Action Construction Equipment: PAT growth of 25% & revenue growth of 14% in Q1-25 at a PE of 45

Guidance of 15-20% revenue growth in FY25 with scope of guidance revision. 3X revenue by FY29 on the base of FY24.

1. World’s largest Pick & Carry Crane Manufacturer

ace-cranes.com | NSE: ACE

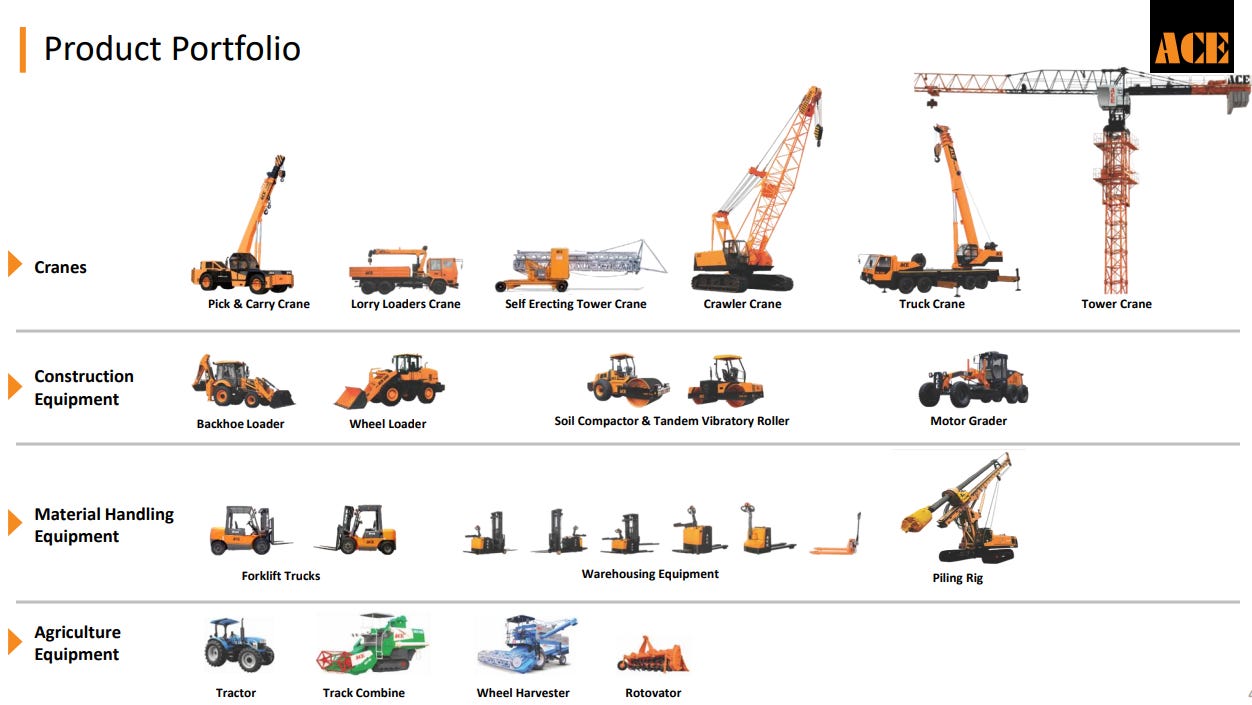

The company is the world’s largest Pick & Carry cranes manufacturer with over 63% market share in the Mobile cranes segment in the country and a majority market share of more than 60% in Tower Cranes segment domestically.

2. FY21-24: PAT CAGR of 60% & Revenue CAGR of 34%

3. FY23: PAT up 65% & Revenue up 34%

4. Strong FY24: PAT up 90% & Revenue up 36% YoY

5. Q1-25: PAT up 25% & Revenue up 14% YoY

6. Business metrics: Strong & improving return ratios

7. Strong outlook: Revenue CAGR of 23% for FY24-27

i. FY25: 15-20% revenue growth

Guidance of 15-20% revenue growth with scope for and upward revision

In the current year, we are hopeful of at least 15%, 20% growth, if not more.

We should definitely be in a position to further advise with respect to our -- revise our projections by end of quarter 2 or early quarter 3, and we are hopeful that we have positive news for you.

ii. FY25: EBITDA margins at 16-17%

Growing in this year with a 16% to 17% EBITDA margin, which looks really sustainable

iii. FY24-FY27: Revenue CAGR of 23%

FY27 revenue of Rs 5,500 cr from Rs 2990.9 cr in FY24 implies a FY24-27 CAGR of 23%.

Keeping FY23 as base from INR 2,200 crores, we really expect to double ourselves by FY26 to INR 4,400 crores and going forward to up to INR 5,500 crores in FY27.

iv. FY24-FY29: Triple FY24 revenue by FY29. Revenue CAGR of 25%

8. PAT growth of 25% & Revenue growth of 14% in Q1-25 at a PE of 45

9. So Wait and Watch

If I hold the stock then one may continue holding on to ACE

Coverage of ACE was initiated after Q3-24 results. The investment thesis has not changed after a strong FY24 even though the management the guidance of FY25 is conservative while the outlook till FY27 & FY29 looks unchanged.

Despite the big event of general elections, we have been able to register our best ever Q1, that is April to June quarterly performance. It is the best ever in the company's history.

Management was indicating for a slower Q1-25. However, growth is expecting to pick up from Q3-25. ACE is guiding for Rs 1,000 cr quarterly revenue from Q3-25 up from the Rs 857 cr quarterly revenue in Q4-24

Demand for the April and May maybe postponed to the second quarter.

But hopefully everything going well, Q3 we'll be able to touch the INR1,000 crores

We are expecting good sales in quarter 3 on account of prebuy because of transition to BS V norms.

The roadmap of 23% revenue CAGR for FY24-27 provides a reason to continue with ACE. With bottom-line growth to be higher than the top-line growth one can see opportunity over the longer term.

And the short-term, medium-term, long-term fundamentals and potential of the company seem to be on track with respect to our growth agenda.

10. Join the ride

If I am looking to enter ACE then

ACE has delivered PAT growth of 25% and revenue growth of 14% in Q1-25 at a PE of 45 which makes the valuations fully valued in the short term.

With the guidance of revenue growth of 15-20% in FY25 with the possibility of the guidance being revised upwards the valuations of ACE at PE of 45 looks fully valued from a FY25 term perspective.

With an outlook of revenue CAGR of 23% for FY24-27 the valuations of ACE at PE of 45 looks reasonable from a long term perspective.

With an outlook of revenue CAGR of 25% for FY24-29 the valuations of ACE at PE of 45 looks reasonable from a longer term perspective.

As ACE grows to a Rs 5,500 cr business the PAT growth will be higher than the revenue growth of 23% as margin expansion is expected with every Rs 500 cr of incremental revenue. With bottom line growing faster than the top-line growth of 23% for FY24-27 the valuations of ACE at PE of 45 provide an opportunity from a long term perspective.

we have been saying that with the increased capacity utilization, every INR500-odd crores of revenue at around 75 basis points to our bottom line 75 to 100. Owing to that, we can see incremental EBITDA levels of around 125 to 150 basis points because of increased capacity utilizations.

One may not see opportunities in ACE in the short-term at a PE of 45. Additionally one can see a reaction in case of a weak quarter given that the PE is 45. One may look at ACE as a longer term opportunity.

Previous Coverage of ACE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer