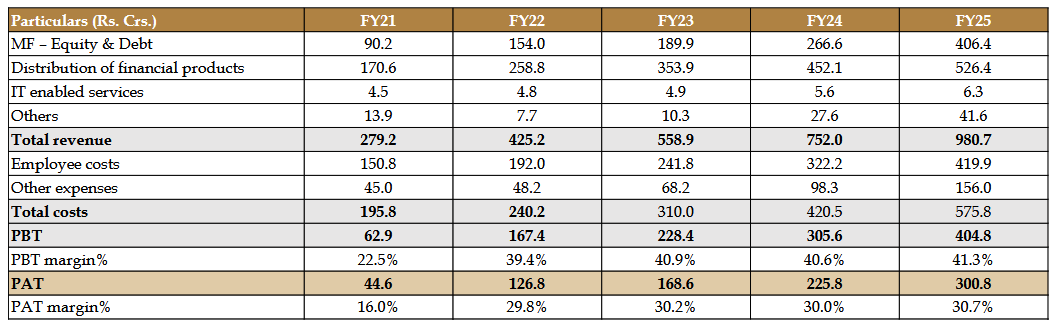

2. FY21-25: PAT CAGR of 61% & Revenue CAGR of 37%

3. Strong FY24: PAT up 34% & Revenue up 35%

4. Strong Q4-25: PAT up 30% & Revenue up 20%

5. Strong FY25: PAT up 33% & Revenue up 30%

6. Strong return ratios

7. FY26: Guidance of PAT growth of 25% & Revenue growth of 20%

Strong growth guidance for FY26 in an environment of uncertainty and macro weakness.

8. PAT growth of 33% & Revenue growth of 30% for 9M-25 at a PE of 58

9. Hold?

If I hold the stock then one may continue holding on to ANANDRATHI

FY25 performance against guidance has been strong and is being followed up by a strong guidance for FY26 in an environment of weakness.

One should hold on as long as the management holds on to its promise of 20-25% growth business with a 30% PAT margin. Its not easy to find a 20-25% growth business with a 30% PAT margin at a scale.

Expected to grow our PAT by 20–25% consistently for years to come.

10. Buy?

If I am looking to enter ANANDRATHI then

ANANDRATHI has delivered a strong FY25 with PAT growth of 33% & revenue growth of 30% at a PE of 49 which makes the valuations quite rich in the short term.

Guidance of 25% PAT growth and 20% Revenue growth in FY26 by ANANDRATHI is already discounted in the price at a PE of 49

Guidance of ANANDRATHI being a sustainable 20-25% growth business over the longer term at a PE of 49 provides an opportunity over the longer term.

At a PE of 49 the margin of safety is limited in ANANDRATHI, one not so strong quarter and the stock may start looking quite expensive.

If the trend of margin expansion deliver PAT growth exceeding revenue growth continues then there is value in ANANDRATHI over the longer term even at current PE of 49.

ANANDRATHI is a high-growth, high-expectation stock where valuation will compress only if execution falters.

Previous coverage on ANANDRATHI

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer