Vijaya Diagnostic Centre Ltd - Overpriced share

A good small cap company irrespective of the share price.

Company Overview

Vijaya Diagnostic Centre Limited is one of India’s leading diagnostic centre networks. Based in Hyderabad, it considers itself to be the largest integrated player in South India.

Share Details

NSE:VIJAYA

Closing Price = 385.5 (6-Jun-23)

52 Week High = 528 (36% above closing price)

52 Week Low = 295 (23% below closing price)

P/E = 47

Market Cap = 3.970 cr ( ~$ 480 million)

Quality: Returns on capital employed in cash

VIJAY has delivered high quality company results consistently over the last 4 years.

For a small cap the results are consistent, ireespective of a sub par performance in FY22-23

Growth

Growth numbers are reasonable but in a small cap we would like to see 20% growth or else there is no fun in buying a small cap

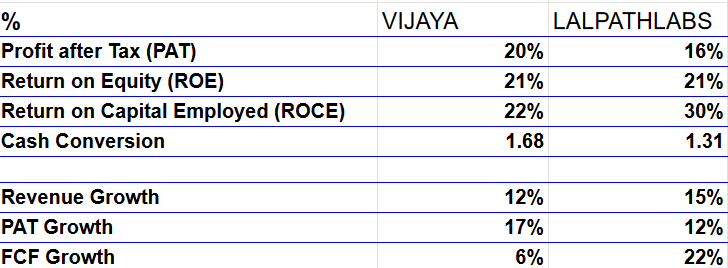

Comparison with Dr Lal PathLabs

Read detailed analysis of Dr Lal PathLabs

Dr Lal PathLabs is clearly the bigger brother in space so comparisons with VIJAYA is but natural.

Dr Lal PathLabs over a longer period of time and much larger scale makes it superior to VIJAYA.

So What????

If I own the stock, I may keep it based on my historic returns, future return expectations, and availability of alternative stock ideas

If I don’t own the stock, I will keep tracking it. It is a good company and may give an opportunity at a later date. I will not enter into the stock right now.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades