Zen Technologies: 134% revenue CAGR FY23-25 at a PE of 67. "Obscene growth" coming in next 4 years

Growing to 2X by FY24 and 6X by FY25 on FY23 revenue. Order book 5X+ FY23 revenue to be executed in 18 months. Strong growth visibility till FY25

1. Defence training & anti-drone solutions provider

zentechnologies.com |NSE: ZENTEC

2. Growth picking up from FY22

3. 200%+ growth in revenue and PAT in FY23

This year has been a strong one, as we achieved our highest-ever revenue.

4. Q1-24 growth momentum stronger than FY23

250%+ growth in revenue YoY

500%+ growth in PAT YoY

Performance for Q1FY24 has set a new record for us in terms of revenue and profitability. This strong performance in the quarter was driven by the successful execution of a significant part of the simulation export and domestic anti-drone orders

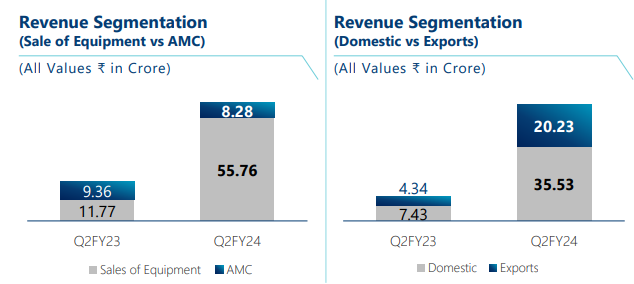

5. Q2-24 strong YoY, but very weak QoQ

Strong Q2-24 YoY: PAT up 170% & Revenue up 99%

Weak Q2-24 QoQ: PAT down 68% & Revenue down 50%

EBITDA margins down from 53% to 34% in Q2-24 is alarming

6. Strong H1-24 YoY: PAT up 376% & Revenue up 182%

7. Order book confirms, revenue visibility till FY25

Equipment order book 5.2X FY23 revenue to be executed in 18 months

Rs 1,208 cr of equipment orders to be delivered by FY25 with additional Rs 250 cr of AMC revenue and any new orders won and executed up to FY25

The total order book of ₹ 1,487 Cr, equipment orders worth ₹ 1,208 crores are slated for execution by 31st March 2025.

H2 started on a good note with order for training simulators worth ₹ 84 Cr received.

Still anticipating new orders.

Export market prospects are also bright.

Deliveries have started earlier than the timeline given in the contracts.

8. Outlook: 134% CAGR growth between FY23-25

i. Growth projections: Obscene growth! Fantastic coming four years

I don’t know how to give that number to you because internally what we are discussing is almost obscene, so I don’t want to share that with you. So, I will not give the number on that but just be assured that we actually feel it’s going to be fantastic three, four years coming four years.

ii. FY24 revenue ~ Rs 450 cr i.e. 2X of FY23 revenue

In line with our earlier guidance, we expect to achieve a revenue target of ₹ 450 crores during the current financial year

iii. FY25 revenue ~ Rs 1,200+ cr i.e. 6X of FY23 revenue

FY24 revenue guidance is Rs 450 cr and H1-24 achievement is 198.95 cr. Thus H2-24 revenue is expected to be Rs 251.05 cr.

H2-24 revenue + FY25 revenue = 1,487 cr

FY25 revenue = 1487- 251.05 = 1288.05 cr

out of the total order book of ₹ 1,487 Cr, equipment orders worth ₹ 1,208 crores are slated for execution by 31st March 2025

9. Outlook: 134% revenue CAGR FY23-25 at a PE of 67

10. So Wait and Watch

If I hold the stock then one must wait and watch for quarterly results to see if the company is on track deliver on guidance

Execution for H1-24 has been very strong.

Q2-24 was concerning on a QoQ basis and one needs to watch for the EBITDA margins in this euphoria of growth.

Its order book for the next 18 months is very strong. 18 months is not a long time to wait to see the execution play out

Grow to a revenue of Rs 450+ cr by FY 24

Grow to a revenue of Rs 1200+ cr by FY 25

H1-24 has been excellent and ZENTEC looks to be on track to meet the asking rate for FY24

Since initiation of coverage after Q1-24, the investment thesis by and large holds after Q2-24 results while keeping in mind the Q2-24 margins and weak QoQ performance.

11. Join the ride

If I am looking to enter the stock then

PE at 67 looks very high

However valuations are reasonable given that PE of 67 is for 134% revenue CAGR for FY23-25 makes ZENTEC very attractive

This is a story of 6X FY23 revenue in FY25 which plays out in the next six quarters. So the delivery and upside should come quickly.

On the flip side the margin for error is small. One bad quarter and the asking rate will become quite high. This aspect becomes important given that Q2-24 was weak on QoQ basis.

There is a margin of safety in the stock. Instead of delivering 134% revenue CAGR till FY25, if ZENTEC underdelivers and grows at less than half the guided rate say 100% CAGR, even then a PE of 67 provides a safety cushion.

Previous coverage of ZENTEC

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades