AGI Greenpac: PAT growth of 20% & Revenue growth of 14% in H1-24 at PE of 19

Outlook of revenue growth of 15-18% till FY25 & ~20% PAT growth in FY24. The potential of AGI revenue going 2X in FY26 with the HNG acquisition coming thru makes it an interesting stock idea

1. Glass bottles and containers manufacturing

agigreenpac.com | NSE : AGI

Packaging Products Segment: Consisting of Container glass business, PET bottles & products business and counterfeit resistant security caps and closure business

20% market share in organised glass packaging industry

Hindustan National Glass (HNG) Acquisition by AGI

2. FY20-23: Pick up in FY23

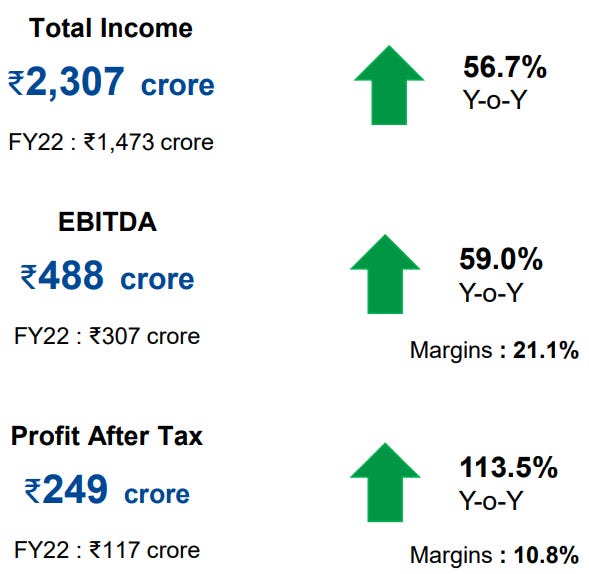

3. Strong FY23: PAT up 113% and Revenue up 57% YoY

4. Weak Q1-24: PAT down 4% and Revenue up 6% YoY

5. Strong Q2-24: PAT up 65% & Revenue up 21% YoY

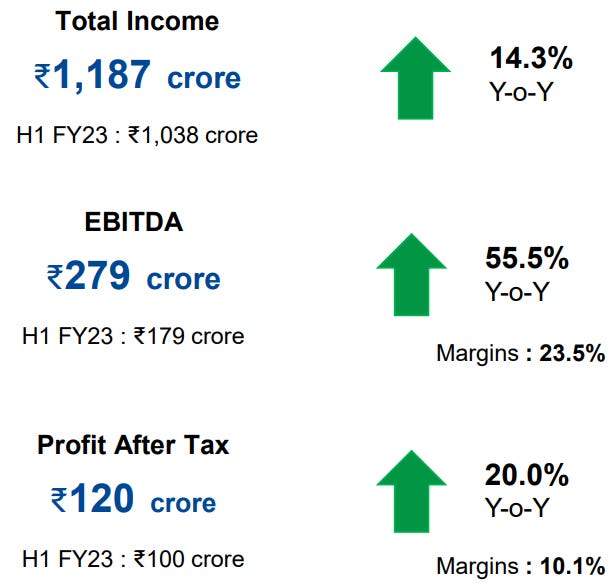

6. H1-24: PAT up 20% & Revenue up 14% YoY

7. Business metrics: Solid return ratios improving YoY

8. Outlook: Revenue growth of 15-18% till FY25

i. FY24: Revenue growth of 15-18%

We have given guidance that based on the last year, we should be able to maintain our growth momentum range from 15% to 18% growth.

ii. FY24: ~20% PAT growth

H1-24 EBITDA margins of 23% looks sustainable which is higher than the 21%+ EBITDA margins in FY23. This implies bottom-line to grow faster than the top-line and the 20% growth in PAT for H1-24 looks reasonable from FY24 perspective.

iii. FY25: Top-line growth to be maintained in the same range as FY24

Next year, another furnace is coming up for relining and we see an opportunity for further expanding the capacity there by 50 to 100 tons depending on how the whole thing works around. That's how we continue to gain the momentum on sales growth as such. Obviously, the product mix will play a very critical role as we move forward. That can give us a huge opportunity in terms of maintaining our growth, even with the marginal increment in the volumes we can continue the momentum on the sales

iii. FY26: Top-line to double increase on account of HNI acquisition

Post the acquisition we feel that in the next 2 to 3 years once the acquisition is done and we slowly ramp up the furnaces which are in a not that good situation today, we should have a total combined sales ranging ₹5,500+ crores.

9. PAT growth of 20% & Revenue growth of 14% in H1-24 at a PE of 19

10. So Wait and Watch

If I hold the stock then one may continue holding on to AGI

Based on H1-24 performance, AGI looks on track to deliver a strong FY24.

The outlook for FY25 of 15-18% top-line growth is nothing exciting. The potential for AGI to double its top-line to Rs 5,500+ cr by FY26 is what makes it exciting. The doubling is dependent on the HNG acquisition going through and delivering the promised numbers. Hence developments on HNG needs to be tracked closely.

11. Or, join the ride

If I am looking to enter AGI then

AGI has delivered PAT growth of 20% & Revenue growth of 14% in H1-24 at a PE of 20 which makes valuations acceptable.

Outlook for PAT growth of 20%+ & revenue growth of 15-18% in FY24 makes the valuations acceptable.

Outlook for revenue growth of 15-18% in FY25 makes the valuations acceptable.

Potential to double revenue in FY26 over FY23 is where the opportunity lies in the stock. However, one needs to keep a close watch on the HNG acquisition coming thru on time

The HNG acquisition is expected to be EPS accretive. It would make AGI quite attractive from a FY26 perspective.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action.