Action Construction Equipment: PAT growth of 27% & revenue growth of 13% in H1-25 at a PE of 45

Guidance of 15+ revenue growth in FY25 with stable margins. Ambition to 2X revenue by FY26. Revenue of Rs 5500 cr by FY27. 3X revenue by FY29. Capacity expansion in place to support revenue targets

1. World’s largest Pick & Carry Crane Manufacturer

ace-cranes.com | NSE: ACE

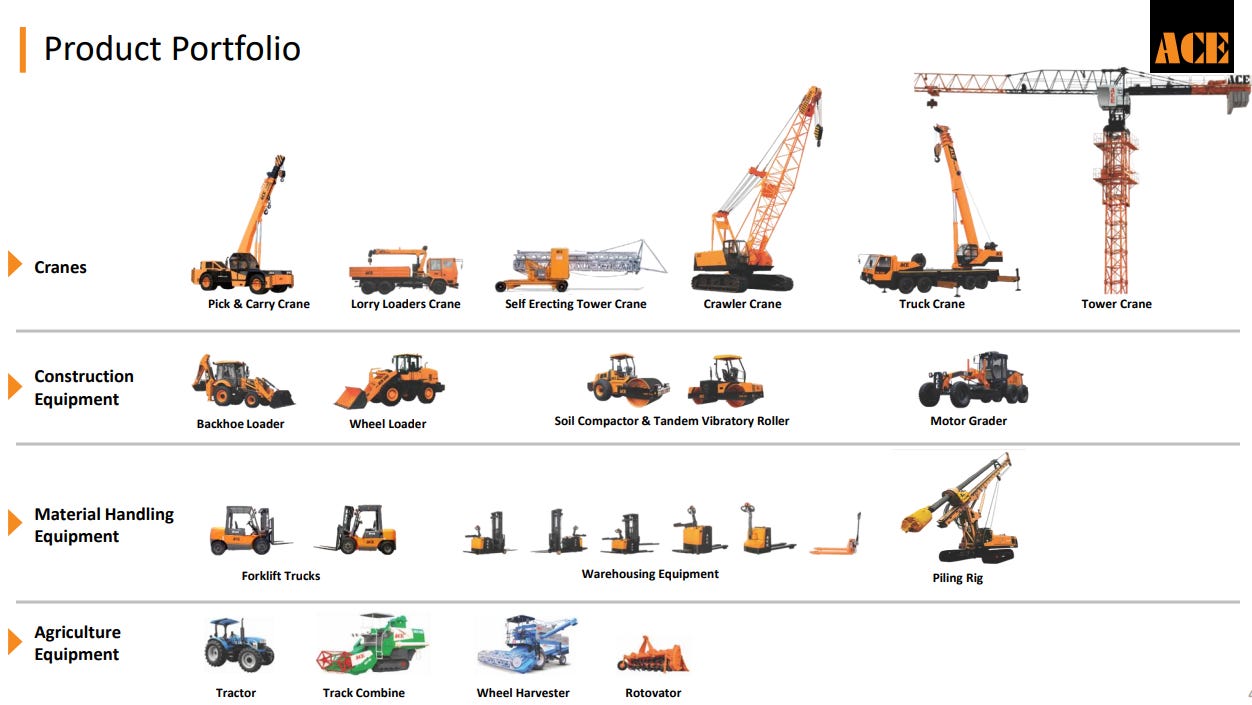

The company is the world’s largest Pick & Carry cranes manufacturer with over 63% market share in the Mobile cranes segment in the country and a majority market share of more than 60% in Tower Cranes segment domestically.

2. FY21-24: PAT CAGR of 60% & Revenue CAGR of 34%

3. Strong FY24: PAT up 90% & Revenue up 36% YoY

4. Q2-25: PAT up 28% & Revenue up 12% YoY

PAT up 13% & Revenue up 3% QoQ

5. H1-25: PAT up 27% & Revenue up 13% YoY

6. Business metrics: Strong & improving return ratios

7. Strong outlook: Revenue CAGR of 23% for FY24-27

i. FY25: 15+ revenue growth

ACE management has revised FY25 guidance to 15%+ growth from the previous guidance of 15-20% revenue growth.

On the whole, we are looking at a growth of around 15% plus with stability in EBITDA margins at current levels.

With some prebuying of BS III and BS IV machines happening as BS V kicks in, in January that should also add to our revenue growth in quarter 3 and on a whole year basis, I think we are committed to at least a 15%-plus scenario with respect to our revenue, which can reach up to 20%, that time will tell

ii. FY25: Stable EBITDA margins with scope of expansion

Several factors suggest the company may be able to expand margins further.

Experiencing favourable shifts in product mix, with higher tonnage cranes and multi-activity cranes (for which the company holds patents) gaining traction.

New emission standards, which will increase the price of all machines, will also result in margin expansion, assuming the company can fully pass on the increased engine costs to customers.

Thirdly, there is potential to increase margins in the spare parts business, which the company acknowledges is currently under-penetrated.

iii. FY24-FY26: Revenue CAGR of 20%+

FY24 revenue of Rs 2909 cr growing to Rs 4400 cr by FY26 implies a revenue CAGR of 21% for FY24-26

Keeping FY23 as base from INR 2,200 crores, we really expect to double ourselves by FY26 to INR 4,400 crores

iv. FY24-FY27: Revenue CAGR of 23%

FY27 revenue of Rs 5,500 cr from Rs 2990.9 cr in FY24 implies a FY24-27 CAGR of 23%.

Keeping FY23 as base from INR 2,200 crores, we really expect to double ourselves by FY26 to INR 4,400 crores and going forward to up to INR 5,500 crores in FY27.

v. FY24-FY29: Triple FY24 revenue by FY29. Revenue CAGR of 25%

8. PAT growth of 27% & Revenue growth of 13% in H1-25 at a PE of 46

9. Hold?

If I hold the stock then one may continue holding on to ACE

ACE management is confident of a strong FY25 even thought H1-25 was slow. Management is is confirming that business momentum has already started picking up.

This year has been slightly slower as compared to what we would have planned. But it was evident that first half will be slow mainly because of elections and then obviously, monsoons. And second half has already started picking up and about 55% of our revenue generally comes in the second half.

Management is confident in its future prospect and is investing in capex to increase revenue capacity from Rs 4,500 cr to Rs 5,100 cr.

The company currently has a revenue capacity of around INR4,500 crores, which is set to increase by an additional INR600 crores through the ongoing capacity expansion, bringing the total to over INR5,100 crores by quarter 4 of current financial year.

The roadmap of 23% revenue CAGR for FY24-27 provides a reason to continue with ACE. With bottom-line growth to be higher than the top-line growth one can see opportunity over the longer term.

And the short-term, medium-term, long-term fundamentals and potential of the company seem to be on track with respect to our growth agenda.

10. Buy?

If I am looking to enter ACE then

ACE has delivered PAT growth of 27% and revenue growth of 13% in H1-25 at a PE of 46 which makes the valuations fully valued in the short term.

With the guidance of revenue growth of 15%+ in FY25 the valuations of ACE at PE of 46 looks fully valued from a FY25 term perspective.

With an outlook of revenue CAGR of 23% for FY24-27 the valuations of ACE at PE of 46 looks reasonable from a long term perspective.

With an outlook of revenue CAGR of 25% for FY24-29 the valuations of ACE at PE of 46 looks reasonable from a longer term perspective.

As ACE grows to a Rs 5,500 cr business the PAT growth will be higher than the revenue growth of 23% as margin expansion is expected with every Rs 500 cr of incremental revenue. With bottom line growing faster than the top-line growth of 23% for FY24-27 the valuations of ACE at PE of 45 provide an opportunity from a long term perspective.

we have been saying that with the increased capacity utilization, every INR500-odd crores of revenue at around 75 basis points to our bottom line 75 to 100. Owing to that, we can see incremental EBITDA levels of around 125 to 150 basis points because of increased capacity utilizations.

One may see limited opportunities in ACE in the short-term at a PE of 45. Additionally one can see a reaction in case of a weak quarter given that the PE is 45. One may look at ACE as a longer term opportunity.

Previous Coverage of ACE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer