Alpex Solar Q1 FY26 Results: PAT up 3890%, Can Beat FY26 Guidance

Guidance of 100% revenue CAGR till FY27. Stable & expanding margins. Order-book supports FY26 guidance. FY27E valuations give leeway to support execution misses

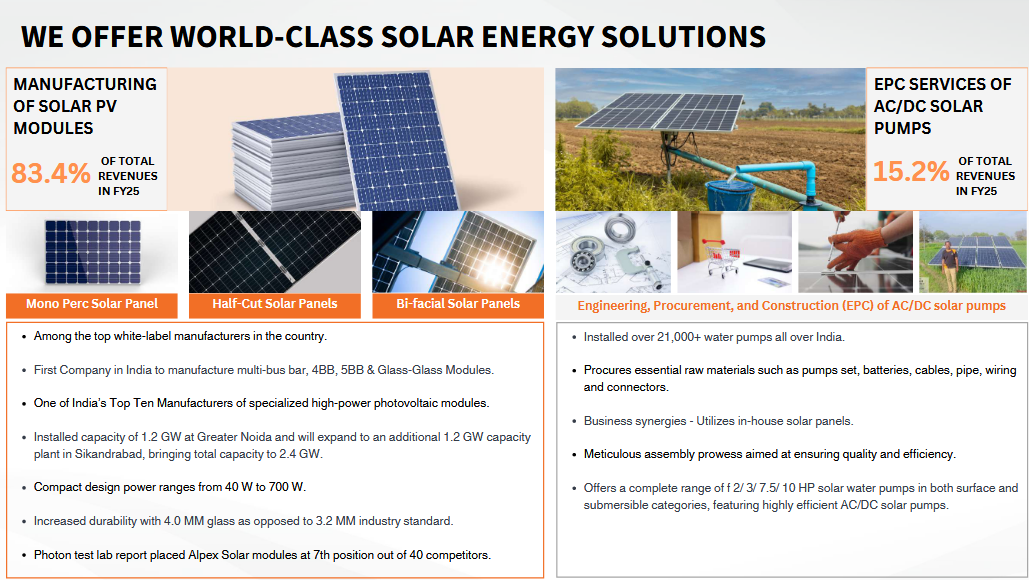

1. Photo Voltaic (PV) Module Manufacturers

alpexsolar.com | NSE - SME: ALPEXSOLAR

Alpex Solar Limited - not suited for all:

Limited Trading Volume - Entry and exit is a problem

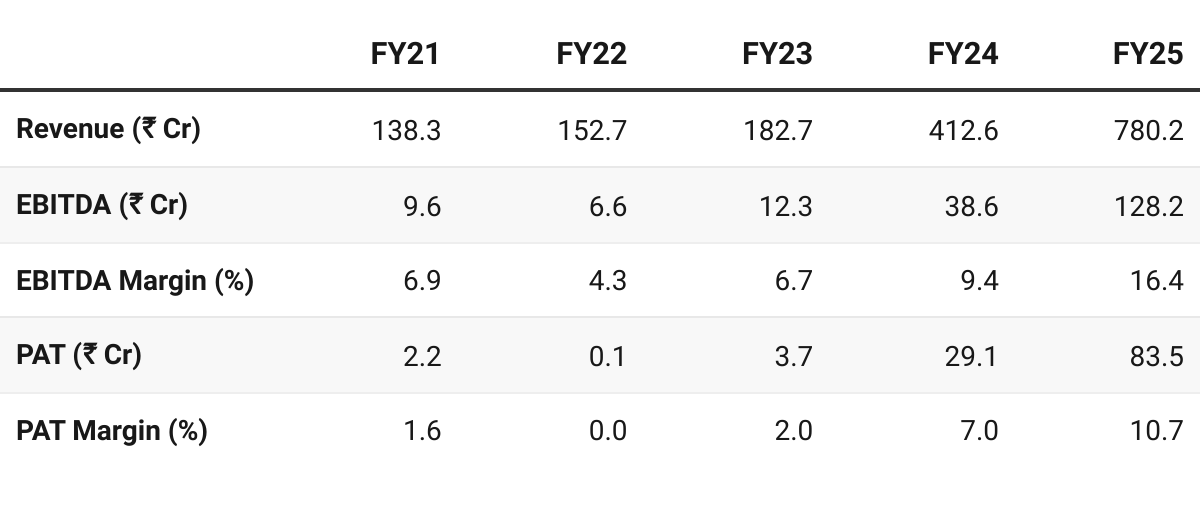

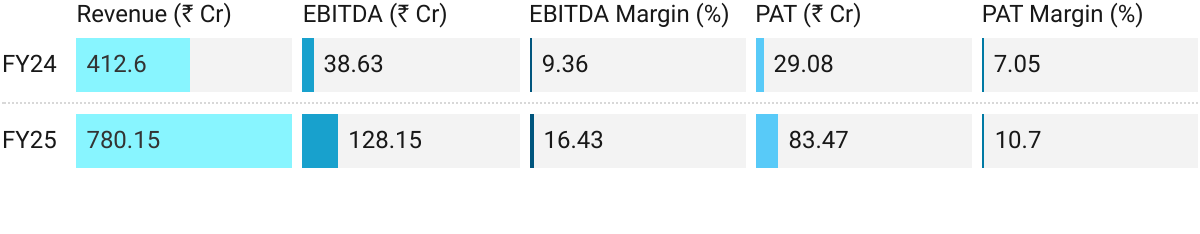

Minimum Purchase = 200 stocks = ₹2.6+ lakh required to enter2. FY21–25: PAT CAGR of 148% & Revenue CAGR of 54%

3. FY25: PAT up 547% & Revenue up 193% YoY

Modules ~₹660 Cr (≈450 MW sold), Pumps/EPC ~₹120 Cr

Capacity doubled to 1.2 GW, aluminum backward integration initiated, cell line under construction.

Module capacity scaled to 1.2 GW at Greater Noida.

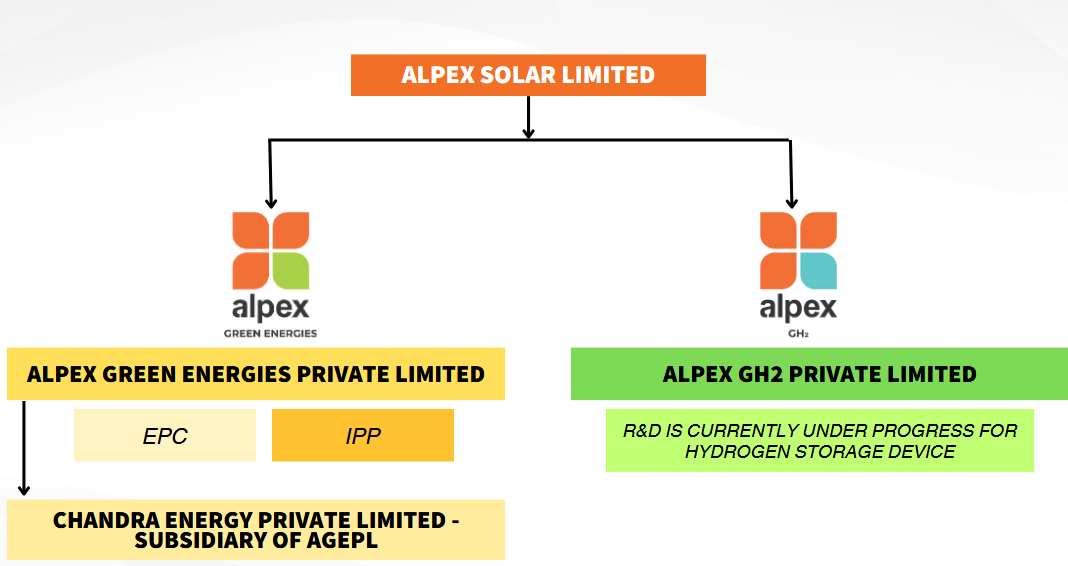

Subsidiaries created (EPC/IPP, GH2).

Alpex Green Energy that carries out EPC and IPP efforts.

Chandra Energy Private Limited, a wholly-owned subsidiary of Alpex Green Energy, handling a few IPP agreements.

Alpex GH2 Private Limited is undertaking R&D in hydrogen storage devices space.

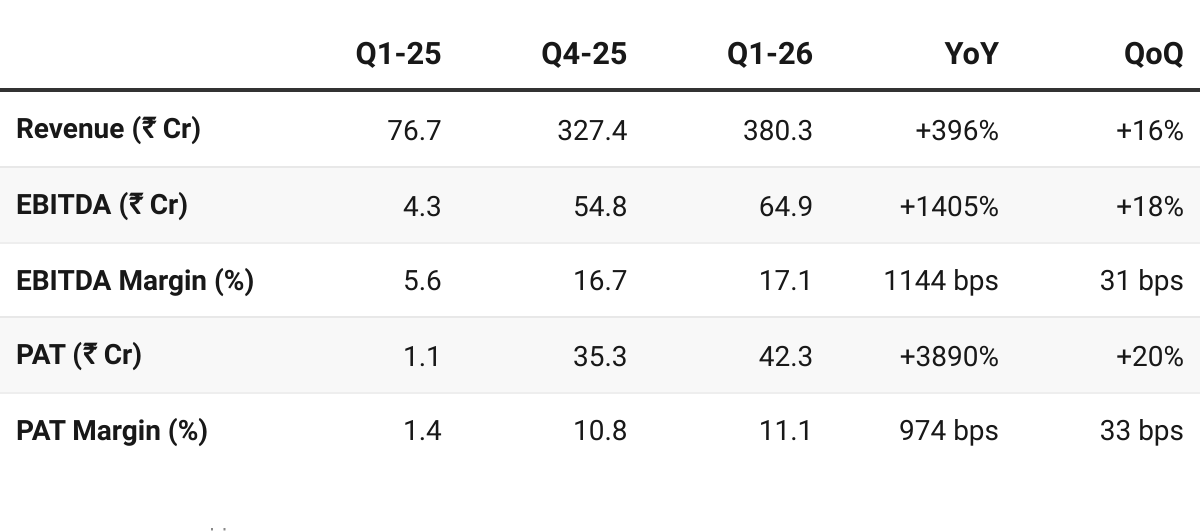

4. Q1 FY26: PAT up 3890%, Revenue up 396% YoY

PAT up 20% & Revenue up 16% QoQ

Business Mix: Modules — 94% of revenue. EPC / Pumps — ~6%

Company is gradually scaling EPC (95 MW target for FY26) and preparing IPP rollouts.

Secured orders worth Rs. 989 Crore from three leading manufacturers

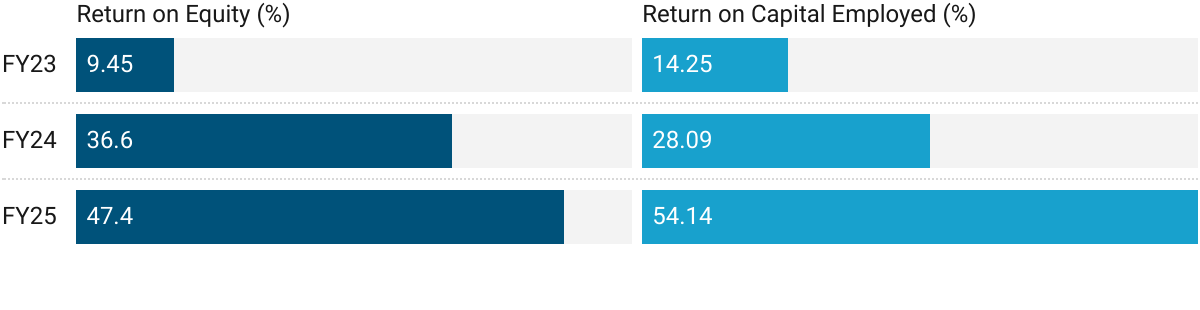

5. Business Metrics: Strong Return Ratios

6. Outlook: 100% Revenue CAGR till FY27

6.1 Guidance

FY26: at our previous investor calls or conferences, we have said that we have given a guidance that we will grow 2x.

FY27: So, yes, 2x is our target, but we feel that we might grow slightly better than that, but our guidance is 2x only

Longer Term Margins: EBITDA levels are around 35% and net profit margins are around 25%. So, we also will have a similar kind of margins

Order book of almost Rs.1,600 crores and this needs to be concluded by the 31st of March and one quarter is already over, so, there will be some spillover also and because we are on the only in the fifth month of this year.

Doubling revenues in FY26 and FY27 respectively. Order book in place to support 2X revenue for FY26

Once cell line integration kicks in (from FY27), EBITDA margins are expected to expand to ~35% and PAT margins to ~25%.

Full year impact of the 35/25% margins should be visible in FY28

Capacity Expansion

Our solar panel manufacturing capacity is standing at 1.2 GW, soon to be expanded

Over the next two years we are looking at increasing our solar module manufacturing capacity to 3.6 GW cumulative, setting up a new 1.6 GW solar cell line, manufacturing 12,000 MT of aluminum frame every year, and also carrying out 150 MW of EPC installations as well as 100 MW of IPP agreements.

Modules:

1.2 GW operational (Greater Noida).

Additional 1.2 GW to be commissioned by Nov’25 (Eco-tech, Greater Noida).

Third 1.2 GW line at Kosi by FY27 → Total 3.6 GW module capacity by FY27.

Cells:

1.6 GW solar cell line at Kosi in 3 phases:

500 MW by Mar’26,

500 MW by Jul’26,

600 MW by Dec’26.

Technology: Mono PERC initially, with planned migration to Topcon when market-ready.

Aluminum Frames: 12,000 T capacity across Greater Noida + Mathura units (fully backward-integrated).

EPC: 150 MW target by FY27 (15 MW done in FY25, 95 MW in FY26, balance in FY27).

IPP: 100 MW target by FY27 (60 MW in FY26, 40 MW in FY27).

Green Hydrogen R&D: Early-stage (Alpex GH2). Commercial rollout expected later, beyond FY27.

6.2 Q1 FY26 vs FY26 Guidance — Alpex Solar

On-track FY26 guidance on revenue growth

Strong Start: Q1 revenue ₹380 Cr already delivers ~25% of full-year guidance; annualizing Q1 suggests ~₹1,500 Cr run-rate, in line with management’s 2× guidance.

Profitability Ahead of Curve: 17% EBITDA / 11% PAT margins in Q1 are above FY25 averages (16.4% / 10.7%), signaling upside to guidance if maintained through FY26.

Execution Visibility: Order book (~₹1,600 Cr) comfortably covers FY26 revenue guidance, with additional orders expected.

Q1 FY26 performance is tracking its guidance on both revenue momentum and margin profile. With ~₹1,600 Cr orders in hand, additional module capacity kicking in by Nov’25, and strong EPC/IPP contribution, the company appears well positioned to meet its FY26 guidance of ₹1,500–1,600 Cr revenue and stable-to-improving margins.

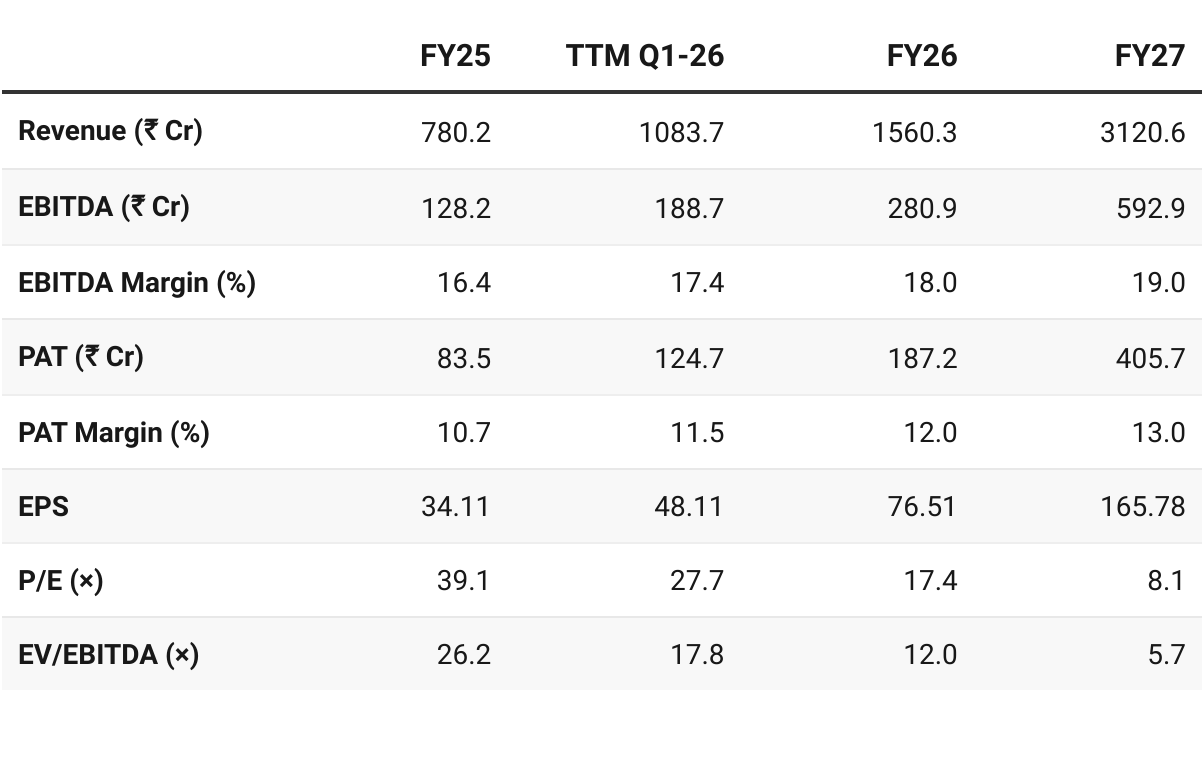

7. Valuation Analysis

7.1 Valuation Snapshot — Alpex Solar

CMP ₹1334; Mcap ₹3,260.35 Cr;

Attractive Forward Valuation:

Near-Term (FY26): At ~17× P/E, valuations look fair relative to growth visibility.

Medium-Term (FY27):

Rich multiples compress rapidly as earnings scale

Materially undervalued — if guidance is achieved.

If ₹3,000 Cr+ revenue and ₹400 Cr+ PAT materialize, stock could see significant re-rating (8× P/E is deep value vs growth peers).

Looking reasonably priced on FY26E and potentially undervalued on FY27E, provided execution stays on track. Multiples leave room for re-rating as APS transitions from a Gujarat-focused rooftop player to an integrated solar manufacturer.

7.2 Opportunity at Current Valuation

Order Book & Growth Visibility: With a confirmed order book of ~₹1,600 Cr (already covering FY26 guidance) and expanding module + cell capacities, Alpex has clear visibility on 2× revenue growth in FY26 and FY27.

Margin Expansion from Integration: Current margins (EBITDA 16–18%, PAT 11–12%) are set to expand as the 1.6 GW cell line comes online by FY27, potentially pushing margins to 25–35% EBITDA and 20–25% PAT — significantly higher than today.

Valuation Compression: At CMP, Alpex trades at 17× FY26E P/E and 8× FY27E P/E, with EV/EBITDA dropping from 26× in FY25 to just 5–6× by FY27. If execution sustains, this creates room for valuation re-rating.

Alpex Solar offers a rare mix of hyper-growth + margin expansion + valuation compression. If FY27 guidance is achieved, the stock could see significant upside and re-rating potential.

7.3 Risk at Current Valuation

Execution Risk: Large capex (₹642 Cr for cells, ~₹110 Cr for modules) requires timely commissioning and ramp-up. Any delays in module/cell expansion (Nov’25 and Mar–Dec’26 milestones) could push growth targets out.

Competitive Intensity: Several new players are entering with lower-cost/second-hand lines from China. While policy support is strong, pricing pressure could emerge, impacting realizations and margins.

This is a real threat and we are assuming significantly lower margins than the 35/25% EBITDA/PAT margins indicated by management

Technology Transition: Current focus is on Mono PERC, while global leaders are moving to Topcon/HJT. A delayed transition could risk technology obsolescence and lower ASPs.

Order Execution & Cash Flow: EPC/IPP businesses have longer cycles, with working capital needs. While management has managed receivables well so far, scaling EPC/IPP could pressure cash flows.

Policy/Regulatory Risk: While current policy is favorable (import bans, ALMM, ALCM), any relaxation or WTO challenges could reopen imports and reduce domestic pricing power.

While Alpex Solar’s growth path is compelling, investors must monitor execution timelines, competitive pricing, and technology shifts. The stock is priced for high growth — any slip could slow the re-rating.

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer