Alpex Solar: PAT up 122%, Can Beat FY26 Guidance, Mixed Q2 FY26 Results

Guidance of 100% revenue CAGR till FY27. Weak margins a concern. Order-book supports FY26 guidance. FY27E valuations give comfort to support execution misses

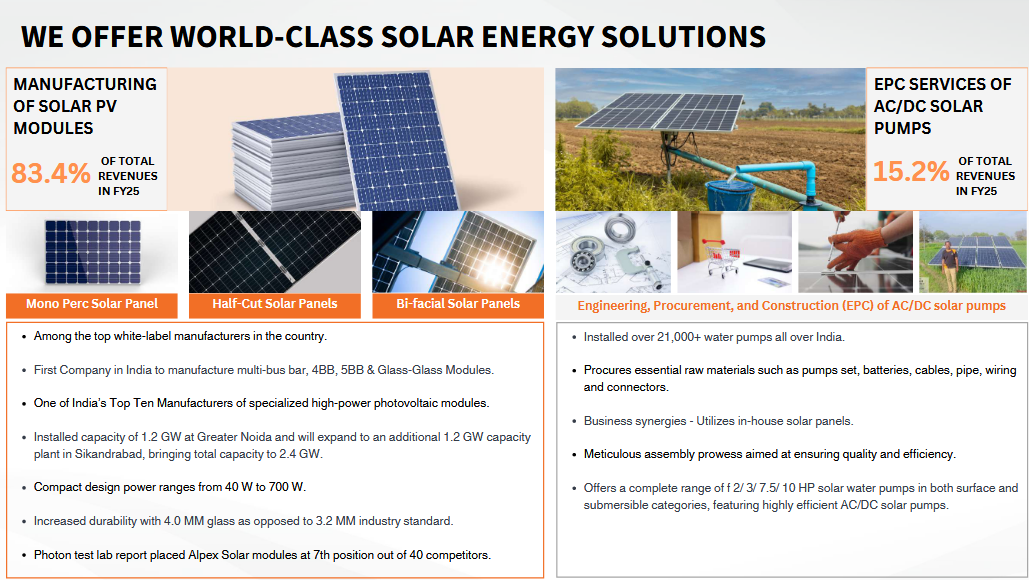

1. Photo Voltaic (PV) Module Manufacturers

alpexsolar.com | NSE - SME: ALPEXSOLAR

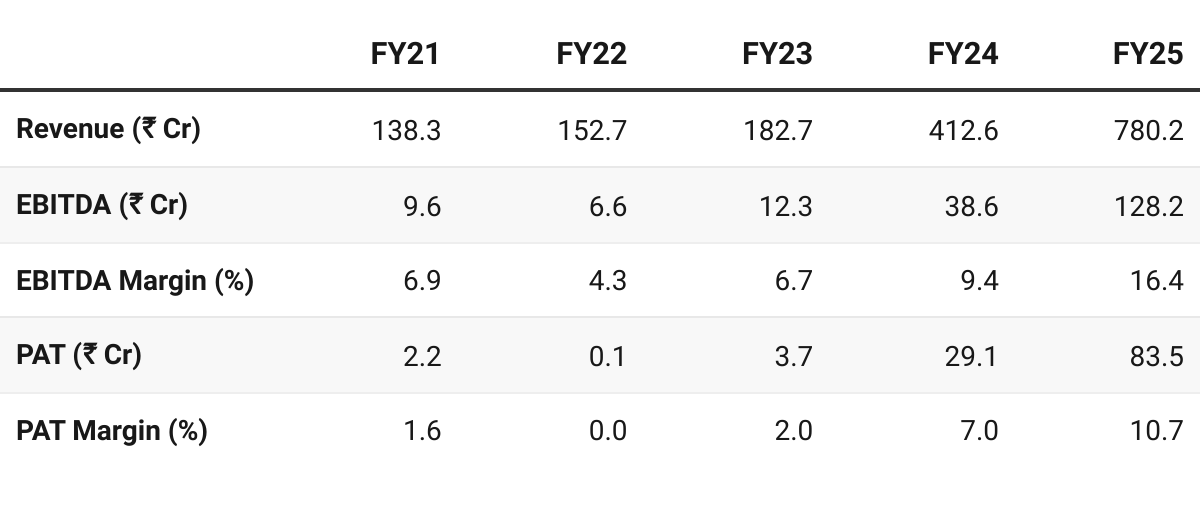

2. FY21–25: PAT CAGR of 148% & Revenue CAGR of 54%

3. FY25: PAT up 547% & Revenue up 193% YoY

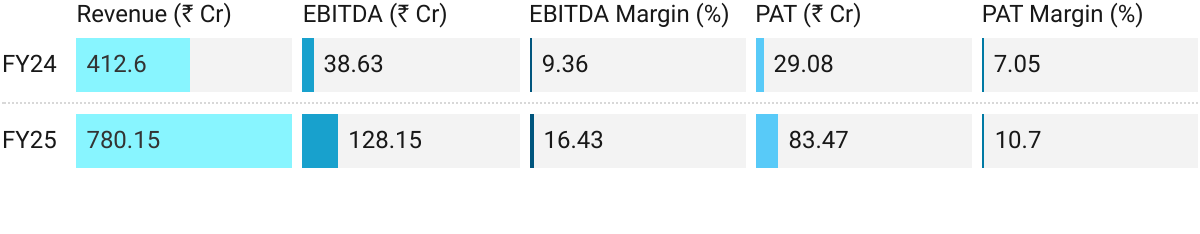

4. Q2 FY26: PAT up 122%, Revenue up 178% YoY

PAT up 25% & Revenue up 37% QoQ

Excellent top-line growth impacted by deterioration in margin.

Even after weakening margins — bottom line growth has been good

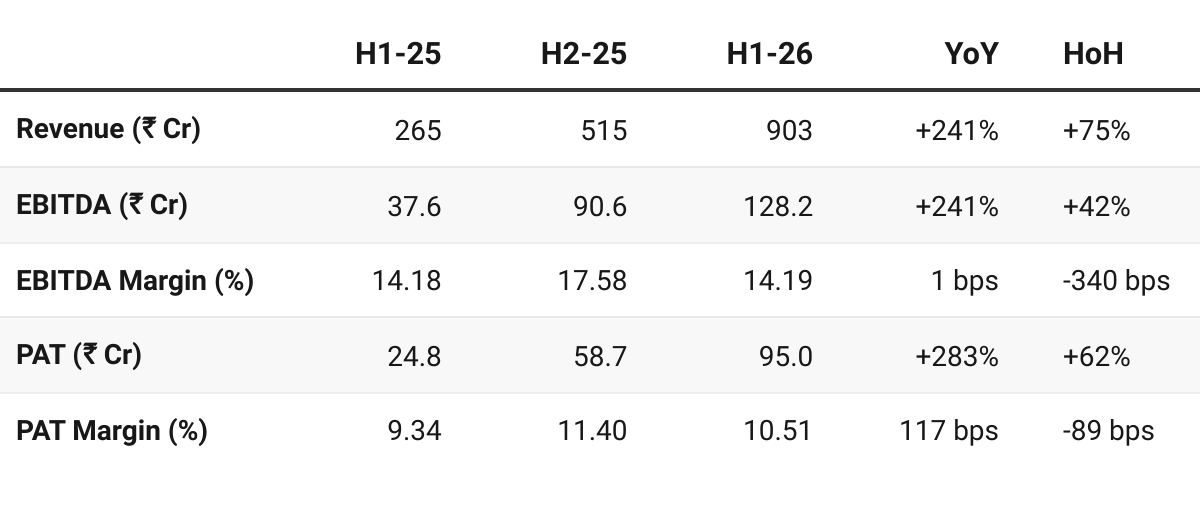

5. H1 FY26: PAT up 283%, Revenue up 241% YoY

PAT up 62% & Revenue up 75% HoH

Weaker margins in Q2-26 impact overall H1-26 results when compared to H2-25

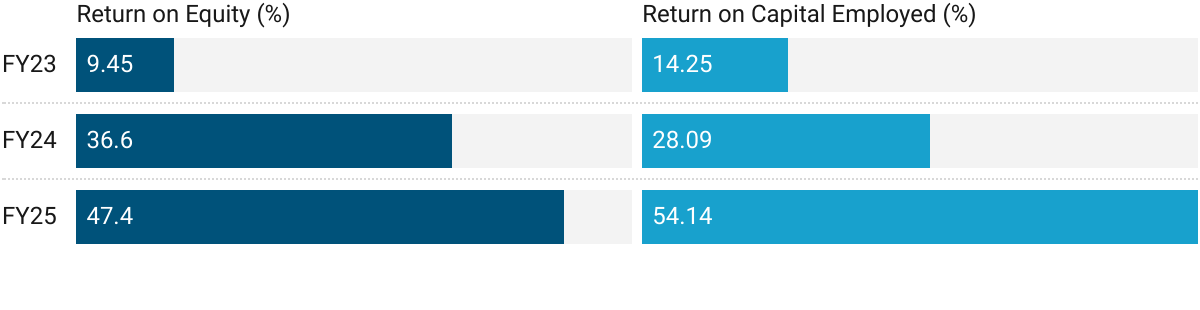

5. Business Metrics: Strong Return Ratios

6. Outlook: 100% Revenue CAGR till FY27

6.1 Guidance

FY26: at our previous investor calls or conferences, we have said that we have given a guidance that we will grow 2x.

FY27: So, yes, 2x is our target, but we feel that we might grow slightly better than that, but our guidance is 2x only

Longer Term Margins: EBITDA levels are around 35% and net profit margins are around 25%. So, we also will have a similar kind of margins

The total order book for FY26 now stands at ₹1,278.84 crore, reflecting robust demand across product categories including PV modules and solar pumps. (as of 24-Sep-2025)

Doubling revenues in FY26 and FY27 respectively. Order book in place to support 2X revenue for FY26

Once cell line integration kicks in (from FY27), EBITDA margins are expected to expand to ~35% and PAT margins to ~25%.

Full year impact of the 35/25% margins should be visible in FY28

Capacity Expansion

The company is looking to triple its solar module capacity to 3.6 GW from the present 1.2 GW by FY 2026-27. Trial production of solar cells (first phase) is set to commence soon. Alpex Solar aims to have a solar cell capacity of 1.6 GW and solar module capacity of 3.6 GW by FY2026–27. Besides, it is also looking to have its 12,000 MTPA aluminium frame manufacturing facility fully operational.

6.2 H1 FY26 Performance vs FY26 Guidance — Alpex Solar

On-track FY26 revenue growth with watch on margins

Strong Start: H1 already delivers ~₹1,008 Cr of the target of ~₹1,560 Cr.

The required run run-rate in H2 is lower than H1 run-rate

Possibility of guidance revision exists — order book is in place to support the growth

Profitability Lagging: Weakening margins need to be watched carefully.

Excellent top-line growth in the short run mitigates the impact of weakening margins

Execution Visibility: Order book (~₹1,278.84) comfortably covers FY26 revenue guidance.

Capex on-track: Gives confidence on ability to deliver FY27 growth

In FY26, we are hopeful of commission Phase 1 of our 1.6 GW solar cell project, with 500 MW commencing commercial production, alongside the 12,000 ton aluminium frame plant.

7. Valuation Analysis

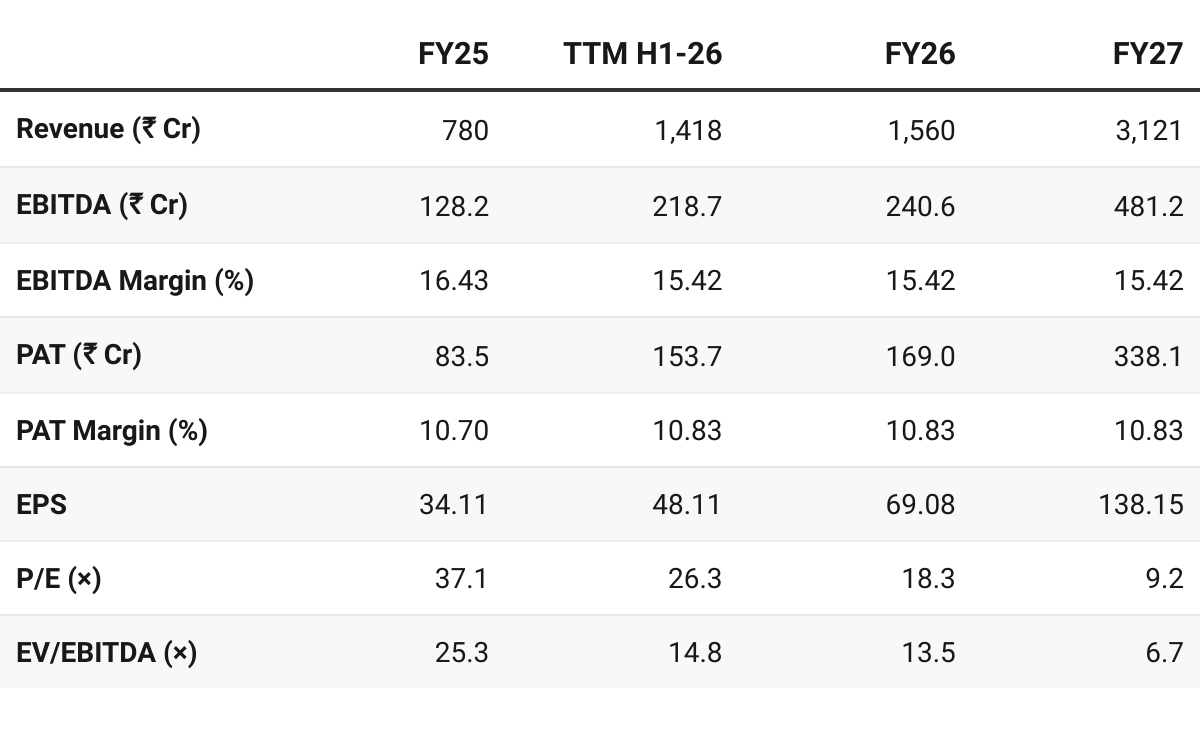

7.1 Valuation Snapshot — Alpex Solar

CMP ₹1264; Mcap ₹3,228.64 Cr;

Attractive Forward Valuation:

Near-Term (FY26): At ~18× P/E, valuations look fair relative to growth visibility.

Medium-Term (FY27):

Rich multiples compress rapidly as earnings scale

Materially undervalued — if guidance is achieved.

If ₹3,000 Cr+ revenue and ₹300 Cr+ PAT materialize, stock could see significant re-rating (7× P/E is deep value for company doubling for 2 years).

Looking reasonably priced on FY26E and potentially undervalued on FY27E, provided execution stays on track. Multiples leave room for re-rating

7.2 Opportunity at Current Valuation

Upward Revision of Guidance: H1 already delivers ~₹1,008 Cr of the target of ~₹1,560 Cr. Target of only ~₹500 Cr in H2 creates opportunity of going ahead of the 2x revenue guidance

Re-rating of multiples: At CMP, Alpex trades at 18× FY26E P/E and 9× FY27E P/E, with EV/EBITDA dropping from 26× in FY25 to just 7× by FY27. If execution sustains, this creates room for valuation re-rating.

Alpex Solar offers a rare mix of hyper-growth + margin expansion + valuation compression. If FY27 guidance is achieved, the stock could see significant upside and re-rating potential.

7.3 Risk at Current Valuation

Weak Margins: Margin compression is a risk which needs to be watched carefully. However with revenue expected to more than doble in FY26, there is a cushion to handle margin compression

Competitive Intensity: Several new players are entering with lower-cost/second-hand lines from China. While policy support is strong, pricing pressure could emerge, impacting realizations and margins.

This is a real threat and we are assuming significantly lower margins than the 35/25% EBITDA/PAT margins indicated by management

Technology Transition: Current focus is on Mono PERC, while global leaders are moving to Topcon/HJT. A delayed transition could risk technology obsolescence and lower ASPs.

Policy/Regulatory Risk: While current policy is favorable (import bans, ALMM, ALCM), any relaxation or WTO challenges could reopen imports and reduce domestic pricing power.

While Alpex Solar’s growth path is compelling, investors must monitor execution timelines, competitive pricing, and technology shifts. The stock is priced for high growth — any slip could slow the re-rating.

Previous coverage of ALPEXSOLAR

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer