Action Construction Equipment: PAT growth of 27% & revenue growth of 15% in 9M-25 at a PE of 36

Guidance of 15% revenue growth in FY25 followed by 28% growth in FY26. FY25-27 revenue CAGR of 26. 3X revenue by FY29 at revenue CAGR of 25%. Capacity in place to support revenue targets

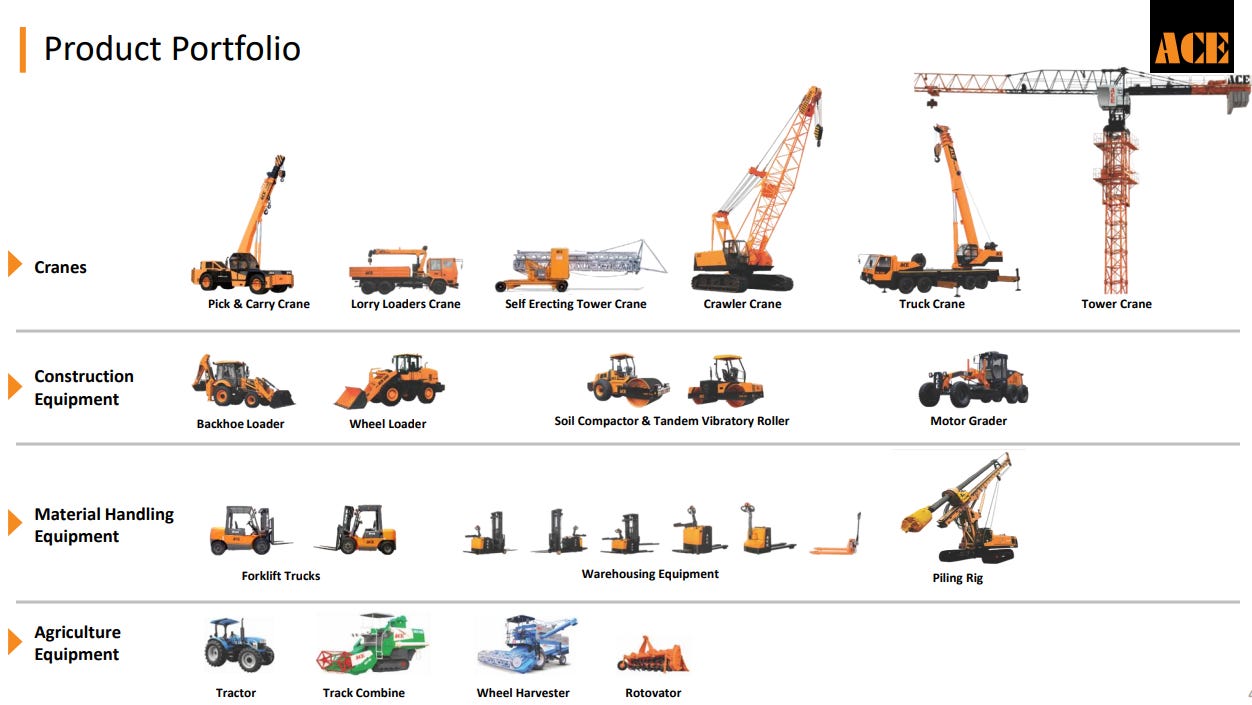

1. World’s largest Pick & Carry Crane Manufacturer

ace-cranes.com | NSE: ACE

The company is the world’s largest Pick & Carry cranes manufacturer with over 63% market share in the Mobile cranes segment in the country and a majority market share of more than 60% in Tower Cranes segment domestically.

2. FY21-24: PAT CAGR of 60% & Revenue CAGR of 34%

3. Strong FY24: PAT up 90% & Revenue up 36% YoY

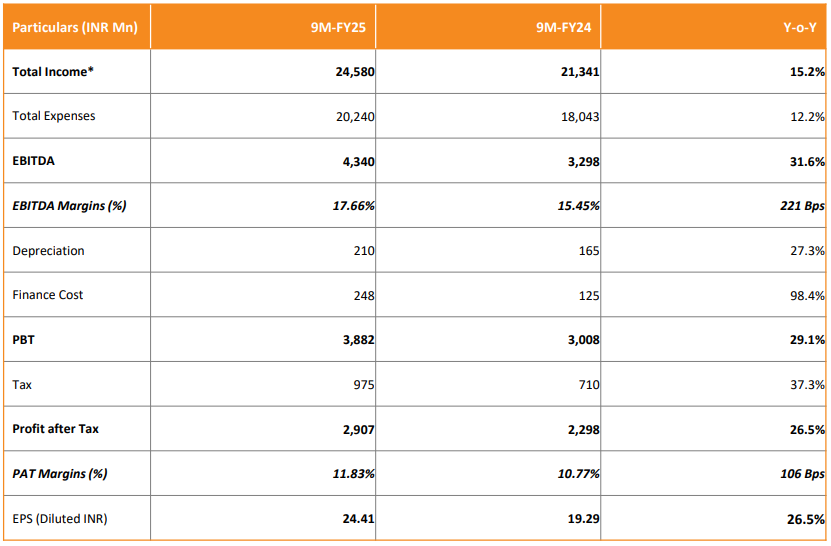

4. Q3-25: PAT up 27% & Revenue up 17% YoY

PAT up 18% & Revenue up 15% QoQ

5. 9M-25: PAT up 27% & Revenue up 15% YoY

6. Business metrics: Strong & improving return ratios

7. Strong outlook: Revenue CAGR of 23% for FY24-27

i. FY25: 15% revenue growth

On the whole, we are looking at a growth of around 15%- plus with a stability in EBITDA margins at current levels.

ii. FY25: Stable EBITDA margins with scope of expansion

So we would like to have a little bit of stability in the current EBITDA margins. Of course, there is a scope because of operating leverage and pricing actions. There is a scope of a little bit of expansion also, but as of now, we would like to guide that the EBITDA margins will remain stable at the current levels.

iii. FY26: Revenue growth of 28%

With 15% growth in FY25, the FY25 expected revenue of Rs 3440 cr growing to Rs 4400 cr by FY26 implies a revenue growth of 28%

Keeping FY23 as base from INR 2,200 crores, we really expect to double ourselves by FY26 to INR 4,400 crores

So we said that whatever we had achieved in FY '23, we are going to double that by FY '26. More or less, that's the medium-term guidance, and we are sticking to that as of now.

iv. FY25-FY27: Revenue CAGR of 26%

The FY25 expected revenue of Rs 3440 cr growing to Rs 5500 cr by FY27 implies a revenue CAGR of 26%

Keeping FY23 as base from INR 2,200 crores, we really expect to double ourselves by FY26 to INR 4,400 crores and going forward to up to INR 5,500 crores in FY27.

v. FY24-FY29: Triple FY24 revenue by FY29. Revenue CAGR of 25%

8. PAT growth of 27% & Revenue growth of 15% in 9M-25 at a PE of 36

9. Hold?

If I hold the stock then one may continue holding on to ACE

ACE management revised FY25 growth downwards from 15-20% to about 15%. However, ACE management is holding on to its FY26 guidance of doubling revenue on FY23 base by FY26.

The revenue targets set for FY26 (Rs 4,400 cr), FY27 (Rs 5,500 cr) to tripling revenue by FY29 (Rs 8,973 cr) provides a strong outlook to continue with ACE.

ACE has the capacity to deliver on the growth promised till FY27 i.e. Rs 5500 cr.

So as of now, the current capacity by the end of this quarter, which will be operational, will be close to INR5,000 crores to INR5,100 crores.

But with nominal capex, we can further increase this INR5,100 crores to, let's say, INR600 crores more

The roadmap of 23% revenue CAGR for FY24-27 provides a reason to continue with ACE. With bottom-line growth to be higher than the top-line growth one can see opportunity over the longer term.

And the short-term, medium-term, long-term fundamentals and potential of the company seem to be on track with respect to our growth agenda.

10. Buy?

If I am looking to enter ACE then

ACE has delivered PAT growth of 27% and revenue growth of 15% in 9M-25 at a PE of 36 which makes the valuations fully valued in the short term.

With the guidance of revenue growth of 15%+ in FY25 the valuations of ACE at PE of 36 looks fully valued from a FY25 term perspective.

With an outlook of revenue growth of 28% for FY26 the valuations of ACE at PE of 36 looks reasonable from a FY26 perspective.

With an outlook of revenue CAGR of 25% for FY24-29 the valuations of ACE at PE of 36 looks reasonable from a longer term perspective.

The opportunity in ACE is dependent over consistent execution over the long term. One may see limited opportunities in ACE in the short-term at a PE of 36. Additionally one can see a reaction in case execution is not in line with targets set out by the management. One may look at ACE as a longer term opportunity.

Previous Coverage of ACE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Spectacular Set of Q3 Numbers With Margin Improvement, but as you mentioned Fully Priced in at 36x Times P/E.