Waaree Renewables: 3X revenue & volume in FY24, order book 3.3X FY23 execution at 47 PE

3X or tripling in FY24 over FY23 driven by its roadmap to execute projects on time or ahead of schedule.

1. Solar EPC company

waareertl.com | BSE: 534618

Waaree Renewable Technologies Limited is a subsidiary of the Waaree Energies Limited and is mainly into the business of the EPC, O&M and the IPP business. We are technically advanced End-to-end EPC solution provides that finance constructs, owns, operates solar projects. The company operating across the geography strategically targets long-term investment within the commercial and industrial customer segment.

Over 490+ MW O&M Portfolio of solar power plant assets

2. FY20-23: Scaling up of revenue and profitability

Q1-24 revenue is near about FY22 revenue

3. FY23: PAT up 522% and Revenue up 117% YoY

Back in the green in FY22 and FY23 after making losses in FY20 and FY21

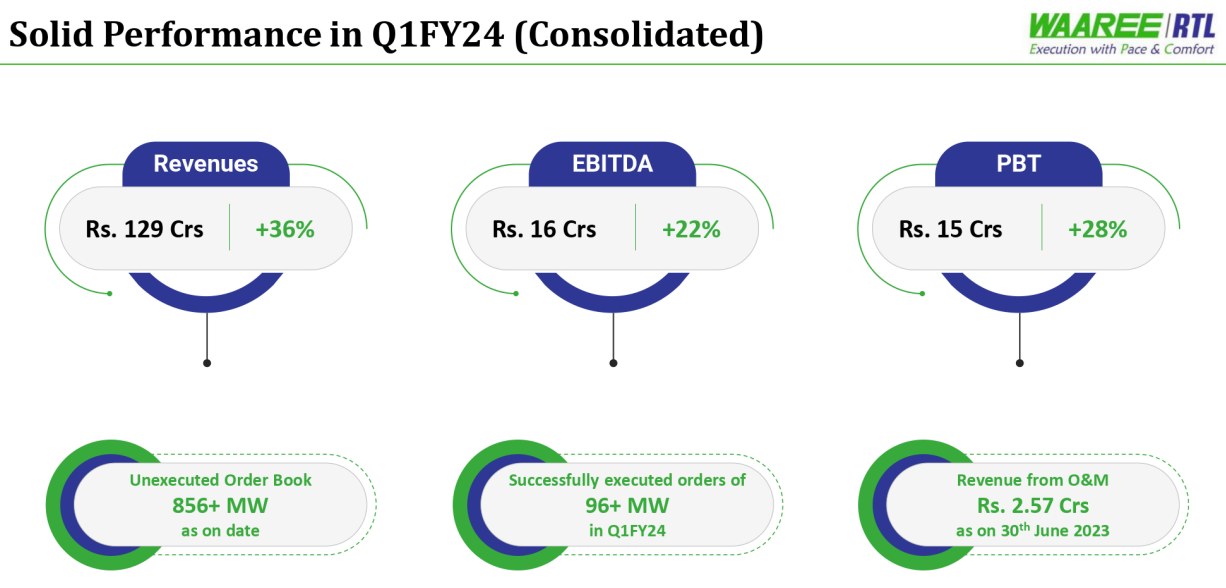

4. Q1-24: PAT up 12% and Revenue up 36% YoY

Bottom line growth slower than the top-line.

In Q1 2024 our profit before tax was INR15.2 crores as compared to INR11.9 crores in Q1 of FY ‘23. In Q1 of FY ‘24 our net profit after tax is INR11.1 crores as compared to INR9.9 crores in Q1 of FY ‘23 which is representing 12% of the growth

5. Business metrics improving along with return ratios

6. Outlook: 3X revenue & volume in FY24

i. 3X+ volume growth in FY24

Order Execution

FY23 = 295 MW

Q1-24 = 96 MW

Remaining part of FY24= 9-10 times Q1-24

FY24 = 960-1056 MW vs 295 MW in FY23

96-megawatt. So, around 9 times to 10 times, so that is the outlook for the next 9 months.

ii. Strong visibility for FY24: Order book 3.3X FY23 execution

856 MW order book as of end Q1-24

Additionally 136 MW orders received in Q2-24 as of 28-Jul-23

Total orders = 992 MW vs 295 MW executed in FY23

But last year, we did around 300- megawatt of the projects and this year as I said that we have a backlog of around 856-megwatt of the orders and we intend to finish this in next 9 months to 12 months period.

Starting with our order book position, we have an unexecuted order book of 856+ megawatt. We have successfully executed 96+megawatt in the Q1 of FY24. In this quarter, we have received some major orders of 100 megawatt in Jamnagar, Gujarat and 36 megawatt in Amreli, Gujarat respectively.

iii. FY24 could be 3X FY23 revenue

Revenue for orders without solar modules Rs 1.25-1.5 cr

Revenue for orders with solar modules Rs 3.5-4 cr

Assuming all the 960-1056 MW to be executed is without module, it would lead to a revenue forecast of Rs 1200- 1320 cr which would be 3X FY23 revenue of Rs 351 cr. The revenue forecast may not hold based on the price per MW

Fall in module prices

While in last 2 years, prices were still range bound and in last quarter we have seen, you know, prices started again falling.

7. 3X growth in FY24 at a PE of 47

8. So Wait and Watch

If I hold the stock then one may continue holding on to WRTL for the next three quarters while continuously assessing its ability to efficiently execute on its order book.

It's important to keep a close eye on the PAT (Profit After Tax) margins. As Q1-24 showed a 12% growth in PAT despite a 36% increase in revenue, it's crucial to avoid situations where rapid revenue growth comes at the expense of declining margins. One may not want to participate in the 3X growth where margins are collapsing.

To form an outlook for FY25, closely monitor the order intake and how the order book evolves in the upcoming quarters.

9. Or, join the ride

If I am looking to enter the stock then

WRTL is expected to triple, 3X in FY24 which makes the PE of 47 look quite attractive.

The short term story will play out as FY24 comes to an end. Will get a quick result based on the FY24 story

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades