AGI Greenpac: PAT growth of 22% & Revenue growth of 13% in 9M-24 at PE of 18

AGI is proxy to increasing alcohol consumption in India. Potential of AGI revenue doubling by FY26 through the HNG acquisition makes it interesting. Standalone basis AGI expected to grow at 13-15%

1. Packaging Products Company: Glass bottles & containers manufacturing

agigreenpac.com | NSE : AGI

Packaging Products Segment: Consisting of Container glass business, PET bottles & products business and counterfeit resistant security caps and closure business

20% market share in organised glass packaging industry

Hindustan National Glass (HNG) Acquisition by AGI

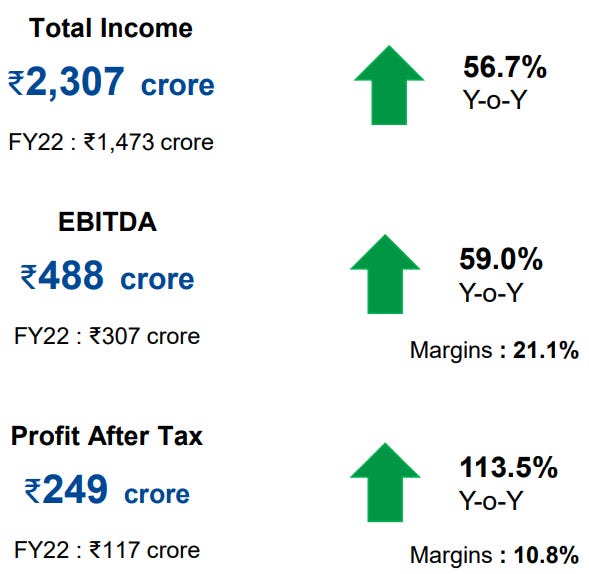

2. FY20-23: Pick up in FY23

3. Strong FY23: PAT up 113% and Revenue up 57% YoY

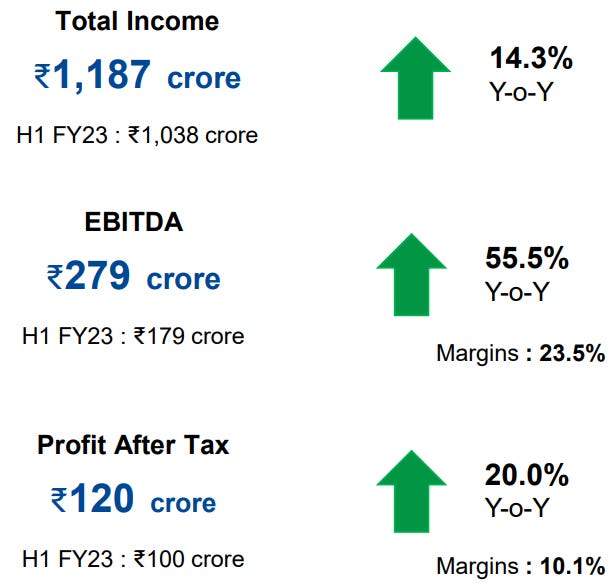

4. H1-24: PAT up 20% & Revenue up 14% YoY

5. Q3-24: PAT up 26% & Revenue up 10% YoY

PAT up 20% & Revenue up 1% QoQ

6. 9M-24: PAT up 22% and Revenue up 13% YoY

7. Business metrics: Solid return ratios improving YoY

8. Outlook: Revenue growth of 13-15%

i. FY24: Revenue growth of 13-15%

Ex of HNG acquisition 13-15% growth is possible in the medium term. The realizations is linked to raw material prices. Reduction in raw material prices is leading to trimming of revenue guidance but margins are intact.

trimmed its revenue guidance for the current financial year (FY24) to 13-15% from 15-18%.

ii. FY26: Top-line to double increase on account of HNI acquisition

If HNG acquisition comes thru the revenue run rate will of Rs 5,000 cr in FY25. But Rs 5,000 cr revenue will be achieved in FY26

ii. EBITDA Margins 21-23% vs 23.8% in 9M-24

But medium to long term we feel EBITDA margins ranging 21%-23% based on the current market conditions they are justifiable margins.

9. PAT growth of 22% & Revenue growth of 13% in 9M-24 at a PE of 18

10. So Wait and Watch

If I hold the stock then one may continue holding on to AGI

Coverage of AGI was initiated after Q2-24 results. The investment thesis has not changed after a strong 9M-24. The only changes are the delivery of a strong Q3-24 and the increased confidence in the management to deliver a stronger FY24

The outlook for FY25 of 13-15% top-line growth is nothing exciting. The potential for AGI to double its top-line to Rs 5,500+ cr by FY26 is what makes it exciting. The doubling is dependent on the HNG acquisition going through and delivering the promised numbers. Hence developments on HNG needs to be tracked closely.

Even if the HNG acquisition does not go thru, the current business can sustain its current valuations support the 20%+ PAT growth seen in 9M-24

Industry tailwinds in place, as AGI is optimistic about the benefits of premiumization in alcohol businesses due to demographic and economic evolution of the country. AGI is one of the best proxy to play increasing consumption of alcohol in India.

For the second year in a row, Diageo India honored AGI Greenpac Limited with the Supplier of the Year award

11. Or, join the ride

If I am looking to enter AGI then

AGI has delivered PAT growth of 22% & Revenue growth of 13% in 9M-24 at a PE of 18 which makes valuations acceptable.

Potential to double revenue run-rate in FY25 over FY24 expected revenue is where the opportunity lies in the stock. However, one needs to keep a close watch on the HNG acquisition coming thru on time

The HNG acquisition is expected to be EPS accretive. It would make AGI quite attractive from a FY25 perspective.

From a risk management perspective, AGI can sustain its current valuations without the planned HNG acquisition.

Previous coverage of AGI

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer