Yash Highvoltage H2 FY26: PAT up 119%, Ahead of FY26 Guidance

Guidance of 25-35% revenue CAGR for the next 5 years with stable margins. Valuations discount the growth till FY27. Opportunity if growth plays out for 5 years

1. Manufacturer — Transformer Bushings

yashhv.com | BSE - SME: 544310

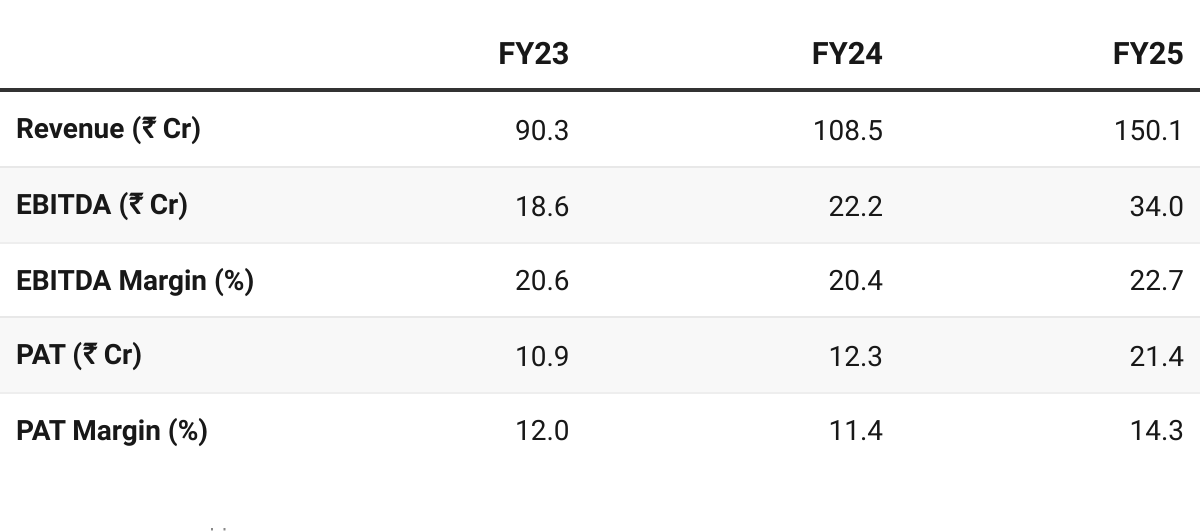

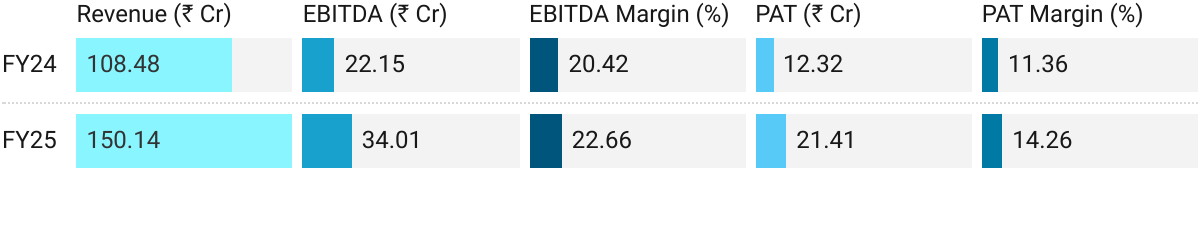

2. FY23–25: PAT CAGR of 40% & Revenue CAGR of 29%

3. FY25: PAT up 74% & Revenue up 38% YoY

Growth was driven by strong transformer-sector capex, higher export traction, and early benefits of operational leverage from its recent capacity additions.

Product Mix and Market Reach

RIP (Resin Impregnated Paper) Bushings contributed 70–80 % of revenue, OIP (Oil Impregnated Paper) ~15–16 %, and High-Current Bushings 4–5 %

RIP carry ~4× higher realization than OIP, supporting margin expansion.

Export share: ~35–40 % of OIP sales, primarily to 60 countries; exports nearly doubled YoY.

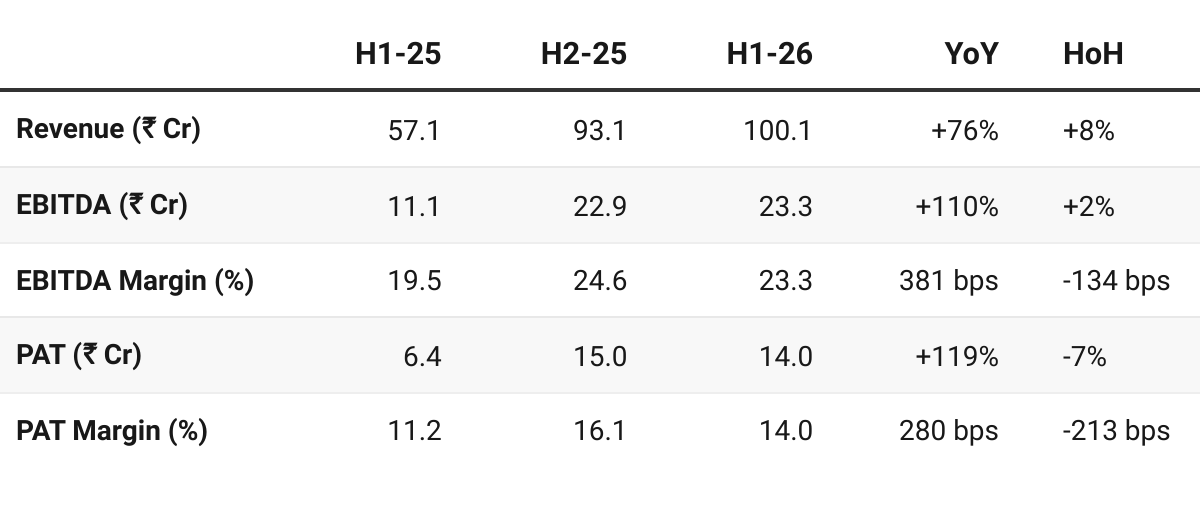

4. H1 FY26: PAT up 119%, Revenue up 76% YoY

H1 FY26 was driven by robust order inflows from both domestic and international power and infrastructure sectors, coupled with strong operational efficiency, and strategic capacity expansion.

Margins remained healthy, reflecting the company’s continued focus on manufacturing excellence and product diversification.

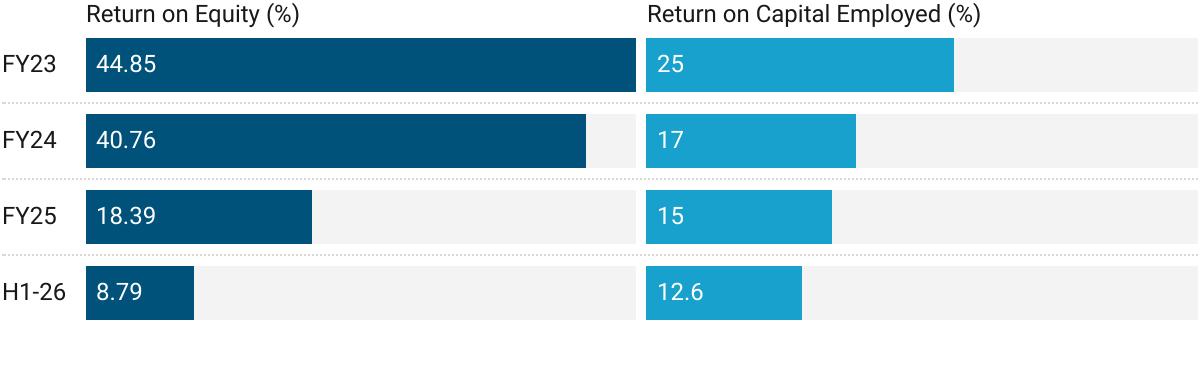

5. Business Metrics: Strong Returns

Returns muted by funds from IPO

6. Outlook: 25-35% Revenue CAGR for 5 years

6.1 Guidance

Backed by ongoing expansion projects, we envision multifold revenue growth over the next five years, targeting about 30% CAGR as new facilities come online post-FY27. The company expects strong demand momentum as global and domestic infrastructure investments grow, with improved efficiencies and cost reductions from backward integration

The new greenfield plant has a land area of 1.6 lacs sq. ft with built up area of 1.2 lac sq. ft in Vadodara and would be ready by H2 of next year with total outlay of Rs. 90 crores.

the next two years the Company has already got enough order book today and we have our supply chain in place for the next 1 1/2 or two years, so next one and half or two years we can easily maintain the growth rates what we have been growing historically growing at from 2008 onwards.

We can, you know, as I reasonably reach a top line of may be at least 3-4 four fold between now and at the end of the 5th year from today.

Strong Growth Visibility and Order Book Coverage

25–35% annual growth over FY26–FY27, backed by a healthy order book that already covers the next year’s revenue target.

Strategic Capacity Expansion (FY26 Commissioning)

Plant at Vadodara will commission by March 2026.

Raise total capacity from 9,000–10,000 to 15,000–16,000 bushings per year.

The new unit will manufacture RIP cores in-house—currently imported from Switzerland/China—enabling 40–45% raw-material cost reduction and margin expansion through backward integration.

Margin Expansion and Profitability Outlook

FY25 EBITDA margins were ~22–23% with potential to improve as RIP core localization and export mix scale up post-FY27.

Shift from imported to localized RIP cores, savings in freight/duty, and high-value product mix are expected to expand gross margins by 200–300 bps over 3–4 years.

Company reiterated intent to maintain current EBITDA levels (~22–23%) or better, even while scaling rapidly.

Exports and Globalization Strategy

Incorporated Yash High Voltage US Inc. to build presence and logistics in the US

Export share will rise significantly post-FY27 once localized RIP cores enable full compliance with US/EU standards (IEEE, IEC, Russian GOST).

Management sees huge global opening as supply chain bottlenecks persist and few global players dominate the segment.

Long-Term Growth Aspiration

Targeting 3–4× topline growth by 2030 (~₹600 cr vs ₹152 cr FY25).

Long-term aspiration: 5% share of global serviceable bushing market

Vision: become one of the top 5 global bushing manufacturers by the end of the decade.

Capex

Capex of ₹85–90 crore to complete by March 2026; no major new projects planned till 2030.

Industry Tailwinds

Transformer OEMs in India and abroad are expanding capacity to meet renewable, grid, and data-center demand.

Robust demand pipeline from transformer OEMs, utilities, and data centers, with most global transformer manufacturers booked out for 2–5 years, ensuring steady bushing demand.

6.2 Q2 FY26 vs FY26 Guidance — Yash Highvoltage

Ahead of FY26 guidance on revenue growth

Revenue Split: It is 40-60 split between H1 and H2 normally

H1 FY26 revenue growth ahead of 25-35% growth guidance given that H1 is typically 40% of annual revenue

Margins are stable — on track FY26 guidance

Order-book in place to support growth for FY26 and FY27

Capacity expansion by Mar-26 is on track

7. Valuation Analysis

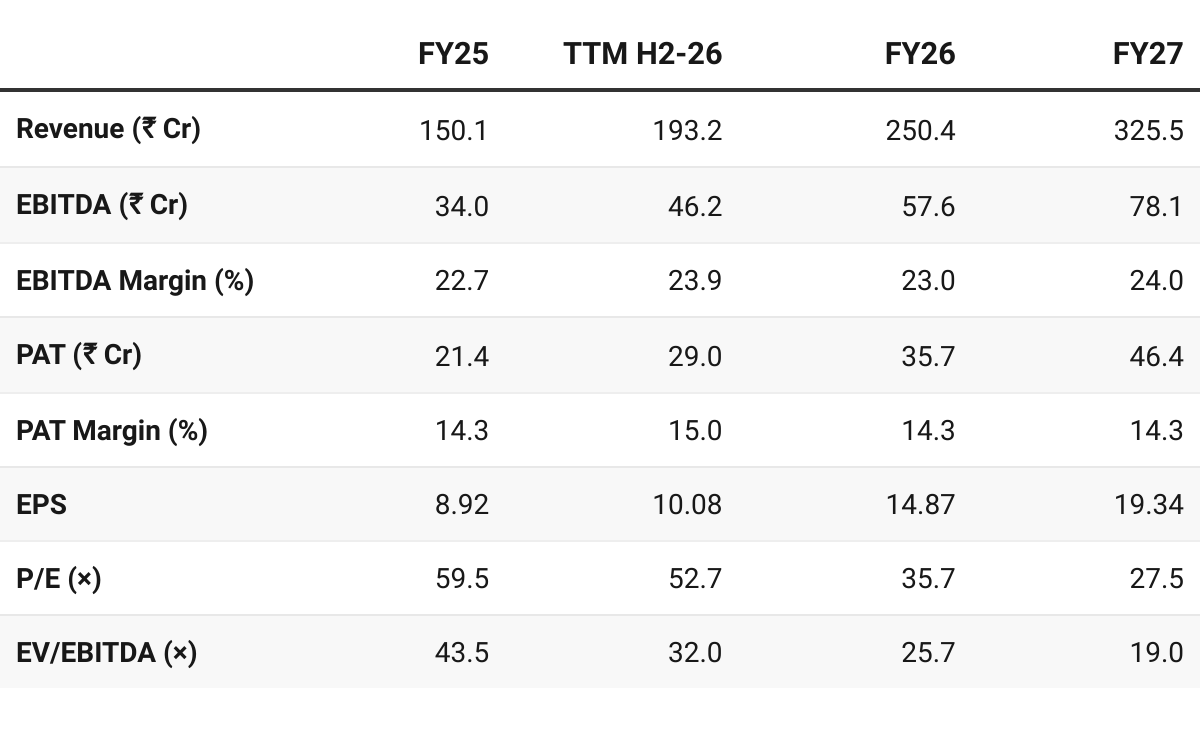

7.1 Valuation Snapshot — Yash Highvoltage

CMP ₹531; Mcap ₹1,511.93 Cr;

Valuations assume mid-point of 25-35% growth with stable margins.

At ~28× FY27E P/E and 19× EV/EBITDA, the stock trades near fair value for FY27 but offers re-rating potential by FY28 as earnings compound and the greenfield project goes live.

PEG < 1 and optionality of industry tailwinds could make it a strong small-cap compounding story in India’s power-equipment value chain.

7.2 Opportunity at Current Valuation — Yash Highvoltage

Execution Momentum — The 30% CAGR guidance till FY30.

Structural Margin Expansion:

The commissioning of the ₹ 85–90 crore Vadodara greenfield facility in Mar 2026 will backward-integrate RIP core manufacturing, cutting raw-material dependency on imports and adding 200–300 bps margin leverage post-FY27.Export and Localization Tailwind:

Exports currently form 35–40 % of OIP sales; the U.S. subsidiary and EU approvals open a pathway to >50 % export mix by FY27. Localization lowers logistics costs and import duties while enabling global certification sales in USD.

7.3 Risk at Current Valuation

Execution and Timeline Risk: The RIP core facility must be commissioned and qualified by Mar 2026; any delay in type-testing or utility approvals would defer margin benefits and push earnings to FY28.

Supply-Chain Dependence: Despite localization, critical inputs (resins, conductors) remain partially imported. Cost volatility or logistical disruptions can compress EBITDA margins by 100–150 bps in interim quarters.

Valuation Compression: At ~35× FY26E P/E, the stock already discounts execution success. Any earnings miss or macro slowdown in power capex could trigger de-rating towards 25× multiples (short-term drawdown risk 10–15 %).

Product and Client Concentration: Transformer bushings account for ~95 % of revenue, and the top 5 customers contribute 40–45 %. Delays in orders from a few OEMs can impact quarterly revenue visibility.

Technical and Quality Risks: Bushings are safety-critical components; any field failure can lead to reputational damage and liability claims despite insurance coverage. Management emphasizes rigorous testing and FEM-based design validation, but risk cannot be eliminated.

→ Monitor: Capex execution milestones, export approvals, margin trajectory, and FY27 volume ramp-up to validate the current premium multiple.

Yash Highvoltage offers a rare blend of steady compounding, global scalability, and margin expansion potential. At current valuations, it is not cheap but reasonably priced for its execution record and earnings visibility — a small-cap opportunity in early expansion phase.

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer