Aditya Birla Money: PAT growth of 56% & Revenue growth of 48% in FY24 at PE of 13

BIRLAMONEY delivered PAT CAGR of 45% & Revenue CAGR of 24% for FY20-23. BIRLAMONEY delivered QoQ growth in revenue & PAT in all the 4 quarters of FY24. Absence of management commentary is a challenge

1. Equity & derivatives broking services; Portfolio Management Services

stocksandsecurities.adityabirlacapital.com | NSE : BIRLAMONEY

Aditya Birla Money Ltd (ABML) is present in equity broking, commodity broking, depository services, PMS (portfolio management services) and distribution of products like mutual funds, insurance and loans of Aditya Birla group companies.

The revenue sources are well-diversified encompassing retail and institutional broking, fair value gains from wholesale debt market and portfolio management services.

Aditya Birla Capital Ltd, the holding company for the financial services business of the Aditya Birla Group, is the promoter of BIRLAMONEY.

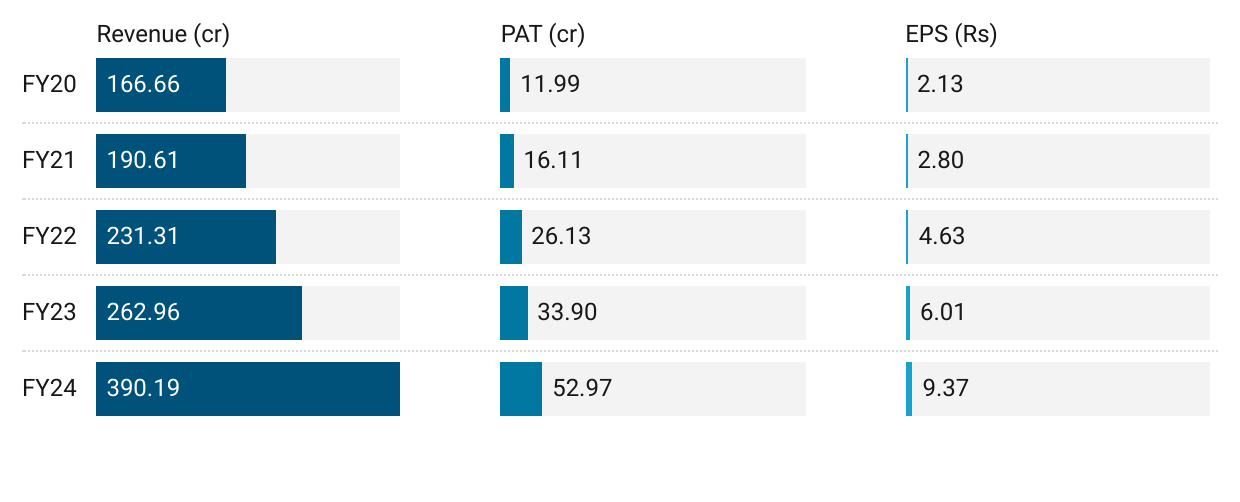

2. FY20-23: PAT CAGR of 45% and Revenue CAGR of 24%

3. Strong FY23: PAT up 30% and Revenue up 14% YoY

4. Strong 9M-24: PAT up 38% & Revenue up 40% YoY

5. Strong Q4-24: PAT up 124% & Revenue up 73% YoY

PAT up 9% & Revenue up 13% QoQ

6. Strong FY24: PAT up 56% & Revenue up 48% YoY

FY24 strong than FY23

7. Business metrics: Strong return ratios

8. Outlook: Expecting of continuation of FY20-24 trend

No management commentary is available on BIRLAMONEY

In the absence of management commentary one is expecting the continuation of the long term trend of PAT CAGR of 40%+ as delivered during FY20-24.

9. PAT growth of 56% & Revenue growth of 48% in FY24 at a PE of 13

10. So Wait and Watch

If I hold the stock then one may continue holding on to BIRLAMONEY

BIRLAMONEY has delivered the strongest top-line and PAT in FY24

BIRLAMONEY is in the middle of a strong run. For all the 4 quarters of FY24, BIRLAMONEY has delivered QoQ and YoY growth in the top-line and PAT.

11. Or, join the ride

If I am looking to enter BIRLAMONEY then

BIRLAMONEY has delivered PAT growth of 56% & Revenue growth of 48% in FY24 at a PE of 13 which makes valuations quite attractive.

Outlook for 40% PAT growth in FY25 based on historic PAT CAGR of 40%+ at a PE of 13 makes the valuations quite attractive from a longer term perspective.

In the absence of management commentary, the key question is will the performance of BIRLAMONEY in FY24 carry into FY25. If yes, then there exists potential for multi-bagger returns in this stock idea.

Previous coverage of BIRLAMONEY

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Brokerage business is booming, given the increased participation from Retail Investors in India. Almost all brokers are having a sunshine moment. This of course is linked to markets, so may not be a Buy and hold buy (my opinion, could be wrong). Thanks for sharing nonetheless !