Welspun Corp: 1.5X revenue, 3.4X EPS committed for FY24

Welspun management making a daring commitment of growth and earnings for FY24

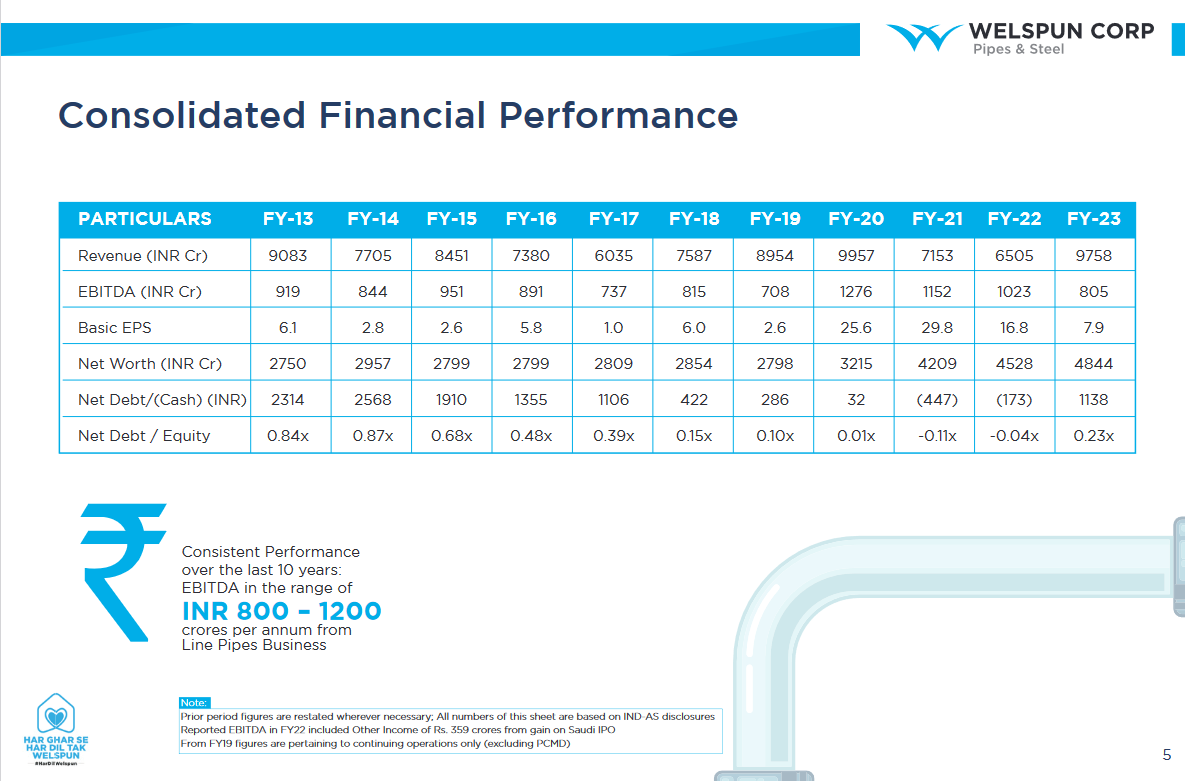

1. Average business

Nothing bad, nothing spectacular to talk about

Went nowhere in the last decade

2. Daring commitment by the average business

3. Commits to EPS growth of 3.4X in FY23

4. Q1-24 commitment met

The Ugly Duckling in the middle of becoming a swan

Q1-24 inspiring confidence that FY24 commitment will be met

27% of Rs 15,000 cr revenue commitment met

28% of Rs 1,500 cr EBITDA commitment met

EPS of 6.30 in Q1-24 ==> 24% of EPS commitment met

5. Confidence to meet FY24 guidance is high

I am happy that we started the new financial year on a strong footing and it’s in line with our stated guidance for the full year FY24.

Q1-24 management commentary

Q1 is always a sort of a muted quarter, right? And then you start building up in Q2 and it reaches to its pinnacle around Q4. So that's the way it happens

You will continue to see superlative performance moving forward in the subsequent quarters.

We are very optimistic and confident to the guidance what we have given this time to the market

Q4-23 management commentary

6. BTW, what does this company do?

NSE: WELCORP

Welspun Corp Ltd (WCL) is the flagship company of Welspun Group. WCL is one of the largest manufacturers of large diameter pipes globally. WCL also manufactures BIS-certified Steel Billets, TMT (Thermo Mechanically Treated) Rebars, Ductile Iron (DI) Pipes, Stainless Steel Pipes, and Tubes & Bars.

WCL acquired Sintex-BAPL, a market leader in water tanks and other plastic products, to expand its building materials portfolio.

WCL also acquired specified assets of ABG Shipyard with a potential to enter Defence and commercial shipbuilding, green steel, ship breaking, and ship repair.

6. Exciting story, but the stock is at a 41 PE

41 on FY23 earnings

PE of 23 on trailing 12 months earning

Forward PE of 12 based on FY24 EPS guidance

7. Wait! Stay committed

If I hold the stock then

I may commit to the stock, after all the management has made a daring commitment for me.

Keep tracking the quarterly numbers and take decisions based on quarterly performance

In this context WCL has passed the test of Q1-24 with distinction

Additionally, adequate confidence has been given that the test for FY24 will also be passed with distinction

8. Wait! Look before you jump in

If I am looking to enter the stock then

Consider the past

The very recent past does not inspire confidence. Top-line grew 50% in FY23, but EBITDA was down.

Is FY24 a one off daring guidance.

Will the company now stagnate at around Rs 15K cr mark the way it stagnated for a decade in the sub Rs 10K cr mark

Looking ahead

One makes money in a stock thru earnings growth and or PE multiple expansion

Earnings growth has been completely discounted as the PE moved from 41 based on FY23 earnings to 21 based on trailing twelve months earning and 12 based on FY24 guidance.

In the short term, the money to be made due to earnings growth has been mostly made. Opportunities for upside are limited in the short term.

The question remains, can we have a PE multiple re-rating to support the next leg of money making in this stock?

9 Possibility of PE re-rating

Going back to what the company does, there are opportunities emerging from the new business (greenfield + acquisitions)

We are confident on huge upside potential in the building material vertical, with new product offerings on the cards along with improving market share in water storage tank segment. Operational metrics in all other new businesses including Stainless Steel Pipes & Bars, DI Pipes and TMT Bars have been significantly improving.

Q1-24 management commentary on new business

If one believes in the management commentary then one should not only look towards a beat on FY24 guidance but also an equally daring guidance for FY25

Only if it looks interesting then a safe way to enter into this stock would be building up positions on bad days. If for any reason the stock runs away. So be it. Should be wary of chasing the stock. After all the stagnation of a decade cannot be forgotten with one solid year.

Don’t like what you get every morning?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades